Bitcoin Price: US$19,591.51 (+0.92%)

Ethereum Price: US$ 1,335.70 (-0.11%)

Solana NFT Volume Market Share Increases As Mints Surge

- Circle announces native USDC support on Arbitrum, Cosmos, NEAR, Optimism, and Polkadot. Circle also unveiled a tool to facilitate cross-chain transfers.

- CFTC Chairman Rostin Behnam says, “Bitcoin might double in price if there’s a CFTC-regulated market.”

- Record label Warner Music Group has partnered with OpenSea to offer early access to the new NFT drops product to select artists.

- Meta announces that US-based users can connect their wallets to Facebook and Instagram and share NFTs.

- SWIFT, the interbank messaging system, is working with Chainlink on a cross-chain interoperability protocol that will allow member banks to send messages instructing on-chain token transfers.

- Since Aug 14th, Solana’s market share of total NFT trading volume has increased from 7% to 27%, with a peak market share of 36% in the week of Sept 4th. During the same period, Ethereum’s market share fell from 85% to 58%.

- Out of the top five blockchains by NFT trading volume, only Solana and Flow had an increase in 30-day NFT trading volume. Flow had a 9% increase, while Solana has seen a 117% increase.

- NFT minting transactions on Solana have also spiked to reach an all-time high of 389k transactions during the week of Sept 11th, representing a 350% change from two weeks prior. This was likely driven by the release of several NFT collections on Solana.

- The top five NFT collections on Solana by 30-day trading volume include y00ts: mint t00b, Abracadabra, DeGods, UkiyoNFT, and Critters Cult. Out of these, all but DeGods were minted in the last three weeks.

- The number of Solana wallet addresses associated with first-time and returning buyers is also up. First-time buyers are up 80% while returning buyers are up 78% in the last 30 days.

- OpenSea has averaged 76% dominance of NFT volumes over the past 90 days, peaking at 89%.

- Its dominance has been contested, albeit momentarily, by marketplaces that prioritized user acquisition, incentivized trading, and returning service fees.

- LooksRare has failed to gain meaningful traction with this methodology. LooksRare’s market share has diminished from 19% to 3% since the beginning of the year.

- On the contrary, X2Y2’s market share has risen 19% recently despite having near-identical token economics to LooksRare.

- Contributing factors to this situation include direct NFT project launches, buyer optionality in paying royalties, and the lowest trading fees alongside Sudoswap.

- The CryptoPunks marketplace is a standalone marketplace for Punks, which has fended off competition for its Punks by charging only gas fees through its marketplace.

- In early July, Sudoswap comprised a mere 0.1% of total marketplace volume, peaking at 18% in mid-August as a result of the Sudo-NFT frenzy.

- Sudoswap has been able to rival LooksRare and the CryptoPunks marketplaces – without token incentives to boost rewards.

- A breakdown of Sudoswap users shows that 60% made just a single trade. These users are likely comprised of curious traders, airdrop speculators, and regular NFT enthusiasts looking for optimal prices.

- 40% of users made two or more trades, implying they are returning users. Only 1% of users traded 20-100 times, with 0.1% making more than 100 trades.

- This is likely a result of trades made in large batches and bots that arbitrage price differences between many different exchanges.

- With integrations with NFT aggregators now live, the percentage of returning users will likely increase as trades automatically route to the most efficient price, which happens to be on Sudoswap most of the time.

Cardano’s Founding Entity Emurgo to Invest Over $200M to Boost Ecosystem

- Cardano development lab Emurgo will invest over $200 million to support the ecosystem’s growth over the next three years, founder Ken Kodama told CoinDesk on the sidelines of the ongoing Token 2049 conference on Thursday.

- Emurgo is a founding entity of the Cardano protocol and develops products, services and applications meant to support the growth of the network.

- The funds, which are from Emurgo’s own capital, will be provided to projects directly building atop Cardano and to projects from other networks that build products that integrate Cardano’s network alongside their own.

- Kodama said $100 million will be earmarked for investments in Africa under Emurgo’s African investment initiative. He explained that a key growth driver in the region was the use of lending and borrowing crypto services meant for daily life, as opposed to speculative purposes.

