Bitcoin Price: US$19,412.82 (+1.75%)

Ethereum Price: US$ 1,337.20 (+0.69%)

stETH Returns To Peg As Staking APR Increases Post-Merge

- Sam Bankman-Fried considers acquiring Celsius Network after the company’s CEO resigned yesterday. SBF had previously passed on the acquisition.

- Robinhood releases a beta version of its non-custodial wallet to 10k users. The wallet will support Polygon and allow users to trade using the DEX aggregator, 0x.

- Auction house Christie’s launches an Ethereum-based platform for on-chain NFT auctions, in partnership with Chainalysis, Manifold, and Spatial.

- Jihan Wu, founder of Bitmain, will invest $50m to purchase distressed Bitcoin mining firms. The fund aims to raise an additional $200m from outside investors.

- Since the Merge was successfully completed on Sept 15th, stETH has gradually returned to par with ETH, after spending almost 4 months trading below peg. Simultaneously, Lido staking APR increased from 3.85% to 5.52% and has remained at elevated levels ever since.

- Lido is a liquid staking solution that lets users stake ETH without locking assets or maintaining infrastructure. Lido Staked ETH or stETH is a liquid, ERC-20 token that represents ETH staked with Lido.

- All stETH tokens will be redeemable for ETH on a 1:1 basis when a future upgrade to Ethereum, dubbed the Shanghai upgrade, enables withdrawals of staked ETH. This is tentatively scheduled for 2023.

- This future redemption mechanism pegs the current value of stETH to ETH on a 1:1 basis. However, the peg broke in May of this year with stETH trading as low as 0.93 per ETH on Jun 20th.

- As the Merge went without a hitch, improved market confidence in stETH likely caused the peg to return to par with ETH. Other liquid staking tokens such as cbETH have also seen increased post-Merge inflows.

- Additionally, as Lido collects and re-stakes MEV rewards, including priority fees, staking APR has increased. Since stETH is a rebasing token, holders can expect a higher increase in the number of stETH tokens held.

- Lido is the most used liquid staking solution, even beyond just Ethereum. Thus, it’s no surprise that Lido DAO has generated ~$165m in revenue over the last 180 days.

- This revenue goes to node operators, the DAO, and the protocol’s insurance fund. Over the same time frame, Lido DAO has distributed ~18.95m LDO tokens, which equates to ~$49m, calculated using the monthly open price multiplied by token emissions for that month.

- Currently, close to 31% of the total LDO token supply is in circulation. Lido’s adjusted revenue is ~$116m, meaning its expenditure on token rewards is much lower than the revenue it generates.

- However, none of this value accrues to the LDO token. Currently, token holders do not have a claim over the use of treasury funds – though this could change in the future.

- From a prospective holder’s perspective, LDO sits in a peculiar position. While revenue generation is underway and product market fit is clear, that value does not accrue to holders in any way, at least right now.

- Further, a large portion of the supply has been allocated to the team and investors. This supply overhang could lead to sharp selling pressure in the future, even as this hasn’t been the case during previous token unlocks.

- The revenue/token emissions ratio is difficult to assess given that LDO does not have a fixed emission schedule.

- But the numbers do seem quite positive for Lido given the delta between revenue and tokens issued to users in USD. However, this ratio has been trending downwards since mid-July after a massive uptick.

Bitcoin Could ‘Double in Price’ Under CFTC Regulation, Chairman Behnam Says

- Commodity Futures Trading Commission (CFTC) Chairman Rostin Behnam said Thursday that CFTC-led regulation could have significant benefits for the crypto industry, including a potential boost to the price of bitcoin.

- “Growth might occur if we have a well-regulated space,” Behnam told attendees during a fireside chat at NYU School of Law. “Bitcoin might double in price if there’s a CFTC-regulated market.”

- Behnam has consistently argued for the need to provide market participants with regulatory clarity – something that many in the crypto industry have argued is lacking. For years, the CFTC and the U.S. Securities and Exchange Commission (SEC) have squabbled over the role of top regulator for the crypto industry, both reluctant to issue much in the way of formal guidance for crypto companies, choosing instead to set regulatory precedent through enforcement actions.

- A clear regulatory framework, Behnam argued, could pave the way for institutional investors to enter the market.

Jack Dorsey’s TBD Teams Up With Circle to Take US Dollar Stablecoin Savings and Remittances Global

- TBD, the bitcoin-focused subsidiary of Twitter co-founder Jack Dorsey’s Block (SQ), is teaming up with Circle Internet Finance, issuer of the USDC stablecoin, to bring cross-border dollar-linked stablecoin transfers and savings to investors globally.

- The firms unveiled their partnership Wednesday during Circle’s Converge22 conference in San Francisco.

- Block is a payments firm that runs Cash App and is helmed by Twitter (TWTR) co-founder and notable bitcoin (BTC) proponent Jack Dorsey. Its filial, TBD, is an open source developer platform that has been working on a decentralized crypto exchange called TBDex. TBD has been working on a so-called web5 decentralized identity initiative that would allow people to retain their user data and interact with each other without intermediaries.

Stablecoin Markets Shift as Binance Begins USDC Conversions

- Binance conversions of Circle’s USDC, Paxos’s Pax Dollar, and TrueUSD to the exchange’s own stablecoin, Binance USD, have begun. And the effects on the stablecoin market are already being felt.

- Since Binance’s announcement that it would discontinue support for competing stablecoins on its exchange, the world’s largest by volume, USDC outflows from Binance—that is, the number of USDC stablecoins leaving the exchange—are up by 93%. Meanwhile, USDC’s market cap has fallen by 5%.

