Bitcoin Price: US$ 16,212.91 (-1.31%)

Ethereum Price: US$ 1,167.77 (-2.17%)

BTC Volatility Contracts as Market Awaits Clarity

- Between Nov. 5-10, BTC price fell by over 27% as it traded below its summer range. This is largely due to the FTX collapse and the resulting contagion. This decline was coupled with the Bollinger Band Width Percentile (BBWP) indicator reaching 3.57.

- The last four instances of similar moves in the indicator have led to one upside move of 46% and three downside moves of -35% on average. Such a downside move from current price levels takes BTC price to $10.5K.

- The BBWP is a second-order derivative of the Bollinger Bands, a volatility-based indicator made of three lines. The middle line is the 20-day simple moving average, and the upper and lower lines are two standard deviations away.

- While the fallout from the FTX collapse spreads, BTC finds itself in limbo. In case of a significant price move, the BBWP indicator can set expectations and provide important context.

DeFi Giant MakerDAO Voting on Hiking DAI Stablecoin Rewards

- Decentralized finance giant MakerDAO’s community is voting on increasing the annual reward for its DAI stablecoin up to 1%.

- Community members are casting their ranked-choice vote through Dec. 1 to hike the so-called DAI Savings Rate to either 1%, 0.75%, 0.5%, 0.25% or leave it unchanged from its current 0.01% rate. MakerDAO initiated the vote on Monday.

- At the time of publication, all votes favored raising the rate to 1%. This may change as more voters cast their preference.

- The voting is occurring as yields in decentralized finance (DeFi) have plummeted amid lower appetite for crypto lending. Meanwhile, yields in traditional markets have increased dramatically due to the Federal Reserve’s aggressive campaign to raise interest rates, which has exacerbated the capital flight from DeFi.

Bitcoin, Ethereum Slide Lower With Stocks Amid China Unrest, Crypto Contagion Fears

- Bitcoin, Ethereum, and the wider digital asset market dipped Monday along with global stocks as investors seemingly spooked by uncertainty around China due to anti-lockdown protests sold risk assets.

- The largest digital asset was trading for $16,081 at the time of writing, according to CoinGecko—a 3% 24-hour drop.

- Ethereum was experiencing a bigger sell-off. The second-largest cryptocurrency by market cap was trading for $1,158, down nearly 5% in the past day.

Singapore Banks’ Exposure to Bitcoin ‘Insignificant’ but Subject to Highest Risk Weight

- Singapore’s banks are required to hold $125 of capital against an exposure of $100 to risky cryptocurrencies like bitcoin or ether, an official said Monday.

- Although the jurisdiction’s banks have “insignificant” levels of exposure to crypto – contributing less than 0.05% of total risk weighted assets – these types of crypto assets are subject to the toughest risk management requirements set by international standard-setters, said Senior Minister and Minister in charge of the Monetary Authority of Singapore Tharman Shanmugaratnam in a written response to a question posed during a parliamentary session.

- “Pending the finalization of the framework, MAS requires Singapore-incorporated banks to apply a 1250% risk weight for exposures to riskier crypto assets such as Bitcoin and Ether,” he said. “… Based on MAS’ minimum total capital adequacy requirement of 10% for systemically important banks incorporated in Singapore, this means that Singapore-incorporated banks are required to hold $125 of capital against an exposure of $100 to a cryptoasset like Bitcoin.”

- Singapore’s lawmakers are facing tough question about crypto during the ongoing parliamentary session, which kicked off Monday. Most questions involve the collapse of Sam Bankman-Fried’s crypto exchange FTX, with some scrutinizing the investment made by state fund Temasek in the fallen enterprise.

MakerDAO Community Rejects CoinShares Proposal to Invest Up to $500M in Bonds

- The MakerDAO community rejected a proposal to use up to $500 million of the stablecoin USDC to invest in bonds with crypto investment firm CoinShares.

- CoinShares had proposed to manage between 100 million and 500 million USDC and actively invest the money in a portfolio of corporate debt securities and government-backed bonds, aiming to return a yield matching the Secured Overnight Financing Rate (SOFR). SOFR currently stands at 3.8%.

- Some 72% of votes were cast against the proposal. The voting concluded Monday.

- The rejection came as MakerDAO is in the process of investing billions of dollars from its reserve and optimizing its balance sheet to earn revenue from yields.

Ready to trade? Fidelity finally opens retail crypto accounts

- Fidelity has opened up retail crypto trading accounts after first announcing a waiting list earlier this month.

- “The wait is over,” the investment powerhouse said in an email Monday sent to some users, adding that a Fidelity brokerage account was needed to be able to fund a new Fidelity Crypto account.

