Bitcoin Price: US$ 22,632.89 (-1.24%)

Ethereum Price: US$ 1,555.97 (-4.32%)

Heads or Thales: Exploring the Potential of Positional Parimutuel Markets

- As Vitalik notes in his blog post, “Prediction Markets: Tales from the Election,” prediction markets remain some of the lowest hanging fruit for crypto disruption. Decentralized prediction markets (DPMs) deliver valuable insights and financially incentivize the fight against information asymmetry. For an optimal prediction market, crypto’s central pillars of decentralization, credible neutrality, and censorship resistance are prerequisites rather than buzzwords.

- Thales is leveraging the power of parimutuel markets to build easy-to-understand derivatives, prediction markets, and sports betting. This report will analyze what makes Thales unique from its predecessors and evaluate its potential as a killer app.

- Synthetix is a derivatives platform that enables users to mint and trade synthetic assets, or synths. SNX stakers make up the collateral pool and are permitted to mint sUSD, which can be exchanged for other synths. These synths are pegged 1:1 to their corresponding crypto, fiat, stocks, or commodities via Chainlink oracles. Due to the nature of synthetic assets, Synthetix is able to onboard a wide array of assets without dealing with slippage, liquidity bootstrapping, and other overhead costs that plague development of nascent protocols.

- The Thales community was spun out from Synthetix as the scope of its binary options product grew to command a dedicated team. Thales maintains a close relationship with Synthetix, with widely overlapping communities, a republic-style DAO structure, and sUSD as its main collateral. If you’re interested in learning more about how Synthetix works and its burgeoning ecosystem, peep our recent deep dive.

- Parimutuel markets place participants against one another rather than a centralized bookmaker. All bets are placed into a pool which is ultimately divided among the winning side. Odds are a function of the pool balance rather than the more traditional fixed odds structure. Bets are represented by positional tokens, which are priced by the Thales AMM according to the Black-Scholes Model. Winning positional tokens are redeemable for one dollar, while losing positional tokens expire worthless. Parimutuel markets offer an easy-to-understand alternative to derivatives such as standard options and perps.

Crypto Infrastructure Firm Blockstream Raises $125M for Bitcoin Mining

- Crypto infrastructure company Blockstream raised $125 million in convertible note and secured loan financing to expand its bitcoin mining hosting services.

- The company, which raised $210 million in August at a $3.2 billion valuation, said in a press release Tuesday it will use the proceeds from the new capital to expand its mining facilities to meet strong demand for large-scale hosting services, according to the statement. “Hosting has remained a resilient market segment as compared with ‘prop’ miners (and their lenders) who have been more directly exposed to bitcoin price volatility and compressed margins,” the statement added.

- Blockstream’s new funding round didn’t mention the valuation of the company. However, in Dec. 7, Bloomberg reported the company is seeking to raise funds at a 70% lower valuation than in its previous round, under $1 billion.

- Hosting is a service that data centers provide to crypto miners so customers can store their mining rigs and mine digital assets for a fee. The service has been a popular way for miners to earn bitcoin rewards without having to sink a large amount of capital into building out infrastructure, as crypto winter has weighed heavily on the industry and capital markets have been essentially inaccessible for many.

UK Treasury Is Looking for CBDC Head as It Explores Digital Pound

- A new LinkedIn job posting from the U.K. Treasury is seeking a “Head of Central Bank Digital Currency.”

- “The successful candidate will be responsible for leadership of HM Treasury’s work on a potential digital pound – a U.K. central bank digital currency (CBDC),” reads the posting.

- The CBDC chief will lead the Treasury team as it works with the Bank of England on the government’s soon to be issued consultation on the digital pound, the listing continues. This role will fit into the existing Payments and Fintech Team and is a separate from the current head of crypto-assets and digital currencies.

- At the time, the U.K. is still considering whether or not it should issue a CBDC. In November Bank of England Deputy Governor Jon Cunliffe said the collapse of crypto exchange FTX and its impact on crypto as a whole proved the need for a digital pound.

Binance Says Management of Its Funds ‘Has Not Always Been Perfect’

- Binance has acknowledged that it may have mistakenly kept collateral backing some of its Binance-peg tokens—known as B-Tokens—in the same wallet as other company funds.

- These B-Tokens allow users to trade popular cryptocurrencies such as Ethereum (ETH) and Bitcoin (BTC) on the crypto exchange’s native BNB blockchain.

- When questioned on the reports, Binance told Decrypt that “on-chain data highlighted by third parties show that the administration of hot wallets has not always been perfect.”