- Kodama acknowledged that the growth of the Cardano network had been relatively slow compared with other networks. However, he added that Cardano was now ready with the infrastructure needed to safely expand and grow the network in the coming years.

Surging Bitcoin-Sterling Trading Volume Points to Hedging Demand for Crypto, or Does It?

- The bitcoin-British pound (BTC/GBP) pair listed on major cryptocurrency exchanges, including Bitstamp and Bitfinex, is more active than ever. Analysts, however, are divided on whether the surge stems from investors switching to the largest cryptocurrency by market value to protect against the sterling slide or from traders looking to profit from the volatility.

- On Monday, which was the day when the pound crashed to a record low $1.035, trading volume in the pair listed on those two exchanges climbed to a record $881 million. That’s 12 times the $70 million average daily volume of the past two years, according to data tweeted by James Butterfill, head of research at CoinShares, an early-stage crypto investor, early this week.

- The pound’s weakness was prompted by concerns over the U.K.’s fiscal health stemming from the new government’s tax-cut plans. This month, the currency has weakened 7% against the dollar, the steepest drop since December 2016.

- “An explosion in bitcoin trading against the pound underlines the potential of the biggest cryptocurrency to benefit from an apparent fragility in fiat currencies,” analysts at Bitfinex said in an email.

BlackRock launches ETF in Europe with blockchain and crypto company exposure

- BlackRock just made another move into crypto, this time launching an ETF with exposure to blockchain and crypto companies for its European customers.

- The iShares Blockchain Technology UCITS ETF is designed to track the New York Stock Exchange FactSet Global Blockchain Technologies capped index, it said in a release. The index includes 35 companies from around the world and is listed on the Euronext under the ticker BLKC.

- The index has 75% exposure to companies with primary business related to blockchain — including crypto miners and exchanges. It has a further 25% exposure to companies supporting the blockchain ecosystem, whether that be payments or semiconductor companies.

- “We believe digital assets and blockchain technologies are going to become increasingly relevant for our clients as use cases develop in scope, scale and complexity. The continued proliferation of blockchain technology underscores its potential across many industries,” Omar Moufti, product strategist for thematic and sector ETFs at BlackRock, said.

Money Laundering via Metaverse, DeFi, NFTs Targeted by EU Lawmakers’ Latest Draft

- Members of the European Parliament looking to tackle money laundering want to target large crypto transactions as well as the metaverse, decentralized finance (DeFi) and non-fungible tokens (NFT), a draft bill seen by CoinDesk shows.

- The European Parliament is currently deliberating on an overhaul of European Union money-laundering laws proposed by the European Commission in 2021.

- The draft, badged as a set of “compromise amendments” to the law which seek to find consensus among different political factions, incorporates a July idea from left-wing lawmakers to include decentralized finance within the law’s scope.

- DeFi, and the decentralized autonomous organizations (DAO) that govern it, “should also be subject to Union [anti-money laundering/counter-terrorist financing] rules where they are controlled directly or indirectly, including through smart contracts or voting protocols, by natural and legal persons,” the text said.

Celsius stablecoin sale plan faces objections from securities regulators

- State securities regulators in Texas and Vermont are objecting to crypto lender Celsius’s plan to sell its stablecoin holdings.

- The Texas State Securities Board, the Texas Department of Banking and the Vermont Department of Financial Regulation filed their objection today. Celsius wants to sell the stablecoin holdings in order to shore up its finances amid the ongoing bankruptcy proceedings.

- Vermont’s lawyers said it’s possible Celsius could use the proceeds to resume potentially illegal activities. They objected on the basis that the Celsius request doesn’t detail how the firm would use the funds, and thus “creates the risk [Celsius] will resume operating in violation of state law.” The filing references the collaborative investigation among 40 state regulators into Celsius’ activities that include potential unregistered activity, fraud and market manipulation.

- The Texas agencies filed jointly with similar arguments, calling Celsius’ request to sell its stablecoin “troublingly broad.” Celsius failed to provide sufficient details in their application to sell the stablecoin holdings, according to the Texas filing.

