Bitcoin Price: US$ 16,599.57 (-0.02%)

Ethereum Price: US$ 1,203.73 (+1.62%)

Cardano DeFi Project Ardana Halts Development, Citing Funding, Timeline Concerns

- Ardana (DANA), a once-promising decentralized finance project built on perennial top-ten proof-of-stake blockchain Cardano (ADA) has halted development.

- The project cited “funding and project timeline uncertainty” as the reason for ceasing operations, in a tweet addressed to the Ardana community yesterday.

- Ardana was barely a year into development after raising $10 million last year via a funding round led by now defunct crypto hedge fund, Three Arrows Capital, Cardano’s cFund and Ascensive Assets. The project was working on stablecoin minting and foreign exchange services, and aspired to be “the MakerDAO and the Curve Finance of Cardano.”

- Per the Ardana Twitter account, “Development on Cardano has been difficult with a lot of funding going into tooling, infrastructure and security. This alongside the uncertainty around development completion has led to the best course of action being halting development of dUSD.”

UK’s ‘biggest ever’ scam leads to 100 arrests after police track bitcoin records

- More than 100 people were arrested in what the London’s Metropolitan Police calls “the UK’s biggest ever fraud operation” after taking down a fraud website called iSpoof used on 200,000 potential victims in Britain alone.

- iSpoof allowed scammers to pose as officials from banks such as Barclays, Santander, HSBC, Lloyds, Halifax, First Direct, Natwest, Nationwide and TSB. Criminals paid for the service in bitcoin, according to the police report.

- Scotland Yard’s Cyber Crime Unit worked in cross-national cooperation, including authorities in the U.S. and Ukraine, to take down the site this week. In a 20-month period, the Met police claims the operation earned the criminals almost £3.2 million ($3.9 million).

Jump Crypto, Polygon Ventures, GSR contribute to Binance’s $1 billion recovery fund

- Binance’s industry recovery fund, to which it’s already contributed $1 billion, has attracted some big names early on including Jump Crypto, Polygon Ventures and market maker GSR.

- Aptos Labs, Animoca Brands and Kronos are also among some of the other early contributors, CEO Changpeng Zhao said. These firms joined the recovery fund with an initial aggregate commitment of around $50 million. Binance expects more participants to join soon, with over 150 applications already received.

- The fund was announced last week to help mitigate the fallout stemming from FTX’s collapse. Binance’s initial commitment of 1 billion BUSD can be verified at the following address. The addresses of other participants will be available in the next week.

- Participants must set aside committed capital to access investment opportunities through the recovery fund’s application process. The capital can be in stablecoins or other tokens. Public addresses must be shared for transparency.

Starkware open-sources latest version of its Cairo programming language

- Blockchain development firm Starkware has open-sourced a new release of its programming language Cairo — the first step in a wider move to make its entire blockchain stack for StarkNet open source.

- Cairo underpins Starkware’s Layer 2 networks, StarkNet and StarkEx. This is the first major release for the language since it was created and the new version will soon be brought to StarkNet, according to a statement.

Ethereum Developers Agree on What Could Be Included in the Next Upgrade – But Not When

- On Thursday, Ethereum developers decided to consider eight Ethereum Improvement Proposals (EIPs) for inclusion in the network’s upcoming hard fork, called “Shanghai.” The hard fork upgrade will unlock Beacon Chain staked ETH withdrawals, and might include proposals that address issues of scalability and others designed to improve the Ethereum Virtual Machine.

- But there is no consensus yet on when that will happen.

- Having EIPs “considered for inclusion” (CFI) means that the developers will commit to developing these proposals and will run them through tests on developer networks (devnets). However, there’s no guarantee that all these proposals will make the final cut for inclusion in Shanghai.

- Even before the core developers met, they’d determined that Beacon Chain withdrawals, or EIP 4895, was definitely going to be part of the fork. This means that once Ethereum goes through its next upgrade, users that staked ether prior to the Merge by locking them up in the Beacon Chain smart contract will be able to access them, along with any additional accrued rewards.

- For now, EIP 4844, also known as proto-danksharding, is in the CFI package. EIP 4844 is a significant first step the protocol would take toward making the network more scalable through sharding, a method that splits up the network into “shards” as a way to increase its capacity and bring down gas fees.

Wall Street closed until Black Friday, GBTC discount narrows on Thanksgiving

- The minutes from the Fed’s Nov. 1 and 2 meetings showed the central bank is going to “slow” down its hikes. A 50-basis point rate hike is expected at the Dec. 14 meeting.

- Grayscale’s GBTC discount was trading below -40%. The bitcoin trust hit an all-time low discount to NAV of 45% on Monday. The structured product has lifted each day since, despite fears that sister firm Genesis could declare bankruptcy without emergency funding.

- With markets closed for the holidays, trading on Wall Street takes a breather today. Markets are open on Black Friday, finishing up at 1 p.m. Eastern. Bond markets in the U.S. are following the same holiday hours.

