Bitcoin Price: US$ 23,240.95 (+2.10%)

Ethereum Price: US$ 1,671.02 (+3.51%)

Analyzing Price Action: Markets Framework – Delphi Video Series

- In this video, I look at price action in the SPX and BTC markets over the last several months using the techniques discussed in our Markets Framework report series, trying to convey how I think through markets. We then take a more focused view, and look at the price action before and after the most recent FOMC meeting.

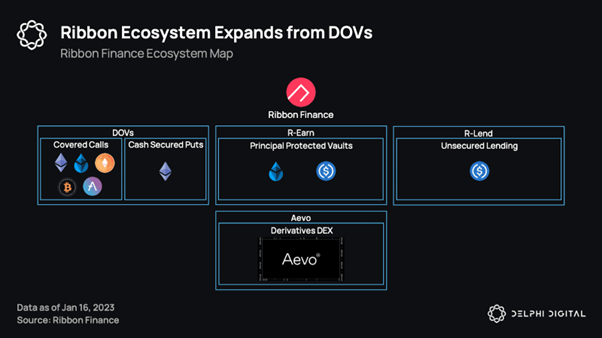

Ribbon Expands to Options DEX With Aevo

- Ribbon Finance started out as an asset management protocol that specialized in simple structured products. They initially gained traction for their decentralized options vaults (DOVs) and have since diversified into various products like R-Earn and R-Lend. Ribbon also has an upcoming product called Aevo which is a derivatives DEX built on top of its own rollup.

- DOVs are Ribbon’s main product. They allow for automated option selling on behalf of depositors. The two main DOV strategies are selling covered calls and cash-secured puts.

- R-Earn offers principal-protected vaults that use a small portion of capital and/or yields earned for various options strategies to drive higher-yield returns. Currently, R-Earn offers vaults for USDC and stETH.

- The USDC vault utilizes uncollateralized lending to market makers and allocates a portion of the yields towards the purchase of straddle-like ATM knock-out barrier options, allowing depositors to profit from intra-week volatility.

- The stETH vault utilizes stETH’s base yield and 0.5% of deposits to purchase weekly call-like ATM knock-out barrier options.

- R-Lend is Ribbon’s uncollateralized lending product that generates yields by lending USDC deposits to various institutions. Depositors can select which institutions they’re comfortable lending to. Deposits from R-Earn flow through R-Lend.

- Aevo is Ribbon’s derivatives order book DEX built on its own rollup to bring a CEX-like trading experience on-chain. We will dive deeper into its functionality later in this report.

- Aevo is a unique derivatives DEX built on its own L2 EVM called the Aevo rollup. It offers a hybrid off-chain order book and on-chain settlement DEX, similar to dYdX v3. Aevo will initially focus on offering options trading and will expand to include perpetual swaps in the future, which will allow options traders to delta hedge on the same platform.

- Continue on Delphi Pro…

Millions in Crypto Donations Pour Into Turkey Following Devastating Earthquakes

- Several cryptocurrency companies—including Binance, Tether, Bitfinex, OKX, and Kucoin—have pledged over $9 million in donations to aid the victims of the massive earthquakes that hit Turkey and Syria early Monday morning.

- As the number of casualties continues to rise—more than 7,000 killed and over 20,000 injured—the collective effort demonstrates that the crypto community is again ready to step up to support humanitarian efforts.

- Joining in the fundraising efforts, Avalanche Foundation donated $1 million in AVAX tokens.

- “Turkey is close to the heart of the Avalanche Foundation and community, and the funds will help people recover faster in the wake of this tragedy,” Executive Director of the Avalanche Foundation, Aytunc Yıldızlı, told Decrypt in an email. “It is time to come together and show that crypto is a force for good and a sign of hope for all of us hurting.”

- “The recent earthquakes in Turkey have had a devastating impact on so many people and communities. We hope that our efforts will bring some relief to those affected. We are also calling on our industry peers to once again come together to offer support in these times of crisis,” Binance CEO Changpeng Zhao said in a press release.

- “Time to take care of our users,” Zhao tweeted, adding that the crypto exchange would airdrop $100 (1883 TRY) in BNB, totaling $5 million, to users in the region.

- Soon after news broke of the earthquake and the staggering number of lives lost, Bitfinex, Keet, Synonym, Tether, and other companies announced a collective pledge of 5 million Turkish Lira, around $266,000, to go towards the earthquake recovery effort.

- Contine to Decrypt…

‘Crypto-assets’ on SEC’s 2023 to-do list

- The Securities and Exchange Commission’s Division of Examinations named “crypto-assets” and other emerging technologies as a top priority for this year.

