Bitcoin Price: US$ 22,762.52 (-0.74%)

Ethereum Price: US$ 1,614.29 (-0.90%)

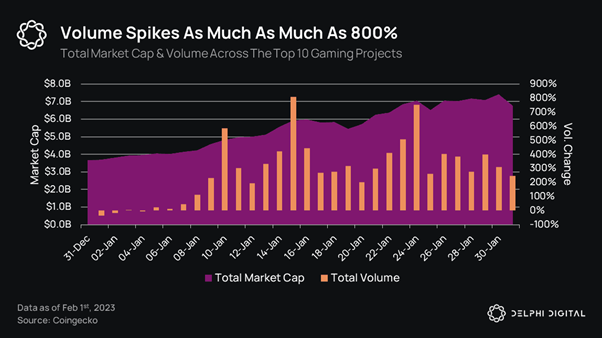

- The total market cap for all gaming-related tokens sits at around $11.5B as of writing this report. That represents an almost 82% increase from December. This is largely thanks to the positive price movements seen across the board. However, there were also a number of token unlocks from ApeCoin (APE), Aptos (APT), and Axie Infinity (AXS) that, in combination with increasing prices, have further added to the growth in total market cap for the gaming sector. Notably, we saw standout performances from GALA, MAGIC, & GMT.

- As illustrated in the graph below, January saw a sizable spike in trading volume across the top 10 gaming tokens. A large portion of this can be attributed to GALA and IMX, which both saw volume increase ~800% compared to the start of the month. This further illustrates the increased interest from investors over the past 30 days.

- Another notable mention is MAGIC, the ecosystem token powering the TreasureDAO ecosystem. TreasureDAO aims to become the “Nintendo of Web3” and is focused on helping develop, publish, and support a collection of indie blockchain games. The recent price increase has undoubtedly been helped by the upwards movement of ETH as well as a recent listing on Binance in early December. However, a series of announcements, including a new Game Builders Program (GBP), which aims to “support and incentivize” games building in the Treasure ecosystem, and the launch of TreasureTag, an ENS-like feature that will act as a user’s immutable gamer tag, have both helped to add further buy pressure to the token. This is particularly impressive due to the fact that the DAO recently voted to pass TIP-23, which resulted in roughly 50M MAGIC tokens being unlocked and distributed to users who deposited/staked NFTs in the Atlas Mine.

- Continue on Delphi Digital…

Digital bank Revolut launches crypto staking for UK and EEA customers: Report

- United Kingdom-based neo-banking platform Revolut, which boasts 25 million customers globally, has introduced crypto staking to its U.K. and European Economic Area (EEA) customers.

- According to a report from London-based news agency AltFi, the staking feature is expected to go live this week, allowing users to generate income on their crypto assets during its “soft testing” phase.

- At present, the staking feature is available for Polkadot’s DOT, Tezos’s XTZ, Cardano’s ADA and Ether ETH, with yields ranging from 2.99% to 11.65%. However, these yields are not guaranteed.

Bitcoin dominates as primary focus for digital asset investors: Report

- On Feb. 6, European cryptocurrency investment firm CoinShares published its “Digital Asset Fund Flows Report,” which revealed that investors are showing a strong interest in digital asset investment products, with inflows totaling $76 million last week, marking the fourth consecutive week of inflows.

- The report indicates a change in investor sentiment for the start of 2023, with year-to-date inflows now at $230 million. This growth has led to an increase in total assets under management (AUM), which now stands at $30.3 billion — the highest since mid-August 2022.

- Investors are primarily focusing on Bitcoin BTC, with weekly inflows of $69 million, accounting for 90% of total flows for the week. This investment growth primarily comes from the United States, Canada and Germany, with weekly inflows of $38 million, $25 million and $24 million, respectively.

- However, opinions are divided over the sustainability of this growth, with short-Bitcoin inflows totaling $8.2 million over the same period. Although these inflows are relatively small compared to long-Bitcoin inflows, they have increased by 26% of total AUM over the last three weeks. Despite this, the short-Bitcoin trade has not attracted sizable interest year-to-date, with total short-Bitcoin AUM falling by 9.2%.

