Bitcoin Price: US$ 16,966.35 (-0.81%)

Ethereum Price: US$ 1,259.41 (-1.56%)

LTC Outperforms as the Halving Draws Closer

- Since FTX filed for bankruptcy, LTC has outperformed the market by gaining 57% as opposed to ETH up 12%, and BTC up 3%.

- The outperformance can likely be attributed to the upcoming LTC halving in mid-2023 when the block reward will be slashed from 12.5 LTC to 6.25 LTC.

- LTC rallied over 500% leading into its previous halving in August 2019. The rally lasted about 200 days, finding a top 2 months before the halving.

- A similar move from June’s bottom price of $53 could lead LTC price to $265 to an interim top.

- With a market starved for narrative, the LTC halving may capture the attention of market participants and could pull liquidity away from other tokens.

- Insurance alternative Nexus Mutual is expecting to take a loss on its investment in a credit pool on Maple Finance, a large decentralized lending platform, according to a statement released Monday.

- Nexus warned about a potential loss of 2,461 ether (ETH), some $3 million, from Orthogonal Trading’s recent default and said it started to withdraw all funds from the affected wrapped ether credit pool. This represents 1.6% of Nexus’ assets, according to the statement.

- In August, Nexus deposited 15,463 ETH, worth some $19.3 million at current price, into a wrapped ether credit pool on Maple Finance following community voting. Nexus is a peer-to-peer, risk-sharing protocol offering an alternative to insurance against risks such as DAO hacks and smart contract bugs in decentralized finance (DeFi). It is governed by a community of NXM token holders.

- However, more Nexus funds appear to be endangered. Orthogonal Trading’s defaulted debt on Maple’s wrapped ether credit pool amounts to some $5 million (3,900 wETH). On top of that, embattled market maker Auros Global failed to repay a $3.1 million (2,400 wETH) loan and has another $7.5 million (6,000 wETH) in active loans outstanding from the same pool.

- The troubled debt represents 56% of the $27.8 million outstanding debt in the wETH credit pool, according to Maple’s credit dashboard. Only $3.1 million in cash deposits are not actively tied up in loans, which limits Nexus’ ability to withdraw funds. Maple has a 10-day waiting period before depositors can withdraw capital.

- Nexus Mutual’s warning comes as contagion from the implosion of FTX, once one of the world’s largest crypto exchanges, spreads to DeFi lending protocols. Orthogonal Trading received a default notice for a total of $36 million loans on Maple after it allegedly misrepresented its losses from the FTX fallout to creditors. Auros Global said last week it is facing “short-term liquidity issues” and missed payment on a loan from Maple.

GameStop Cuts More Staff—Including Crypto Wallet Engineers

- Video game retailer GameStop has laid off another round of employees today ahead of its upcoming earnings report, according to reports and social media posts from affected individuals. The team behind the company’s crypto wallet was particularly hard hit, according to Axios.

- Daniel Williams, GameStop’s Lead Software Engineer, posted on LinkedIn earlier today that there was “another big round of layoffs at GameStop currently in progress,” including ecommerce product and engineers employees—”lots of them,” he added. In a follow-up comment, Williams said that a company announcement is due later today.

- Multiple former employees have shared public status updates about the layoffs on LinkedIn today, including blockchain and iOS engineer Brandon Jenniges, who wrote that he was impacted by the company’s move.

Chainlink ‘Smart Money’ Might Be Pulling LINK Tokens Off Exchanges to Stake Them

- Chainlink, the crypto oracle project that specializes in providing data feeds to blockchain protocols, is set to allow early access for qualifying users to stake LINK tokens starting Tuesday.

- According to a Chainlink web post, “Staking provides Chainlink ecosystem participants with the opportunity to earn rewards for increasing the security guarantees and user assurances of oracle services by backing them with staked LINK tokens.”

- Nansen, a blockchain analysis firm, said wallets identified as “smart money” have been taking LINK tokens down from crypto exchanges – possibly an indication that users might be planning to stake them.

- The price of LINK is up 28% in the past two weeks, from $5.60 to $7.19 at time of writing.

- Early access to Chainlink Staking v0.1 opens on Dec. 6 at 12 p.m. ET, while general access is available Dec. 8.

- According to a Chainlink blog post, “Chainlink Staking v0.1 will initially be capped at 25M LINK, with plans to scale up to 75M LINK overtime.”

- “Smart Money” net flow to exchanges for LINK in the past seven days is down nearly 67,000 tokens (worth $486,000), which means LINK withdrawals exceed deposits, according to Nansen.

