Bitcoin Price: US$ 24.271.76 (-1.46%)

Ethereum Price: US$ 1,679.75 (-0.70%)

Pro Crypto Insider Talks – February 2023 – Video with Raoul Pal

- In this episode, they cover a wide range of topics, including:

- Impact of L2s on ETH fees and potential implications of ETH’s deflationary economics

- Updates and developments on Cosmos

- Macro cycles and latest market outlooks from Raoul & Kevin

- Secular tailwinds for crypto/web3

- Potential impact of recent regulations

- Early ideas on the AI x crypto intersection

- NFT marketplaces and ways to benefit from the growth of NFTs

DAI Finds Its Spark With Spark Lend

- Last week a Maker DAO cluster launched a new lending market. Think Aave, because, well, it is actually using much of the same code.

- And the term cluster here is intentional; the group of developers who built what is now called Spark Protocol were quite literally called the “Crimson Cluster.”

- Now, they’re called Phoenix Labs, and they’re led by protocol engineer Sam MacPherson.

- He told Decrypt that the key motor behind the idea was to provide “more advanced features” for DAI users that weren’t available on Maker previously. Basically, get DAI into more hands by providing more ways to use it.

- Spark Protocol isn’t the lending platform itself, but rather a frontend dashboard through which users can do a bunch of fun DeFi things, all in the name of supporting its decentralized stablecoin DAI.

- The lending market is called Spark Lend, and it uses code from Aave’s latest v3 launch. For using the code, Spark Protocol will pay the AaveDAO 10% of all profits made within the DAI market. The Aave community voted in favor of the proposal and, voila, an open-source revenue-sharing agreement was established.

OpenSea makes changes to fees following tension with Blur

- OpenSea is dropping fees, citing a shift in the NFT ecosystem and coming shortly after Blur made its case for creators to list on its platform rather than OpenSea.

- OpenSea, the largest NFT marketplace, tweeted on Friday that it had started “started to see meaningful volume and users move to NFT marketplaces that don’t fully enforce creator earnings.”

- OpenSea cited events such as NFT marketplace Blur’s decision to roll back creator earnings and the “false choice they’re forcing creators to make between liquidity on Blur or OpenSea.”

- The CEO of Blur made a case for creators to list on that marketplace and not OpenSea in a blog post on Wednesday. Creators can’t earn royalties on Blur and OpenSea simultaneously, according to that post.

- OpenSea said it was dropping its fee to 0% for a period of time while also moving to a 0.5% “creator earnings model, with the option for sellers to pay more.”

- The marketplace is also allowing sales using competitors with the same policies, so creators won’t have to make the choice between receiving earnings on OpenSea or Blur, it tweeted.

- “This is the start of a new era for OpenSea,” the marketplace tweeted. “We’re excited to test this model and find the right balance of incentives and motivations for all ecosystem participants — creators, collectors, and power buyers and sellers.”

CZ Denies Binance Is Considering Delisting Tokens From US Projects

- Binance CEO Changpeng Zhao has spoken out regarding news reports that the company will cut ties with U.S. crypto projects.

- In a tweet Friday, Zhao—better known as CZ—wrote “False” in response to a post claiming that Binance was considering “delisting all U.S.-based cryptocurrencies.”

- He then added that “blockchain has no borders” when someone asked what a “U.S.-based token” even was.

- The post was referring to a Friday Bloomberg report which claimed that Binance, the world’s biggest crypto exchange, was thinking about ending relationships with U.S. business partners such as banks and intermediary firms.

Bank of Russia to Pilot CBDC in April

- The Bank of Russia’s central bank digital currency (CBDC), the digital ruble, is ready for its pilot phase, said the bank’s deputy governor, Olga Skorobogatova, on Friday.

- The project will be launched for peer-to-peer transfers between individuals and for retail purchases, Skorobogatova told journalists during a fintech conference in Russia. “The pilot will work on real operations for real people, but only for a limited number of them, with the 13 banks that have signaled they’re ready,” she said, according to Russian news agency TASS.

- The central bank will pilot the CBDC with sets of selected clients, she added. After the pilot, the Bank of Russia will decide on the ways to expand the project, according to TASS.

- Russia’s central bank first proposed a CBDC project in October 2020 when it published a consultation paper outlining potential designs of the digital ruble. In later comments, the bank said the project can help decrease the Russian economy’s dependency on the U.S. dollar and mitigate the impact of foreign sanctions on the country since its invasion of Ukraine.

- The pilot was initially expected to go live in 2021 but provoked some concerns in the Russian banking community that rolling out infrastructure for the digital ruble will be burdensome for lenders and make the banking system more centralized and less diverse. The Bank of Russia later promised to modify the concept so that it doesn’t hurt the traditional system.

U.S. investigation into Do Kwon and his infamous stablecoin unveils several new revelations

-

- The collapse of supposed stablecoin TerraUSD last May wiped out more than $40 billion of market value held by investors who bought into the story that creator Do Hyeong Kwon and his firm Terraform Labs had found a novel way to create a perpetual money machine.

- Yesterday’s charge sheet filed in court by the U.S. Securities and Exchange Commission was the first detailed look at what went wrong. The allegations presented a very different picture from the one 31-year-old Kwon and his partners painted to investors and the world’s media.

- Here is a breakdown of some of the key findings:

- Unstable stablecoin. Terraform and Kwon misled investors about the stability of TerraUSD (also known as UST). The token was pitched as an algorithmic stablecoin that used complicated math to ensure a 1:1 peg against the U.S. dollar.

