Bitcoin Price: US$ 20,285.73 (+3.73%)

Ethereum Price: US$ 1,551.80 (+8.76%)

Futures OI Leverage Ratio Indicates Deleveraging Event Yet To Occur

- Limit Break raises $200 million over two investment rounds to build Web3 MMO games. Investors include Paradigm, FTX, Coinbase and others.

- Singapore‘s central bank considers tighter crypto regulations to discourage retail investors from trading cryptocurrencies.

- CME Group announces the launch of Euro-denominated BTC and ETH futures.

- Eminem and Snoop Dogg perform at the MTV Video Music Awards, featuring BAYC NFTs. Watch full performance here.

- The Futures Open Interest Leverage Ratio for BTC reached its highest level ever recorded at more than 3% of BTC market cap, following the market-wide collapse on August 26th.

- The ratio’s all-time high follows hawkish statements from Fed chair Jerome Powell at the Jackson Hole Symposium on August 26th. Since then, BTC is down 7% while ETH is down 9%.

- This ratio indicates the amount of leverage that exists within a market, relative to the asset’s market cap. The ratio is calculated by dividing the open contract value by the market cap of the asset.

- Higher values suggest that open interest is large, relative to the market size. This implies a higher risk of market squeezes, liquidation cascades or deleveraging events. In turn, lower values generally imply a lower risk of such derivatives-led trading activity.

- Historically, such deleveraging events have foreshadowed market bottoms in BTC prices. However, this ratio has been on a strong upward trajectory since the market-wide plunge beginning in May-2022.

- Will we see a true deleveraging event before we can solidify a market bottom? Or is this just the outcome of higher appetite for leverage in a relatively new market? Time will tell.

- The “decoupling” narrative has started to regain traction recently, suggesting crypto has finally broken the shackles that tether it to traditional markets.

- There are some valid points to this argument, including the notable dispersion in performance we’ve seen over the last couple of months attributed to crypto assets with positive fundamental catalysts.

- However, it’s too early to call this an official decoupling, not because the argument doesn’t have merit, but because we just haven’t seen enough evidence yet.

- And prior to the recent market plunge, the revival of risk appetite fueled strong recoveries across most risk assets. This hasn’t been unique to just crypto or just traditional markets: it’s impacted both.

- If the crypto rally we witnessed between July and early August was truly a result of newfound catalysts and not macro-driven, we’d expect to see a greater divergence even among higher beta names in both markets.

- In our view, it’s quite clear that the crypto market has not decoupled from macro yet. Although it is important to be aware of newfound fundamental catalysts, our focus should primarily be directed at the most pivotal macro factors which dictate market direction.

- We have covered many of these factors in prior reports – most notably Liquidity Runs The World and the Monthly Chartbook from July – some of the critical factors being:

- Liquidity, liquidity, liquidity. Everyone’s focus is on a Fed rate pivot, but global liquidity trends are even more important for asset prices. We’ve highlighted how the year-over-year change in total crypto market cap has been heavily correlated with the change in global M2 (which is a major part – but not the only component – of global liquidity).

- Dollar strength. It’s tough to imagine a scenario where risk assets rally alongside a surging dollar. The DXY broke to a fresh 20-year high this year. After a short consolidation period, it closed at a new yearly high earlier this week, breaking from its July downtrend.

- Tighter central bank conditions and major central bank rhetoric – notably the Fed’s. This may lead to the continuation of restrictive policy to combat generationally high inflation.

Bitcoin reaches ‘short squeeze’ trigger zone as BTC price nears $20.4K

- Those betting on further downside begin to see setbacks as Bitcoin starts the Wall Street trading week with a spike higher.

- Data from Cointelegraph Markets Pro and TradingView showed BTC/USD climbing to near $20,400 on Bitstamp as United States equities began trading.

- The move signaled welcome relief for hodlers, who had looked on as the pair dove increasingly below $20,000 during the weekend.

- Now, with the market “aggressively short positioned,” conditions appeared to favor a further relief bounce to burn those nursing short trades.

