Bitcoin Price: US$ 22,707.88 (-0.33%)

Ethereum Price: US$ 1,627.44 (+0.05%)

Crypto Sentiment Split Between Bull Trap or Bottom as Bitcoin Nears 23K

- A recent upswing in the price of cryptocurrencies like Bitcoin and Ethereum has provoked a distantly familiar debate: whether a market rebound could be imminent or if recent trends are just a prelude to more pain.

- While Bitcoin is down nearly 67% from its peak, digital assets–and other investments like stocks–have had a positive start to the year. The price of Bitcoin has risen 38% so far this month to $22,858, its highest price since last August. Ethereum, meanwhile, has seen the value of ETH rise around 38% as well to $1,645, according to CoinGecko.

- Cryptocurrency prices began rising earlier this month in anticipation of an economic report that showed inflation cooled in December. The reading also lifted hopes about the Federal Reserve raising interest rates less aggressively than they have in the past year to tame soaring prices.

- But be weary, say the cautious. Many crypto commentators believe the recent uptick in prices is too good to be true and are labeling the rally a bull trap, predicting the breakout will come crashing down and burn traders who mistook it as the beginning of a new uptrend.

- Others following the rally are also skeptical. A Twitter poll conducted by a popular Bitcoin page reached a consensus among over 18,000 participants that the rally was indeed a bull trap on Jan. 15.

CBDCs Could ‘Revolutionize Global Financial Systems’: Report

- At least 114 central banks—representing 58% of all countries, which further generate 95% of global GDP—are now exploring Central Bank Digital Currencies (CBDCs), up from 35 in May 2020. And a team of cryptocurrency analysts from Bank of America are unabashedly bullish on the tech.

- “Digital currencies appear inevitable,” a new research report concludes. “We view distributed ledgers and digital currencies, such as CBDCs and stablecoins, as a natural evolution of today’s monetary and payment systems.”

- The report includes analyses of CBDCs’ potential benefits and risks—both in their issuance and non-issuance—as well as potential approaches to their distribution. As part of the study, there are also several case studies into CBDC development and challenges within specific economic blocs and nations.

- Some key observations from the analysts revolve around the current financial system’s antiquated infrastructure and numerous inefficiencies—issues that properly developed CBDCs might solve instantly.

- CBDCs’ potential to remove intermediaries—once the technology makes them redundant—could bring about real-time settlement, complete transparency, and lower costs, the report states.

- The analysts point to an estimated $4 trillion of capital that banks are required to deposit in corresponding banks in order to remove settlement risk. The study argues that this is an inefficient capital allocation that could otherwise be generating yield elsewhere.

- Furthermore, less capitalized banks and payment service providers cannot expand into cross-border payments, the research report argues, due in part to the requirement to pre-fund accounts at correspondent banks:

Solo Bitcoin Miner Solves Block With Hash Rate of Just 10 TH/s, Beating Extremely Unlikely Odds

- A solo Bitcoin miner with an average hashing power of just 10 TH/s (terahashes per second) won the race to add block 772,793 to the Bitcoin blockchain on Friday.

- At the time the block was added, Bitcoin’s total hash rate was just over 269 exahash per second, meaning the solo miner’s 10 TH/s hash rate represented just 0.000000037% of the blockchain’s entire computational power.

- Put simply: It was an extremely unlikely win for an individual miner.

- Despite the odds stacked against them, the solo miner was the first to produce a valid hash for the block to be mined. In return, the miner received 98% of the total 6.35939231 BTC allotted for the block reward and fees. The remaining 2% went to Solo CK Pool, an online mining service that facilitates individual mining.

The US Government Wants You To Know It’s Cracking Down on Crypto

- The jokes wrote themselves.

- On Wednesday, the U.S. Department of Justice declared ominously that it would hold a live press conference at noon to announce an “International Cryptocurrency Enforcement Action.”

- Crypto Twitter panicked, and so did crypto prices. Bitcoin and Ethereum each fell nearly 5% in just a few minutes, amounting to a flash crash. Which big player was caught in the DOJ’s crosshairs? Binance was a popular bet, and CZ didn’t help matters by tweeting just “4,” which he announced on January 2 is his new signal for incoming “FUD, fake news, attacks, etc.”

- Then the press conference happened. It wasn’t Binance. It wasn’t Celsius, or Voyager, or Blockfi, or any other bankrupt crypto lender that screwed over its customers. It was a Hong Kong-based, Russian-owned crypto exchange called Bitzlato.

- Bitz-what? Bitzlatte? I’ve been writing about crypto since 2011, and never heard of it.

