Bitcoin Price: US$19,537.02 (+0.62%)

Ethereum Price: US$ 1,375.98 (+3.11%)

Was The Merge A ‘Sell The News’ Event?

- SEC charges Ian Balina for promoting unregistered ICOs.

- UK’s financial watchdog says that FTX is not authorized to provide services in the UK.

- Infura announce plans to launch a decentralized infrastructure protocol in 2023.

- South Korean prosecutors request Interpol to issue a red notice for Do Kwon.

- The wait is finally over! Last Thursday, Ethereum successfully transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus, setting forth a new era for Ethereum and the wider crypto ecosystem.

- Since the Merge timeline was announced on July 14th, ETH has significantly outperformed BTC and most other asset classes. However, ETH has shed most of these gains over the weekend after the Merge.

- Since the activation of PoS, ETH has sunk 19% whereas BTC is down just under 5%. Was the Merge just another classic ‘sell the news’ event?

- One factor that may support this is the large exchange inflows of ETH seen before the Merge. On Sept 14th, centralized exchanges witnessed the largest net inflow of ETH since 2016, totaling nearly 1m ETH. This was the 7th largest single-day net inflow ever.

- Despite the changes to token issuance brought by the Merge, Ethereum as well as the rest of crypto continues to be influenced by macroeconomic factors such as global liquidity, dollar strength, stock market returns, and central bank monetary policies.

ETHW confirms contract vulnerability exploit, dismisses replay attack claims

- Post-Ethereum Merge proof-of-work (PoW) chain ETHW has moved to quell claims that it had suffered an on-chain replay attack over the weekend.

- Smart contract auditing firm BlockSec flagged what it described as a replay attack that took place on Sept. 16, in which attackers harvested ETHW tokens by replaying the call data of Ethereum’s proof-of-stake (PoS) chain on the forked Ethereum PoW chain.

- According to BlockSec, the root cause of the exploit was due to the fact that the Omni cross-chain bridge on the ETHW chain used old chainID and was not correctly verifying the correct chainID of the cross-chain message.

- Ethereum’s Mainnet and test networks use two identifiers for different uses, namely, a network ID and a chain ID (chainID). Peer-to-peer messages between nodes make use of network ID, while transaction signatures make use of chainID. EIP-155 introduced chainID as a means to prevent replay attacks between the ETH and Ethereum Classic (ETC) blockchains.

Bitcoin, Ethereum crash continues as US 10-year Treasury yield surpasses June high

- Bitcoin (BTC) and Ethereum’s native token, Ether (ETH), started the week on a depressive note as investors braced themselves for a flurry of rate hike decisions from central banks, including the U.S. Federal Reserve and Bank of England.

- This week, the Fed and a number of its global peers will potentially attack rising inflation by further raising interest rates.

- Data compiled by Bloomberg suggests that the U.S. central bank, alongside Sweden’s Riksbank, the Swiss National Bank, Norway’s Norges Bank, the Bank of England and others, will raise lending rates by a combined 500 basis points, or 5%.

- Therefore, this growing correlation against the prospect of global rate hikes could continue to pressure BTC and ETH lower despite their growth-oriented narratives.

Goldman’s Bullish Stance on ‘Real Bond Yield’ Spells Bad News for Crypto

- The U.S. inflation-indexed bond yield has surged by 100 basis points (bps) since early August, causing renewed jitters in risky assets, including cryptocurrencies. And to the dismay of bitcoin (BTC) bulls, the so-called real yield is likely to rise even further in the coming months.

- On Friday, Goldman Sachs (GS) said 10-year U.S. Treasury inflation-protected securities (TIPS), which are adjusted periodically to compensate for increases in the consumer price index, could rise to 1.25% by the year end and eventually peak somewhere at between 1.25% and 1.5%.

Solana outperforms Ethereum in daily transactions in Q2: Nansen report

- Daily transactions in the Solana blockchain consistently increased, ending with more than 40 million daily transactions compared to Ethereum’s 1 million daily transactions between April and June.

- Hype does not always equate to greater adoption, as the on-chain data from the second quarter of 2022 shows Solana (SOL) surpassing Ethereum in users’ daily transactions despite various drawbacks from both macroeconomic conditions and network outages.

- Throughout the second quarter, Solana’s daily transactions consistently increased, ending with more than 40 million daily transactions compared to Ethereum’s 1 million daily transactions between April and June, confirmed Nansen’s State of the Quarter Report.

