Bitcoin Price: US$ 24,182.21 (-1.10%)

Ethereum Price: US$ 1,643.14 (-1.00%)

- Arbitrum’s DeFi ecosystem is starting to look strong. Arbitrum-native projects such as GMX have outperformed during the bear cycle and rekindled the spirit of experimentation and composability. Arbitrum is now luring established projects from other chains to develop a presence on it. Among these projects is Gains Network, a synthetic derivatives platform originally deployed on Polygon.

- Gains Network has generated an impressive amount of usage and hype in spite of its less prominent blockchain. Where does Gains Network fit into the blossoming Arbitrum ecosystem, and can it coexist with established players like GMX?

- gTrade is Gains Network’s first product. gTrade is a perpetual futures exchange that allows users to trade crypto, stocks, forex, indices, and commodities with 2-1,000x leverage depending on the asset class.

- gTrade features a synthetic model with oracle-fed prices. A single pool provides liquidity for all supported trading pairs. This is similar to how Synthetix works, but Gains Network doesn’t bother with spot synths, and targets a collateralization ratio closer to 100% (much lower than Synthetix’s c-ratio of 400%). To compensate for the additional risk of this more capital efficient approach, Gains Network features an intricate token economics design.

- gTrade’s gDAI vault serves as the counterparty for trading activity, providing liquidity for all asset pairs. gDAI — and eventually other gTokens — represent a user’s ownership of DAI in the vault. The gDAI vault receives a share of trading fees, but depositors do not directly benefit from trader losses. Instead, trader losses are kept in the vault to serve as a buffer, preventing vault depositors from incurring drawdowns while safely earning trading fees. If the DAI pool becomes under-collateralized, the GNS token serves as the guarantor of last resort.

- In this case, the vault is refilled by minting and selling GNS OTC, capped at 0.05% of the GNS total supply every 24 hours (18.25% per year). A percentage of all trader losses (currently 1% on Polygon, 3% on Arbitrum) are used to buy back and burn GNS. Therefore, GNS is the best way to get exposure to vault PnL.

- Continue on Delphi…

Canadian Regulators Say No to Algorithmic Stablecoins

- The Canadian Securities Administrators (CSA)—made up of securities regulators from each of the 10 provinces and 3 territories in Canada—have published a long list of new requirements for crypto companies wishing to stay legally compliant, and stablecoin platforms are clearly in the agency’s crosshairs.

- Crypto asset trading platforms within the country will now be prohibited from allowing customers to buy or deposit stablecoins, or other “Value Referenced Crypto Assets” (VRCAs), without the CSA’s prior written consent. Obtaining consent means meeting the administrators’ many due diligence requirements, including ensuring that the stablecoin is fiat-backed.

- “For greater certainty, we would not expect to provide consent in respect of a VRCA that is not fully backed by an appropriate reserve but rather maintains its value through an algorithm,” wrote the regulator in a notice published on Wednesday.

Dapper Labs’ NBA Top Shot Moments NFTs are securities, federal judge rules

- NBA Top Shot Moments NFTs meet the requirements to be considered a security, a federal judge said in a court filing on Wednesday, giving the green light to a class-action lawsuit against Dapper Labs.

- The judge denied a motion by Dapper Labs CEO Roham Gharegozlou to dismiss a lawsuit that alleges his firm violated securities laws by selling NBA Top Shot Moments NFTs without standard registration and disclosure applied to other investment contracts.

- Judge Victor Marrero’s decision is narrow, he noted in a court filing, and may not apply to other NFTs.

- “Not all NFTs offered or sold by any company will constitute a security, and each scheme must be assessed on a case-by-case basis,” Marrero wrote.

- The judge applied the Howey Test, a legal tool for determining whether a transaction counts as an investment contract, as well as more recent case law around initial coin offerings to determine whether the NFTs count as securities. The judge cited the company’s control over Top Shots after they are sold, as well as specific tweets promoting the NFTs in his court filing that used emojis to suggest the assets would gain value.

- “Although the literal word ‘profit’ is not included in any of the tweets, the ‘rocket ship’ emoji, ‘stock chart’ emoji, and ‘money bags’ emoji objectively mean one thing: a financial return on investment,” Marrero wrote.

Binance Urges Industry-Wide Action to Boost Trust in Crypto

- Binance, the biggest CEX by trading volume globally, was one of the first to recognize the colossal challenge the industry faces.

- Throughout last year, the firm began introducing measures around transparency and trust, culminating in a new, actionable framework of guidelines for centralized exchanges, and for the broader community to use (should they wish to do so), and accompanied by a dedicated Building Trust landing page.

