Bitcoin Price: US$ 22,916.45 (+0.92%)

Ethereum Price: US$ 1,626.29 (-0.07%)

Ethereum Shanghai Mainnet Shadow Fork Goes Live

- Ethereum users are one step closer to accessing the $26 billion worth (and counting) of ETH staked with the world’s largest smart contract network.

- On Monday, Ethereum’s core developers announced the successful deployment of the first mainnet shadow fork designed to test the readiness of ETH staking withdrawal capability, a feature expected to launch by March.

- Mainnet shadow forks are full dress rehearsals of system upgrades, which allow developers to test for design flaws and tweak any outstanding issues. Monday’s test previewed Ethereum’s upcoming and much-anticipated Shanghai upgrade, which will introduce staked ETH withdrawals to the Ethereum ecosystem.

FBI confirms Lazarus Group and APT38 were responsible for $100 million bridge hack

- The FBI confirmed Monday that Lazarus Group and APT 38 were behind a $100 million heist on proof-of-stake blockchain platform Harmony last June, and they attempted to launder the money through the RAILGUN privacy protocol.

- The FBI said Lazarus Group and APT38, cyber actors associated with the North Korea, committed the theft of $100 million of virtual currency from Harmony’s Horizon bridge reported on June 24. The hack was associated with a malware campaign called “TraderTraitor” that was led by the Democratic People’s Republic of Korea, according to the FBI and Cybersecurity and Infrastrastructure Security Agency (CISA).

- Portions of some $60 million worth of ETH the hackers routed via RAILGUN, a privacy exchange, “were frozen, in coordination with some of the virtual asset service providers,” according to the agency.

- The DPRK uses funds it acquires from hacks like this to fund its ballistic missile and weapons of mass destruction programs, the FBI said. Lazarus Group was connected to the $600 million Ronin exploit last year in April. The U.S. government warned that both groups were associated with targeting crypto firms to steal assets around the same time the Ronin exploit occurred.

BlockFi looks to sell bitcoin mining loans totaling $160 million: Bloomberg

- Crypto lender BlockFi is looking to sell $160 million in bitcoin mining machine-backed loans amid its bankruptcy process.

- The bidding started last year and some of the loans may be under-collateralized due to the decline in machine prices, unnamed sources told Bloomberg.

- The price of mining rigs fell more than 80% over the course of last year as the decline in bitcoin prices and the spike in power costs squeezed mining margins.

Lawyers for Genesis and Its Creditors Are ‘Optimistic’ for a Quick Resolution to Bankruptcy Woes

- Lawyers for Genesis Global told a federal bankruptcy court in New York City on Monday that they’ve been working with creditors’ representatives and the U.S. Trustee’s Office “around the clock” for the past two months in order to reach a “consensual resolution” with the embattled company’s creditors.

- Genesis’ lending arm halted withdrawals on Nov. 18, 2022, after what its lawyers described as “a run on the bank” in the wake of FTX’s collapse earlier that month. Two months later, on Jan. 19, Genesis Global Holdco – the holding company of Genesis Global Capital – and two of its subsidiaries, Genesis Asia Pacific (GAP) and Genesis Global Capital (GGC), filed for Chapter 11 bankruptcy protection in New York.

- Genesis’ lawyers – from the New York-based law firm Cleary Gottleib – told bankruptcy court Judge Sean H. Lane at a hearing on Monday they expect to reach an agreement with the creditors by the end of the week.

- “We have a timeline and an approach to get through this case as quickly as possible,” Genesis attorney Sean O’Neal told the judge. “We really want to avoid getting involved in a prolonged case with litigation that effectively destroys value that would otherwise be available for the creditors.”

- Another lawyer for Genesis, Jane VanLare, told the court that one thing the crypto lender is considering is a sale of itself to generate funds to pay back creditors.

- “We do intend to conduct a marketing and sale process and/or raise additional capital,” VanLare said. “If the process does not result in the sale of a business, the equity interest in GGH, which is the Holdco entity, will be distributed to the debtors’ creditors.”

Wormhole exploiter converts $150 million in ETH to staked assets and levers up

- Following days of inactivity, the address associated with the theft of $323 million worth of ETH from the cross-chain protocol Wormhole began shuffling assets, Etherscan records show.

- News of the activity was first noted by Twitter user @Spreekaway earlier Monday.

- The series of swaps began as the exploiter address consolidated ETH prior to initiating a swap for 95,630 ether ($157.2 million) into staked ether (stETH) via the DEX aggregator OpenOcean.