Ethereum node project Akula shuts down in wake of Paradigm competitor

- The developers behind Akula, an Ethereum client implementation, have decided to scrap the project because they cannot compete with a newly announced rival project called Reth that has similar features and is run by crypto VC firm Paradigm.

- Akula is a high-performance Ethereum client written in Rust. Ethereum clients are software applications that allow nodes to read blocks on the network and interact with smart contracts. Ethereum core developer Artem Vorotnikov began building the project as an open-source client implementation in 2021 with a small team of developers.

- Only this development work is now at an end, according to an announcement issued on Wednesday. The developers will no longer maintain or run the project, but the code remains available because it’s open source. The announcement cited the emergence of an identical node client by a team with access to better funding but did not name the project.

- “Sadly, we cannot outcompete multibillion VCs who copy-paste our architecture and code,” said Vorotnikov in a tweet on Wednesday.

Singapore Police Probe Hodlnaut for ‘Possible Cheating and Fraud’

- Singapore’s white-collar crime investigation unit, the Commercial Affairs Department (CAD), on Wednesday, launched a probe into troubled crypto lender Hodlnaut for “possible cheating and fraud,” according to an official statement.

- Between August and November, the police received “multiple reports” that Hodlnaut and its directors had made “false representations” about the lender’s exposure to “a certain digital token.”

- The unnamed token likely refers to Terra’s now-collapsed USTC, formerly known as UST, an algorithmic dollar-pegged stablecoin that rapidly depegged back in May. Decrypt reached out to Singapore’s CAD and Hodlnaut to confirm this, but did not receive an immediate reply.

Infura Collecting MetaMask Users’ IP, Ethereum Addresses After Privacy Policy Update

- ConsenSys has informed users that it is set to collect additional data from those using its popular Infrura tool, attracting criticism on social media in the process.

- Infura is an API-based tool that allows users to connect their application to the Ethereum network, which provides the basis for many key Web3 projects, such as Aragon, Gnosis, OpenZeppelin, and ConsenSys’s own flagship wallet service MetaMask.

Crypto Exchange Bybit Announces $100M Fund to Support Institutional Clients

- Crypto exchange Bybit has established a $100 million fund to support institutional clients “during this challenging period in the crypto industry,” the company said Thursday.

- Bybit will offer up to $10 million to existing and new market makers on its platform, as well as dedicated account managers, it said in an emailed statement.

- Bybit, the 35th largest exchange by trading volume according to CoinMarketCap, joins Binance, the largest, in trying to turn the industry tumult of the past few weeks into an opportunity. The crypto market has lost two-thirds of its value in a year and has been roiled by the collapse of large market participants.

Polygon’s ‘Secret Sauce’: Why Starbucks, Meta, and Reddit Chose the Ethereum Scaler

- Amid a brutal crypto downturn that has only gotten worse with FTX’s collapse, one blockchain platform has repeatedly shown that it can still onboard massive brands with a collective reach of billions into the Web3 world: Polygon, the Ethereum scaling network.

- Recent highlights include Meta tapping Polygon to let Instagram users mint NFTs, Starbucks building an NFT-driven loyalty rewards program, Reddit minting unique NFT avatars, Nike revealing plans to mint digital apparel NFTs, and an NFT collectibles partnership with Disney after Polygon took part in the entertainment giant’s accelerator program.

- Polygon is having a moment right now with mainstream brand adoption, but Wyatt admits that what he sees as the Studios team’s advantage over rival scaling solutions like Immutable X and Arbitrum might not last.

- “That is something that others will replicate over time,” he said. “I think we’re taking advantage of the moment.”

- But the brand push may also yield network effects that convince other companies to build on Polygon. While best known as an Ethereum sidechain that enables faster, chapter transactions than Ethereum’s mainnet, Wyatt also pointed to its upcoming zkEVM scaling tech, suggesting that it reassures developers that they can “be on Polygon protocols forever.”

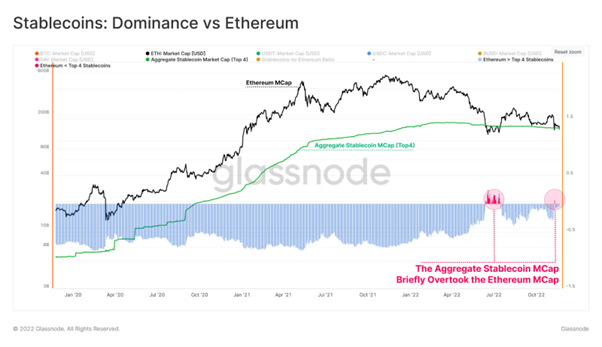

Glassnode

- During the chaos of the last few weeks, the #Ethereum market cap briefly fell below the aggregate stablecoin cap, once again.

- The Top 4 stablecoins USDT, USDC, BUSD and DAI make up over $138B in total, with the $ETH market cap just 2.8% higher at $142B