Bitcoin Price: US$ 21,559.04 (+0.89%)

Ethereum Price: US$ 1,695.11 (+2.33%)

Nike NFTs Dominate Other Fashion Brands In Royalty Collections

- Sam Trabucco, co-CEO of Alameda Research, announces his resignation. Caroline Ellison will continue as the sole CEO of the trading firm.

- Coinbase gets into liquid staking derivatives with Coinbase Wrapped Staked ETH (cbETH), an ERC-20 token that represents ETH staked with Coinbase.

- Alexey Pertsev, arrested Tornado Cash developer, is denied bail. Pertsev must stay in jail for upto 90 more days, despite not being charged with a crime.

- Head of NFTs at Uniswap says they are in talks with 7 lending protocols with the goal of turning Uniswap into an interface for all NFT liquidity.

- As of August 25th, Nike remains the most successful fashion brand to issue NFTs. The company has amassed a cumulative trading volume of $1.25 billion and cumulative royalties of $87 million across all NFT collections.

- On the other hand, Adidas trails significantly behind Nike, despite ranking second with a cumulative trading volume of only $174 million and cumulative royalties of only $4.7 million.

- Nike’s most successful NFT collection is Clone X, which was launched by RTFKT (pronounced ‘artifact’) in Nov-2021 with a 5% royalty on secondary sales. Two weeks later, RTFKT was acquired by Nike.

- Since then, RTFKT has continued to release multiple NFT collections. Currently, 86% of the cumulative royalties earned by Nike come from just 3 collections – Clone X, Clone X Mintvial and MNLTH. These 3 collections make up $1.17 billion of Nike’s $1.25 billion in cumulative trading volume.

- The size and popularity of Nike and Adidas outside crypto naturally factor into Nike’s advantage, but is not the only factor influencing success. While Adidas’ Into The Metaverse features only 2 items for its 20k+ owners, Nike’s Clone X is a PFP project with distinct rarities and artwork across all NFTs.

A16z-backed CoinSwitch exchange raided over alleged forex law breaches

- Major Indian crypto exchange CoinSwitch Kuber had five of its premises searched by anti-money laundering agents on Thursday over alleged violations of forex laws.

- According to an Aug. 25 report from Bloomberg, India’s Enforcement Directorate searched CoinSwitch Kuber’s offices as well as the residences of its directors and CEO Ashish Singhal.

- A source told the publication the crypto exchange is under suspicion of acquiring shares worth more than $250 million in contravention of forex laws, as well as being non-compliant with certain know-your-customer (KYC) requirements.

- The Directorate of Enforcement is a federal enforcement and intelligence agency operating under the Ministry of Finance. According to its website, the agency’s primary objective is the enforcement of acts including the Foreign Exchange Management Act and the Prevention of Money Laundering Act.

- CoinSwitch Kuber said in a statement: “We receive queries from various government agencies. Our approach has always been that of transparency.”

- “Crypto is an early stage industry with a lot of potential and we continuously engage with all stakeholders.”

Alameda Research and FTX merge VC operations: Report

- The investment arm of Sam Bankman-Fried’s cryptocurrency exchange, FTX, has reportedly absorbed the venture capital operations of Alameda Research in response to the ongoing crypto bear market.

- According to a Thursday Bloomberg report, Alameda’s Caroline Ellison said in an interview that the merger had happened prior to former co-CEO Sam Trabucco announcing his resignation on Wednesday, leaving Ellison as the firm’s sole CEO. The investment arm of the crypto exchange, FTX Ventures, launched in January — when the absorption of Alameda reportedly began — with $2 billion in assets under management.

Crypto ATM firm Bitcoin Depot aims to go public in 2023 via $885M SPAC deal

- Bitcoin Depot, a major cryptocurrency ATM provider in the United States, is planning to go public through a merger with a special-purpose acquisition company (SPAC).

- Atlanta-based Bitcoin Depot has reached a definitive agreement to merge with the SPAC GSR II Meteora (GSRM) in an $885 million deal to go public, the firm officially announced on Thursday.