- First and foremost, the guidelines deal with the handling of customer assets; they describe what every centralized exchange should do in terms of transparency—including the kind of disclosures that can be expected and the guardrails that CEXs can put in place, in addition to those mandated by regulation.

- The framework is designed to be useful for users and policymakers in the broader industry, as well as centralized and decentralized exchanges, and Kortam hopes to elicit community feedback from all of these groups so that the industry “can continue to raise the bar.”

Uniswap Traders Can Now Buy NFTs With UNI, SHIB or Any Ethereum Token

- NFT marketplaces typically have restrictions on which cryptocurrencies can be used to purchase assets—but Uniswap’s NFT marketplace has just launched a new feature that changes all that.

- Uniswap NFT traders can now use any token on the Ethereum blockchain, such as stablecoins like USDC or Tether, or even a meme coin like Shiba Inu, to purchase their NFTs through a simplified interface.

- How does it work? According to the crypto startup, Uniswap’s new Universal Router contract “finds the most cost-efficient route” to complete a swap from any Ethereum-based token into the required token for the NFT sales (in most cases, Ethereum) and then pushes that crypto to OpenSea’s Seaport protocol to finalize the transaction.

Archblock to use Chainlink’s proof-of-reserves system for TrueUSD verification

- Archblock, the issuer of TrueUSD stablecoin, said it will use Chainlink’s proof-of-reserves system to let users verify its reserves are fully collateralized on the blockchain via an automated data feed.

- “We’re excited to use Chainlink’s Proof of Reserve to enhance the transparency and verifiability of our stablecoin,” said Ryan Christensen, CEO of Archblock. “As the industry-standard decentralized oracle network, Chainlink will help ensure that TUSD is always collateralized by off-chain fiat reserves.”

- TUSD is backed by US dollars and is the sixth-largest stablecoin, with a market capitalization of $966 million. Integrating with Chainlink’s proof of reserve (PoR) system will allow TUSD holders to verify on-chain that its stablecoin reserves are fully collateralized through automated off-chain data feeds.

- The Network Firm (TNF), an independent accounting firm, will aggregate the oracle data for TUSD. This firm will collect real-time data on all reserve holdings (US dollars held at financial institutions). This will be provided on-chain through Chainlink’s decentralized oracle network, Archblock stated in a note shared with The Block

- Using TNF’s data feed, The TUSD smart contract will automatically check whether the total supply of TUSD exceeds the total amount of US dollars held in reserve before any new stablecoins are minted.

Ethereum developers schedule Shanghai upgrade on Sepolia testnet for Feb. 28

- The core developers of the Ethereum blockchain scheduled the launch of the Shanghai-Capella upgrade on the Sepolia test network for Feb. 28 at epoch 56832, per an official announcement.

- Shanghai-Capella, also known as Shapella, is an upgrade aimed at enabling ether (ETH) withdrawals from network validators — a feature that wasn’t enabled during the network’s transition to proof-of-stake consensus, called The Merge.

- The upgrade combines changes to the execution layer (Shanghai) and the consensus layer (Capella). Shanghai will upgrade the execution layer of Ethereum, while Capella will upgrade the consensus layer of the blockchain.

- To reach the final upgrade in March, developers have planned multiple phases of public testing. The upcoming launch on Sepolia is the second public testnet to deploy the upgrade. Shapella has already been tested on the Zhejiang testnet earlier this month. As expected, the testing on Zhejiang revealed some minor bugs that have been worked on.

- After deploying Shapella on the Sepolia testnet, developers will move to the Goerli testnet for the final phase of dress rehearsal ahead of the mainnet launch — expected to happen in March.

Immutable carries out second round of layoffs in seven months, cuts 11%: SMH

- Australian blockchain gaming firm Immutable cut 11% of its staff — the second round of layoffs since the end of July — according to the Sydney Morning Herald.

- The cuts were blamed on the need to elongate the company’s runway and put resources toward its most important projects, the report said — citing a note to staff from CEO James Ferguson.

- Changes will also include outsourcing the development of the more traditional aspects of its games to partners to focus on the web3 components and reorganizing some of its divisions.

- Cuts last summer from the developer, which makes blockchain trading card game Gods Unchained, hit “more than 20” employees — or around 8% of the business’s total headcount.

- Immutable did not immediately respond to a request for comment.

Tezos signs up Google Cloud as a validator on its blockchain

- Tezos Foundation teamed up with Google Cloud to accelerate the development of web3 applications on the Tezos blockchain. Under this partnership, Google Cloud, the cloud division of the search engine giant Google, has agreed to serve as a validator on the proof-of-stake blockchain Tezos.