- As of Wednesday afternoon, $26 billion worth of stablecoins were sitting on Binance’s exchange, according to blockchain analytics firm Nansen. Of that, $20 billion was in BUSD, with the rest in competing stablecoins: $683 million worth of USDC, $48 million USDP, and $283 million TUSD.

- The only other sizable stablecoin balance on Binance was $5 billion worth of Tether (USDT), according to Nansen.

SWIFT Partners With Crypto Data Provider Chainlink on Cross-Chain Protocol in TradFi Play

- SWIFT, the interbank messaging system that allows for cross-border payments, is working with Chainlink, a provider of price feeds and other data to blockchains, on a cross-chain interoperability protocol (CCIP) in an initial proof-of-concept.

- CCIP will enable SWIFT messages to instruct on-chain token transfers, helping the interbank network to be able to communicate across all blockchain environments.

- This will help accelerate the adoption of distributed ledger technology (DLT) blockchains and benefit various institutions across capital markets, Chainlink co-founder Sergey Nazarov said at the SmartCon 2022 conference in New York City on Wednesday.

- SWIFT’s Strategy Director Jonathan Ehrenfeld Solé said that one of the reasons working with Chainlink on CCIP has been successful is that there is “undeniable interest” in crypto from institutional investors. Traditional finance (TradFi) players want access to various digital and traditional assets on one network that can connect different types of asset classes, Solé said.

- The partnership between Chainlink and SWIFT in cross-chain interoperability will help bridge the gap between traditional and digital assets for TradFi institutions, he added. Chainlink’s native token is LINK.

Scaling Ethereum? Arbitrum Co-Founder Says Projects Should Consider 3 ‘Critical’ Points

- The race to make Ethereum faster is heating up.

- With Polygon rolling out new zero-knowledge technologies, StarkWare announcing a token airdrop, and NFT marketplace OpenSea integrating Optimism, there are plenty of contenders to scale the top crypto network for DeFi and NFTs.

- “Ultimately, it’s a large space, and it’s a large pie,” CEO and co-founder of the layer-2 network Arbitrum Stephen Goldfeder told Decrypt at Mainnet. “There are a lot of different opportunities for different teams to experiment, basically, with different scaling technologies and different trade-offs.”

- Arbitrum is one of many so-called rollup solutions which effectively move Ethereum operations off-chain to reduce congestion on the network’s mainnet. Once the activity is concluded, it’s then compressed into a single transaction on the blockchain.

- Of these trade-offs, though, Goldfeder says there are three “critical” points that teams need to consider: Scalability, security, and compatibility. These scaling solutions need to be fast, reliable, and interoperable with the wider world of crypto.

EU Set to Ban Russian Crypto Payments After ‘Sham’ Referenda

- The European Union will tighten restrictions on Russians’ crypto investments within the bloc as it seeks to respond to “sham” independence votes being held in Russian-occupied regions of Ukraine, CoinDesk has been told.

- A previous cap of crypto holdings of 10,000 euros ($9,600) will be scrapped, a person briefed on the sanctions package told CoinDesk, potentially meaning Russians won’t be able to hold any assets in EU crypto wallets.

- In April, the EU announced that it would restrict Russian payments to European crypto wallets to 10,000 euros as it sought to stop digital assets being used to bypass restrictions on large bank transfers. The new measures mean that figure could now be reduced to zero.

- “The sham referenda organized in the territories that Russia occupied are an illegal attempt to grab land and to change international borders by force,” European Commission President Ursula von der Leyen told reporters Wednesday, following votes held over the last five days in Donetsk, Luhansk, Kherson and Zaporizhzhia.

Pantera Capital Reportedly Eyeing New $1.25B Blockchain Fund

- Pantera Capital is reportedly seeking to launch a second blockchain fund, despite the ongoing bear market that has sent crypto prices spiraling in recent months.

- An institutional asset manager focused on the blockchain industry, Pantera currently offers five funds: venture, bitcoin, early-stage token, liquid-token and blockchain funds.

- Pantera’s blockchain fund, which launched in June 2021, is an actively managed offering that invests in a combination of venture equity, early-stage tokens and liquid tokens. It is for qualified purchasers only and has a minimum investment of $1 million.

- Now, Pantera founder Dan Morehead said Wednesday at a conference in Singapore that the company is planning to raise $1.25 billion for a second blockchain fund, Bloomberg reported. The fund, which Morehead said Pantera aims to close in May, would invest in equity and digital tokens, he said.

Aptos lures Solana developers tired of ‘eating glass’

- Solana developers are window shopping on new blockchain Aptos, which has received $350 million in funding from investors this year.

- The Block spoke to three Solana projects that are exploring Aptos to find out what’s attracting them to the new chain.

Glassnode:

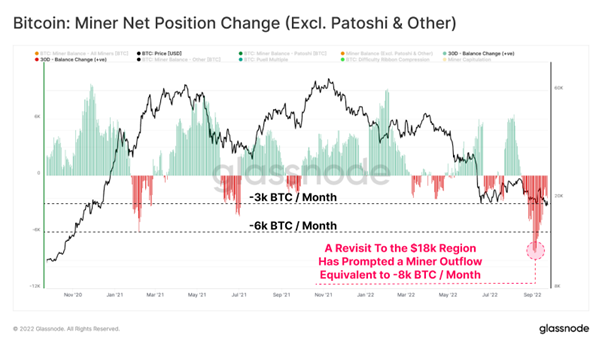

- #Bitcoin Miner Balance has seen large outflows since prices rejected from the local high of $24.5k.

- This suggests aggregate Miner profitability is still under a degree of stress with ~8k $BTC/month being spent to cover USD denominated costs