Bitcoin Price: US$ 16,836.64 (-1.48%)

Ethereum Price: US$ 1,231.18 (-3.16%)

Frax Finance’s Liquid Staking Solution Continues To Grow

- Over the previous 30 days, the total supply of frxETH has increased by 870% while the total supply of sfrxETH has increased by 285%. While frxETH is a stablecoin pegged to ETH, sfrxETH is a liquid staking token that accrues value from staking rewards.

- Users can deposit 1 ETH and mint 1 frxETH. Users can stake frxETH to get sfrxETH and earn staking rewards. Alternatively, users can also provide liquidity to frxETH pairs on Curve and earn trading fees and token rewards.

- The ETH deposited to mint frxETH is staked with validators with 90% of the rewards flowing back to sfrxETH holders. Rewards are deposited back in the vault, allowing sfrxETH holders to redeem more frxETH than originally staked.

- Currently, there are 31.7K frxETH tokens but there are only 12.3K sfrxETH tokens. This allows sfrxETH holders to earn enhanced staking rewards sourced from ETH deposited by other users who have minted frxETH as well.

- Currently, sfrxETH holders are earning an APR of 5.8% from all ETH staked with validators. For comparison, stETH issued by Lido is currently earning an APR of 4.7%.

- frxETH holders who provide liquidity on Curve are earning an APR of 10.4% from trading fees and token rewards (CRV, CVX, and FXS). The APR for sfrxETH and the frxETH pool is likely to converge over time as capital flows to the higher-yielding option.

Celsius must return $44 million in crypto to users, judge orders: Bloomberg

- Crypto lender Celsius Network must return around $44 million worth of crypto back to customers, even if it didn’t enter Celsius’s interest-bearing accounts.

- Chief Bankruptcy Judge Martin Glenn issued the order on Wednesday after parties involved in the case concluded that funds belong to users, not Celsius, Bloomberg reported.

Privacy-Focused Gnosis Chain to Undergo Its Own Proof-of-Stake ‘Merge’

- Privacy-focused Gnosis, one of the first sidechains to Ethereum, will conduct its own version of the Merge to replace its proof-of-authority (PoA) chain with its Gnosis proof-of-stake (PoS) beacon chain. The Merge will take place on Thursday, Dec. 8, when a certain predetermined Total Terminal Difficulty (TTD) is reached. While TTD is a measure that has typically been used for proof-of-work (PoW) blockchains, it can be used to time the fork for PoA chains.

- This will be the second-ever “Merge” event in blockchain history, following the Ethereum blockchain’s Merge in September when it switched out its old PoW model for PoS. This time, however, the Gnosis “Merge” will be slightly different given that it is swapping out PoA for PoS.

Canada’s Largest Pension Fund No Longer Mulling Crypto Investment: Reuters

- Having managed to sidestep the crypto investments that burned two other major Canadian pension funds, CPP Investment (CPPI) said it is no longer pursuing opportunities in that sector, reports Reuters.

- Though declining to comment on the specific reasons, Reuters said CPPI pointed to comments made earlier this year by CEO John Graham: “You want to really think about what the underlying intrinsic value is of some of these assets and build your portfolio accordingly … So I’d say crypto is something we continue to look at and try to understand, but we just haven’t really invested in it.”

- Thus the plan, which manages C$529 billion (US$388 billion) for nearly 20 million Canadians, managed to avoid the losses suffered by peers Ontario Teachers’ (C$250 billion AUM), which had to fully write off its $95 million investment in crypto exchange FTX, and Caisse de Depot et Placement du Quebec (C$300 billion AUM), which fully wrote down its $150 million investment in crypto lender Celsius Network.

Bitcoin’s High Correlation to Copper Does Not Bode Well for Short-Term Investors

- Bitcoin’s price now correlates more strongly to copper futures than to traditional equity indexes.

- BTC’s correlation coefficient relative to copper has risen to 0.84 from 0.27 a month ago, reaching its highest mark since August.

- The correlation coefficient measures the pricing relationship between two assets, ranging from -1 to 1. The former indicates an inverse relationship, while the latter implies a direct pricing relationship.

- The tightening relationship poses a couple of questions.