- Bitzlato, the DOJ said, processed more than $700 million in illicit funds, including millions in proceeds from ransomware.

- Okay. But as of January 18, Bitzlato customer wallets had… $11,000 in them, according to a Coinbase operations director. At Bitzlato’s peak, customer wallets held $6 million—a trifle. And yet DOJ Deputy Attorney General Lisa Monaco touted the enforcement action as “a significant blow to the cryptocrime ecosystem.” She said Bitzlato, “fueled a high-tech axis of cryptocrime.”

- The crypto market quickly rebounded.

Nearly $700M Worth of Assets Linked to Sam Bankman-Fried, FTX Seized by US

- United States prosecutors have seized nearly $700 million worth of assets either owned by collapsed crypto exchange FTX or tied to founder and former CEO Sam Bankman-Fried, authorities disclosed in a Friday court filing.

- Federal authorities in the Southern District of New York have seized just over $698 million worth of assets linked to the disgraced crypto founder, according to the filing, which was first reported on by CNBC.

- The bulk of the value comes from a stack of shares that Bankman-Fried purchased in Robinhood, the stock and crypto trading app, allegedly using stolen FTX customer funds.

- The document submitted by U.S. Attorney Damian Williams details the holdings, with nearly 55.3 million shares of Robinhood stock seized on January 4. As of this writing, the shares are collectively worth about $526 million. They were held by Emergent Fidelity Technologies, a shell company that Bankman-Fried created with FTX co-founder Gary Wang.

Genesis’ Crypto Trading Arm Is Moving Money Around, a Sign of Normalcy Amid Sibling’s Bankruptcy

- Even as Genesis’ crypto-lending business entered bankruptcy court protection, the company’s trading arm, which remained out of Chapter 11, is still moving money around on blockchains – a sign the business was still running at least somewhat as normal.

- A wallet controlled by the Genesis OTC trading desk sent about $125 million of ETH, FTM and USDT to Coinbase, Binance, Bitstamp and Kraken on Thursday, the day of the bankruptcy filing, according to blockchain data compiled by Etherscan. In the past several hours, the wallet has transacted several more times, receiving almost $50 million USDC.

- The movements match parent company Digital Currency Group’s (DCG) pledge that the Genesis trading business will “continue to operate business as usual.” (DCG is also CoinDesk’s parent company.) It’s early yet, however, so it remains to be seen how the bankruptcy of Genesis’s lending entities will affect the spot and derivatives businesses over the long haul.

- “The reputation of Genesis is in the bin,” Charles Storry, head of growth at crypto index platform Phuture, said in an interview with CoinDesk. “Maybe they keep some legacy clients. Maybe. As for introducing new clients, no chance while bankruptcy is in play.”

Binance Garnered Largest Market Share of Crypto Investors From Emerging Markets in 2022

- Countries riddled with inflation are always seeking alternative means to safeguard their money from devaluing currencies. Crypto exchange Binance capitalized on this trend last year, largely because of its easy accessibility for retail investors in these markets, according to a 2022 report from CryptoCompare, which tracks digital asset trends.

- Binance won the largest market share among exchanges, recording a 16.3% increase, according to the report.

- “Binance’s increasing market share is also a result of the growing adoption of cryptocurrencies, particularly in emerging markets,” the CryptoCompare report said. The exchange is often the most readily available choice for users in emerging markets, it added.

- Binance is the world’s exchange by trading volume, according to CoinMarketCap data. Its more than $14 billion in spot trading volume over the past 24 hours exceeded the amount of the next 20 exchanges in CoinMarketCap’s rankings.

- Amid last year’s macroeconomic chaos, inflation in Brazil and Russia, which CryptoCompare groups with other emerging economies, reached 11.9% and 17.2%, respectively. About the time of these highs, Russian ruble (RUB) and Brazilian real (BRL) volumes on Binance increased 232% and 72%, respectively.

- Inflation has been even higher in other countries with less-developed economies, tempting consumers there to look for assets less subject to these spikes.

- “We expect continued adoption and increased cryptocurrency volumes in emerging markets. Despite the inherent risks of cryptocurrencies,” the report said.

Stellar Foundation Nicked by Genesis Bankruptcy With $13M Claim

- Stellar Development Foundation, a nonprofit organization set up to promote growth on the Stellar blockchain, was listed among the largest creditors of Genesis, the beleaguered crypto lending giant that filed for bankruptcy protection on Thursday.

- The foundation has a claim for $13 million against Genesis, according to bankruptcy filings.

- In a statement to CoinDesk, the foundation confirmed it loaned around $13 million to Genesis in 2022 but called the sum “immaterial” in relation to the rest of its treasury.

