Bitcoin Price: US$19,227.82 (+2.24%)

Ethereum Price: US$ 1,336.17 (+3.21%)

Will ETH Remain Inflationary Despite The Merge?

- Apple will allow users to buy or sell NFTs via apps listed on the App Store, subject to the standard 30% fee.

- Walmart forays into the metaverse with plans to release two experiences on the gaming platform Roblox.

- Disney plans to hire a corporate attorney to work on transactions involving NFTs and DeFi.

- Sifu, Co-Founder of failed crypto exchange QuadrigaCX, launches UwU Lend, a fork of Aave.

- Crypto regulation bill in California is vetoed by Governor Gavin Newsom.

- In the week leading up to the Merge, the daily average ETH issued (as PoW rewards) was ~12.7K ETH. After the Merge, the daily average has reduced by 93% to ~818 ETH issued (as PoS rewards). Despite this, ETH continues to be net inflationary. Why?

- After the Merge, the amount of ETH issued is dictated by the amount of ETH staked and the total network activity. In short, more ETH staked = more ETH issued as rewards. But, higher network activity = more ETH burned due to higher gas prices.

- As of today, nearly 14M ETH have been staked, generating 1.7K ETH in daily issuance. On the flip side, the average gas price over the last week has only been 10-12 gwei. At those levels, only 1-1.2K ETH gets burned per day.

- The average gas price since 2020 has been 76 gwei. Using this average, the amount of ETH burned would jump to 7.6K ETH per day. This would turn ETH net deflationary as the supply would reduce by 5.9K ETH per day, assuming the amount of ETH staked remains unchanged.

- Many have speculated that ETH’s new supply dynamics would alleviate massive sell pressure, prompting an immediate positive impact on market price. But even with the Merge erasing nearly $20M of sell pressure, this theory has yet to materialize.

- Outside of macroeconomic influences, ETH’s recent woes can also be attributed to factors derived from Merge hype. The front-loading of demand, market positioning of traders, exchange inflows, and decreased on-chain activity are also driving factors.

- For more on ETH’s post-Merge fallout, Delphi members can read our latest Market Insights report here.

- We have seen an increase in the frequency of liquidity cascades occurring within financial markets – a direct contradiction to prevailing theory. But even while experiencing more frequent liquidity cascades, equity markets have benefitted from one of the strongest bull markets in history. So how do we make sense of this?

- Many people attribute this behavior to three main factors:

- Increased use of accommodative monetary policy,

- The rise and prominence of passive investing and its implications, and

- Fickle liquidity in the face of increasing margin requirements.

- Interestingly, the common denominator behind all of these risk factors is liquidity. These three factors come together to form the “Market Incentive Loop.” This refers to a real-world application of the reflexive feedback loops discussed in our previous report on reflexivity and the fall of the Efficient Market Hypothesis.

Global Wanted Persons Notice for Do Kwon Issued: Report

- Interpol has issued a global request to arrest Terraform Labs founder Do Kwon, Bloomberg reported. The Seoul Southern District Prosecutors’ Office confirmed the development Sunday after it requested Interpol issue him a Red Notice at the beginning of last week.

- A Red Notice, while not the same as an arrest warrant, is a request at the behest of a member country to law enforcement worldwide for the location and arrest of an individual pending extradition, surrender or similar legal action.

- Kwon, rumored to have been living in Singapore after leaving his home country of South Korea, is wanted for charges relating to his involvement in Terra’s collapse earlier this year.

- South Korean prosecutors said last week Kwon was “obviously on the run” from authorities and was refusing to cooperate. Kwon later denied those claims in a series of tweets, saying at the time he did not “have anything to hide.”

Crypto Exchange Binance Eyes Return to Japan 4 Years After Exit: Report

- Four years after pulling out of Japan, Binance, the world’s largest crypto exchange, will seek a license to operate in the country.

- People familiar with the matter told Bloomberg that the country’s friendlier approach to crypto and the substantial opportunities to onboard new users attracted the exchange back to Japan.

- The move comes as Japan looks to adopt more Web3-friendly policies under its new prime minister, Fumio Kishida.

- His hunt for a “New Capitalism” solution to Japan’s sluggish growth and growing inequality has led the country’s politicians to start working on wide-ranging policies, from reforming crypto and NFT taxation to attracting crypto talent.

Australia’s CBDC Pilot to Be Completed in 2023

- The Reserve Bank of Australia (RBA) is expecting to complete its central bank digital currency (CBDC) pilot by mid-2023, according to a white paper published on Monday.

- The purpose of the pilot is to “explore innovative use cases” that could be supported by the issuance of a CBDC, a media release said. The white paper, which is a document produced by the bank that can later be used to inform future laws, said the project was also looking into regulatory considerations associated with a CBDC.

- The paper did not reveal a commitment from the RBA to issue a CBDC but the bank is seeking feedback from industry participants that will “contribute to ongoing research.” The experiment is expected to end in the beginning of next year with results to be published in mid-2023, according to the document.

- Australia’s CBDC research project kicked off in July and the pilot commenced in August. The document was published in the wake of Australian opposition politician Andrew Bragg criticizing the current government, led by Prime Minister Anthony Albanese, on its “inaction” when it came to crypto. The Albanese government has meanwhile announced it will use “token mapping” as a framework for regulation.

Grayscale Bitcoin Trust discount hits all-time low amid crypto market downturn

- The Grayscale Bitcoin Trust (GBTC), which has been trading at a discount since the beginning of 2021, hit a record low last week.

- GBTC’s discount fell to -35.26% — its lowest point ever, according to The Block’s Data Dashboard. This means the market price of GBTC shares is over 35% lower than its net asset value or NAV.