- Solana’s significant increase in daily transactions was observed on daily non-vote transactions when compared to Ethereum — despite sporting higher volatility. On-chain data revealed that decentralized exchanges (DEXs) such as Mango Markets and Serum and Solana-based decentralized oracle network Switchboard were among the top decentralized apps (DApps) contributing to the spike in daily transactions.

Crypto Exchange WazirX to Delist USDC in Boost for Binance’s Stablecoin

- WazirX is delisting stablecoins USDC, USDP and TUSD on Sept. 26. The Indian crypto exchange has also stopped taking deposits, according to a blog post Monday.

- WazirX said withdrawals of those three stablecoins can occur until Sept. 23. The exchange will automatically convert those stablecoins in customer balances to Binance’s BUSD stablecoin at a 1:1 ratio.

- In August, Binance CEO Changpeng Zhao urged users of WazirX to transfer their funds to Binance after it was reported WazirX was being probed by Indian government agencies. Disagreements between Binance and WazirX also occurred at the time on the issue of whether or not Binance owns WazirX.

Crypto market bloodbath leads to $432M in liquidations

- The crypto market turmoil entered the third week of September as most of the cryptocurrencies started the week on a bearish note. The total crypto market cap dipped below $1 trillion again, with several cryptocurrencies recording a double-digit downfall over the past 24 hours.

- The ongoing bearish turmoil has led to nearly half a billion in liquidations for the leverage crypto traders over the past 24 hours. Data from Coinglass highlight that 130,087 traders were liquidated with a total liquidations value of $431.51 million. Bitcoin (BTC) leverage traders lost $44.5 million, followed by Ether (ETH) traders with a total liquidation of $8.39 million.

- Long traders made a significant chunk of losses on majority of the exchanges with the average difference between the amount of long and short liquidations being 10X.

P2E gamers, minors not any safer from the tax man, says Koinly

- Modern parents are going to need to keep an even closer eye on their kids’ gaming habits, as some of them may be accumulating a hefty tax bill, according to a crypto tax specialist.

- Speaking to Cointelegraph during last week’s Australian Crypto Convention, Adam Saville-Brown, regional head of tax software firm Koinly said that many don’t realize that earnings from play-to-earn (P2E) games can be subject to tax consequences in the same way as crypto trading and investing.

- This is particularly true for play-to-earn blockchain games that offer in-game tokens that can be traded on exchanges and thus have real-world financial value.

- “Parents were once worried about their kids’ playing games like GTA, with violence […] but parents now need to be aware of a whole new level […] tax complexities.”

- This week saw the successful deployment of one of the most impressive feats of engineering in the blockchain industry: The Ethereum Merge. The switching of the consensus mechanism from Proof-of-Work (PoW) to Proof-of-Stake (PoS), has been on the Ethereum roadmap, and actively worked on since genesis and is a remarkable milestone for the project.

- As of 15-September at 06:46:46 UTC, at Ethereum blockheight 15,537,393, the final PoW mined block was produced, and the PoS Beacon Chain took over chain consensus. The Ethereum Merge was successful.

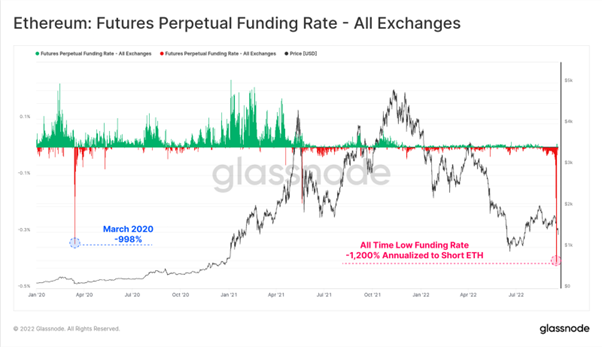

- In our WoC 32 Report, we described how market positioning across Futures and Options markets appeared to be well hedged for a sell-the-news style event. Indeed, ETH prices have sold off, from a weekly high of $1,777, to around $1,650 at the time of the Merge, before collapsing to a low of $1,288 on Sunday.

- The market has effectively given back all gains made since mid July. Such a sell-off is the result of multiple factors, not least of which being traders taking profits after ETHs recent out-performance. Being one of a small handful of assets that performed well during recent months in the prevailing macro-economic conditions, it is quite unsurprising that profits were taken, where profits were available.

- Total Futures Open Interest declined by 15% from $8.0B to $6.8B after the Merge, with both of these extremes being fairly typical in the context of 2021-22 markets. However, to keep this change in context, we must account for the influence of a changing ETH coin-price, which affects the USD value of ETH-denominated futures position sizes.

- Continue on Glassnode Insights…