Bitcoin Price: US$ 20,131.46 (+0.41%)

Ethereum Price: US$ 1,586.16 (+2.06%)

Markets Gear Up for Dreaded September

- Upon reflection of the Jackson Hole speech, Jerome Powell spent 8 minutes reiterating the core stance that the Fed is determined on fighting inflation at the expense of investors. Powell does not want to be remembered as the modern-day Arthur Burns. Even though the FOMC has telegraphed this message plenty of times at previous meetings, the market reacted violently to this speech, seemingly caught off guard by the hawkish comments made by Powell. So how should we think through the short to medium-term implications of this?

- If the market was indeed caught off guard by the FOMC, we’re likely to see ripple effects in the market over the next several weeks. If price action is any indication, the recent bear market rally was at least fueled in part by market participants trying to front-run the Fed pivot. If we are to believe Powell’s most recent comments, the timeline for that pivot has certainly been pushed out to some degree.

- Market participants who have been leaning towards an early Fed pivot (potentially as early as the September FOMC meeting) are likely wrong and at least partially mispositioned within markets. They might even be wrong on the December pivot timeline as well, adding further stress to any positions taken.

- And if history is any indication we may be in for a tough month. Markets are heading into September which has generally unfolded so poorly for crypto and risk assets that it has become a meme.

Michael Saylor got wrecked, but Bitcoin investors needn’t panic

- As cryptocurrency investors know, the market moves in cycles. We had the up-cycle when Bitcoin (BTC) and Ether (ETH) hit their all-time highs, and now the bears are back in town.

- One of them mauled MicroStrategy founder and executive chairman Michael Saylor this week. In this case, it was a very powerful bear — Washington, D.C. Attorney General Karl Racine — suing the Bitcoin evangelist for allegedly owing $25 million in unpaid taxes. MicroStrategy’s stock price has fallen more than 13% on the news, from $251 on Aug. 29 to less than $220 on Sept. 1.

- Still, now isn’t the time for investors to panic. It’s been roughly three months since the now-infamous crash of the Terraform ecosystem—which ended the greatest bull party known to man—and the sky still isn’t falling. The world isn’t ending, and blockchain is as immutable as ever.

Crypto users push back against dYdX promotion requiring face scan

- Many users on social media have been lambasting decentralized exchange dYdX over the identification verification process to receive a sign up and deposit bonus of $25.

- In a Wednesday blog post, dYdX announced that new users who deposited 500 USD Coin (USDC) for their first transactions could receive a bonus promotion of 25 USDC, provided they were willing to do a “liveness check.” According to the exchange, the verification process accessed a user’s webcam and “compares if your image has been used with another account on dYdX.”

- Though the giveaway was completely voluntary, many on Twitter implied the checks were tantamount to invasions of privacy. DeFi Watch founder Chris Blec accused the exchange of “bribing users to allow their faces to be scanned & disguising it as a ‘promotion,’” hypothesizing that dYdX and other platforms could offer greater incentives in return for clients giving up more information.

- “What dYdX is doing now is just wrong,” said Blec. “They’re misleading users on the intent. They know that every face scan they’re collecting is from an innocent. A criminal won’t face-scan but can still use dYdX. They’re bribing new users to give up privacy just to satisfy regulators.”

Mayo Clinic taps into blockchain technology for clinical trial design

- On Thursday, Dutch blockchain startup Triall announced that it has partnered with American nonprofit medical center Mayo Clinic to optimize clinical trial design and the management of study data. Starting this September, Triall’s eClinical platform will support a two-year multi-center pulmonary arterial hypertension clinical trial that includes 10 research sites and more than 500 patients across the United States.

- The software will support activities such as data capture, document management, study monitoring and consent. As told by Triall, the purpose of the collaboration is to demonstrate an immutable public ledger audit trail through its blockchain technology to boost the integrity of clinical trials. Investigators, regulators and stakeholders can then review and assess such trial-related data with trust, knowing that no one can modify the records.

US dollar smashes yet another 20-year high as Bitcoin price sags 2.7%

- There seems to be no stopping the greenback as risk assets, including Bitcoin, pay the price for renewed strength.

- Bitcoin (BTC) faced familiar pressure on the Sept. 1 Wall Street open as the U.S. dollar hit fresh two-decade highs.

- Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it fell to $19,658 on Bitstamp, down 2.7% from the day’s high.

- The pair faced stiff resistance trying to flip the important $20,000 mark to solid support, with macro cues further complicating the picture for bulls.

- That came in the form of a resurgent U.S. dollar index (DXY) on the day, which beat previous peaks to reach 109.97, its highest since September 2002.

California State Assembly passes bill for licensing and regulating crypto firms

- Lawmakers in California State Assembly passed the Digital Financial Assets Law, also known as AB 2269, on Tuesday, Aug. 30, The bill is now in the hands of the state’s Governor Gavin Newsom, who will either set it into motion or veto it completely.

- This bill requires digital asset exchanges and crypto companies to have an operating license given by the state of California’s Department of Financial Protection and Innovation. Any operations outside of said license will be prohibited. The bill would come into effect on and after Jan. 1, 2025.

- If not followed, perpetrators could receive a civil penalty up to $100,000 for each day of violation.

- Assemblyman Timothy Grayson (D-Concord), who sponsored the bill, previously stated he understood the excitement around cryptocurrencies and digital assets.

- “I’m impressed by the market’s ability to help consumers feel empowered to make financial investments and participate in a system that has, in many cases, felt closed off to them.”

- However, Grayson also said the newness brings on risks due to inadequate regulation.

- “This bill will provide consumers basic but necessary protections and will promote a healthy cryptocurrency market by making it safer for everyone.”

CoinGecko reveals the US state most interested in Bitcoin and Ethereum

- The Golden State of California may be America’s most inquisitive state about Bitcoin (BTC) and Ether (ETH), new data from CoinGecko has revealed.

- In a report shared by CoinGecko, internet users from California accounted for a whopping 43% of all Bitcoin and Ethereum web traffic searches on the crypto tracking website. This is despite the entire state population only accounting for 11.9% of the United States population.

- Bobby Ong, chief operating officer and co-founder of CoinGecko, said it was “unsurprising” that California took the crown in the blue-chip cryptocurrency interest, given its place as a “major technological hub.”

- California is also home to Silicon Valley — one of the largest technology and innovation hubs in the world.

- Among the largest companies situated in Silicon Valley to have invested in blockchain-based applications and crypto startups include Apple, Google, Meta, PayPal and Wells Fargo.

Glassnode:

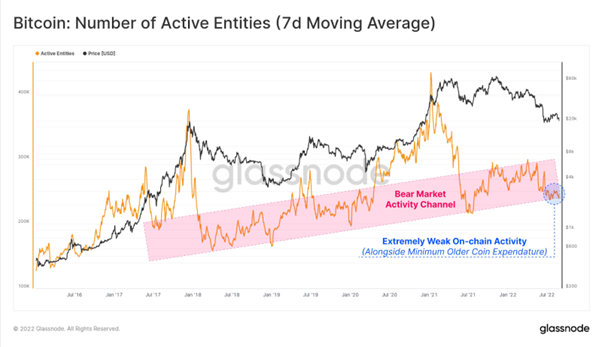

#Bitcoin Active Entities is a proxy measurement for the size of the network user-base.

This activity metric is currently languishing at the lower end of a multi-year channel, indicating softness in network utilisation.

Read More in The Week On-chain