- Analysts often view copper as a proxy for overall economic growth, affectionately calling it “Dr. Copper” for its professorial ability to forecast trends. Does this imply that the macro narrative within the digital asset space will continue?

- Why has traditional equities’ relationship with copper weakened over the last two months? As early as Oct 6, the S&P 500’s correlation was as high as 0.86 before falling to its current level of 0.14.

- On question one, I would say, yes. Absent a black swan or negative contagion event specific to a centralized entity, digital assets still seem very much connected to macroeconomic developments.

- But, notably, yields for the federal funds rate, U.S. three-month and two-year Treasurys exceed the yield of 10-year Treasurys.

- This condition, called an inverted yield curve, has predated past economic recessions. If viewed in isolation, an inverted yield curve does not bode well for bitcoin, or copper prices for that matter. Increased short-term rates and slower economic growth lead to lower demand and prices for physical and digital assets.

Why Is Crypto Twitter Obsessed with ChatGPT?

- While digital selfies created by the artificial intelligence app Lensa have taken over social feeds and profile pictures, text-based artificial intelligence platform ChatGPT is taking Crypto Twitter by storm.

- Launched in November by OpenAI, ChatGPT has seen a flood of interest due to its surprisingly coherent and in-depth responses to questions ranging from how to exploit a smart contract to how the world will end.

- ChatGPT works by entering a question or statement into a text box. The A.I. tool will respond with a series of responses based on the query.

- But while the app has drawn considerable attention, that popularity has also caused ChatGPT to experience a service slowdown and even a crash. A message on the website at the time of writing reads: “We’re experiencing exceptionally high demand. Please hang tight as we work on scaling our systems.”

- OpenAI is a San Francisco-based company founded by Elon Musk, Sam Altman, Ilya Sutskever, Greg Brockman, Wojciech Zaremba, and John Schulman in 2015. The company says its mission is to ensure that artificial intelligence benefits all humanity.

Number of Brazilian Companies Transacting With Digital Assets Increased Again in October

- For the first time in a single month, more than 41,000 Brazilian companies made transactions with digital assets, the South American country’s tax authority Receita Federal has reported.

- According to the report, 41,817 companies in Brazil declared operations made with digital assets in October, up from 40,161 firms in September and 37,741 in August.

- Brazilian companies began reporting transactions with crypto to the government in August 2019 after the passage of a new law that year.

Crypto Bank Signature Suffers Another Analyst Downgrade; Shares Fall

- Signature Bank (SBNY) shares were downgraded to market perform from strong buy at Wall Street firm Raymond James on Wednesday after the bank said it was diversifying its business model away from cryptocurrencies.

- The shares fell over 2% to $116.07 at time of publication. The bank said this week that it planned to shrink its deposits tied to cryptocurrencies by $8 billion to $10 billion. “We are not just a crypto bank and we want that to come across loud and clear,” the bank’s CEO, Joe DePaolo, said at an investor conference in New York on Tuesday.

- Raymond James says it remains bullish on the firm’s long-term prospects to deliver higher loan growth, operating efficiency and credit metrics, but says the bank’s plan to diversify its business model will likely result in slower growth and net interest margin (NIM) compression.

Binance’s Bitcoin Reserves Are Overcollateralized, New Report Says

- Binance, the world’s largest crypto exchange by trading volume, released a new report on Wednesday from global financial audit, tax and advisory firm Mazars showing that Binance’s customer bitcoin (BTC) reserves are overcollateralized.

- “At the time of assessment, Mazars observed Binance controlled in-scope assets in excess of 100% of their total platform liabilities,” Mazars said in an announcement. The exact percentage was 101%.

- The collapse of centralized crypto exchange FTX because of liquidity issues has rivals rushing to improve the transparency of their financial reserves. The report from Mazars was meant to assure customers that their bitcoin is collateralized, exist on the blockchain and is in Binance’s control.

- However, the assessment is not an official audit, according to Francine McKenna, lecturer in financial accounting at The Wharton School at the University of Pennsylvania. “They did a comparison of balances per public key address from a list they got from management. They did not compare any balances in independent banks or custodians or depositories,” said McKenna.

