Bitcoin Price: US$ 17,127.83 (+1.09%)

Ethereum Price: US$ 1,290.16 (+2.06%)

Pace of Huobi Withdrawals Subsides as USDD Sees Renewed Slide

- The pace of withdrawals from crypto exchange Huobi slowed on Sunday, according to data from Nansen, despite a recent slide in the price of Tron’s USDD stablecoin.

- Clients of Huobi had withdrawn $60.9 million from the Singapore-based exchange over a 24-hour period on Friday, as reports circulated that the exchange was cutting staff by 20%.

- Crypto mogul Justin Sun—who has a majority stake in Huobi and founded Tron in 2017— deposited $100 million worth of stablecoins in the exchange as a show of confidence on Friday. The deposit was composed of USD Coin (USDC) and Tether (USDT).

MEXC Global Officially Launches MEXC Mastercard to Support Global Payment

- On December 27, MEXC Global, one of the world’s leading crypto-asset trading platform, officially launched the MEXC Mastercard, allowing cryptocurrency holders to use digital assets in daily payments.

- It is reported that the MEXC Mastercard can be directly connected to the user’s MEXC account, allowing users to recharge with cryptocurrency balances. Cardholders can manage their cards, view transaction history, and access customer support through the card dashboard on the MEXC app and website.

- Andrew, VP of MEXC Global, said: “MEXC is committed to tangibly promoting global cryptocurrency adoption, bringing cryptocurrency into everyday shopping. We believe that the MEXC Mastercard is an important step in encouraging wider cryptocurrency use and global adoption.”

- The launch of the MEXC Mastercard is a new practice of MEXC in cryptocurrency. MEXC Mastercard can not only help cryptocurrency to be used in life payment like traditional bank account payment but also expand the user base from traditional financial card users to those Users who are keen on spending with cryptocurrencies. Now such cryptocurrency cards are becoming more and more popular.

OpenSea adds support for Arbitrum Nova

- OpenSea, the biggest marketplace for digital collectibles and non-fungible tokens (NFTs), announced support for Arbitrum Nova.

- Nova is a Layer 2 blockchain designed to provide data availability at low cost. With OpenSea integrating NFTs on this blockchain, users can access Nova as a cheaper option to Ethereum when buying or selling digital collectibles.

- In September 2022, OpenSea added support for Arbitrum Nova’s sister Layer 2 scaling network called Arbitrum. Both Nova and Arbitrum are designed by Offchain Labs. OpenSea said that collections on Arbitrum Nova will be grouped with other Arbitrum collections on the OpenSea website.

Wyre limits withdrawals to 90% of funds held in customer accounts

- Crypto payment provider Wyre announced a change in rules that will limit customers to withdrawing no more than 90% of the funds currently held in each account.

- “We are modifying our withdrawal policy. While customers will continue to be able to withdraw their funds, at this time, we are limiting withdrawals to no more than 90% of the funds currently in each customer account, subject to current daily limits,” it said on Twitter.

- This new rule applies to all customers using its services and means any withdrawal requests exceeding this limit will be rejected.

- Wyre said that by reducing the amount customers are able to withdraw, the firm will be better positioned to weather potential financial storms ahead. The company said the new withdrawal limit would “enable it to navigate the current market environment.”

U.S. Investigators Subpoena Hedge Funds in Binance Money-Laundering Probe: Report

- Federal prosecutors are investigating the relationship between Binance and U.S.-based hedge funds as part of a broader investigation into the cryptocurrency exchange’s possible skirting of money-laundering guardrails, according to a report by the Washington Post.

- Heading the investigation is the U.S. Attorney’s Office for the Western District of Washington in Seattle, which, in recent months, has sent subpoenas to firms requesting records of their dealings with Binance, the Post reported, citing two people who had reviewed one of the subpoenas.

- The subpoenas come at a time when Binance, the world’s largest crypto exchange by daily trading volume, faces intense media and regulatory scrutiny over its business practices and financials. That scrutiny boiled over late last year in the wake of FTX’s multi-billion-dollar implosion, which rocked investor confidence in an increasingly turbulent and troubled crypto market.

- The subpoenas do not automatically mean authorities will bring charges against Binance or its founder and CEO Changpeng “CZ” Zhao, the Post noted as federal authorities are still discussing a potential settlement with Binance and are assessing whether the evidence they have is sufficient to bring charges.

Justin Sun Moves $100M in Stablecoins to Huobi Amid Rush of Withdrawals

- Crypto mogul and Tron founder Justin Sun today moved $100 million of his stablecoins to his crypto exchange Huobi after news dropped that it was cutting staff.

- According to blockchain data from Nansen, the cash was withdrawn from Binance and then sent to Huobi, which Sun has a majority stake in.

- The money was in the form of USD Coin (USDC) and Tether (USDT). Sun then confirmed to Bloomberg that he moved the “personal funds” because it “shows the confidence to Huobi exchange.”

- Nansen’s Martin Lee said on Twitter that the transfer “might be to help with the increased withdrawals or maintain a level of confidence in the exchange.”

