Bitcoin Price: US$ 15,773.00 (-3.07%)

Ethereum Price: US$ 1,106.95 (-3.03%)

- NFT wash trading is a subset of price manipulation that occurs for two main reasons. The primary reason is to earn trading rewards from incentivized platforms such as LooksRare and X2Y2. These platforms are indifferent about artificial volume, as their token stakers benefit. The second reason is to manipulate the historical price and volume of an NFT collection. Deceiving potential buyers is generally uncommon and unsuccessful, but it exists.

- Another form of price manipulation is “floor sweeping.” Floor NFTs purchased in bulk significantly raise the floor price, as NFTs are illiquid by nature. The goal is to create FOMO from speculators and offload the NFTs at a higher price. Other traders sweep collections to front run an expected rise in value.

- This report will give a primer on NFT wash trading: its prevalence, detection methods, and future solutions.

- Continue on Delphi…

Football Fan Tokens Crater as the FIFA World Cup 2022 Begins

- In financial markets, big events often present big opportunities for traders. In anticipation, some market participants begin positioning a few weeks before the actual event in order to take profits when the event occurs.

- The FIFA World Cup 2022 was no exception, as fan tokens issued by football teams experienced hefty corrections just two days before the event began.

- Since Nov. 18, fan tokens for the national teams of Argentina (ARG: -17%), Portugal (POR: -17%), Brazil (BFT: -21%), Spain (SNFT: -31%), and Peru (FPFT: -26%) have underperformed BTC (-4%) and ETH (-7%).

- Tokens associated with platforms that help football teams issue fan tokens such as Socios (CHZ: -21%) and Bitci (BITCI: -20%) are also down during the same period.

- Additionally, FIFA’s official blockchain partner Algorand (ALGO: -9%) and an index of fan tokens of football clubs (FOOTBALL: -21%) have also underperformed during the same period.

Mobile-Focused Blockchain Celo Partners With Ethereum Software Firm ConsenSys

- Mobile-first blockchain Celo will be working with ConsenSys, an Ethereum software firm that helped engineer the Merge.

- The agreement will allow Celo to make use of ConsenSys’ Infura infrastructure. Celo developers will be able to build with Infura, which will help make the blockchain more scalable. Developers will also be able to deploy Ethereum-based decentralized applications (dapps) built with Truffle. Truffle is a development environment where Ethereum smart contracts can be tested.

- “Developers can use Infura’s trusted and complementary tooling to seamlessly communicate with the Celo blockchain for rapid deployment and scaling” said Xochitl Cazador, Celo’s head of ecosystem growth. The integration will also allow for developers to transact between Celo and other DeFi platforms and dapps.

- In addition, the partnership is intended to kick off Celo’s compatibility with MetaMask, a popular Ethereum-based wallet. Celo will also join the Ethereum Climate Platform that ConsenSys launched last week.

Cardano-based decentralized stablecoin Djed will hit mainnet in January

- Djed, Cardano’s first decentralized stablecoin, will go live on the main network in January.

- Developers announced the move at the Cardano Summit event in Lausanne, Switzerland. Djed is a decentralized stablecoin soft-pegged to the U.S. dollar that will exist on Cardano’s Layer 1 blockchain.

- Backed with crypto assets instead of fiat money, Djed has been developed by a firm called Coti in collaboration with Cardano lead developer Input Output.

- The stablecoin has been in development for more than a year. Once launched, Cardano users will be able to take ADA — the native cryptocurrency of the Cardano network — and use it as collateral to mint the stablecoin.

Genesis Bankruptcy Jitters Send Bitcoin to Fresh Low

- Days after its lending unit was forced to halt withdrawals in wake of the collapse of crypto exchange FTX, Genesis Global Trading has mentioned bankruptcy as a potential option as it seeks fresh capital, reports Bloomberg citing people with knowledge of the matter.

- The Wall Street Journal, also citing people familiar, reported that Genesis sought funding from Binance and Apollo Global Management, and that Binance declined to invest, citing potential conflicts of interest.

- The initial news sent bitcoin (BTC) to fresh two-year low of $15,480. But the price has fully recovered back to where it was before the Bloomberg story came out, trading around $15,913 as of this update.

- “We have no plans to file bankruptcy imminently,” a Genesis representative told Bloomberg. “Our goal is to resolve the current situation consensually without the need for any bankruptcy filing. Genesis continues to have constructive conversations with creditors.”