- The business combination would result in Bitcoin Depot becoming a publicly listed company as the combined company — to be dubbed Bitcoin Depot Inc. — will trade on the Nasdaq under the new ticker symbol BTM.

- The merger has been unanimously approved by the leadership team of Bitcoin Depot and the board of directors of GSRM and is expected to close by the first quarter of 2023. The business combination is subject to regulatory and stakeholder approvals, and other customary closing conditions.

- The GSR II Meteora SPAC reportedly has about $320 million that Bitcoin Depot could use to grow, though SPAC investors are able to withdraw their money before the merger is done. Bitcoin Depot could proceed with a funding round that would close at the same time as the merger deal.

Bitcoin sits at range high as realized price sparks BTC ‘macro signal’

- Interesting signals are being printed by several more chart indicators this week, all of which have proven to be bear market bottom markers.

- That level, coinciding with realized price, had marked the key flip zone to target for bullish continuation the day prior, but at the time of writing, Bitcoin had yet to push beyond it or convincingly turn it to support.

- “At realized price again,” analyst Root summarized alongside a chart showing the interaction between realized price and spot price during prior bear markets.

- Returning to spot price in the short term, meanwhile, trader and analyst Il Capo of Crypto stuck by a prediction of $22,000 being regained before a significant downturn entered.

ETH whales move holdings onto exchanges before Merge

- The Ethereum blockchain is slated for one of the most significant updates since its inception as it transitions from its current proof-of-work mining consensus to a proof-of-stake (PoS) one.

- The Merge date is scheduled for Sept. 15, after the successful Goerli testnet integration — the final testnet merger before the actual transition. Ether (ETH), Ethereum’s native token, saw a bullish surge in July after the announcement of the Merge date, with its price rising to a new six-month high of over $2,000 but failing to consolidate at the critical resistance.

- The bullish enthusiasm in terms of token price and market sentiment seems to be on a decline as the Merge nears. There has been a sharp decline in the holdings of a significant number of ETH whales.

- Data from crypto analytics firm Santiment indicates that the gap between Ethereum’s top 10 largest non-exchange addresses and exchange addresses is closing. Over the past three months, top whale addresses have sent a significant amount of ETH onto exchanges. Non-exchange addresses have declined 11%, while exchange-based addresses have surged by 78%.

72% of Russians say they have never bought Bitcoin: Survey

- Cryptocurrency adoption in Russia has not been moving too fast as an overwhelming majority of Russians have apparently noever bought crypto, according to a new survey.

- Switzerland-based cryptocurrency wallet provider Tangem in July conducted an online poll to learn more about cryptocurrency investors in Russia.

- As many as 72% of the 2,100 respondents claimed that they have never bought cryptocurrencies like Bitcoin (BTC), which leaves Russian crypto investors in a significant minority.

- Among crypto investors, only 5% of respondents said they stopped buying after their first crypto purchase. The other 23% indicated that they continued to buy crypto, on average, on a monthly basis.

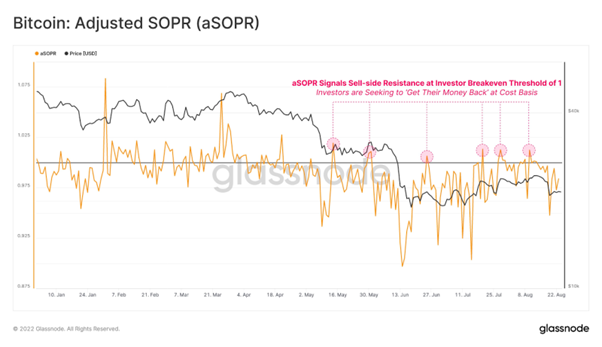

#Bitcoin aSOPR continues to face heavy resistance at the break-even threshold of 1.0.

This suggest $BTC investors are taking profits during bear market rallies, and are spending coins at their cost-basis to simply ‘get their money back’.