Bitcoin Price: US$18,807.38 (-0.60%)

Ethereum Price: US$ 1,294.63 (-1.71%)

Post-Merge Fallout: A Closer Look Into Price and Issuance

- The Merge underscores perhaps the most impactful milestone from the original ETH roadmap, as it ushers in fundamental changes to Ethereum’s consensus, issuance, and it’s energy efficiency. It has also brought with it a high level of speculative interest in the ETH markets and has triggered heated debates on where its price may be headed. Before we dig into the aftermath of ETHs price following the Merge, here’s a quick review of what transpired heading into the Merge.

- Since the market-wide bottom in June, ETH has been on a tear. And despite strong evidence suggesting crypto markets are still highly correlated with their legacy counterparts and macroeconomic factors, ETH was able to buck the trend and significantly outperform BTC and other major asset classes. At its peak, ETH managed to stage a 130% recovery from its lows, with ETH/BTC also fully retracing its capitulary tumble from the crypto contagion in May/June. Compared to BTC, whose revival was much more muted, posting only a 42% recovery (from its bottom to its peak). However, this all changed following the completion of The Merge, in classic “sell-the-news” fashion.

- Since September 14th, ETH has practically given back all gains achieved since the middle of July. ETH is down over 20% since The Merge, whereas BTC and the wider crypto market are only down around 4-7%. Within the past week, only a few digital assets ($XRP, $ALGO, $APE, $HNT, and $FOLD) with varying catalysts have been able to outperform.

- Continue on Delphi…

Tether’s USDT stablecoin goes live on Polkadot

- Tether Limited has launched its USD Tether (USDT) stablecoin on Polkadot, an interoperable network connecting several proof-of-stake blockchains. Tether announced on Friday that the stablecoin was now natively available on Polkadot.

- USDT is the largest U.S. dollar-based stablecoin, with market capitalization of nearly $67.5 billion, according to data from The Block. Tether maintains the value of the centralized stablecoin using a basket of assets and cash reserves.

- With the latest announcement, Tether has further expanded its position as a stablecoin available across different blockchains. Besides Polkadot, the stablecoin is supported on other networks, including Ethereum, Solana, Algorand, EOS, Liquid Network, Omni, Tron, and Bitcoin Cash’s Standard Ledger Protocol.

Tezos activates Kathmandu protocol upgrade on its mainnet

- Layer 1 blockchain Tezos activated an upgrade called Kathmandu, adding new scaling capabilities.

- The Kathmandu upgrade went live on the Tezos proof-of-stake mainnet at block 2,736,129 on Friday at 4:30 p.m. ET, according to the Tezos team.

- This was the 11th upgrade for Tezos since its inception in 2018, and one that promises potential scalability improvements.

- According to the upgrade’s formal proposal, it has added the potential to support off-chain computation via Layer 2 solutions like optimistic roll-ups, and streamlined the block validation process for better transactional throughput. Furthermore, the contributors said that Kathmandu introduced a permanent testnet for experimenting with new features, and improved randomness in how the mainnet picks delegates for enhanced security, among other protocol improvements.

OpenSea aims to automatically index Solana NFTs

- NFT marketplace OpenSea said it would automatically index NFT collections created on the Solana blockchain, making it easier for Solana-focused creators to list on the platform.

- According to OpenSea, Solana-focused NFT creators will no longer need to apply to list their collections as those will automatically get indexed based on a few criteria. The first criterion is that NFT collections created with launchpads like Metaplex’s CandyMachine, Magic Eden and LaunchMyNft will be auto-indexed.

- Secondly, creators who don’t rely on launchpads can expect their NFTs to automatically be supported on OpenSea’s market automatically if the collection uses a coding standard called “Metaplex Certified Collection.” That open standard aims to make it easier to identify whether certain NFTs belong to a specific collection, according to OpenSea.

- “This is another step on the journey towards an open ecosystem where you can work on your project and launch permissionlessly and non-custodially,” OpenSea said in its announcement.

Bitcoin and ether sink lower, Fed fights inflation with new rate hike: This week in markets

- Bitcoin and ether were both down over the past week after another volatile week of trading in which macroeconomic sentiment continues to guide prices.

- Bitcoin was down 5.75% at $18,949 over the past week, while ether shed more than 11.54% and was trading at $1,299, at the time of writing Coinbase data show.

- Ether has continued to decline since The Merge, JP Morgan said in a research note on Wednesday.

- “Reasons for the recent decline likely include a combination of buy-the-rumor, sell-the-news flows specific to Ethereum’s Merge event along with broader weakness in risk assets due to more hawkish central banks.”

- The U.S. Federal Reserve raised the U.S. federal funds rate by 75 basis points on Wednesday, marking a 15-year high. The decision to take the rate to 3% to 3.25% had been expected, with the market pricing in a rise of 75 basis points ahead of time; however, markets sold off sharply on the news.

SEC ‘Out to Damage Or Destroy’ Crypto Industry: LBRY CEO

- LBRY CEO Jeremy Kauffman called out the Securities and Exchange Commission at Messari’s Mainnet, as the file-sharing network faces scrutiny from the regulator.

- The SEC charged LBRY with selling unregistered securities in March of last year. The Commission took issue with over $11 million in funding raised through the sale of LBRY Credits, which are now used to upload files and make payments on the blockchain-based platform but were offered for sale before the network was built.

- That led the SEC to view LBRY Credits as investment contracts, based on the notion that people assumed they would increase in value after purchasing the tokens.

- Kauffman said the company has been “fighting” the SEC for nearly five years and soon expects a federal judge to weigh in with a ruling on whether a full trial is necessary.

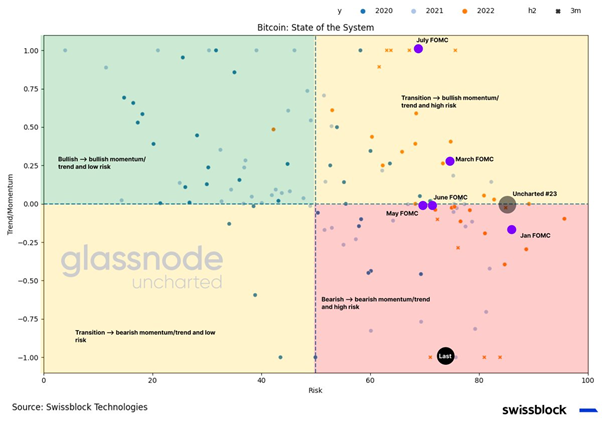

Glassnode: shared Negentropic

- #Bitcoin state of the system denotes a bearish undertone.

- SBT Trend Index: 📉

- SBT Risk Signal: 📈

- However, the hefty traded volume and capital flowing back to #BTC should withstand further selling pressure.

- Is the worst past us? 👉 https://bit.ly/3LATcp7