- After that the stETH was swapped for 86,473 wrapped staked ETH (wstETH), Lido’s form of liquid staked ether, which is compatible with DeFi trading platforms.

- With the wstETH as collateral, the hacker took out a $13 million DAI loan that was used to buy roughly 7,989.5 ETH via KyberNetwork, according to blockchain data. The hacker repeated the process to continue leveraging up.

- “Either this guy is just having fun on-chain with exploited assets or has some long position on stETH when he decided to make the trade,” said Steven Zheng, The Block’s director of research.

- Dune Analytics stETH

- The magnitude of the trade was felt in markets, causing stETH to repeg, according to Dune Analytics.

- Wormhole responded to the exploiter reiterating its offer to capitulate with a $10 million bounty award “for the return of all stolen funds” in an on-chain message.

VC Firm Pantera’s 2023 Crypto Forecast Says the Future Is DeFi

- Crypto-focused venture capital firm Pantera Capital, which has about $3.8 billion in assets under management, has summed up its 2023 forecast, and the future is decentralized finance (DeFi).

- The bear market that emerged early last year was worsened by a wave of headline-grabbing exploits and bankruptcies, including the implosion of multibillion-dollar centralized exchange FTX and last week’s filing by crypto lender Genesis, a sister company of CoinDesk’s.

- “Pantera has managed blockchain funds through three previous ‘crypto winters’,” noted Pantera CEO and co-Chief Investment Officer Dan Morehead in the forward of his investor letter, titled “The Year Ahead.”

- “Each one had supposedly catastrophic events. For example, when Mt. Gox went down, it represented 85% market share – much larger than FTX today,” Morehead continued. “Blockchain is going to change the world. It will certainly survive these issues.”

MakerDAO Approves Deployment of $100M USDC on DeFi Protocol Yearn Finance

- Decentralized-finance (DeFi) giant MakerDAO’s community approved Monday a proposal to deploy up to $100 million in USD coin (USDC) from its reserve on DeFi protocol Yearn Finance, where the deposited stablecoin will earn a yield.

- Maker will open an individual non-custodial vault on Yearn with a ceiling set at $100 million to deposit USDC from its “peg stability module,” or PSM, which backs the value of Maker’s decentralized stablecoin DAI.

- According to the proposal submitted at the end of November, MakerDAO is predicted to earn a 2% annual yield with the strategy.

- Some 72% of voters favored the plan. For final implementation and the transfer of funds from the PSM, a further “executive vote” is necessary, according to MakerDAO’s tweet.

Bitcoin Mining Is Booming Despite Market Headwinds

- Bitcoin mining has never been harder, according to the latest data.

- The network’s mining difficulty hit a new all-time high of 37.59 trillion hashes after posting a rare increase of over 10% on January 15, the highest leap since last November—the only time in 2022 when mining difficulty increased by a double-digit percentage.

- In addition to a high mining difficulty, data from CoinWarz shows that Bitcoin’s hash rate, best understood as the computational power of the network, has also been steadily climbing over the last three years, despite briefly plunging after Terra collapsed in May 2021.

Crypto Exchange Gemini Cutting Another 10% of Staff: Report

- In at least its third round of layoffs since June, crypto exchange Gemini is shedding another 10% of its staff, according to an internal message viewed by The Information.

- Gemini has been swept up in the bankruptcy of crypto lender Genesis Global Capital and has been unable to pay out funds to its Earn account holders. Gemini’s founders, Cameron and Tyler Winklevoss, have engaged in a Twitter war with Digital Currency Group, the parent company of Genesis, over the $900 million owed to Earn customers. (DCG is also the parent company of CoinDesk.)

- “It was our hope to avoid further reductions after this summer, however, persistent negative macroeconomic conditions and unprecedented fraud perpetuated by bad actors in our industry have left us with no other choice but to revise our outlook and further reduce headcount,” wrote Cameron Winklevoss, the president and co-founder of Gemini, in the internal message.

Ethereum’s Buterin Proposes ‘Stealth Addresses’ to Enhance Privacy Protections

- Ethereum co-founder Vitalik Buterin released a new blog post over the weekend proposing a “stealth address system” for enhanced privacy protections for blockchain users.

- In his writing, Buterin notes that assuring privacy remains a big challenge for the ecosystem, and that “improving this state of affairs is an important problem.”

- Stealth addresses are generated by wallets and muddle public key addresses in order to transact in a private way. To access these private transactions, one must use a special key called the “spending key.”

- Privacy has been a big concern for the Ethereum ecosystem, given that transacting on the blockchain is public. There are already some privacy mechanisms. One notable example, Tornado Cash, has limits, Buterin noted, saying it can only hide “mainstream fungible assets such as ETH [ether] or major ERC-20s.”

