Bitcoin Price: US$ 20,591.13 (-1.50%)

Ethereum Price: US$ 1,568.10 (-0.01%)

Tokens Associated With FTX/Alameda Sell Off Amid Concerns

- On Nov. 2, 2022, CoinDesk published an article that reviewed the balance sheet of Alameda Research. The article acknowledged that the document may only paint a partial picture of the market maker.

- Although FTX and Alameda Research are separate businesses, they are closely linked as FTT accounts for a large portion of Alameda’s balance sheet. The firm holds at least $5.7B of FTT tokens.

- While there is nothing wrong with this, concerns that Alameda’s balance sheet rests on a token issued by a sister company instead of an independent asset have prompted growing concern in the market.

- Alameda’s balance sheet amounts to $14.6B in assets and $8B in liabilities. Concerns that they may be forced to sell other illiquid assets in a bear market to repay loans collateralized by FTT have led to a decline in tokens associated with FTX/Alameda.

- Over the last two days, SOL (-17%), FTT (-11%), FIDA (-12%), SRM (-13%), and RAY (-17%) have underperformed BTC (-3%) and ETH (-4%).

- Alameda’s CEO, Caroline Ellison has come forward to assure that the firm remains solvent and has repaid most of its loans already. Regardless, Binance is looking to sell over $500M of FTT tokens held by the exchange as an investment.

- Volatility, Order Flow, & the Inelastic Market Hypothesis. With the rise of electronic market-making and high-frequency trading dominating the liquidity landscape over the last 20 years, order flow analysis and its impact on markets has become a topic of growing intrigue.

- More specifically, many have wondered if analysis based on this new order flow data could provide insight into a topic that has stumped market professionals for decades.

- Continue on Delphi…

Get Ready for the ‘Scourge’: Inside Vitalik Buterin’s Updated Ethereum Plans

- The scourge is coming.

- Ethereum Co-Founder Vitalik Buterin published a technical infographic Friday sharing the updated roadmap for planned upgrades to the network. It includes an addition to the verge—a new milestone for the merge—and the creation of a new stage called the scourge, to name a few.

- The goal of the scourge is to “ensure reliable and fair credibly neutral transaction inclusion [and] solve MEV issues,” said Buterin.

- MEV in crypto refers to Maximum Extractable Value, which the Ethereum Foundation defines as “the maximum value that can be extracted from block production in excess of the standard block reward and gas fees by including, excluding, and changing the order of transactions in a block.”

- The scourge aims to ensure that transactions are neutral and centralization is avoided. This may also include in-protocol pre-confirmations and frontrunning protections. The scourge also includes PBS, or Proposer Builder Separation, which is the idea that constructing and proposing blocks in a blockchain should be delegated to different entities to increase network security and prevent MEV-related attacks.

FTX/Alameda Questions Hold the Spotlight as US Midterm Election, Inflation Data Loom

- Crypto investors will be noting two significant macro events this week: the Nov. 8 midterm elections and the Nov. 10 Consumer Price Index (CPI) report.

- How crypto prices will react to the midterms is unclear. Democrats and Republicans are more focused on gaining control of the House of Representatives and Senate than debating crypto policies.

- Investors will be eyeing whether the CPI veers much from an expected 6.5% increase that will signal inflation remains untamed, potentially testing anew cryptos’ status as an inflation hedge.

- Meanwhile, the crypto industry breathlessly considered questions about the solvency of crypto exchange FTX and the impact on its sister company, Alameda Research. As CoinDesk reported over the weekend, much of Alameda’s equity appears to consist of FTX’s FTT token. The outsized percentage of FTX’s value tied to an asset issued by a related entity has raised concerns about a repeat of issues that have already sent three of the industry’s biggest brands this year – crypto lenders Celsius Network and Voyager Digital and hedge fund Three Arrows Capital – into bankruptcy.

- FTX CEO Sam Bankman-Fried tweeted unequivocally that FTX and its assets “are fine.”

- “FTX has enough to cover all client holdings,” he wrote. “We don’t invest client assets (even in Treasurys). We have been processing all withdrawals, and will continue to be.”