Bitcoin Miner Riot Switches Mining Pool After Falling Short in November

- Riot Blockchain (RIOT), one of the world’s largest publicly traded bitcoin miners, is switching its mining pool to ensure “more predictable results” for its operations, the company said after failing to produce expected monthly bitcoins.

- Riot said that it achieved record hashrate capacity in November with computing power reaching 7.7 exahash per seconds (EH/s), 12% higher than 6.9 EH/s in October, according to a statement. However, the miner produced 521 bitcoin in November, lower than the 660 it expected to mine, due to a payment variance in the mining pool it was using.

- Riot mined only 2% more bitcoin in November than the previous month. Meanwhile, it mined 43% more bitcoins in October versus September.

- “Variance in a mining pool can impact results and while this variance should balance out over time, can be volatile in the short term,” Riot CEO Jason Les said in the statement. “This variance led to lower bitcoin production than expected in November, relative to our hashrate,” he added.

Aave acquires web3 social gaming app Sonar to expand Lens Protocol

- Aave Companies acquired Sonar, a mobile social gaming app that supports NFT-based avatars, in an effort to expand Lens Protocol for identity across web3 consumer products.

- Sonar co-founder Ben South Lee joins Aave as senior vice president of product and design. His brother, Sonar co-founder Randolph Lee, will transition to a principal engineer role with Aave. The two will lead a team focused on developing mobile facing applications that integrate Aave’s Lens protocol, a decentralized identity platform for web3 services.

- Available on iOS, Sonar hosts thousands of active users who may interact with one another with avatars depicted as colorful dots or 3D characters for users who equip Moji NFTs to their profiles. Aave is targeting 2023 for wider integration between Lens Protocol, Sonar as well as other web3 applications.

- “Sonar will be the first social mobile metaverse powered by Lens Protocol,” an Aave representative told The Block via email. “For niche communities, being able to move seamlessly between applications in the Lens ecosystem without having to start from scratch will be important and one of the biggest differentiations from web2 apps.”

- The identity system provided by Lens will also integrate with Sonar. “Users will be able to mint Lens profiles and get ownership of their profiles and benefit from all the features Lens Protocol provides,” said Aave.

Nexo to Phase Out Service in US After Hitting ‘Dead End’ With Regulators

- Crypto lender Nexo today announced it will gradually phase out U.S. products and services over the coming months due to hitting a “dead end” with regulators.

- The U.K. company said in a Monday announcement that it had been talking with regulators for 18 months but the U.S. “refuses to provide a path for enabling blockchain businesses.”

Maple token down more than 24%, cuts ties with Orthogonal Trading following $36 million default

- Maple Finance’s token, Maple (MPL), plummeted on Monday following the revelation that Orthogonal Trading defaulted on $36 million of loans on the crypto lending protocol.

- Orthogonal Trading interacted with Maple Finance through its credit arm as a delegate and through its trading arm as a borrower in order to access credit. As a delegate, its credit arm processed due diligence for investors looking to access the permissioned protocol. The USDC lending pool it ran originated $850 million in loans — with a default rate of 1.2%.

- The trading arm did not access any loans in the pool run by its credit arm.

- The MPL token was trading at $5.29 at 1 p.m. EST, according to data from CoinGecko. The token, built on the Ethereum network, has fallen 24.7% in the past 24 hours.

BlackRock CEO’s Crypto About-Face

- Larry Fink, CEO of BlackRock, the world’s largest asset manager, changed his stance on crypto during 2022, sending strong trust signals to the markets.

- Back in 2017, Fink said bitcoin was an “index of money laundering.” But in the summer of 2022, BlackRock, with $10 trillion under management, made two forays into bitcoin, further cementing the asset’s establishment as a mainstream investment.

- The asset manager connected its Aladdin investment platform to Coinbase Prime, giving TradFi investors access to bitcoin, as prelude to expansion into other cryptocurrencies eventually. The firm also announced a spot bitcoin private trust, giving its clients direct exposure to the world’s largest cryptocurrency by market cap.

- These moves were in response to demand from clients, BlackRock noted in its announcements, showing how even the biggest traditional investment bankers can’t ignore crypto any more.

Australian crypto exchange Swyftx cuts 90 jobs in second round of layoffs

- Australian crypto exchange Swyftx has fired 90 employees in its second round of layoffs in four months.

- “Swyftx has no direct exposure to FTX, but we are not immune to the fallout it has caused in the crypto markets,” co-founder and CEO Alex Harper said in a note to employees on Monday.

- The laid-off staff reportedly translates to around 35% of the company’s workforce.

- The second round of redundancies comes four months after Swyftx let go of 74 employees in August. Commenting on the latest cuts, Harper said that Swyftx has to “prepare in advance for a worst-case scenario of further significant drops in global trade volumes during H1 next year and the potential for more black swan-type events.”