- Stealth addresses would provide a mechanism to also add privacy protections to non-fungible tokens (NFT) and Ethereum Name Service (ENS) domain names.

Bitcoin Shorts Dominate Weekly US Crypto Fund Inflows: CoinShares

- Though inflows into crypto products reached $37.3 million last week, more than two-thirds of that amount (68%) was into short investment products, digital asset investment firm CoinShares said in a new report Monday. Compared to the previous week, last week’s total inflows are nearly four times as high.

- Germany and Switzerland led inflows in Europe ($14 million and $10 million, respectively), while Hong Kong, on the other hand, saw outflows from long investment products to the tune of $11 million.

- American investors were the most skeptical, however, with 95% of inflows in the U.S. moving into short Bitcoin products.

- CoinShares’ weekly reports cover investment inflows and outflows in popular ETPs, mutual funds, and over-the-counter (OTC) trusts referencing Bitcoin (BTC), Ethereum (ETH), and other altcoins. Importantly, these are not direct investments into the cryptocurrencies that these products represent.

FTT Order Flow Fairly Balanced After 150% Rally, but Liquidity Remains Thin

- The market for FTT, the native cryptocurrency of the bankrupt FTX exchange, appears to have found an equilibrium after r bullish price action. However, the market’s ability to absorb large offers at stable prices remains weak, meaning the price could suddenly reverse.

- FTT has rallied nearly 150% this month as a bull revival in the broader market triggered a short squeeze in the battered cryptocurrency. FTT crashed 96% in November, hitting a low of 81 cents as its parent exchange, headed by Sam Bankman Fried, went bust.

- Data tracked by Paris-based Kaiko Research shows a balanced order book in Binance’s FTT-BUSD market, with the number of buy orders for 20,000 FTT or more now matching similar-sized sell orders. BUSD is a stablecoin developed in partnership between Binance and Paxos and is backed 1:1 by U.S. dollars, according to its official website.

- “When looking at the transaction-level data, we can see that price takers have been placing large market buy orders at the same pace as market sell orders – so it looks fairly balanced right now at current levels,” Clara Medalie, research director at Kaiko Research, told CoinDesk.

Crypto Exchange Bitzlato Converted Over $1B in Crime-Linked Assets, Europol Says

- Bitzlato, a previously little-known crypto exchange that last week was charged by the U.S. with money laundering, exchanged around 1 billion euros ($1.08 billion) in assets linked to criminal activities, European Union police agency Europol said in a statement Monday.

- “Targeting crucial crime facilitators such as crypto exchanges is becoming a key priority in the battle against cybercrime,” Europol said, citing transactions in multiple crypto currencies including bitcoin (BTC), dash (DASH) and litecoin (LTC), as well as U.S. dollars and Russian rubles.

- The company’s CEO, financial director and market director were all arrested in Spain, as well as one additional individual in Cyprus and one in the U.S., Europol said, after the U.S. Department of Justice announced it had shut down the Hong Kong platform and taken founder Anatoly Legkodymov into custody in Miami.

- The statement from Europol, the EU agency that coordinates activities among national law-enforcement authorities within the bloc, details house searches in Spain, Cyprus and Portugal; the takedown of digital infrastructure in France; and seizures of 18 million euros ($19.5 million) in cryptocurrency, vehicles and electronics, plus the freezing of 50 million euros ($54.3 million) of crypto at other exchanges.

New tool lets Tornado Cash users privately show their funds were not illicit

- A tool built by Chainway lets Tornado Cash users prove their initial deposits were not from a list of wallets containing stolen funds — without revealing their own address.

- Called Proof of Innocence, the tool is designed for those who want to use Tornado Cash but also want to show they’re not a bad actor. It’s designed for legitimate users who don’t want to be associated with nefarious activities, yet still want to maintain their own privacy.

- “Nice way to prove you’re not a bad actor without giving up your anonymity,” said Roman Semenov, a co-founder of Tornado Cash, on Twitter on Friday.

- Those who want to use the new tool need to provide a list of malicious wallets they don’t want to be associated with. It then uses cryptography to prove that the wallet they used to deposit the funds isn’t contained within that list.

Uniswap Poll Shows 80% Support Decentralized Crypto Exchange’s Move to BNB Chain

- A “temperature check” to gauge support in the Uniswap community for a possible move of the decentralized exchange’s V3 protocol to the BNB Chain saw 80% of UNI token holders vote in favor.