- “The division will conduct examinations of broker-dealers and RIAs that are using emerging financial technologies or employing new practices, including technological and on-line solutions to meet the demands of compliance and marketing and to service investor accounts,” the SEC said in the division’s public to-do list.

- Those examinations will focus on whether firms dealing with digital assets “met and followed their respective standards of care when making recommendations, referrals, or providing investment advice” as well as whether they continuously review their own compliance, disclosure and risk management practices.

- The examinations division also will focus on ensuring that investment advisers have complied with a new marketing rule the commission implemented last year that restricts the use of testimonials and recommendations in promoting investments. The SEC has pursued high-profile cases related to celebrity endorsements of digital assets.

Chorus One brings MEV protocol to Solana

- The Solana blockchain may see a new open-source approach to maximal extracted value (MEV), according to a white paper produced by blockchain protocol architect, Chorus One.

- The version of MEV for Solana by Chorus One is in the prototype stage, and the company doesn’t intend to deploy it as a competitive platform to other existing models for Solana-based MEV. Instead, Chorus One intends to turn the MEV protocol over to the public for ongoing refinement and integration.

- “The Solana-MEV client is a public good. Chorus One will not explore the model commercially,” Chorus One research analyst Thalita Franklin told The Block.

- On Solana, as the blockchain’s network architecture differs significantly from that of Ethereum, a simple plug-and-play version of an Ethereum-based MEV would lack functionality. For instance, Solana lacks any such mempool and, unlike Ethereum, validators are predetermined, so transaction information is passed directly to the next in line to process a block.

- For MEV to work on Solana, Chorus One’s approach adds a step to the validation process where the block processor performs an extra check to see if any MEV opportunities exist. If an opportunity exists, the MEV transaction is added to the transaction block and broadcast to the network, and if none exist the block is sent to the network without modification.

Bitcoin Favored Over Ether by CME Traders So Far This Year, Arcane Research Report Shows

- Institutional traders are prioritizing bitcoin over ether exposure so far in 2023, according to a report from digital asset analysis firm Arcane Research.

- Open interest in bitcoin (BTC) futures listed on the derivatives giant Chicago Mercantile Exchange (CME) has climbed 6% this year while CME’s ether (ETH) futures have declined by 29% in open interest, Arcane Research said.

- Open interest is the total number of outstanding derivative contracts that have not been settled for an asset.

- “This open interest trend deviates from the normal trend in CME futures, and it illustrates that BTC has led the early 2023 market strength,” Arcane Research’s Bendik Schei and Vetle Lunde wrote in the report.

- Smaller altcoins have also rallied in January, driven by short squeezes, poor liquidity and increased risk appetite among retail investors emboldened by BTC’s surge, the report noted. In contrast, ether hasn’t jumped similarly to BTC, which could explain ETH’s relatively weak start in January compared to other altcoins, according to the report.

- The report also highlighted that the ETH futures annualized rolling three-month basis has grown in the last few weeks and now sits at similar levels to that of BTC. Both BTC and ETH’s futures basis on CME has been positive since the week of Jan. 6, signaling a positive sentiment among traders.

- Joe DiPasquale, CEO of crypto fund manager BitBull Capital, told CoinDesk that institutional investors’ preference for BTC represented “the safest choice in a bear market.” He noted that Ethereum’s upcoming protocol updates might be raising concerns about an increased “risk of things going wrong,” and added that the Shanghai hard fork, which will allow validators who help operate the network to withdraw 16 million staked ETH, “is expected to add selling pressure.”

Bitcoin Pops, Then Drops as Fed Chief Powell Says Beating Inflation Will ‘Take Time’

- Bitcoin swung upwards with stocks but then settled lower following Federal Reserve Chairman Jerome Powell’s comments that the central bank is beginning to get inflation under control. Powell cautioned, however, that it will take a long time to fully tame inflation.

- The digital asset first rose when the U.S. central bank chief spoke at the Economic Club of Washington, D.C. Tuesday and said that inflation would drop lower.

Ethereum Testnet Processes First ETH Staking Withdrawals

- An Ethererum test network (testnet) successfully simulated withdrawals of staked ether (ETH) for the first time, bringing the second-biggest blockchain yet another step closer to its historic transition to a fully featured proof-of-stake network. The upgrade was triggered at epoch 1350 at 15:00 UTC and finalized at 15:13 UTC. (10:13 a.m. ET).

- The testnet, known as Zhejiang, facilitated the withdrawal simulations early Tuesday after going live last week, according to an explorer website set up to track transactions on the system. The test network is designed to provide developers with a dress rehearsal of the withdrawals similar to those that will happen on the main Ethereum blockchain following its long-awaited Shanghai upgrade, expected next month.