- Clients have been withdrawing funds in large amounts: Nansen today said that $60.9 million of the $94.2 million in net outflow in the past week occurred in the past 24 hours.

Polygon Paid Top Solana Projects Y00ts and DeGods $3M to Migrate Chains

- DeLabs, the Los Angeles-based startup behind popular non-fungible token (NFT) projects DeGods and Y00ts, received a $3 million grant from Polygon to migrate blockchains.

- Y00ts, a generative art project of 15,000 NFTs, and DeGods, a 10,000-edition digital art collection, were among the top projects built on the Solana blockchain. Last week, the team behind the collections announced that they were leaving the Solana network, with DeGods moving to the Ethereum blockchain, and Y00ts moving to Polygon.

- A DeGods representative previously told CoinDesk that Polygon had paid for the move with a grant from its partnership fund. On Friday, the project’s leader, Rohun Vora, known as Frank, confirmed that the size of the grant was $3 million.

- “DeLabs received a $3M non-equity grant from Polygon to help fund the expansion of the DeLabs team and to kickstart and initially help scale the incubator we are building that will allow you to spend y00tpoints and DePoints to mint our incubator’s NFT collections,” he wrote in the Y00ts Discord channel. Y00tpoints and DePoints are tokens given to holders who stake their NFTs.

Block Manager Sees Self-Custody as Future of Crypto Post-FTX

- Following the collapse of FTX, the future of crypto is self-custody, said Max Guise, bitcoin wallet lead at Block (SQ), the payments company led by Twitter co-founder Jack Dorsey.

- “We want to put customers in control of their money,” Guise said on CoinDesk TV’s “First Mover” program on Thursday from CES 2023, a tech conference in Las Vegas. “[The] best way not to gamble with customer funds is to not be able to do so in the first place.”

- Block is developing a digital wallet to allow customers to hold bitcoin (BTC) themselves, rather than entrusting the coins to a third-party platform like FTX. The wallet, which would have three “keys,” is scheduled to come to market this year.

- In order to move funds with the wallet, the user decides when they want to use just their phone with the app or their phone and the hardware together to move money. Without the two, Guise said, “Block can’t move their money for them.” The third key, which is held by Block in its “cloud recovery services,” is available for users who lose their phone or wallet, he said.

‘Binance Effect’ Means 41% Price Spike for Newly Listed Tokens

- Token prices spike 73% in the first 30 days following their listing on crypto exchange Binance, an analysis by crypto investor Ren & Heinrich has found.

- The report, which tracked 26 coins over 18 months, showed a 41% increase a day after a listing on the world’s largest crypto exchange by market volume and 24% gain on day three. Ren & Heinrich’s findings offer evidence of a “Binance effect” that benefits tokens at least for the short term and resembles a similar “Coinbase effect,” a term first conceived in 2021 to account for price bumps that occurred soon after listings on that popular exchange.

- A study in April 2021 by crypto-analysis firm Messari found that token listings on Coinbase led to a 91% price jump in the first five days of trading.

- This week’s study by Ren & Heinrich suggests that Binance’s emergence as the dominant global crypto exchange might mean that its individual token listings are now getting a lot more attention – at least among speculators.

- “In most cases, a Binance listing does have a positive impact on a cryptocurrency’s price,” Ren & Heinrich wrote.

- A “Binance effect” appears to be a byproduct of the exchange’s massive trading volume, which far exceeds its competitors. On Thursday, the exchange’s nearly $7.5 billion in trading volume was about triple that of any other exchange.

Balancer warns $6.3 million of funds at risk, urges LPs to remove liquidity

- Decentralized exchange Balancer warned its liquidity providers to withdraw funds from five pools where $6.3 million of funds are at risk.

- This appears to be part of a larger potential exploit or bug, which Balancer is trying to mitigate. Balancer said that it has used emergency controls to set protocol fees to zero for some of its other pools. This was done in order to protect against an issue that it will disclose in the future. It wasn’t able to do so for these five pools, hence it is encouraging liquidity providers to withdraw their funds as quickly as possible.

- The five pools are on Ethereum, Polygon, Optimism and Fantom. The largest pool is DOLA / bb-a-USD, which currently looks after $3.6 million of funds.

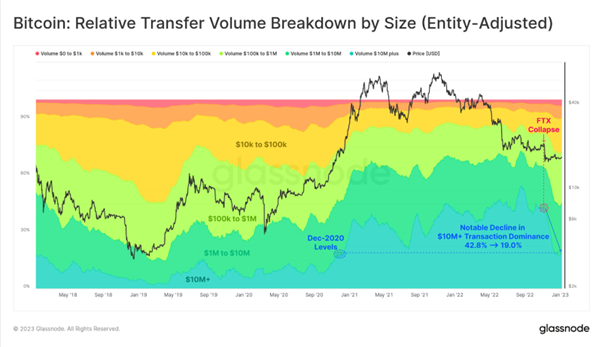

Glassnode

- Following the collapse of FTX, the dominance of large $10M+ sized transactions on #Bitcoin have fallen dramatically.

- At the start of Nov, $10M+ sized transfers accounted for over 42.8% of all transaction volume.

- Today, this cohort represents just 19% of total on-chain volume.