- Voting on the proposal, which was floated by OxPlasma Labs, ended Sunday night with about 20 million tokens cast in favor of the move. “Our proposal to deploy Uniswap v3 on BNB Chain has passed the ‘Temperature Check’ with 20M votes ‘YES’ and 6,495 $UNI voters (the biggest number for the whole Uniswap Governance History),” Plasma tweeted.

- Uniswap, like other decentralized exchanges (DEXs), relies on smart contracts to match trades and supply liquidity between traders. It locks up over $3.4 billion worth of various tokens across five blockchains, with V3, the latest iteration, commanding $2.6 billion of that figure, according to DefiLlama.

- Plasma said the move is warranted because BNB Chain, a blockchain closely linked to the centralized crypto exchange Binance, has a large and growing user base, providing a potential new market, as well as high transaction speeds and low fees, making it a suitable platform for Uniswap’s DEX services.

- “Deploying to BNB Chain could help Uniswap to tap into the growing popularity of DeFi (decentralized finance) in the Binance ecosystem,” developers wrote in that proposal. “BNB Chain offers unique features such as staking and cross-chain support that could enhance Uniswap v3’s functionality.”

Cardano Network Quickly Recovers After Brief Node Outage

- The Cardano network had a brief outage on Sunday that was automatically fixed within minutes with no singular root cause determined as of writing time, developers wrote in a GitHub post.

- Several developers reported the error on GitHub but said all nodes were restarted automatically.

- Block-producing nodes were temporarily affected, a Telegram broadcast message shows. Nodes are network stakeholders that maintain and process transactions on any blockchain and are very essential to any network’s upkeep.

- “There was a brief period of degradation,” Rick McCracken, a developer building staking tools for Cardano, tweeted. “Most nodes impacted had gracefully recovered. No network restart was required.”

- Blockchain nodes have previously gone offline on networks such as Solana, with one such instance causing the entire Solana network to be disrupted for over seven hours in May, as CoinDesk reported. In a separate instance in 2021, Solana validators had to restart the network to troubleshoot a network stoppage.

Glassnode: An Opportunity, or a Trap?

- The recent market rally has pushed BTC prices above $23k, and has surprised many investors. However, alongside higher prices, comes an increased motivation for holders and miners to take exit liquidity, especially after the prolonged and painful bear of 2022.

- The recent surge in price action to the $21k to $23k region involved reclaiming multiple on-chain pricing models, which has historically signified a psychological shift in holder behavior patterns.

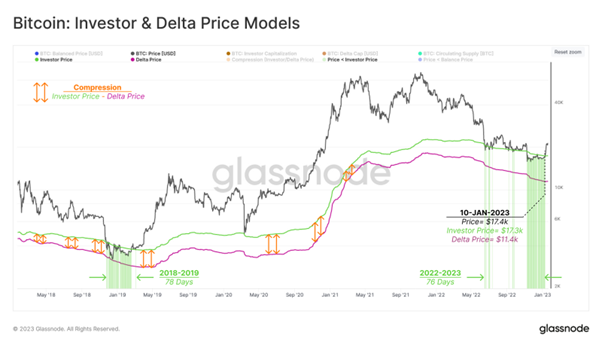

- The chart below presents two specific models from our Pricing Model Dashboard where:

- 🟢 Investor Price ($17.4k) is derived from the difference between the Realized Cap and the Thermocap. It reflects the average acquisition price for all coins which have been spent and distributed by miners.

- 🟣 Delta Price ($11.4k) is calculated from the difference between Realized Cap and the all-time Average Cap. This produces a combined on-chain and technical pricing concept.

- Surprisingly, price action across the 2018-2019 and the current bear market bottom discovery phase have spent a similar amount of time within the bounds of the Investor-Delta price band. This suggests an equivalency in durational pain across the darkest phase of both bear markets.

- When the market is in a prolonged bottom (or top) discovery stage, new investor behavior becomes an influential factor in forming local recovery (or correction) pivot points. We can assess this behavior via the Percentage of Short-Term Holder Supply in Profit 🔵.

- Interestingly, during bear markets, when > 97.5% of the acquired supply by new investors is in loss 🟥 the chance of seller exhaustion rises exponentially. Conversely, when > 97.5% of short-term holder supply is in profit, these players tend to seize the opportunity and exit at break-even or profit 🟩.

- The recent surge to $23K has pushed this metric to > 97.5% in profit for the first time since the ATH in November 2021. Given this substantial spike in profitability, the probability of sell pressure sourced from STHs is likely to grow accordingly.

- Continue on Glassnode Insights…