Bitcoin Price: US$ 16,603.11 (+2.32%)

Ethereum Price: US$ 1,184.52 (+3.94%)

GBTC And ETHE Trade at Record Discount to NAVs

- Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE) are trading at the largest discount to net asset values ever with GBTC as well as ETHE trading at a -45% discount on Nov. 18, 2022.

- This is the result of growing concern amid market participants regarding the solvency of Genesis, a crypto lender that has an exposure of $200M to FTX. Genesis had previously announced exposure of $1.2B to now-bankrupt 3AC in July 2022.

- Genesis is the sister company of Grayscale with both entities owned by the Digital Currency Group (DCG). Despite a $140M equity infusion from DCG on Nov. 11, Genesis halted client withdrawals five days later. Now, the company is trying to raise $500M while hiring Moelis & Company as a restructuring advisor.

- While DCG regularly bought back GBTC and ETHE shares, Genesis accepted them as collateral against loans. As large holders of these shares, market participants fear that they may be forced to dump them to raise liquidity.

- Moreover, Grayscale has also refused to provide proof-of-reserves for crypto backing the assets held by the trusts, causing further concern among market participants. Instead, the company pointed to a letter from Coinbase confirming the accounting of tokens held by Coinbase Custody.

- Currently, GBTC holds $10.2B of assets and ETHE holds $3.4B of assets. Grayscale charges an annual fee of 2% on GBTC and 2.5% on ETHE. This makes the company a cash cow for DCG with a combined estimated annualized fee revenue of $290M.

Liquity’s Chicken Bonds: Will They Fly?

- Chicken bonds are a bonding mechanism that can be applied to yield-bearing tokens to bootstrap protocol-earned liquidity while boosting yields for bonders. The enhanced yield on boosted tokens is derived from yield generated on liquidity owned by the protocol as well as liquidity from users bonding underlying tokens to newly issued boosted tokens.

- Let’s illustrate the chicken bond mechanism with Liquity’s example. A user can create an LUSD chicken bond by depositing LUSD into the chicken bond system. After this, the bond position accrues a virtual balance of boosted LUSD tokens (bLUSD) over time. bLUSD offers a boosted yield compared to LUSD deposited into the stability pool. The longer they bond, the more bLUSD accrues, according to a smooth plateauing curve up to a cap (defined here). At any time, a user can choose to cancel their bond and get their initial LUSD principal back — an action called “chicken out.” Alternatively, the user can choose to claim the bLUSD they have accrued in exchange for their LUSD which they will permanently give up — an action called “chicken in.”

- Continue on Delphi…

Hacker steals $42 million from Fenbushi Capital partner Bo Shen

- Bo Shen, founding partner at Fenbushi capital, said his private crypto wallet was hacked in an incident on Nov. 10, which resulted in a $42 million loss of various crypto assets.

- The majority of the tokens, some $38 million, was taken in the stablecoin USDC. The rest of the stolen assets included tether (USDT), uniswap (UNI), reputation (REP), and liquity (LQTY) tokens, on-chain data from the wallet shows.

- “A total of 42M worth of crypto assets, including 38M in USDC were stolen from my personal wallet ending in 894 in the early morning of November 10 EST,” Shen said in a tweet.

- Shen said he reported the exploit to relevant law enforcement agencies. He clarified the stolen assets were personal funds and were separate from Fenbushi and its related entities.

Ethereum client teams test staking withdrawals on devnet

- Ethereum developers have released a developer network to test validator staking withdrawals, a feature currently missing on the network.

- Ethereum developer Marius Van Der Wijden said the devnet will help prepare Ethereum to open up validator staking withdrawals next year with a planned upgrade called Shanghai. The lack of the feature has raised some fears about centralization risks after Ethereum migrated to proof-of-stake consensus.

- “It’s the first devnet that enabled withdrawals on all of these implementations and is a big step forward,” Van Der Wijden told The Block. “It also helps other clients to test their implementations by joining the network.”

- Ethereum clients, teams that build validator software, are testing staking withdrawals to prepare for Shanghai and find any potential bugs, Van Der Wijden said. He clarified that the ongoing devnet only focuses on withdrawals and separate Shanghai features have yet to be tested.

Japan’s central bank to issue experimental digital yen in early 2023

- The Japanese central bank will begin experiments with a proof-of-concept digital yen early next year, Nikkei reported.