‘Twitter Coin’ hints unveiled by tech sleuth – (Rumour)

- Twitter may be taking more decisive strides toward integrating crypto payments — and, perhaps, a native coin.

- Security researcher Jane Manchun Wong extracted code for a vector image depicting a “Twitter Coin,” which she shared in a now-deleted tweet. Wong also shared an image of a “Coins” section within Twitter’s “Tips” feature.

- The code was extracted from a recent version of the Twitter Web App, Wong told The Block. The icon of Twitter Coin may be related to the crypto-integrated tipping feature Twitter seems to be working on.

Bitcoin Lags as Unwinding of ‘Fed Trade’ Lifts US Stocks Above 200-Day Average

- Investors have been reassessing their commitment to these so-called hawkish Federal Reserve trades in recent weeks and piling back into risk assets, except bitcoin, thanks to the peak inflation narrative and the central bank hinting at moderation in liquidity tightening from December.

- The S&P 500, Wall Street’s benchmark equity index, has gained 16% in less than two months to trade above the widely-tracked 200-day moving average for the first time since early April. The USD/JPY pair, often called a turbo bet on the Fed policy and U.S. rates, has dropped 11% to its 200-day moving average. The dollar index, which tracks the greenback’s value against major fiat currencies, has also dropped below its 200-day average.

- The U.S. government bond yields have come off sharply from the yearly highs, validating the peak inflation narrative and the resulting risk revival in equity and currency markets.

- Bitcoin, however, appears to have decoupled from macroeconomic developments and traditional markets. At press time, the leading cryptocurrency by market value changed hands at $17,340 or traded at a discount of 22% to its 200-day moving average.

- This shows that the FTX insolvency couldn’t have come at a worse time for bitcoin and the broader crypto market.

- “Historically, (U.S.) stocks and crypto have a strong relationship with each other. Without FTX implosion, bitcoin might have been trading at $29,000 by now – instead of $17,200 (or 69% higher),” Markus Thielen, head of research and strategy at crypto services provider Matrixport, said.

Glassnode – A Capital Reset

- In the wake of one of the largest deleveraging events in digital asset history, the Bitcoin Realized Cap has declined such that all capital inflows since May 2021, have now been flushed out. There is an associated uptick in on-chain activity, however it lacks substantial volume follow through.

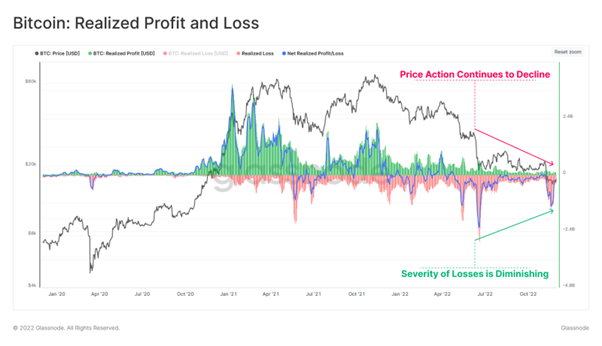

- Both the June 2022 sell-off, and the FTX Implosion prompted investor capitulation events that are of historical scale. The FTX event recorded an ATH one-day loss of -$4.435B. However, when assessed with a weekly moving average, losses appear to be subsiding. The June Sell-off by comparison sustained over -$700M in losses each day for almost 2 weeks after the event.

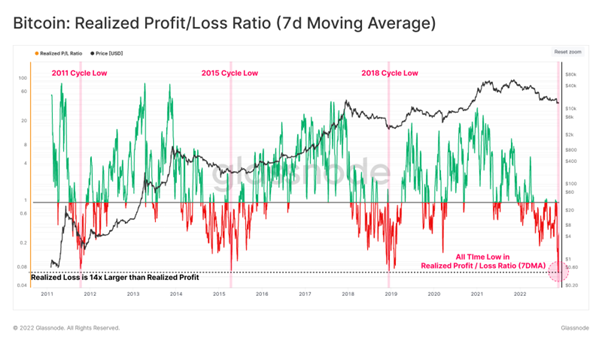

- We can supplement this analysis by inspecting the ratio between realized profit , and realized loss. Here we can observe that the ratio between realized profit / loss has recorded a new all time low.

- This indicates that losses locked in by the market were 14x larger than profit taking events. It is likely this in part reflects how the entirety of the 2020-22 cycle price action is above the spot price.

- Previous instances of extremely low Realized Profit/Loss ratios at this scale have historically coincided with a macro market regime shift.

- Continue on Glassnode Insights…