Bitcoin mining difficulty rises slightly after latest adjustment

- Bitcoin mining difficulty has increased by 0.51% after the latest adjustment, according to an update posted Sunday evening on BTC.com.

- The network’s hash rate has fallen 3.8% since Nov. 6, the date of the last update to mining difficulty, according to data compiled by The Block Research.

- Mining difficulty refers to the complexity of the computational process used in mining, and it adjusts about every two weeks (or every 2,016 blocks) in sync with the network’s hash rate.

- Bitcoin mining difficulty has increased by 0.51% after the latest adjustment, according to an update posted Sunday evening on BTC.com.

- The network’s hash rate has fallen 3.8% since Nov. 6, the date of the last update to mining difficulty, according to data compiled by The Block Research.

- Mining difficulty refers to the complexity of the computational process used in mining, and it adjusts about every two weeks (or every 2,016 blocks) in sync with the network’s hash rate.

Investors Are Shorting Bitcoin, Ethereum in Record Numbers

- More institutional investors than ever are betting on the price of Bitcoin and other cryptocurrencies going down, according to a Monday report from CoinShares.

- Institutional investor sentiment was “deeply negative” last week, according to the report, as short product inflows represented 75% of the total inflows—the largest inflow on record.

- Short products allow investors to short cryptocurrency (bet on the price of an asset going down). In the case of last week, investors flocked to put their money on the price of Bitcoin and Ethereum continuing to decline.

- The report said that assets under management in crypto investment products also hit a two-year low of $22 billion, “suggesting on aggregate sentiment was deeply negative for the asset class.”

- And it noted that last week more investors than ever before poured money into short-Ethereum investment products—a sum of $14 million.

Coinbase, MicroStrategy Bonds Tank as FTX Collapse Dents Institutional Confidence in Crypto

- Bonds issued by cryptocurrency exchange Coinbase (COIN) and by MicroStrategy (MSTR), a business-intelligence company and investor in bitcoin, have slumped as investor confidence in the industry slid in the wake of FTX’s collapse.

- Coinbase’s bond due 2031 has dropped 15% this month to 50 U.S. cents on the dollar, according to data source Finra-Morningstar, sending the yield – which moves in the opposite direction to price – to a record high 13.5%. The decline comes after nearly three months of consolidation and marks an extension of the bearish trend seen early this year. The yield on the company’s bond due in 2026 jumped to 17%.

- Bonds tied to MicroStrategy have taken a similar beating. On Friday, the yield on the company’s 2028 notes, issued last year to finance bitcoin (BTC) accumulation, climbed to 13.35% as the price dropped to a record 72.5 cents on the dollar. MicroStrategy holds about 130,000 BTC worth approximately $2.08 billion on its balance sheet.

- The companies’ bonds carry a premium of around 1,000 basis points – or 10 percentage points – to the U.S. 10-year Treasury note yield, as of Friday. In traditional markets, a premium of that level is taken to represent credit stress. The 10-year Treasury was yielding 3.80% at press time.

More Than 50% of Bitcoin Addresses Are Now in Loss

- Most addresses holding bitcoin (BTC), the largest cryptocurrency, are now in the red, the first time that’s happened since the start of the coronavirus-induced crash of March 2020.

- Just over 51%, or 24.6 million addresses of the total 47.9 million, are below purchase price on their investments, according to data provided by blockchain analytics firm IntoTheBlock. About 45% are in the money, which means they are boasting unrealized gains, while the rest are roughly at break-even

FTX Japanese subsidiary preparing to resume withdrawals by year end: NHK

- FTX Japan plans to resume customer withdrawals by the end of the year, according to Japanese public broadcaster NHK.

- Withdrawals cannot be resumed immediately as the exchange uses the same suspended payment system as its parent company FTX, said the report, citing an unnamed executive. It is now developing its own system to allow customers to withdraw assets.

- The country’s Financial Services Agency ordered FTX Japan to suspend operations on Nov. 10. It held 19.6 billion yen ($138 million) in deposits at the time it ceased operations.

Binance Labs makes strategic investment in hardware wallet maker Ngrave

- Binance Labs, the venture arm of the Binance crypto exchange, has made a strategic investment in hardware wallet maker Ngrave.

- The investment is part of Ngrave’s series A funding round that Binance Labs will be leading, an Ngrave spokesperson said. The amount of funding wasn’t disclosed.

- Ngrave makes a hardware wallet called Zero, which aims to compete with larger providers like Ledger and Trezor. The devices, which secure private keys of crypto assets inside hardware in an attempt to guard users against hacks, can offer what some perceive to be better security than web-based private wallets, including MetaMask and TrustWallet.