Hackers Nab Nearly $1 Million in Crypto From Ethereum ‘Vanity Adress’ Exploit

- Roughly $950,000 worth of crypto has been stolen from an Ethereum “vanity address” generated with a tool called Profanity. The exploit leveraged a similar vulnerability related to the recent $160 million attack on market maker Wintermute.

- A “vanity address” is a type of crypto address that conforms to certain parameters laid out by the creator, often representing their brand or name.

- Instead of the crypto address being a random, machine-generated string of numbers and letters, a vanity address would be human-generated. It’s for this reason that users on GitHub have indicated these types of addresses are more vulnerable to brute force attacks.

- The hacker stole 732 Ethereum on September 25 before transferring the funds straight to the now-sanctioned crypto mixer Tornado Cash, according to the data from PeckShield.

New Cosmos White Paper Revamps Cosmos Hub, ATOM Token

- A new white paper released at the Cosmoverse conference in Medellín, Colombia, proposes major expansions to the utility of the Cosmos Hub – the blockchain that sits at the center of the Cosmos blockchain ecosystem. The paper also spells out a new vision for ATOM, the Cosmos Hub’s native token.

- Today, the Hub’s primary role is to serve as a template for building blockchains into the Cosmos “interchain” – a web of individual blockchains that can easily share information and assets.

- The Cosmos Hub 2.0 white paper outlines a revamped role for the Hub as the heart of interchain security – meaning other chains will be able to use the Hub to secure their own networks. The white paper also proposes changes to the utility and issuance schedule of ATOM – changes that the paper’s authors think will back up its informal role as an index of the broader Cosmos family of blockchains.

Nubank logs more than 1.8 million crypto users in Brazil

- Digital bank Nubank has attracted more than 1.8 million Brazil-based users to its crypto platform since its full rollout at the end of June, highlighting a strong appetite for digital assets among consumers in South America’s largest country.

- This figure, which represents users who have made at least one cryptocurrency purchase through Nubank’s app, is almost double the 1 million crypto users the digital bank disclosed in late July. The company introduced the crypto trading to all of its Brazilian users in late June after revealing the plan in May, and announced the latest user numbers in a Sept. 26 press release.

- Nubank has also reached 70 million customers for its banking services in the Latin America region. These include 66.4 million in Brazil, 3.2 million in Mexico and 400 million in Colombia. The company also counts 6 million customers for its investment services.

- “Our accelerated growth is driven by a constant search for efficiency, which balances expansion, new products and revenue growth per customer,” Nubank CEO and founder David Vélez said in a statement.

Apple Allows NFT Sales On Its App Store — But There’s a Catch

- Tech giant Apple now allows NFTs to be bought and sold through applications listed on its App Store. This enables developers of current apps to sell non-fungible tokens in-app and new apps to install NFTs within them.

- The first catch, however, is that Apple applies its existing Web2 monetization structure, taking a 30% cut from app developers who make over $1 million through the App Store on an annual basis, and 15% making less than that.

- Android’s app store Google Play applies the same policy.

- Before this decision, apps that were storing or displaying NFTs may have been breaking Apple’s rules. Now, developers can sell NFTs with Apple’s blessing.

Disney Pushes Further Into Crypto, DeFi, NFTs With Recent Job Post

- Disney is diving deeper into NFTs and the metaverse.

- The entertainment giant is looking to hire a principal counsel specializing in NFTs, the metaverse, blockchain technologies, and decentralized finance, to guide the company through what appears to be its coming—and aggressive—push into Web3.

- A Friday job posting for the position explains that the attorney will principally provide “legal advice and support for global NFT products” made in collaboration with Disney Media and Entertainment Distribution, as well as Disney Parks, Experience, and Products.

- Additionally, the principal counsel will “provide day-to-day legal advice to Disney legal and business teams on NFT and cryptocurrency related matters and issues,” and “provide thought leadership and strategic direction on products involving digital currency and blockchain technology.”

Glassnode: The Great Detox

- Bitcoin has once again rejected below the psychological $20k region, plunging Short-Term Holders into severe unrealized loss. However, HODLers remain steadfast, with numerous metrics displaying a full cycle detox.

- As the evaporation in global liquidity continues, emphasized by new local highs on the DXY index, Bitcoin has remarkably shown a degree of relative strength. BTC prices remained range bound this week, trading between a peak of $19,639 and lows of $18,309. However, price action is just barely hanging on to the consolidation range lows set in July, holding the line from what could be further capitulation.

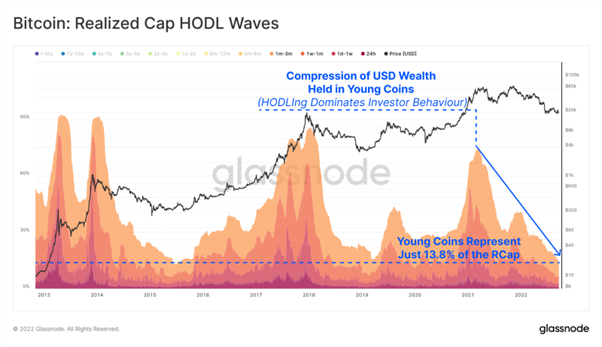

- This sentiment is echoed by the Realized Capitalization HODL Waves metric which displays the USD Wealth held by individual age bands. With mature spending severely muted, the degree of HODLing behavior is historically high.

- In a binary system of just Young and Mature coins, an increase in mature coin wealth held in BTC directly leads to an equivalent decrease in Young coin wealth.

- Currently, wealth held by mature coins is at an ATH, due to the dominant investor behavior being a refusal to spend despite exceedingly uncertain global markets. Thus, almost all market activity is being conducted by the same cohort of young coins repeatedly changing hands. As the number of young churning coins incrementally decreases, it can lead to an eventual supply squeeze if and when the market tides turn.

- Continue on Glassnode…