Bitcoin Price: US$ 17,105.70 (+1.31%)

Ethereum Price: US$ 1,279.41 (+3.14%)

The Curious Case of Token Unlocks

- Tokens are a financial innovation that confer either ownership or decision-making power to their holders. Token economics refers to the distribution, value accrual mechanism, emission schedule, and sinks associated with a token. A well-designed token economy helps good projects compound their growth by enabling a flywheel to bootstrap usage. If successful, the value generated by the project can be passed on to token holders.

- While good token economics can complement good products, success really boils down to the product’s strength. Unsurprisingly, poorly designed token economies don’t help good projects, as they often serve as an added point of friction. Poor token economics with a poor product spells doomsday.

- In the case of a good project with bad token economics, the market is bound to take advantage of the situation. GCR is a well-known trader from the last cycle, noted for topping the FTX PNL leaderboard and making several accurate market predictions. Towards the end of the last cycle, GCR was focused on finding coins with massive upcoming unlocks and taking short positions on them to profit when investors sold their unlocked tokens.

- The increasing focus on token economics and, more specifically, token unlocks has been attributed to changes in token distributions. Despite the negative connotations, ICOs provided a level playing field where most participants invested in a project at the same cost. However, in the past couple of years, the environment has shifted to one where professional investors have a massive edge – from increased allocations to a significantly lower cost basis versus retail investors. Both market cycles had “fair” and VC-dominant token distributions, but the latter seems more pronounced nowadays.

- Continue on Delphi…

Bybit reducing workforce as bear market deepens

- Crypto exchange Bybit is reducing its workforce as a direct result of “the deepening bear market.”

- The Singapore-based crypto exchange’s CEO and co-founder, Ben Zhou, made the announcement on Twitter at 12:32 a.m. ET.

- “The planned downsizing will be across the board,” Zhou tweeted, adding: “For our impacted colleagues, we will try to make this process as smooth as possible and take care of each individual’s needs as much as we can.”

- Bybit is not alone in reducing its workforce as the blockchain and cryptocurrency industry struggles to regain its footing after a tough year — which saw the collapses of the Terra ecosystem, hedge fund Three Arrows Capital, major crypto exchange FTX and its sister firm Alameda Research.

- San Francisco-based crypto exchange Kraken announced it was cutting 1,100 staff, or 30% of its workforce, on Nov. 30 — citing a need “to adapt to current market conditions.” Earlier in November, rival Coinbase, also based in San Francisco, said it was laying off more than 60 employees from its human resources department. Mexico-based crypto exchange Bitso also let go of an unspecified number of workers.

LedgerX for sale, with interest from Blockchain.com, Gemini, others: Bloomberg

- Crypto derivatives exchange and clearinghouse LedgerX is for sale, with Blockchain.com and Gemini among those interested in acquiring the firm, Bloomberg reported late Friday.

- LedgerX is regulated by the US Commodity Futures Trading Commission (CFTC), and has been a subsidiary of FTX US since October 2021. LedgerX is one of the few solvent entities remaining in the FTX group of companies, Bloomberg noted.

- At least 10 companies have expressed interest in purchasing LedgerX, the report said. These include the exchanges Blockchain.com, Gemini, Bitpanda and Kalshi, a CFTC-regulated platform specializing in trades based on the outcome of events. About six others could also have interest in buying the company, Bloomberg wrote, citing a person familiar with the matter.

- Twitter direct messages sent to both LedgerX and its CEO Zach Dexter were not returned by press time.

- LedgerX is planning to make $175 million available for use in FTX’s bankruptcy proceedings, Bloomberg reported on Nov. 29. It would come from a $250 million fund LedgerX was planning to use for a CFTC application aimed at getting regulatory approval to “clear crypto derivatives trades without intermediaries,” according to Bloomberg.

- LedgerX was requesting CFTC approval to offer products that were not fully collateralized, an agency announcement shows. The derivatives exchange withdrew that application on Nov. 11 — the same day FTX and more than 100 subsidiaries filed for Chapter 11 bankruptcy protection.

Genesis Owes Gemini Earn Users $900M: Report

- Embattled crypto broker Genesis and its parent company Digital Currency Group (DCG) owe users of Gemini Earn $900 million, the Financial Times reported on Saturday, citing anonymous sources.

- Gemini had used Genesis as its primary lending partner for its high-yield Earn service, which allowed customers to deposit their cryptocurrency in exchange for interest, similar to a bank account, offering returns of between 0.45% and 8% depending on which token you deposited.

- According to the FT, Gemini is working as part of a creditors’ committee to regain the funds from Genesis and DCG.

Alameda invested $1.15 billion into crypto miner Genesis: Bloomberg

- Alameda Research, the trading firm closely related to embattled exchange FTX, invested $1.15 billion into crypto miner Genesis Digital Assets.

- This was Alameda’s and FTX’s biggest venture investment and valued the company at $5.5 billion in an April funding round, according to documents obtained by Bloomberg that listed FTX and Alameda’s venture portfolio.

- Alameda made four separate capital injections into the crypto miner. Last August, it invested about $100 million in the miner. It invested $550 million in January, followed by $250 million in February and $250 million in April.

- The crypto miner has no relation to Genesis Trading, whose lending unit suspended redemptions in the wake of FTX’s collapse.

BlockFi’s bankruptcy is the latest blow for a bleeding Bitcoin mining industry

- As if crashing crypto assets, high energy prices and increasing difficulty in mining weren’t enough, now Bitcoin miners face the fallout from BlockFi’s bankruptcy protection filing.