- The Bank of Japan will work with several unnamed financial institutions to stress test a central bank digital currency. Tests will include how deposits and withdrawals can work, and also what happens when no internet access is available.

- A decision will be taken in 2026 on whether to formally adopt a digital yen.

ZkSync passes security audit as it gears up to expand access to the public

- ZkSync, an Ethereum scaling protocol, passed its first security audit in preparation of expanding access to users this year.

- Security auditing for new protocols has become more important after the worst hacking year in crypto history, according to Chainalysis. The security audit adds an extra layer of trust in zkSync’s network security for builders and users of protocols.

- For example, several well known decentralized finance protocols such as Aave and Uniswap have committed to launch on zkSync. The audit allows protocols and users to have more trust in expanding to the new network and transacting on them.

- OpenZeppelin, a leading crypto auditing firm, conducted the audit, which took place over a four-week period. OpenZeppelin is providing on-demand security feedback in between future audits and has assigned technical and security advisors to oversee zkSync.

Ethereum R&D Firm Flashbots Shares Details About Its Next-Gen Block Builder

- Ethereum research and development firm Flashbots released new information Wednesday on “The Single Unifying Auctions for Value Expression” (Suave) – its vision for a new kind of blockchain that would radically transform the process by which chain-operators (i.e., “validators”) earn value across different networks.

- According to Flashbots, Suave, a so-called sequencing chain, will be geared towards completely decentralizing the block-building process. By the firm’s description, it would be a “plug-and-play” solution that “unbundles the mempool and block-builder role” from existing blockchains.

- In addition to maximizing the revenue that validators earn for operating blockchains, Flashbots hopes Suave can ameliorate rising concerns around transaction censorship, exploitative MEV practices and slow transaction execution.

Founder of EOS Developer Block.One Buys 9.3% of Crypto Bank Silvergate

- Brendan Blumer, the founder and CEO of EOS developer Block.One, has bought 9.3% of crypto bank Silvergate Capital (SI), while Block.One bought an additional 7.5%, according to Securities and Exchange Commission documents filed on Wednesday. According to the filings, Blumer bought 2,934,537 shares of the crypto bank on Nov. 16 while Block.One bought 2,363,186 shares.

- The purchase makes Blumer the largest shareholder of Silvergate, according to the latest statistics from FactSet.

Bitcoin, Ethereum and Dogecoin Jump on Release of Fed Minutes

- Bitcoin jumped slightly on the release of the Federal Reserve’s minutes from its November meeting, the captured discussion suggesting that the central bank may make smaller interest rate increases going forward.

- The stock market similarly ticked up as traders digested the news.

ApeCoin DAO Launches Community-Driven NFT Marketplace

- ApeCoin DAO, a community-led governing body made up of ApeCoin holders, has launched its own white-label non-fungible token (NFT) marketplace.

- ApeCoin, the Ethereum-based governance and utility token used within the Bored Ape Yacht Club (BAYC)-linked APE ecosystem, launched in March.

- Built by non-fungible token (NFT) infrastructure company Snag Solutions, the new community marketplace lists for-sale NFTs from Yuga Labs-owned NFT collections like BAYC, Mutant Ape Yacht Club (MAYC), Bored Ape Kennel Club (BAKC) and Otherdeed for Otherside.

- Zach Heerwagen, CEO of Snag Solutions, said the platform offers “unique features built specifically for the BAYC and Otherside communities, including ApeCoin staking and NFT metadata integrations.”

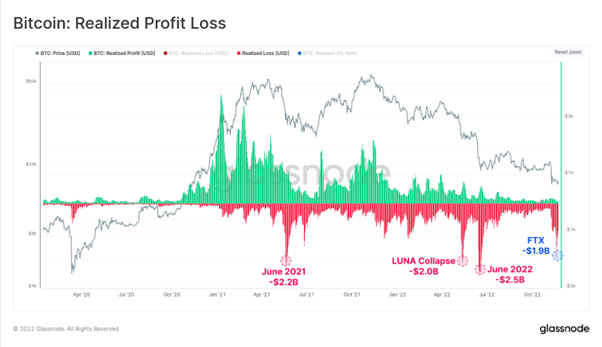

Glassnode

- The total #Bitcoin market Realized Loss peaked at -$1.9B last Friday.

- This is the fourth largest daily realized loss in history, ranking behind:

- -$2.0B during LUNA collapse

- -$2.2B in June 2021 start of bear

- -$2.5B in June 2022 sub-$20k