Federal Reserve’s FedNow Real-Time Payments Set for Mid-2023 Debut

- The U.S. Federal Reserve has tightened the window for the launch of its FedNow instant payments platform to between May and July of 2023.

- According to a press release, FedNow will be open to financial institutions of any size, allowing them to facilitate instant payments for consumers and businesses, giving customers immediate full access to funds. The platform is currently in pilot phase with more than 120 organizations participating, including lender U.S. Bank and payment processor Alacriti Payments among them.

- Initially announced in August 2020 by then-Fed Governor (now Vice Chair) Lael Brainard, the FedNow platform is seen as a stepping stone to an eventual central bank digital currency (CBDC).

- “The benefits of instant payments are increasingly important to consumers and businesses, and the ability to provide this service will be critical for financial institutions to remain competitive,” Ken Montgomery, FedNow Service program executive, said in the central bank’s press release.

The End of the Texas Bitcoin Mining Gold Rush

- Texas was once a promised land for bitcoin miners, a business-friendly state with stable regulations and a seemingly endless energy supply. But the tide has turned.

- The state’s grid operator, the Electric Reliability Council of Texas, or Ercot, has slowed issuance of new permits for miners to connect to the grid, said Steve Kinard, director of bitcoin mining analytics at the Texas Blockchain Council (TBC), an industry association. Ercot is trying to balance the state’s demand and supply of electricity.

- Meanwhile, the pipeline of readily available electricity in Texas has run dry, and bitcoin miners increasingly have to build out energy infrastructure such as generators and power lines for their machines to be plugged into. That buildout will take a while.

- “There’s very few or no sites where you’re just going to show up and plug in without any work,” even for smaller sites that consume around 10 megawatts (MW), Kinard said. “A lot of people have searched for that,” and now there are none left, he said.

- Ercot noted the large number of miners waiting to plug into the grid and referred CoinDesk to the TBC.

Cardano Builder IOG Funds $4.5M Blockchain Research Hub at Stanford University

- Cardano blockchain builder Input Output Global (IOG) has funded a $4.5 million blockchain hub at Stanford University, the latest in a series of academic research outposts around the globe.

- In addition to Stanford, IOG has opened research labs and collaboration projects with the University of Edinburgh, University of Wyoming, University of Athens and Tokyo Institute of Technology. Last year, Cardano founder Charles Hoskinson donated $20 million to Carnegie Mellon University (CMU) to establish the Hoskinson Center for Formal Mathematics.

- Stanford University in Palo Alto, Calif., is a hotbed of tech innovation; the place opened a Center for Blockchain Research back in 2018, led by Dan Boneh and David Mazières, two professors who specialize in cryptography.

- IOG has been collaborating with Stanford for some time, said Tim Harrison, vice president of Community and Ecosystem at IOG. “Before the research hub, we previously donated $500,000 to fund their research into blockchain scalability. As one of the world’s leading academic institutions, Stanford is an ideal location for the hub,” Harrison said in an email.

Dubai-Based Virtuzone to Accept Crypto Payments via Binance Pay

- Dubai-based business formation services provider Virtuzone has begun accepting cryptocurrency payments using Binance Pay.

- “Virtuzone’s decision to accept cryptocurrency payments and integrate Binance Pay into its systems raises the bar for innovation and demonstrates the way forward when it comes to setting up businesses in the UAE,” said Nadeem Ladki, executive director of Business Development and Strategic Partnerships at Binance, in a Monday press release.

- Binance Pay, a contactless cryptocurrency payment service designed by crypto exchange Binance, supports more than 40 cryptocurrencies, including bitcoin (BTC), ethereum (ETH), and USD coin (USDC). The platform is intended to enable instantaneous international money transfers and user-to-user transfers, eliminating third-party transaction fees.

- Aiming to become a crypto hub, Dubai in recent months established a Virtual Assets Regulatory Authority (VARA) and adopted a number of crypto-friendly laws. Among the developments is Dubai’s push to grant operating licenses to several prominent cryptocurrency exchanges, which may have hastened companies’ adoption of crypto payments across the emirates.

Facebook Joins Meta’s Instagram in Supporting NFTs

- Social media powerhouse Meta Platforms (META) said Monday that it’s now allowing users to post their non-fungible tokens (NFTs) on Facebook.