- Altcoins also saw some minor inflows, with Solana SOL, Cardano ADA and Polygon MATIC investment products all posting modest declines. Despite the growing clarity around unstaking, Ether ETH producers only received $700,000 in inflows.

Chainlink oracle, data feeds coming to StarkNet ecosystem

- Blockchain scaling technology firm StarkWare is set to partner with Chainlink Labs to bring oracle services, data and price feeds to the StarkNet ecosystem.

- The coalition will see StarkWare join Chainlink’s Scale program and brings Chainlink price feeds to StarkNet’s testnet. StarkNet tokens will also fund certain operating costs for Chainlink oracle nodes, giving Starket developers access to Chainlink oracle services and data feeds.

- Chainlink is a decentralized oracle network that enables smart contracts to securely access off-chain data sources, APIs and payment systems. It allows smart contracts to interact with real-world data and events, making it possible for them to be triggered by data from external sources.

Crypto Market Sentiment Improves as Investors Await the Fed’s Next Move

- Investors are feeling more optimistic about the digital asset market now and are plugging more cash into crypto funds than previously, according to a Monday report.

- CoinShares said Monday that inflows of $76 million last week flowed into funds—the fourth consecutive week of such movements. The money is flowing into funds such as Grayscale, 3iQ, and 21 Shares—products available to accredited investors.

- This is different to the end of last year and the start of 2023, when investors were pulling money out of exchange-traded products and similar crypto investment vehicles, mainly down to a brutal bear market compounded by the collapse of exchange FTX in November.

Binance Will Temporarily Suspend US Dollar Bank Transfers

- Binance has confirmed to Decrypt that the exchange plans to pause bank transfers of U.S. dollars this week.

- “We are temporarily suspending USD bank transfers as of February 8th. Affected customers are being notified directly. It’s worth noting that only 0.01% of our monthly active users leverage USD bank transfers, but that we are working hard to restart service as soon as possible,” Binance told Decrypt via email Monday.

- The Binance representative said all other methods of buying and selling crypto on the exchange will remain unaffected, including deposits and withdrawals for euros. Binance users will also be able to continue buying and selling crypto with credit cards, Google Pay, Apple Pay, and on the Binance peer-to-peer marketplace, the spokesperson said.

Riot Just Mined The Most Bitcoin It Ever Has in a Month

- Despite a reduction in its fleet of mining machines and hash rate capacity, Bitcoin mining company Riot today reported it produced 740 BTC last month, its new all-time high.

- This is an increase of approximately 62% as compared to 458 BTC the Texas-based company produced in January 2022, and about 12% as compared to the 659 BTC generated in December 2022.

- The record number of mined Bitcoin, worth $16.8 million in current prices, came despite the operational disruption the North America-based miners faced at the end of December due to extreme weather conditions.

Aave CEO: New Security Upgrades ‘Silo the Risk Away’

- First proposed in November 2021, Aave’s latest upgrade is finally here.

- Launched earlier this month, V3 of the DeFi lending protocol has already raked in more than $143 million across the first seven assets listed.

- Though the asset list is far shorter than the previous iteration, the project’s founder and CEO Stani Kulechov says this upgrade is all about managing risk.

- “The DeFi space itself has been growing significantly, so we’ve seen more and more value at stake,” said the founder. “Because of that, and especially with the DeFi summer explosion in 2020, what we wanted to do is to create a version of the Aave protocol that basically has different kinds of security features, ensuring that the risk management is as optimized as possible for the community.”

- New features like Isolation Mode, for example, will let the protocol safely onboard what Kulechov calls long-tail assets without putting the entire protocol at risk. These would be tokens that have low liquidity, subjecting them to extreme volatility.