Crypto Exchange Binance.US Eliminates Trading Fees for Ether

- Binance.US is getting rid of trading fees for ether (ETH), the company said Tuesday, expanding its zero-free program beyond just bitcoin (BTC).

- Free trading will apply to the following spot market pairs: ETH/USD, ETH/USDT, ETH/USDC and ETH/BUSD. The exchange said it will also offer additional trading fee discounts to customers who pay their trading fees with BNB tokens.

- Back in June the exchange, a unit of the largest crypto exchange by volume, became the first U.S. crypto exchange platform to eliminate bitcoin trading fees in an effort to attract more users. It said at the time it would do the same for more tokens in the future.

- “By eliminating fees first on BTC and now ETH, we are … raising awareness for the high fees consumers are paying on other platforms, and helping to restore trust in the greater ecosystem,” said Brian Shroder, CEO and president of Binance.US, in a press release.

ECB Official Says Energy-Intensive Crypto Should Be Banned

- Crypto assets should be banned if they are too energy intensive, European Central Bank board member Fabio Panetta said in a Wednesday speech that added to the ECB’s previous criticism of private digital currencies.

- Investors have been caught in the “textbook definition of a bubble,” lured by the promise of ever-rising prices, Panetta said in remarks that echo earlier criticism that the unregulated sector is like a “Ponzi scheme” and a “Wild West.”

Ledger’s CEO wants to build the Apple of web3 — and take it public too

- Hardware wallet developer Ledger say it’s seeing an uptick in sales in the wake of FTX’s collapse as investors seek to self-custody their crypto.

- The Block spoke to its CEO Pascal Gauthier, who described November as a breakthrough moment for the company — when it close to doubled its previous monthly sales record.

- Gauthier also described Ledger’s plans for a public listing. Shunning European markets, he envisions that the French company will list in the U.S.

Chainlink Staking Opens With Initial $51M Inflow

- Chainlink, a provider of price feeds and other data for blockchains to use in smart contracts, introduced staking of its native token LINK on Tuesday. Selected holders locked 7 million tokens, valued at about $51 million, in the first 30 minutes, according to a company spokesperson.

- The staking pool, currently in beta, is initially capped at 25 million LINK, which the company says is a security-conscious approach, meaning 28% of the staking capacity was met within the first 30 minutes. The protocol is paying out 4.75% in annualized rewards to stakers in the form of LINK tokens.

- The company didn’t respond to a request for a more recent figure sent outside of U.S. business hours. Chainlink said it plans to scale up to 75 million LINK over time. Some 500 million tokens are currently in circulation.

Binance Generates 90% of Revenue From Transaction Fees, Changpeng Zhao Says

- Cryptocurrency exchange Binance generates 90% of its revenue from transaction fees, CEO Changpeng “CZ” Zhao said in a recent TechCrunch interview posted on YouTube.

- He added that Binance had removed all ads from data site CoinMarketCap, which it acquired in 2020, to make for a cleaner experience.

- “We can turn that back on, that’ll give us $40 million a year. But we don’t need to today,” Zhao said.

- Binance’s revenue is estimated to be around $20 billion in 2021, according to a Bloomberg analysis.

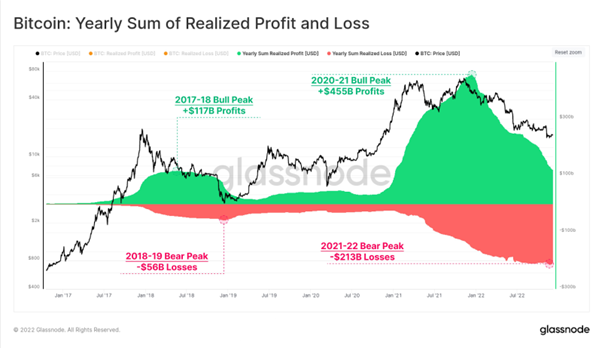

Glassnode

- Over the last 365-days, a total of $213B in Realized Loss has been locked in by #Bitcoin investors.

- This compares to yearly Profits of $455B realized in the 2020-21 bull.

- This reflects a relative capital loss of ~47% of the bull market gains, similar in scale to the 2018 cycle.