Solana Falls and Speculation Centers on Links to Sam Bankman-Fried’s FTX, Alameda

- Solana’s SOL token was one of the biggest losers in digital-asset markets on Monday, and crypto analysts speculated there might be a connection to the recent drama surrounding Sam Bankman-Fried’s FTX exchange and his trading firm, Alameda Research.

- One theory is that Alameda might try to dump its SOL tokens in a bid to raise fresh liquidity.

- “The large amounts of SOL and Solana ecosystem tokens held by Alameda could get sold off in a worst-case scenario and underline the close links between FTX/Alameda and Solana,” said Riyad Carey, research analyst at crypto data firm Kaiko.

- The SOL token plunged 4.7% in the past 24 hours.

Russia’s Central Bank promotes crypto as means of internationalizing embattled economy

- The Central Bank of Russia is working on integrating crypto assets into the local financial system.

- The CBR released a report on digital assets, focusing on integrating them into financial systems. Main areas of concern included proper taxation and regulation of digital asset issuance — familiar themes in crypto regulatory discussions worldwide.

- Notably absent is the mention of any money laundering regulations, which tend to be major focus of crypto policies elsewhere in the world. There’s also very little talk of the sanctions currently wreaking havoc on the Russian economy even though CBR Governor Elvira Nabiullina has been largely successful in shoring up the Russian economy from their impact.

- Crypto’s role in Russia, and particularly the central bank’s increasing openness to crypto technology, comes as the country has tried to monetize its natural resources and move away from the US dollar, which is a powerful tool for sanctions and remains the currency of note in global oil and natural gas markets. Prior to invading Ukraine, President Vladimir Putin spoke out in favor of crypto and its possibilities for the Russian economy.

US Government Now Has More BTC Than Largest Crypto Holders

- The US Department of Justice has seized roughly $1 billion worth of bitcoin (BTC) from a man who “unlawfully obtained” more than 50,000 bitcoins from the Silk Road dark web internet marketplace in 2012.

- James Zhong pleaded guilty in court on Nov. 4 to committing wire fraud and is set to be sentenced in February.

- The whereabouts of the stolen 50,000 BTC remained unknown for more than 10 years, according to Damian Williams, US attorney for the southern district of New York.

- Zhong had executed a detailed scheme designed to steal bitcoin from the Silk Road Marketplace — one of the first modern darknet markets. Silk Road operated as a Tor hidden service — a privacy tool that allows anonymous internet browsing.

- Tyler Hatcher, a criminal investigator for the Internal Revenue Service (IRS) said following the heist, Zhong “attempted to hide his spoils through a series of complex transactions.”

- But that didn’t prevent law enforcement from following the bitcoin trail. After obtaining a search warrant for Zhong’s residence in November 2021, authorities located the lost bitcoins in “an underground floor safe,” as well as on a single-board computer in a bathroom closet. The computer was beneath blankets in a popcorn tin stored in a bathroom closet.

- The bitcoins were worth roughly $3.4 billion at the time of the seizure. Officials also found nearly $662,000 in cash.

What To Expect on Miners’ Q3 Earnings Calls As Industry Remains ‘Distressed’

- A range of bitcoin miners are set to report third quarter results in the coming days as several companies in the mining sector are struggling to cope with financial pressures.

- Marathon Digital, Stronghold Digital Mining and Hut 8 Mining are among the companies in the space set to host earnings calls this week.

- While analysts are not necessarily expecting big pronouncements of bankruptcies or acquisitions during industry players’ upcoming calls, they will be listening for how mining executives intend to navigate the current environment.

- “I’m always listening for cues on expectations — company-specific and industry-specific — and specific companies’ moves to address their expectations,” Kevin Dede, senior technology analyst at HC Wainwright & Co. told Blockworks.

Bank of Korea Tested NFT Trading, Remittances With CBDC: Report

- The Bank of Korea (BoK) has developed and tested a program that facilitates cross-border remittances by linking different central bank digital currencies (CBDC) from other countries, local media outlet Yonhap News reported on Monday.

- The central bank had recently completed a 10-month experiment into a digital South Korean won, Governor Chang Yong Rhee revealed in a September speech.

- During the project, the bank also tested the use of its CBDC to purchase non-fungible tokens (NFT), according to the report.