- BlockFi was the second biggest lender in the space after NYDIG, according to public information laid out by The Block Research in June. On top of that, BlockFi debtor Core Scientific — ie, the largest mining company in the world — is itself close to filing for bankruptcy. Core had $54 million in outstanding debt to BlockFi in September and late in October said that it would not make payments by end of the month.

- They are far from the only miner struggling with liquidity.

- Machine-backed loans helped miners bootstrap operations and plan lofty expansions at the height of the bull market. The future of that financing is now uncertain, and those who owe money are in a tight spot, experts said.

- “They ran a very aggressive lending model and it finally, unfortunately, caught up with them,” said Pablo Bonjour, managing partner and crypto expert at restructuring firm MACCO, which advised crypto lender Cred through chapter 11 bankruptcy.

- Now that BlockFi has filed for Chapter 11 bankruptcy protection, their financial advisors will likely be reaching out one by one to companies that owe them money.

- It’s a sign of the times: the next bitcoin mining difficulty update might be the largest drop this year.

- The adjustment is projected to happen in the early hours of next Tuesday and could be between -8% and -7%, according to most estimates. Luxor placed it at -7.98%, Braiins at -7.9% and Bitrawr between -7.9% and -7.5%, at the time of publication.

- Those numbers are subject to change over the next few days, depending on how many machines go on and offline, but still paint a pretty clear picture of the current state of the mining economics.

- Companies are hurting, with the biggest one by hash rate, Core Scientific warning that it might have to file for bankruptcy. The industry has seen margins plunge due to rising power costs and declining bitcoin prices. And some companies are cash-strapped and buried in debt.

- “The upcoming difficulty adjustment is tracking to be significantly negative, as hashprice levels hit resistance points due to mining profitability thresholds turning negative,” said Ethan Vera, COO of Luxor, a bitcoin mining software company, which runs a mining pool.

- On top of that, “many distressed miners are unplugging and relocating machines, adding additional downward pressure on network difficulty,” Vera added.

- In other words, a “difficulty drop is (the) result of miners shutting off machines that are no longer profitable,” said Jeff Burkey, VP of Business Development at Foundry.

- “I actually think we’re going to see potentially another drop because selling machines are not profitable at this price. A lot of S19J Pros are not profitable,” said William Foxley, Compass Mining’s media and strategy director.

- The size of Grayscale’s Bitcoin Trust (GBTC) could pose a potential problem for the entire market — at least according to a UBS report.

- Grayscale’s Bitcoin Trust, which passively invests in bitcoin, holds over 633,000 of the coins, which at today’s prices equals nearly $11 billion and represents 3.3% of all coins mined. The sheer size would “spell trouble for the entire market, as bitcoin still comprises more than 45% of the space ex stablecoins,” UBS wrote.

- The bank’s analysis comes as questions swirl around the health of Grayscale’s parent, Digital Currency Group. Concerns first cropped up when DCG’s Genesis Global Capital said it had a $175 million exposure to FTX following the exchange’s collapse. Genesis has reportedly been looking to raise $1 billion or it may file for bankruptcy protection. There have also been reports of DCG putting cryptocurrency news site CoinDesk up for sale, and the New York Times said DCG hired Moelis & Company to explore options.

- One possible option mentioned by UBS was for DCG to tap into its GBTC investment.

- DCG is the largest holder of GBTC shares with almost 10%, based on Bloomberg data. It could potentially decide to sell its holdings to raise cash, Ivan Kachkovski, a strategist at UBS wrote in a note.

- “This stake is presently worth $600m, 12 times greater than the three-month average of the trust’s daily trading volume,” he said.

Galaxy Digital to acquire custodian GK8 from bankrupt Celsius

- Galaxy Digital agreed to purchase high-security custodian GK8 from bankrupt crypto lender Celsius.

- Galaxy will support GK8’s self-custody solution in the ongoing development of GalaxyOne, a new prime offering for institutional investors combining trading, lending, cross-portfolio margining and derivatives with the company’s risk-management processes.

- Mike Novogratz’s firm said the acquisition represents a “crucial cornerstone” in the firm’s effort to build a full-service financial platform for digital assets.

- “Adding GK8 to our prime offering at this pivotal moment for our industry also highlights our continued willingness to take advantage of strategic opportunities to grow Galaxy in a sustainable manner,” he said.

- Celsius filed for Chapter 11 bankruptcy protection in July following the collapse of Terra’s ecosystem. The lender froze customer withdrawals in June as it faced mounting liquidity issues. At the time, FTX had considered a deal with Celsius but walked away after seeing the firm’s finances.

Glassnode

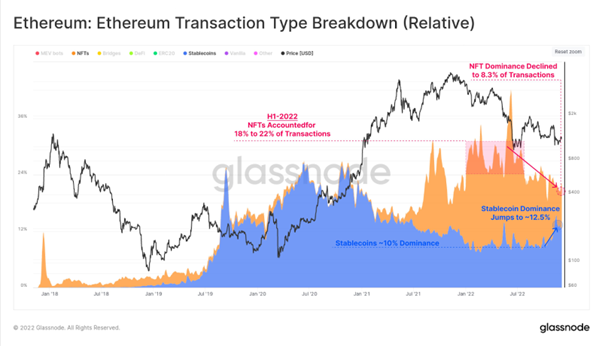

- NFTs on #Ethereum accounted for 18% to 22% of transactions during H1-2022.

- However NFT dominance has since declined to just 8.3%, as interest in the space wanes during the bear market.

- Stablecoin dominance has spiked since FTX from 10% to 12.5%.