- “The outstanding claim represents an immaterial portion of our overall treasury and does not impact our operations in any way,” according to a Stellar Development Foundation representative.

- According to its website, the “Stellar Development Foundation currently holds 30 billion XLM to be used for promoting and enhancing Stellar.” At current prices, Stellar’s holdings of its native XLM token place the paper value of its treasury above $200 million.

- Though the foundation claims it has weathered the Genesis fiasco relatively unscathed, the entanglement of an ecosystem fund’s assets with the over-the-counter crypto lending desk underscores just how widespread the contagion of the Genesis fallout might be.

SEC Charges Mango Markets Attacker With Manipulating Price of ‘Security’

- The United States Securities and Exchange Commission (SEC) today charged Mango Markets attacker Avraham Eisenberg—who previously claimed responsibility for the scheme—with alleged fraud and market manipulation offenses related to his actions on the Solana-based decentralized exchange (DEX) in October 2022.

- Eisenberg, a U.S. citizen, was arrested in Puerto Rico in December and will be transported to New York to face the various criminal and civil charges filed against him. He is alleged to have manipulated the platform’s markets to steal approximately $116 million worth of cryptocurrency.

- He boasted of the original attack on Twitter last October, describing it as a “highly profitable trading strategy.” Mango Markets had been temporarily rendered insolvent as a result of the strategy, which he said he executed with a team of users. He also defended the scheme during an appearance on the Unchained Podcast.

Genesis Claims $5.1B in Liabilities in First-Day Bankruptcy Filing

- Crypto lending firm Genesis held $5.1 billion in liabilities in the weeks following its freeze on withdrawals last November, according to bankruptcy court documents signed by interim CEO Derar Islim.

- In his first-day motion in the U.S. Bankruptcy Court for the Southern District of New York, Islim provided a breakdown of Genesis’ financial state heading into its restructuring. Genesis became the latest crypto firm caught up in the immediate fallout of FTX’s implosion, with three of its entities – Genesis HoldCo, Genesis Global Capital LLC and Genesis Asia Pacific PTE. LTD – filing for Chapter 11 bankruptcy protection late Thursday.

- Those entities were perhaps less affected by direct losses to FTX and sister company Alameda than by the “run on the bank” that Islim said their collapse sparked. Customers demanded Genesis repay $827 million in loans, forcing its lending units to freeze withdrawals.

- “At the same time, Holdco’s corporate parent, Digital Currency Group (DCG), and its various subsidiaries, including DCG International Investments Ltd., were also impacted by the market turmoil and did not have the liquidity to pay back the Company on certain loans, adding pressure to the Debtors’ balance sheets,” Islim said. (DCG is also the parent of CoinDesk.)

- At least part of the liquidity crunch began months earlier thanks to Genesis’ $1.2 billion loss to crypto hedge fund Three Arrows Capital (3AC), which collapsed in the summer of 2022. That loss came out of the Genesis Asia Pacific unit (that also filed for bankruptcy), which managed Genesis’ lending relationship with 3AC. At the time of 3AC going under, Genesis had $2.4 billion in outstanding loans to the fund, of which Genesis was able to recover just half, according to the filing.

- DCG last year assumed much of that exposure, swapping a 10-year promissory note in exchange for Genesis’ $1.2 billion in claims against 3AC. That note is now at the center of DCG’s public spat with crypto exchange Gemini over the exchange’s yield product Earn, with Gemini being Genesis’ largest creditor at more than $700 million.

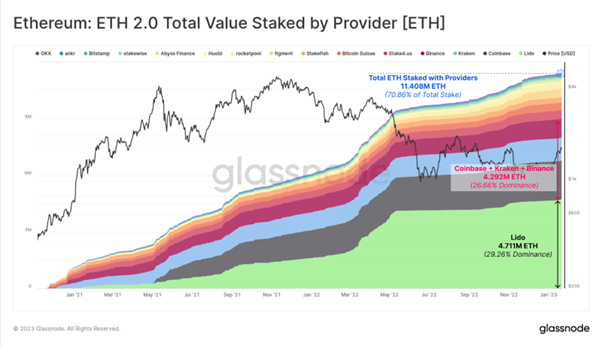

Glassnode:

- A total of 16.101M $ETH is staked on the #Ethereum Proof-of-Stake beacon chain (13.4% of circulating).

- Of this, 11.408M $ETH is via staking service providers, representing 70.86% of the total:

- Staking Service Dominance

- Lido: 29.3%

- Coinbase 12.8%

- Kraken 7.6%

- Binance 6.3%