- “On the Zhejiang testnet, partial and full withdrawals as well as BLS changes are included in the execution payload,” Barnabas Busa, a DevOps engineer at the Ethereum Foundation, told CoinDesk. “We have a successful fork.” BLS changes allow people to change their withdrawal credentials to properly process staked ether withdrawals.

- Zhejiang is the first of three testnets to run through a simulation of Shanghai. Testnets duplicate the main blockchain, and allow developers and users to test any code changes to their applications in a low-stakes environment.

- The next testnet upgrade will happen sometime in the next few weeks to Sepolia, followed by Goerli.

Dell Joins Hedera Governing Council to Explore Developing Decentralized Applications

- Computer manufacturer Dell (DELL) has become a member of the Hedera Governing Council to develop decentralized applications to help its customers with their blockchain and Web3-related ventures.

- Hedera’s HBAR token spiked higher on the news. It’s retraced a bit since, but remains up nearly 6% for the day.

- Specifically, Dell will explore developing applications on the Hedera network for decentralized environments such as edge computing – a paradigm in which data is processed using networks and devices near to where it is generated, enabling it to be processed at greater speeds and volumes.

- “With secure, provisioned [distributed ledger technolgies], customers can build cost effective and efficient applications across IT environments, including edge, that provide scalable data persistence, protection, control and process automation,” Hedera said on Tuesday.

- The council that runs the Hedera public ledger now has up to 39 members, each of which run a node on the network. Other members include Google, IBM Deutsche Telekom, Boeing, DBS and Nomura Holdings.

- Hedera’s aim is to provide a public distributed network with the security and stability to attract big businesses to build on it.

Lido presents plan for Version 2, adding staking withdrawals and more

- Lido Finance finished the design for the second version of its protocol, which will bring in support for Ethereum staking withdrawals post-Shanghai and rework the Staking Router in a way that should boost the platform’s level of decentralization.

- The plans were presented to the Lido community in a blog post shared with The Block. It will need to be turned into an official proposal and approved in a vote by token holders before it will be implemented.

- Lido Version 2.0 will go through six audits that will include providers such as Sigma Prime, ChainSecurity and Oxorio. The security checks will focus on withdrawals, the code for the staking router code and a key ceremony.

- The timeline will see a code freeze in February, when the security audits begin. At the end of February, the upgrade will go to a vote on Lido’s governance platform. At the start of March, the upgrade will go live on the Goerli testnet, and the upgrade will go live on mainnet ahead of the Shanghai-Capella (also referred to as Shapella) upgrades.

AI Crypto Tokens Fetch, Singularity Rally More Than 20% Overnight

- Amid the largely sideways performance of major cryptocurrencies, AI-related crypto tokens including Fetch (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN) have soared in the past day.

- FET, the utility token poweringFetch.AI, a decentralized platform that provides tools and infrastructure required for building an AI-based digital economy, is up 25% over the day, changing hands at $0.54, according to CoinGecko.

- Ranked 86th by market capitalization, FET has enjoyed explosive growth since the start of the year, gaining 106% over the week and more than 250% in the past 30 days, hitting levels not seen since January of last year.

- AGIX, the native token powering a decentralized platform for creating, distributing, and monetizing AI services SingularityNET, has seen an even more bullish price action since the start of the year, soaring 883% over the month.

- AGIX went on to hit a 17-month high of $0.59 in the early hours on Tuesday before dropping to the current price of $0.54. The move still represents a 22% increase in value over the past 24 hours, per CoinGecko.

- SingularityNET, which runs on Ethereum and Cardano, has been strongly focused on increasing interoperability between the two networks, launching a bridge to tokens last year, with further plans to introduce a staking portal for Cardano’s native token ADA as early as Q1 2023.

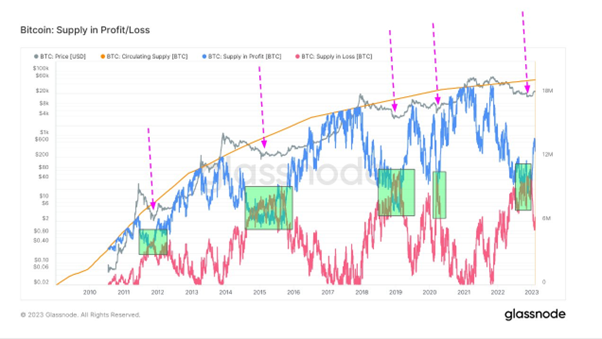

Glassnode: via Straten, J. post

- Each time Supply in profit/Loss has converged marked a #Bitcoin bottom in each cycle.

- Roughly 12.5m #BTC are sitting in profit, the most amount since March ’22, just before the collapse of Luna.