Bitcoin Price: US$ 23,742.30 (+3.13%)

Ethereum Price: US$ 1,644.72 (+4.62%)

Feds Want Sam Bankman-Fried to Stop Contacting Potential Witnesses on Signal

- Federal prosecutors have urged U.S. District Judge Lewis Kaplan to modify Sam Bankman-Fried’s bond agreement, saying the disgraced crypto mogul may have engaged in “witness tampering” by sending encrypted messages to a potential witness.

- In a four-page filing put forward Friday, prosecutors said Bankman-Fried had tried to contact “the current General Counsel of FTX US” through the encrypted messaging application Signal and email on January 15. While identified in the filing only as “Witness-1,” Ryne Miller is FTX US’s current counsel.

- “I would really love to reconnect and see if there’s a way for us to have a constructive relationship, use each other as resources when possible, or at least vet things with each other,” U.S. prosecutors allege Bankman-Fried wrote.

- Prosecutors said Bankman-Fried has tried to contact other current and former employees of FTX as well. And his desire to “vet things” with Miller suggests an effort to influence the testimony of potential witnesses, they argued.

Arbitrum-based DEX Vest comes out of stealth with seed round from Jane Street, others

- Vest Exchange came out of stealth and revealed plans to launch a decentralized perpetual futures exchange on the Arbitrum network.

- The exchange has closed a seed round for an undisclosed amount from Jane Street, QCP Capital, Big Brain Holdings, Ascendex, Builder Capital, Infinity Ventures Crypto, Robert Chen (Ottersec), Pear VC, Cogitent, Moonshot Research, Fugazi Labs and other angel investors.

- “We hope that Vest will elevate the standard of perpetual futures trading by democratizing access to unique trading opportunities in all markets,” Vest said in a blog post.

- Vest will focus on providing low barriers for token listings, strong risk management and clear fees for liquidity providers. It said it will provide these elements through the design of its risk engine.

A mission to make blockchain more useful: Flare, the blockchain for data.

- Flare is an EVM-based Layer 1 blockchain aiming to address this issue, making blockchain more useful by providing decentralized access to high-integrity data from other chains and the internet. This will enable new use cases and monetization models, while allowing dapps to serve multiple chains through a single deployment.

- An example use case could be triggering a Flare smart contract action with a payment made on another chain, or with input from an Web2 API. Flare’s technology can also facilitate new ways of bridging between blockchains, supporting free decentralized movement of both smart-contract and non-smart contract assets between chains.

- To make this possible, Flare has developed two native interoperability protocols which enable on-chain, decentralized acquisition of blockchain, time series and Web2 API data. The protocols are secured by the network itself, with decentralized and independent data providers incentivized to deliver accurate data. This helps Flare to minimize risks for users and developers.

- The State Connector securely acquires event information from other blockchains and the internet to be used in smart contracts on Flare. This could be detailed data regarding an individual transaction on another chain, including using the contents of the memo data field to transmit a payment reference. Alternatively, it could be event data from a Web2 API, such as for a bank or social media platform.

- The second core protocol is the Flare Time Series Oracle (FTSO). This utilizes the network structure to deliver highly decentralized prices and data series to dapps on Flare without relying on centralized data providers. The FTSO is supported by almost 100 independent data providers incentivized to provide reliable data every 3 minutes.

- U.S. Attorneys want to restrict FTX founder and ex-CEO Sam Bankman-Fried’s access to encrypted messaging services and bar communication with former FTX and Alameda employees, after prosecutors suggested he was trying to influence witnesses, according to court documents.

- U.S. prosecutors contend Bankman-Fried’s messages were “suggestive of an effort to influence” the testimony of a witness. The witness is said to have received instructions via encryption messaging app Signal for “liquidating Alameda’s investments to satisfy FTX customer withdrawals” to cover a $45 million hole in FTX US’s balance sheet in November.

- “I would really love to reconnect and see if there’s a way for us to have a constructive relationship, use each other as resources when possible, or at least vet things with each other,” SBF wrote to “Witness-1” on Jan. 15.

- “This is particularly concerning given that the defendant is aware that Witness-1 has information that would tend to inculpate the defendant,” the document said. “The appeal for a ‘constructive relationship’ likewise implies that Witness-1 should align with the defendant. This is particularly concerning given that the defendant is aware that Witness-1 has information that would tend to inculpate the defendant.”

BH Digital didn’t just get Dragonfly’s head of liquid strategies, it got the whole team

- Brevan Howard Digital didn’t just hire Dragonfly’s head of liquid strategies — it scooped up the whole team.

- The firm said on Thursday that Dragonfly’s Kevin Hu, a former general partner and head of the liquid strategies, had joined Brevan Howard’s crypto arm and would focus on listed digital assets. But BH Digital also acquired Hu’s former liquid group at Dragonfly, according to two sources familiar.

- BH Digital and Dragonfly both declined to comment.

- BH Digital is expanding amid a difficult market for the industry. While cryptocurrencies have seen prices rally in recent weeks, they are still far from their 2021 peak. The collapses of 3AC and FTX triggered ripple effects, sending companies scrambling to survive.

SEC Chair Gary Gensler Says There Are Three Ways to Tell If a Crypto Project Is a Scam

- How hard is it to spot a crypto scam? According to SEC Chair Gary Gensler, it’s not nearly as difficult as it might sound.

- Speaking to the U.S. Army during a Twitter Spaces earlier this month, Gensler and SEC Commissioner Caroline Crenshaw discussed what they consider the dangers of investing in crypto and how to tell if a project is a scam.

- “If something looks too good to be true, sometimes they really are,” Gensler said. “There are certain red flags that you can look for beyond it being too good to be true.”

- In general, Gensler laid out three telltale signs that something may be a scam: (1) the crypto project can’t provide clear documentation regarding how it works or how it plans to delivers on its goals; (2) the project can’t demonstrate that it’s in regulatory compliance; and (3) the project can’t easily explain what it is at all.

- Gensler also said that offers of high returns are a red flag and warned against projects that are overly complicated or that rush the investor to make a decision, praying on “FOMO,” or the fear of missing out.

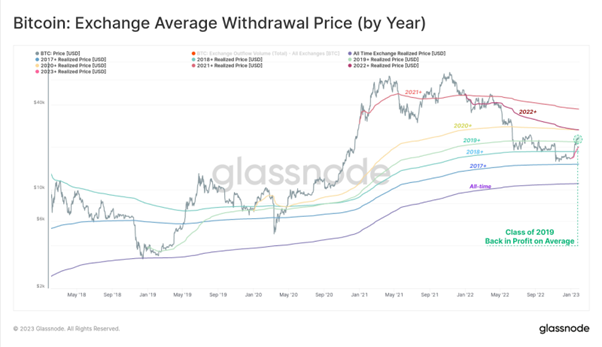

Glassnode:

- We can calculate the average acquisition price for #Bitcoin by tracking exchange withdrawals.

- The chart below shows the average withdrawal price for investors for each year.

- The average class of 2019+ $BTC is now back in profit (at $21.8k)

- We can also see the average #Bitcoin withdrawal price on a per-exchange basis.

- 🟠 for All Exchanges, was intersected by price in the recent $16.7k range.

- 🟡 and🔵 for Binance and Coinbase, the two largest exchanges, are now also back in profit ($21k)