Bitcoin Price: US$19,329.72 (-1.23%)

Ethereum Price: US$ 1,343.61 (-1.51%)

Can Euler Finance Carve Out a Moat?

- Amidst the doom and gloom of the broader market, Euler Finance has been a standout for its escalating growth as well as core design differentiations.

- Euler is a non-custodial, permissionless lending protocol built from scratch by the team at Euler Labs. It is designed to handle the risks associated with borrowing and lending risky assets. Unlike Aave v2 and Compound v2 where all the assets exist in one interconnected money market, Euler doesn’t allow cross-borrowing for most assets.

- In order to ensure safety and allow permissionless listing, Euler has taken a more systematic approach to risk management and made several design choices to decentralize the protocol. For instance, they have applied both borrowing and lending LTVs to every asset, meaning that the LTV of a user’s loan is dependent on collateral used as well as the asset being borrowed. This is unlike other money markets which only take into consideration the LTV of the asset being borrowed, while ignoring the volatility of the borrower’s collateral when calculating a loan’s LTV.

- Euler was initially designed to rely solely on Uniswap v3 TWAP for their price oracles, a decentralized and on-chain oracle solution that reduced the need for centralized intervention whenever a new market was created. With Uniswap v3’s price feed, any asset that has a WETH pair can be added on Euler by any user immediately and permissionlessly.

- Continue on Delphi…

Is the Football Fan Token Space Heating Up?

- Two Chinese intelligence officers are charged with bribing a U.S. government employee with Bitcoin.

- Tether will make USDT tokens available across 24K ATMs in Brazil.

- Super PACs backed by Sam Bankman-Fried and Anthony Scaramucci plan last-minute ad blitz for U.S. midterm elections.

- FTX allocates $6M to compensate users affected by a phishing attack.

- Crypto staking platform Freeway which promised users up to 43% in annual awards halts withdrawals citing market volatility.

- One of the most anticipated sporting events of the year, the FIFA World Cup 2022, is set to begin on Nov. 20, 2022. This may bring renewed interest and attention to fan tokens issued by football clubs.

- While fan tokens don’t represent any ownership of the football team, they confer benefits such as VIP experience, the ability to design banners, exclusive meet and greets, and other loyalty rewards to their holders.

- The two leading platforms to issue fan tokens are Socios and Bitci. There are several fan tokens issued by football clubs but only a few have been issued by national teams.

- Over the past 7 days, fan tokens for the national teams of Brazil (BFT: +12%), Peru (FPFT: +34%), and Spain (SNFT: +13%) have outperformed BTC, ETH, and the DeFi Pulse Index.

- Over the same period, fan tokens for Argentina (ARG: -2%) and Portugal (POR: -4%) have struggled to keep up.

SEC Chair Gensler Says Crypto Is Centralized Despite Founding Principles

- Gary Gensler, chair of the Securities and Exchange Commission, took yet another shot at the crypto industry in a speech Monday, critiquing what he perceives to be the disproportionate power wielded in the sector by centralized cryptocurrency exchanges.

- Gensler’s comments, made on Monday before the annual meeting of the Securities Industry and Financial Markets Association—a prominent trade group representing securities firms, banks, and asset managers—focused primarily on promoting competition among equity market makers. But the SEC chair, while cautioning about the danger of centralization in traditional finance, also made a point to take a passing swipe at the crypto industry.

- “We’ve even seen centralization in the crypto market, which was founded on the idea of decentralization,” Gensler said. “This field actually has significant concentration among intermediaries in the middle of the market.”

MakerDAO Votes in Favor of Rune Christensen’s ‘Endgame Plan’

- MakerDAO has voted in favor of moving forward with founder Rune Christensen’s “Endgame Plan” — which aims to make the protocol more decentralized.

- As one of the largest DeFi protocols, MakerDAO has had to navigate complicated internal political and structural disagreements. The Endgame Plan was designed by Christensen in the hopes of improving protocol governance mechanisms.

- In early October, Christensen submitted a set of Maker Improvement Proposals (MIPs) to set the ground rules that would enable the launch of the Endgame Plan

- The plan proposes a new structure for the DAO to better align incentives between the different community members — including the DAO workforce, MKR holders, governance delegates, holders of the DAI stablecoin and Maker vault owners — by restructuring the DAO into smaller teams with one aligned mission.

- These smaller teams, dubbed MetaDAOs, will each have its own governing token — they will have a specialized purpose that is aligned with the protocol at large but will be its own fully functional decentralized governance.

Apple Refuses to Exempt NFTs From App Store’s 30% Fee

- Apple has rejected calls to exempt NFTs from its 30% “Apple Tax” on in-app purchases.

- The tech giant codified its rules for iOS apps that handle non-fungible tokens on Monday with its first formal green light on offering in-app NFT minting, buying and selling – activities that it had never technically banned.

- But the iPhone-maker’s de facto ban on NFT trading in apps is likely to remain. That’s because in-app NFT transactions must use Apple’s rails for in-app commerce, where Apple demands a 30% cut. Creators and marketplaces have long balked at the fees, choosing to limit in-app NFT functionality rather than lose a massive slice of revenue.

- Just last month, The Information reported on how Apple’s fee policies are keeping marketplaces and creators away from its ecosystem and sometimes leading them to abandon NFT integrations outright.