- Major economies such as the U.S., U.K. and European Union have been exploring the issuance of CBDCs, while China has already carried out several trials. South Korea began its CBDC trial last year and completed the first of two phases by January.

SEC wins suit against LBRY in major blow to crypto token issuance

- The Securities and Exchange Commission has prevailed in a courtroom battle with decentralized publishing platform LBRY after arguing that its token was subject to regulatory oversight.

- The court found that LBRY’s LBC token was an investment contract, even though the project did not sell it via an initial coin offering, or ICO. The project began in 2016 with the stated aim of decentralizing publishing.

- “LBRY is mistaken about both the facts and the law,” the New Hampshire District Court said in the decision. Judge Paul Barbadoro granted the SEC’s motion for summary judgment, sealing the fate of a case that begin last March.

- The decision is a major blow to crypto issuers, many of whom have argued that the SEC is pursuing a course of “regulation by enforcement.” Like LBRY, many defenders of token issuance claim that the commission has not given enough warning to crypto firms of how it will apply its oversight. It’s a defense that SEC Chair Gary Gensler has criticized very publicly in recent months while commending the SEC’s application of existing laws and, particularly, the Howey Test, which refers to a U.S. Supreme Court case revolving around whether a transaction may qualify as an investment contract.

- “What the evidence in the record discloses is that LBRY promoted LBC as an investment that would grow in value over time through the company’s development of the LBRY Network,” the court said. Referring to the Howey Test decision, the court said that “the SEC has based its claim on a straightforward application of a venerable Supreme Court precedent that has been applied by hundreds of federal courts across the country over more than 70 years. While this may be the first time it has been used against an issuer of digital tokens that did not conduct an ICO, LBRY is in no position to claim that it did not receive fair notice that its conduct was unlawful.”

Ethereum Apps Could Soon be Launching on Competitor Solana

- Software startup Neon Labs will open its gateway for Ethereum-based crypto projects to access the competing Solana ecosystem before the year is out.

- Neon Labs will launch its “ethereum virtual machine” for Solana on December 12, CEO Marina Guryeva told CoinDesk. EVM is the standardized engine that powers decentralized finance (DeFi) apps on Ethereum and a handful of other ecosystems, sans Solana, which follows a different infrastructure.

- Rolling out an EVM for Solana means that Ethereum-based projects will be able to deploy on Solana without rewiring their codebases, a cumbersome task. Neon says that some of Ethereum’s DeFi heavy-hitters including Aave and Curve are preparing to use Neon’s long-awaited EVM.

- “The winning strategy is to go on each and every new layer 1 blockchain” to capture those ecosystem’s user-bases, Guryeva said.

- Following a fourth consecutive US rate hike of 75bps, a small pull back has occurred in the Dollar Index allowing global equities a brief period of respite. However, the stress present in the bond market remains persistent with further inversions across the front end of the yield curve, most notably in the 3month T-Bill in respect to the 10yr risk-free rate.

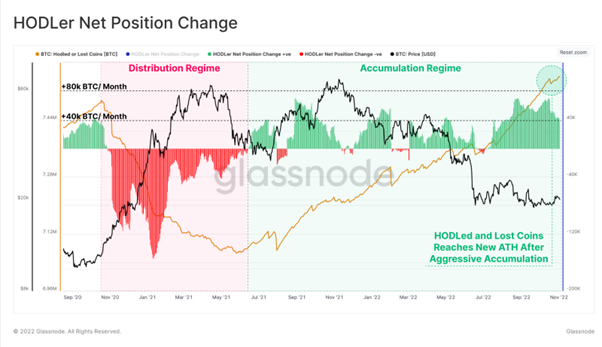

- In response, Bitcoin prices have experienced a relatively small upwards surge, applying upwards pressure on key on-chain cost-basis’ in its first bid for recovery. This price action is supported by muted HODLer behavior and the first glimmers of demand re-entering the system, as the asset class attempts to begin the long climb out of the depths of the bear market.

- The supply younger than 6 months old which is available on the market has remained around historic lows since May 2022 and continues to decline, further reiterating the extreme level of HODLing present in the current market.

- Continue on Glassnode.