- The deals aims to to allow Google Cloud’s corporate clients to develop and deploy web3 applications on the Tezos blockchain using Google’s cloud infrastructure, according to a statement.

- By acting as a validator or “baker” on the Tezos network, Google Cloud will allow its corporate customers to support blockchain development. Furthermore, select startups incubated by Tezos will also be eligible for Google Cloud credits and mentorship.

- James Tromans, engineering director of web3 at Google Cloud, said, “At Google Cloud, we’re providing secure and reliable infrastructure for Web3 founders and developers to innovate and scale their applications. We look forward to bringing the dependability and scalability of Google Cloud to power Web3 applications on Tezos.”

- This is not Google Cloud’s first foray into the blockchain space. Last September, it agreed to run a validator node on the Ronin network, which is a gaming-centric Ethereum sidechain. Then, a month later, it launched a blockchain node-hosting engine for Ethereum developers

Self-hosted wallet ban avoided in new draft of EU’s anti-money laundering bill

- Self-hosted addresses, formerly known as “unhosted wallets” in the European Union’s policies, are back in discussion as European Parliament staff look to clarify that lawmakers do not want an outright ban on non-custodial services.

- Privacy-enhancing crypto assets and “anonymizing instruments,” including privacy wallets or crypto mixers, may be prohibited under the current text of the anti-money laundering regulation draft bill, according to documents seen by The Block. The latest changes to the text clarify that these restrictive provisions should not apply to self-hosted wallets in most cases.

- Non-custodial services have been in the EU’s crosshairs since the Transfer of Funds Regulation (TFR) first sparked debates on “unhosted wallets” last year when it set down crypto transaction and know-your-customer rules

- When it comes to rules on transaction limits, the latest version of the European Parliament’s review of the anti-money laundering bill resulted in changing up the language to “self-hosted addresses” from “self-hosted wallets.”

- With this change, policymakers aim to clarify their objective of preventing non-custodial wallets from existing without being linked to an identified account on an crypto service provider like an exchange, said Tommaso Astazi, head of regulatory affairs at lobby group Blockchain for Europe. The previous wording could have implied that crypto service providers in the EU would have been prohibited from providing non-custodial services all together.

- Self-hosted wallets will still be subject to a transaction limit of €1,000 ($1,070) if the owner cannot be identified. This aligns with the TFR requiring originator and beneficiary data on crypto transactions of the same cap.

- The change from “self-hosted wallets” to “self-hosted addresses,” however, may cause regulatory uncertainties since the TRF, with its text finalized, uses different language from the Parliament’s AML proposal. The AML proposal under the European Council also currently refers to “wallets” and not “addresses.”

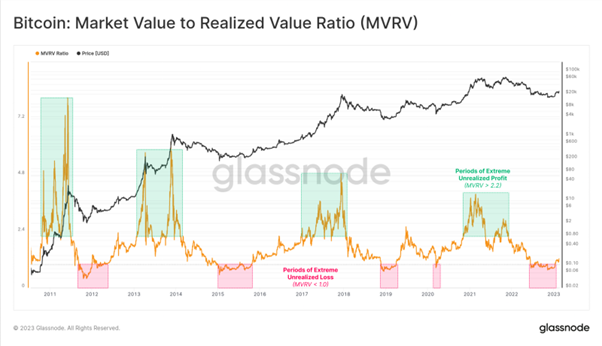

Glassnode: Mastering the MVRV Ratio

- MVRV is shorthand for Market Value (MV) to Realized Value (RV), and is the ratio between Price, and the Realized Price. Since the Realized Price is the average price at which every coin last moved on-chain, MVRV can be thought of as a measure of ‘Unrealized Pofit’ held within the supply.

- A MVRV of 2.2 means Price is 2.2x the Realized Price (120% Profit)

- A MVRV of 1.0 means Price is equal to the Realized (Break-Even)

- A MVRV of 0.8 means Price is 0.8x the Realized Price (-20% Loss)

- The chart below shows the MVRV ratio, and roughly shows the euphoric periods of extreme unrealized profit in bulls 🟩, and the painful periods of extreme unrealized loss in bears 🟥.

- High MVRV Values (> 2.4) ↗️ indicate the market holds large unrealized profits.

- Low MVRV Values (< 1.0) ↘️ indicate the market holds unrealized losses.

- An average profit percentage held by the market can be calculated as MVRV – 1.

- Continue on Glassnode Insights…