ARK’s Cathie Wood Bought $100K Worth of Bitcoin Years Ago at $250 and Has Never Sold It

- Appearing on Peter McCormack’s “What Bitcoin Did” podcast, ARK Investment Management CEO Cathie Wood said she purchased $100,000 worth of bitcoin (BTC) when it was trading around $250 (which would suggest sometime in 2015). She said she hasn’t sold any of that initial investment, meaning her current profit on that $100,000 bet would be around $7.6 million.

- Wood, whose firm she co-founded is focused on innovative and disruptive investments, said that while she was able to make that personal bet on bitcoin, she couldn’t do the same in the ARK funds themselves as they were and are only allowed to invest in securities.

- ARK eventually was able to get bitcoin exposure via the Grayscale Bitcoin Trust (GBTC). The ARK Next Generation Internet Fund (ARKW) currently holds about 5.9 million shares of GBTC valued at roughly $67.4 million.

- Wood continues to be bullish on bitcoin, and sees the Grayscale Trust – currently selling at about a 35% discount to net asset value – as trading at a “fire sale” price given the chance that at some point it will be cleared to convert into a spot exchange-traded fund (if regulators allow).

Struggling Bitcoin Miners Are Flocking to Maple Finance’s $300M Lending Pool

- Bitcoin miners are queuing up to borrow from a special purpose decentralized finance (DeFi) lending pool created by Maple Finance, as a stressed out crypto industry explores creative ways to get through the bear market.

- Since Maple and credit agent Icebreaker launched the miner finance pool a month back, a pipeline of about six to 10 mining companies is in place to form the first cohort of borrowers, with another 25 on the waiting list, according to Maple Finance CEO Sidney Powell.

- Mining companies, many of which are already burdened with debt, are feeling the chill of the crypto winter as the price of bitcoin languishes around the $20,000 mark and the cost of electricity rockets. Most recently, Compute North, one of the largest data centers that host mining computers, filed for bankruptcy, citing market conditions as one of the reasons.

Near Foundation Urges Winding Down of USN Stablecoin, Sets Aside $40M

- The Near Foundation, an organization supporting the blockchain of the same name, urged the winding down of the USN stablecoin and announced it’s setting aside $40 million to fund a “USN Protection Programme.”

- USN is a Near-native stablecoin, which was created and launched by Decentral Bank (DCB) in April, according to a statement from the Near Foundation on Monday.

- The foundation said USN is an independently operated community-run project, and that it had no direct financial assistance from the Near Foundation.

- According to the statement, DCB recently contacted the Near Foundation to advise it that USN had become undercollateralized, a condition that is “inherent” with algorithmic stablecoins, especially in “extreme market conditions.” DCB further confirmed, according to the foundation, that there was also double-minting of USN, which contributed to the undercollateralization.

- “The Near Foundation is recommending that USN should wind down. The Foundation encourages DCB to do this at the earliest opportunity in a responsible and professional manner that protects all of its users,” Near wrote.

Binance ‘Narrowing Down’ Identity of $570M Smart Chain Bridge Attacker

- Binance is “narrowing down” the identity of the attacker who stole $570 million worth of crypto from a cross-chain bridge on October 6, Binance CEO Changpeng Zhao told CNBC on Monday.

- Zhao said Monday that up to 90% of the stolen funds were frozen on the blockchain before they could be moved. And now the company, which runs the world’s largest centralized crypto exchange, has had some help tracking down the responsible party.

- “We’re still actually helping [law enforcement] to chase the bad players and working with law enforcement around the globe,” Zhao said, speaking to CNBC from Dubai. “In this particular instance, law enforcement gave us tips on who they think it may be, so we’re narrowing it down.”

Ripple’s Director of Engineering Leaves Firm as XRP Turns 10

- Ripple’s chief engineer announced over the weekend that he is leaving the company to chart new horizons, which he chose not to reveal.

- “My decade-long journey at Ripple has been a fantastic (if exhausting and all-consuming) one. I got to work on a project that I love, towards a goal I believe in. But that journey will be coming to an end in a few weeks,” Bougalis tweeted.

- At Ripple, Bougalis oversaw a series of developments to the ledger’s code base including the introduction of non-fungible tokens (NFT), which is scheduled to go live in November.

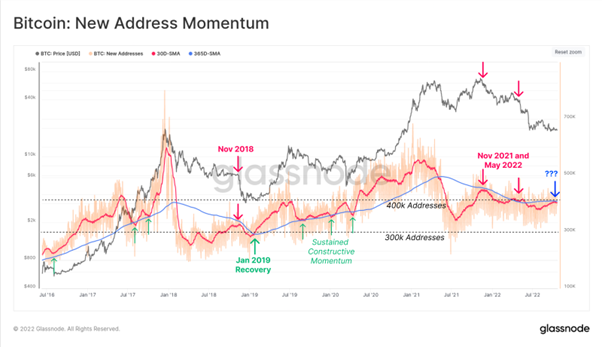

- As the volatility of Bitcoin markets compress to historical lows, we present both the bull and the bear case for Bitcoin. We cover the $1.5B overhang of a miner deleveraging, weak on-chain activity, persistent draining of exchanges, and unwavering HODLer conviction.

- On-chain activity and utilization of the network remains persistently weak, suggesting lacklustre network effect expansion.

- Miners are on the cusp of severe stress, with some 78.2k BTC held in treasuries at risk.

- Exchange BTC balances continue to drain, whilst an excess of $3B/month in stablecoin buying power is flowing in.

- The HODLer cohort have reached all-time-high coin ownership, and steadfastly refuse to release coins back into the market.

- Continue reading in Glassnode…