- Fake business relationships. To drum up excitement in the power of the Terraform blockchain, Kwon and his team claimed a Korean payments company called Chai was using it to settle millions of transactions. That was a complete fabrication, the SEC alleged.

- Unregistered securities. Another line of attack is that UST and other tokens associated to Terraform were unregistered securities, the watchdog alleges. These included so-called wrapped tokens created when moving between blockchains, and also mirror tokens designed to replicate price movements of listed equities. Terraform breached U.S. securities rules by not registering these various products, the SEC said.

- Secret stash. Kwon has a secret stash of more than 10,000 bitcoin, investigators alleged. The bitcoin was transferred by Kwon from Terraform and related entities to a self custody wallet. Since May 2022 when UST tanked, bitcoin from the wallet was transferred to an unnamed Swiss bank and converted into fiat. Since June last year more than $100 million in fiat currency was withdrawn from the bank.

Jump Crypto Is Unnamed Firm That Made $1.28B From Do Kwon’s Doomed Terra Ecosystem: Sources

- When U.S. regulators sued Do Kwon and Terraform Labs this week for the spectacular implosion of the terraUSD (UST) stablecoin and related LUNA token, a huge question was left unanswered: Who was the trading partner that booked $1.28 billion in profits before Terra’s $40 billion ecosystem crumbled?

- According to people familiar with the matter, it was Chicago-based Jump Crypto, a company whose parent has deep roots in conventional finance and has become a giant in digital assets.

- A spokesperson for Jump Crypto said the company had no comment. The news was first reported by The Block.

- The U.S. Securities and Exchange Commission’s (SEC) complaint this week accused Kwon and Terraform of committing securities fraud and selling unregistered securities that hurt U.S. retail and institutional investors. Within the complaint there’s reference to an unnamed U.S. trading firm that had an exclusive market-making arrangement with Terraform Labs, the developer of the UST stablecoin. That anonymous firm was not accused of wrongdoing.

- That company – which CoinDesk’s sources identified as Jump Crypto – was able to buy heavily discounted luna tokens, the assets that supported UST. The firm deployed only $62 million to help keep UST’s price near $1 in May 2021, according to the SEC complaint, but earned $1.28 billion by selling off discounted tokens that it had purchased according to the terms of its agreement with Terraform Labs.

- Jump Crypto was active in the Terra ecosystem, frequently posting governance proposals and heavily invested in the project, including building a Terra cross-chain bridge and co-leading a $1 billion capital raise to seed the Luna Foundation Guard. Jump Crypto President Kanav Kariya also served on the board of the Luna Foundation Guard, which stewarded Terra’s multi-billion-dollar bitcoin reserve treasury. The reserves were depleted in May 2022 in a failed attempt to restore UST’s dollar peg and also siphoned to a Swiss bank account controlled by Kwon, according to the SEC complaint.

Blur’s Token Airdrop Fuels Sky-High Gas Prices and Mass Ethereum Burn

- This week’s token airdrop by newcomer NFT marketplace Blur has resulted in over $4 million worth of Ethereum being burned (or destroyed) in the last seven days.

- The token was airdropped on Valentine’s day to Blur users who actively traded Ethereum NFTs on the marketplace in the last six months.

- The price climbed as high as $5 on launch, before quickly retreating down below a dollar within an hour. At $0.90, the BLUR token currently trades 82% short of its launch day high.

- Per data from Ultra Sound Money, a culmination of Blur activity has seen more than 2,469 Ethereum burned. Since the London hard fork in August 2021, a portion of transaction fees that were previously paid to miners is now burned and removed from circulation.

- The heft of this sum, roughly 1,158 ETH, appears to be directly related to users claiming their airdrop. The remaining activity stems from BLUR token transfers and activity on the Blur marketplace itself.

MicroStrategy Has Raised $46.6M Through Share Sales Since September

- Michael Saylor’s MicroStrategy (MSTR) disclosed that it’s raised $46.6 million via share sales since it entered an agreement with underwriter Cowen and Company in September for the sale of up to $500 million in common stock.

- In a Securities and Exchange Commission filing on Friday morning, the company also updated the “use of proceeds” statement, saying money raised may also go towards repayment of debt, including its term loan with Silvergate Bank (SI). That loan – for $205 million and taken out in March 2022 – is a floating rate, and has thus gotten more expensive as the U.S. Federal Reserve has hiked short-term interest rates.

- The Silvergate loan matures in March 2025 and does have a prepayment penalty, but that penalty in March 2023 drops by half to just 0.25% of the principal balance being repaid.

- MicroStrategy has previously mostly used proceeds from share sales to add to its bitcoin (BTC) holdings.

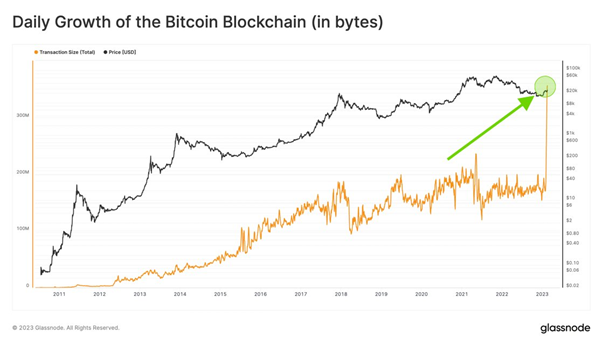

Glassnode: shared Rafael Schultze-Kraft @n3ocortex post:

- The recent development of #Bitcoin ordinals and inscriptions is truly astounding.

- If adoption continues to accelerate, we might well see a paradigm shift in terms of network usage, block space, and fees – as suggested by the recent on-chain footprint.