- Assets added in Isolation Mode have a specific debt ceiling and can only be used to borrow stablecoins, which are defined by the Aave governance community. A debt ceiling refers to exactly how much money can be borrowed using these kinds of long-tail assets as collateral. With this update, Kulechov says the protocol “can silo the risk away.”

- After the security optimization, the latest upgrade is also introducing a new portal feature that will let users move assets across different markets on different blockchains. “In the portal feature, you can move assets from Ethereum to Polygon, Polygon, to, let’s say, Avalanche, pretty much instantly,” he said.

- But perhaps the most interesting feature is one will let Ethereum bulls lever their bets using so-called liquid staking derivatives.

Glassnode: Shifting Tides

- Following an explosive month of volatile price action, Bitcoin is consolidating above the on-chain cost-basis of several cohorts. Despite a -6.2% pullback to a weekly low of $22.6k, the average BTC holder is now holding an unrealized profit, with several macro scale on-chain indicators suggesting turning of the market tides is potentially underway.

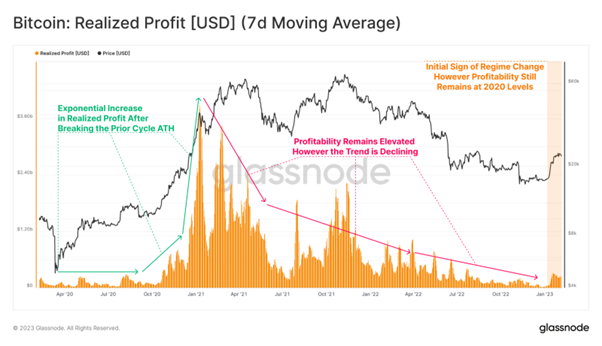

- An recent resurgence in realized profits can be observed in response to recent price action, however, it remains muted in response to the exuberance experienced throughout the 2021-22 cycle.

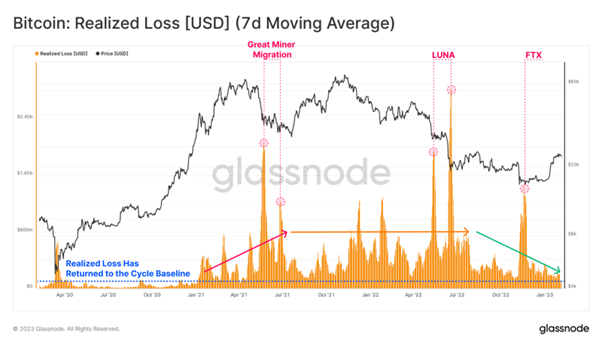

- The losses realized by the market over this same time-frame started to expand after Jan 2021, reaching an initial peak on the May 2021 sell-off (A Bear of Historic Proportions).

- However, it can be seen that the present level of realized losses has declined towards the cycle baseline of around $200M/day, with an overall contraction in loss profile barring explicit capitulation events (e.g. LUNA / FTX).

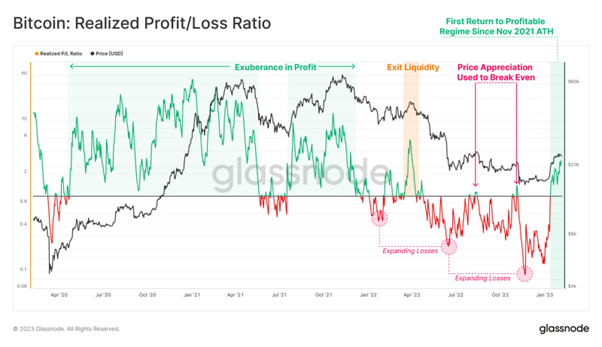

- Taking ratio between Realized Profits and Losses, we can identify structural changes in dominance between the two. Following the collapse in price action after the Nov 2021 ATH, a regime dominated by losses ensued, driving the Realized P/L Ratio below 1, with increasing severity with each subsequent capitulation in price action.

- Nevertheless, we can observe the first sustained period of profitability since the Apr 2022 exit liquidity event, suggesting initial signs of a change in profitability regime.

- Continue on Glassnode Insights…