- Once opened, the account promises commission-free trading of bitcoin and ether. Users trying to open an account were asked to read and accept a number of disclosures, including a risk statement which stated that “investing in, buying, and selling digital assets presents a variety of risks that are not presented by investing in, buying, and selling products in other, more traditional asset classes.”

- They were also reminded that “digital assets can fluctuate quickly, and materially.” The service says a spread of 1% will be factored into every trade execution price.

‘Shrimp’ and ‘Crab’ Bitcoin Balances Hit Record Highs Amid FTX Collapse

- So-called Bitcoin (BTC) shrimps, a category of addresses holding less than 1 BTC, have added 96,200 BTC to their collective stashes since FTX exchange’s collapse earlier this month.

- According to the analysts at Glassnode, this cohort now holds over 1.21 million BTC, which is equivalent to 6.3% of the world’s flagship cryptocurrency’s circulating supply.

- Another category of smaller Bitcoin holders that took an opportunity to buy this month’s dip is “crabs,” a demographic holding between 1 BTC and 10 BTC.

UK Crypto Fraud Climbs by a Third to Over $270M: Report

- Cryptocurrency fraud in the U.K. rose by 32% to 226 million pound ($273 million) in one year, according to data from the U.K. police unit Action Fraud, the Financial Times reported on Monday.

- The U.K. is in a recession and the cost of living has increased, making some people vulnerable to fraudsters.

- “Whenever times are tough, fraudsters always seek to prey on less experienced investors by promising huge returns,” Hinesh Shah, a forensic accountant at law firm Pinsent Masons, told the FT.

Ether Drops as Large Investor Moves 73K ETH to Binance

- Ether (ETH) traded weak early Monday amid reports of large cryptocurrency transfers to Binance, the world’s largest cryptocurrency exchange.

- The native token of Ethereum’s blockchain fell nearly 4% to $1,170, CoinDesk data shows.

- A “whale” address moved 73,224 ETH, worth $85.7 million, to Binance during the Asian trading hours, according to an analysis by on-chain researcher Lookonchain.

- Investors typically transfer coins to centralized exchanges when they intend to sell or use the coins as a margin in derivatives trading. Therefore, an uptick in exchange inflows often paves the way for heightened price volatility.

- “Watch out for the selling pressure of ETH,” Lookonchain tweeted, after noting the large inflow into Binance.

- According to Lookonchain, the address that moved more than 73,000 ETH to Binance was the same one that pulled out 84,131 ETH from decentralized exchange Curve’s staked ether (stETH)-ether liquidity pool last week.

- The price of liquid-staking protocol Lido’s staked-ether (stETH) token fell to 0.97 ETH after the large investor withdrew more than 84,000 ETH from the Curve pool. At press time, stETH traded at 0.982 relative to ether, according to Dune Analytics.

Glassnode The Character of Capitulation

- The Bitcoin market has continued to consolidate after a chaotic few weeks, with prices trading within a narrow range, holding just above $16k. As the dust settles following the collapse of FTX, the aggregate response of Bitcoin holders is slowly becoming clearer. A key question is whether the recent sell-off can be better characterized as simply a continuation of the bearish trend, or perhaps a trigger of a deeper psychological shift amongst investors.

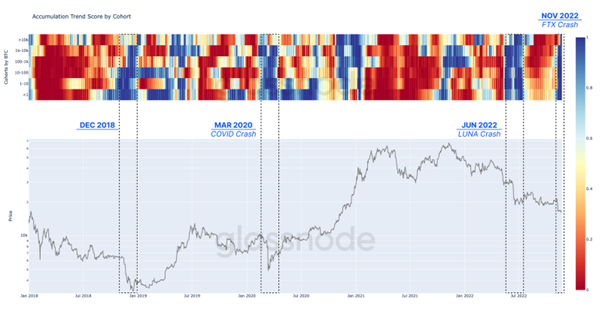

- Inspecting the following chart illustrates that almost all cohorts have shifted towards accumulation 🟦 after the recent price contraction. This is a signal of both a perceived opportunity to buy but also a widespread move of coins away from exchanges and towards self-custody (as discussed in WoC 46).

- A similar period of widespread accumulation can be observed after all aforementioned sell-off events.

- Among all cohorts, the entities holding < 1 BTC (also labelled as Shrimp 🦐) have recorded two distinctive ATH waves of balance increase over the last 5-months. Shrimps have added +96.2k BTC to their holdings since the collapse of FTX, and now hold over 1.21M BTC, equivalent to a non-trivial 6.3% of the circulating supply.

Continue on GLASSNODE INSIGHTS