- Binance posted the holdings of a cold wallet known as “Binance 8” which holds much of the collateral backing these B-Tokens.

- However, this wallet contained more tokens needed to collateralize the B-Tokens on a 1:1 basis, per data from EtherScan. There is more collateral backing these tokens than needed at press time.

- The crypto exchange told Decrypt that this inconsistency emerged due either to the funds being “not moved quickly enough to the appropriate hot wallets” or that “collateral assets had been stored in cold wallets that were not known to the public.”

- These findings may also contradict Binance’s own stated policies regarding collateralization.

- The crypto exchange has previously gone on the record as saying “when a user deposits one Bitcoin, Binance’s reserves increase by at least one Bitcoin to ensure client funds are fully backed.”

- However, Binance also said that these reserves should not include “Binance’s corporate holdings” which it asserts “are kept on a completely separate ledger.”

Kraken hires Blockchain.com’s former chief compliance officer

- Crypto exchange giant Kraken has hired C.J. Rinaldi as its chief compliance officer.

- Rinaldi joins Kraken after working at the crypto services firm Blockchain.com as its chief compliance officer from October 2021 until December 2022. Rinaldi helped mitigate Blockchain.com’s risk and expand its global compliance framework. Before Blockchain.com, Rinaldi worked at Deutsche Bank as chief compliance officer, and prior to that as senior counsel in the Enforcement Division of the U.S. Securities and Exchange Commission.

- Jesse Powell, Kraken’s CEO of over 11 years, stepped down on Sept. 21, 2022, and the firm’s COO David Ripley assumed the CEO role. Kraken laid off 30% of its workforce on Nov. 30, 2022 to help “weather the crypto storm,” joining Bitso, Gemini, Immutable and a myriad of other crypto firms to downsize their workforce amid depressed market conditions last year, The Block previously reported.

- Kraken saw $13.8 billion in monthly crypto exchange volume in December, comprising 2.95% of all crypto exchange volume for the month, according to The Block’s Data Dashboard.

Binance Processed $346M of Bitcoin Trades for Crypto Exchange Bitzlato: Reuters

- Binance, the world’s largest crypto exchange by trading volume, processed $345.8 million worth of bitcoin (BTC) transactions for crypto exchange Bitzlato, Reuters reported Tuesday, citing data by blockchain research firm Chainalysis.

- According to Reuters, Binance processed 205,000 transactions in behalf of Bitzlato between May 2018 and last week, when Bizlato shut down after the U.S. Department of Justice charged it and its founder with money laundering.

- About $90 million worth of bitcoin transfers were carried out after August 2021, according to the report, which was when Binance said it would start demanding stricter background checks from customers in order to fight financial crime.

- Binance was named as one of Bitzlato’s top three counterparties by the U.S. Treasury’s Financial Crimes Enforcement Network.

EU Plans Digital Euro Bill, Metaverse Policy for May, Commission Says

- The European Commission, the executive body of the European Union, will publish a bill to underpin a digital euro and set out its strategy on virtual worlds in May, according to a document published on its website Monday.

- Even though the European Central Bank has yet to decide whether to issue a central bank digital currency (CBDC), the commission has indicated new laws could be needed to assert a digital euro’s status as legal tender and set anti-money-laundering rules.

- “Our legislation will be the framework for a digital euro,” Mairead McGuinness, the EU’s financial-services commissioner, told lawmakers on the Economic and Monetary Affairs Committee Tuesday. “It will be negligent if Europe did nothing now, but at some point in five or 10 years had to urgently rush through something.”

- The bill is set to be published by the commission May 24. It’s up to the European Parliament and governments of countries in the EU to “look at the finer points around the use cases of a digital euro” and “the technology to be used,” she said.

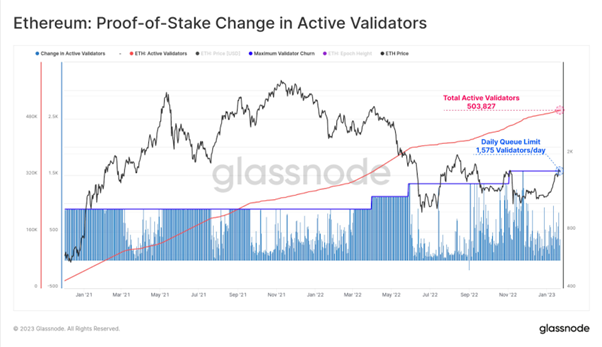

Glassnode:

- There are now over 503k active Proof-of-Stake Validators on the #Ethereum beacon chain.

- The total number of new, or exiting validators is capped each day, depending on the validator pool size. The current limit is 1575 validators/day.