Bitcoin Price: US$19,570.40 (+1.91%)

Ethereum Price: US$ 1,364.20 (+3.85%)

Bitcoin mining difficult rises by more than 3%

- Bitcoin’s mining difficulty rose roughly 3.4%.

- The move was modest compared to the 13% increase from earlier this month.

- The mining difficulty automatically adjusts every 2016 blocks, occurring roughly every two weeks. The difficulty exists to ensure that transactions process at a steady pace regardless of how high or low the network hash rate is at a given time.

- The bitcoin mining hash rate hit an all-time high of 266 EH/s this month. The current network hash rate was roughly 263 EH/s as of Saturday.

This week in markets: US recession risk hits 100% as crypto tokenomics highlighted

- The chance of a recession in the United States has now hit 100%, according to new Bloomberg Economics model projections — meaning that it is “effectively certain” the country’s economy will contract over the next year.

- Bitcoin, the first and foremost cryptocurrency, was born out of a global economic recession — but has never existed inside one. The same goes, of course, for Ethereum and every crypto protocol spawned after it. If the aforementioned projections are correct, the blockchain and cryptocurrency industry will enter a new, distinct and defined chapter of existence.

- Despite crypto proponents unsurprisingly finding many cryptocurrencies’ tokenomics favorable, crypto markets remain closely tied to macro factors — including rate hikes from the U.S. Federal Reserve.

Bitcoin’s correlation with gold hints at return to haven status, BoA strategists say

- Bitcoin’s shifting relationship with traditional markets hints that investors may again be thinking of it as a haven asset, according to research by the Bank of America.

- The crypto market heavyweight has seen its correlation with gold increase from zero to 0.5 since mid-August, Bloomberg first reported, citing BoA digital assets strategists Alkesh Shah and Andrew Moss.

- Its correlation with major indexes has also flattened out below record highs, with the S&P 500 registering 0.69 and the Nasdaq hitting 0.72.

- Investors may be viewing bitcoin as a “relative safe haven” amid macro uncertainty, Moss and Shah wrote, adding that “a market bottom remains to be seen.”

Ethereum supply on trend to drop below pre-Merge levels

- The supply of Ethereum’s native asset ether (ETH) appears on trend to deflate to pre-Merge levels as a result of more coins being burned than created for the last few weeks, on-chain data shows.

- At the time of The Merge on Sept. 15, Ethereum’s upgrade from proof-of-work to proof-of-stake consensus, the ETH supply was 120,520,000 coins. After The Merge, the supply rose to 120,534,000 on Oct. 8, but has since fallen back to 120,522,000, now sitting just a couple of thousand coins more than the supply recorded at The Merge. This deflationary trend has occurred as more coins have been burned for transaction fees than were created as rewards for validators in recent weeks.

- “Since issuance is significantly reduced now compared to pre-Merge, even a slight increase in burned ETH from recent levels would make daily net emission go negative,” said Kevin Peng, research analyst at The Block.

Circle partners with Axelar on cross-chain initiative for USDC

- Circle has announced a partnership with Axelar focused on the use of USDC and cross-chain applications.

- Avalanche, Cosmos, Ethereum, Polygon, and Sui will be the first chains integrated with Axelar’s General Message Passing (GMP). The announcement comes shortly after Circle announced its native USDC bridging protocol last month.

- When a user bridges an asset, the token they receive on the other end is non-native, meaning it is a synthetic version subject to liquidity issues and security vulnerabilities if the bridge is attacked and hacked.

- In essence, Circle oversees and verifies the movement of native USDC between chains removing the need for wrapped assets. Axelar’s GMP takes this process one step further and allows applications to integrate Circle’s bridge.

Ethereum Co-Founder Gavin Wood Steps Down as CEO of Company Behind Polkadot

- Gavin Wood, co-founder of Parity Technologies, the company behind the Polkadot blockchain, is stepping down as the firm’s CEO, according to a Bloomberg report.

- Wood, also an early Ethereum contributor and co-founder, will remain Parity’s majority shareholder and chief architect. Parity co-founder Björn Wagner will assume the title of CEO. The move is reportedly of Wood’s own volition, due to his feeling that serving as chief executive has limited his ability to pursue “eternal happiness.”

Collapsed Australian Crypto Exchange ACX Allegedly Used Customer Funds to Run Business

- Blockchain Capital – which operated the ACX crypto exchange that collapsed last year – used customer deposits to fund another part of its business instead of keeping the money in reserve, according to a Sydney Morning Herald report on a court hearing that involved looking into the findings of the exchange’s liquidators.

- Former Chief Technology Officer Jin Chen, who left the company in 2018 and is not accused of any wrongdoing, told liquidators he was instructed by Allan Guo, Blockchain Global’s co-founder, to transfer bitcoin (BTC) from customer accounts to other parts of the business. “I understood it was for a collateral purpose,” Chen testified.

- In other signs of poor controls. the exchange allegedly mingled customer funds into a single pool. “There’s no way of identifying that this bitcoin was owned by Customer A and this bitcoin is owned by Customer B?” Chen was asked. “Yes,” he replied.

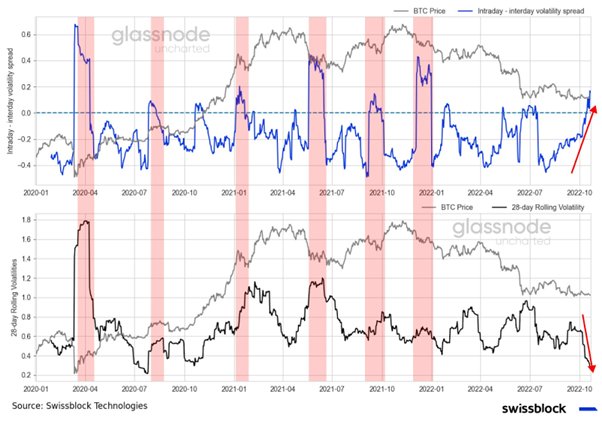

Glassnode

- #Bitcoin intraday volatility spiked but realized volatility is significantly low. #BTC is sensitive to incoming data and the macro environment.

- Demand is low and there is no clear direction in the market. A big move is imminent