- Binance Labs said the company is eager to capitalize on the emerging hardware wallet sector and partner with Ngrave, it said in a statement.

FTX Bankruptcy Filing: ‘No Amounts’ Will Be Paid to SBF or His Inner Circle

- Former FTX CEO Sam Bankman-Fried was right about one thing: He and his inner circle won’t see any more money from the company.

- FTX spelled out in a court filing over the weekend that neither Bankman-Fried nor the three recently fired members of his inner circle (nor their family members) will see any compensation from the now-bankrupt company.

- The way Bankman-Fried put it on November 10, the day before FTX filed for bankruptcy and he resigned as CEO, making users whole comes first. “After that, investors—old and new—and employees who have fought for what’s right in their career, and who weren’t responsible for any of the fuck ups,” he wrote on Twitter.

Glassnode – Uncertainty Amongst Whales and Old Hands

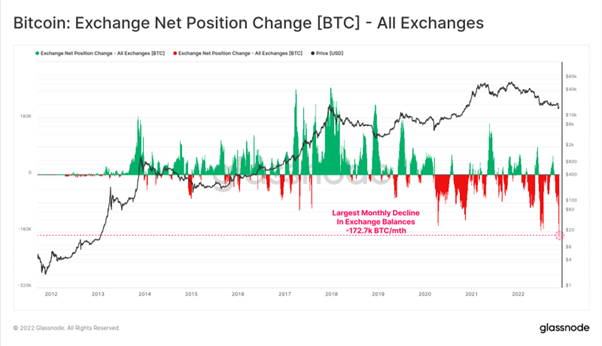

- As we covered in last weeks edition, outflows from exchanges and into investor wallets of almost all sizes have been historical in scale, as BTC holders seek safety in self-custody. As a result, the 30-day net position change of all exchange balances has reached a new all-time-high for outflows this week.

- BTC is currently flowing out of exchanges at a rate of -172.7k BTC per month, eclipsing the previous peak set following the June 2022 sell-off.

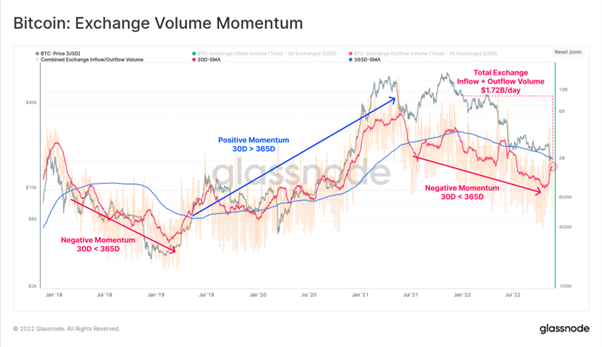

- On a 30-day moving average basis, the combined USD denominated inflow and outflow volumes across all exchanges spiked higher, reaching $1.72B/day this week. The chart below presents this monthly average 🔴 relative to the yearly average 🔵 as a gauge for overall momentum of the Bitcoin economy.

- Historically, periods where the monthly average of exchange volumes exceeds the yearly has signalled positive market momentum, as more coin volume changes hands. In the current market, the combined exchange inflow and outflow volume would have to reach and sustain levels above $2.15B to signify positive momentum on this front.

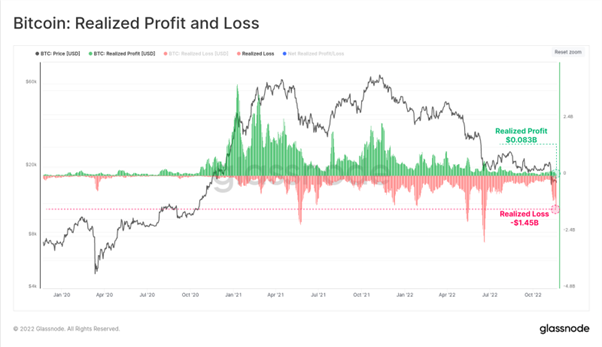

- This magnitude of financial pain is being expressed across the wider market, with one of the largest spikes in Realized Loss in the 2020-22 cycle. A peak daily value of -$1.45B in realized loss was locked in this week, ranking as the fourth largest in history.

- A comparably small $83M in realized profits occurred, suggesting that the vast majority of spent volume at present is sourced from investors from the current cycle, and very little coin volume from previous cycles are on the move.

- Continue on Glassnode…