ETHW Surges as Binance Launches Ethereum Proof-of-Work Mining Pool

- Cryptocurrency exchange Binance today announced an Ethereum Proof-of-Work (ETHW) mining service for its users. Binance further announced Thursday that those who take part in the ETHW pool will not be charged a fee until October 29.

- Mining pools are formed when groups of crypto miners want to share resources to allow other miners to work with them and collectively have a better chance of processing a transaction. Binance gives its users the chance to join pools with a service called Binance Pool.

Judge denies another SEC attempt to shield documents in Ripple case

- A U.S. District Judge has rejected the Securities and Exchange Commission’s (SEC) attempts to shield documents related to a 2018 speech on cryptocurrencies from former Division of Corporation Finance Director Bill Hinman in its ongoing case with blockchain firm Ripple.

- The commission had appealed a prior judge’s decision for it to hand over the materials as part of its legal case with the crypto payments company.

- The two have been locked in a legal battle since the SEC brought its case against Ripple in 2020, alleging the sale of its XRP token constituted an unregistered securities offering. Since then, much of the case has centered on internal documents relating to Hinman’s speech, which sought to create regulatory wiggle room for some digital tokens to be exempted from securities registrations.

- Ripple has continued to request the emails and memos related to the speech, and Magistrate Judge Sarah Netburn has repeatedly sided with Ripple, denying the SEC’s requests for reconsideration in February and April. In July, the SEC once again objected, kicking the issue to District Judge Analisa Torres. Torres overruled the objection today, directing the SEC to comply with the orders and produce the documents.

Star Atlas offers first glimpse of gameplay with debut on Epic Games Store

- Star Atlas has released its first pre-alpha gameplay demo on the Epic Games Store, offering fans a long-awaited glimpse of what they might expect in the full version of the massively multiplayer online role-playing game (MMORPG).

- The demo introduces players to Asha, a pilot and captain of the Council of Peace, and gives them option to summon and view their NFT ships on launching pads in the “Showroom.”

- Based on Solana and built using Unreal Engine 5, Star Atlas is one of the most ambitious gaming projects in the space. Its lore is based around three factions struggling for resources, territorial conquest and political domination in the year 2620.

- The project launched in 2020 and it’s already attracted a loyal following. Fans have spun off ship-making guilds and even a dedicated news site based on the game.

- But with almost $200 million spent on NFTs for a game that — by co-founder CEO Michael Wagner’s own estimate — may not be rolled out for another 5-7 years, it’s faced questions as to whether it can deliver on its lofty goals.

Jack Dorsey Told Elon Musk Twitter Should Be a Protocol ‘Like Signal’

- During Elon Musk’s contentious attempt to acquire Twitter, former CEO and co-founder of the birdsite Jack Dorsey told the Tesla CEO that the microblogging platform should be based on an “open source protocol, funded by a foundation.”

- The suggestion was unearthed as part of the legal discovery process in Musk’s ongoing litigation with Twitter and its Board of Directors, which is attempting to hold the billionaire to his offer to buy the service. One of the exhibits in the case is an archive of text messages that Musk exchanged with a variety of prominent tech personalities, including Dorsey, FTX CEO Sam Bankman-Fried, Oracle co-founder Larry Ellison, and investor-podcaster Jason Calcanis.

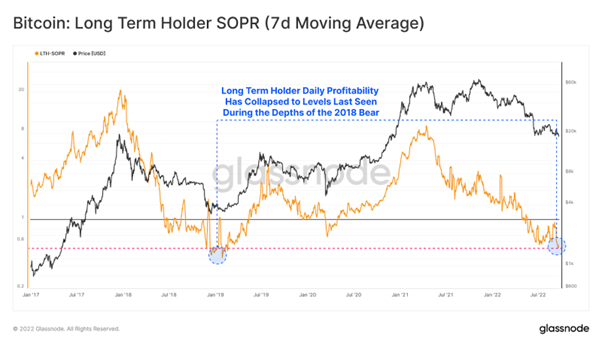

Glassnode:

- #Bitcoin Long-Term Holder profitability has declined to levels last seen during the depths of the Dec 2018 bear market.

- Long-Term Holders are selling $BTC at an avg loss of 42%, indicating LTH spent coins have a cost basis around $32k.