- What started as an Instagram-oriented NFT integration in May is now available on both Meta-owned platforms. According to Meta’s updated May 10 post, users can now connect their crypto wallets to either app and post their digital assets across both social media platforms.

- The latest integration could expose vast new audiences to crypto collectibles because Facebook has billions of users worldwide. Whether and how parent company Meta monetizes those eyeballs remains to be seen.

- Meta supports NFTs from the Ethereum blockchain, the layer 2 companion blockchain Polygon and Flow, a blockchain best known for NBA Top Shot. Flow’s native token FLOW rallied on the news of the Facebook integration.

Looks bare: OpenSea turns into NFT ghost-town after volume plunges 99% in 90 days

- An ongoing debt crisis at lending platform BendDAO is also increasing the risk the NFT bubble will burst.

- OpenSea, the world’s largest nonfungible token (NFT) marketplace, has witnessed a substantial drop in daily volumes as fears about a potential market bubble grow.

- Notably, the marketplace processed nearly $5 million worth of NFT transactions on Aug. 28 — approximately 99% lower than its record high of $405.75 million on May 1, according to DappRadar.

- The massive declines in daily volumes coincided with equally drastic drops in OpenSea users and their transactions, suggesting that the value and interest in the blockchain-based collectibles have diminished in recent months.

- That is further visible in the falling floor prices — the minimum amount one is ready to pay for an NFT — of leading digital collectible projects.

Near-term weakness continues to haunt numerous Bitcoin fundamentals, with prices faltering amidst minimal excess sell-side pressure. Investors who are spending appear to be taking advantage of any and all exit liquidity offered.

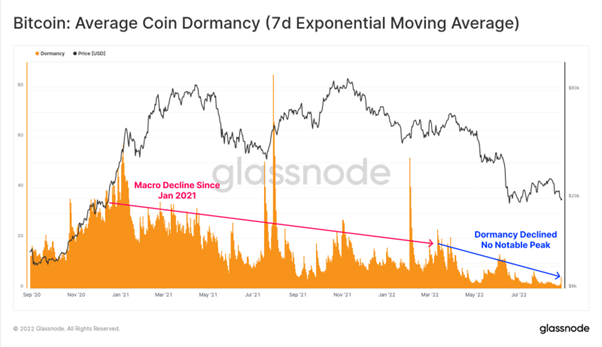

At a macro scale, the Coin-Years Destroyed metric continues to push lower, reaching a relatively significant low. This metric aggregates the total lifespan destroyed (in years) over the last 365-days, and similar to dormancy, low levels are usually constructive and typical of late stage bear markets.

It remains plausible that the Bitcoin market is trading within what may become a longer-term bottom formation pattern. However, it is clear that the market is only just hanging on at present and is far from out of the woods yet.

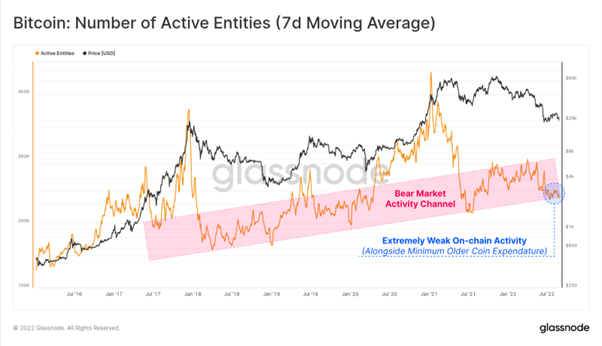

To really hammer home this point of fundamental weakness, we can top it off with the Active Entities chart below. This metric can be considered analogous to ‘unique daily active users’ of the Bitcoin network, and it is currently testing the lower end of the long-standing Bear Market Channel.

This indicates that there is little growth in the active user-base, and the network is currently trafficked by the bare minimum user base we would consider to be within ‘historical bounds.’ Should Active entities decline much further, it would suggest an unfortunate deterioration of the user base, and enter a zone of aggregate weakness which has not been seen for many years.

Continue on Glassnode Insights…