Bitcoin Price: US$ 16,977.37 (-1.09%)

Ethereum Price: US$ 1,276.41 (-1.39%)

Blur Captures Market Share Among NFT Aggregators

- Blur.io is a new NFT marketplace targeted at experienced traders and NFT power users. The platform offers an aggregation feature and portfolio analytics with zero marketplace fees.

- Blur was in closed beta for nearly a year before going live on Oct. 19, 2022. Blur also announced an airdrop of “Care Packages” for users who have traded on the platform in the previous six months. This includes an unspecified number of BLUR tokens.

- After launch, the platform achieved approximately 90% volume market share on Oct. 31, 2022 against competitors such as Gem and Genie. This dominance has persisted for nearly the entire month of November as well.

- During the Thanksgiving weekend, Blur briefly surpassed OpenSea’s volume with 40.3% volume market share on Ethereum compared to OpenSea’s 38.9%.

- The dominance in market share likely comes as a result of Airdrop 2 which will distribute even larger “Care Packages” than Airdrop 1 to users who list and trade on the platform in November.

Stripe Debuts Fiat-to-Crypto Payment Offering for Web3 Businesses

- Payments firm Stripe has debuted a project to facilitate fiat-to-crypto payments for companies in dozens of countries around the world, the company said Thursday.

- The offering, a customizable widget that can be embedded directly into a decentralized exchange (DEX), non-fungible token (NFT) platform, wallet or decentralized app (dapp), is designed to allow customers to instantly purchase cryptocurrencies in Web3 apps. Eleven of the company’s initial 16 projects are built on Solana. Stripe said it offers customizable on-ramping services and handles know-your-customer (KYC), payments, fraud and compliance issues.

- “We built our fiat-to-crypto onramp to remove [logistical] complexity,” the company wrote in a blog post.

Solana Soars, Flow Falls as NFT Market Declines Further in November

- Turmoil across the cryptocurrency market in November spilled into the NFT space, with falling crypto prices and declining NFT valuations further impacting an ever-weakening market. New data from DappRadar suggests that total NFT trading volume fell again in November, continuing a broader market trend that began in May.

- According to data provided by the analytics firm, the overall NFT market produced about $643 million worth of organic trading volume in November. That’s down over 8% from October, when Decrypt tallied about $702 million worth of volume between partial data from DappRadar paired with additional marketplace data from Dune.

- It’s less steep of a month-over-month drop than before, given a roughly 25% dip from September to October, but still represents a dramatic fall in trading action since earlier this year. The market peaked with $5.36 billion in sales volume in January, meaning that trading volume in U.S.-dollar terms has dropped by 88% since then.

November Jobs Report Due Friday as the Fed’s Powell Confirms Slower Pace of Rate Hikes

- Speaking Wednesday at a Brookings Institution event, Federal Reserve Chair Jerome Powell more or less confirmed what has been suggested for weeks – that this month the central bank was going to ratchet back the pace of interest rate hikes from 75 basis points to 50 basis points.

- Equity markets soared on the news, led by the Nasdaq’s 4.5% advance. Bitcoin (BTC) rallied as well, briefly topping $17,000 from the mid-$16,000 area (it’s trading at $16,900 at press time). The rallies were somewhat surprising as bets on a smaller-than-usual rate hike in December barely changed after Powell’s comments on Wednesday.

- According to the CME’s FedWatch Tool, after Powell’s address market participants saw a 77% chance of a 50-basis point move coming out of the Federal Open Market Committee’s mid-December meeting, up a hair from 76% prior to the Fed chair’s speech.

- The small change signals that traders may be waiting for more data from the jobs report on Friday.

Binance Exec Says Firm’s ‘Centralized Exchange’ May Not Be Around in 10 Years

- Patrick Hillman, chief strategy officer of Binance, said the company’s centralized exchange may not exist in 10 years because the crypto market it is moving toward decentralized finance (DeFi).

- For now, the exchange is trying to keep customers’ trust after the collapse of rival exchange FTX by implementing “proof of reserves,” which is a way to show customers that their assets are fully backed. But the process has been slow, Hillman said Thursday on CoinDesk’s “First Mover” program.

- “It will be a multistep process, including bringing in a third-party auditor,” he said. “It takes time to go and be able to conduct an audit of the scope and scale that is required of Binance.”

MakerDAO Community Votes to Hike DAI Rewards to 1%

- The community of MakerDAO, one of the largest decentralized finance (DeFi) protocols, voted to increase the rewards rate for its DAI stablecoin to 1%.

- Some 71% of voters favored a 1% hike, the highest available option, during the voting, which ended Thursday.

- Increasing the rewards known as the DAI Savings Rate (DSR) means that investors can earn a 1% annualized return on their DAI holdings, giving an incentive for investors at a time when decent yields in crypto are scarce. The return is still much lower than what is available for traditional yield-generating assets such as U.S. government bonds.

Magic Eden, Audius and Argent among Stripe’s new partners for crypto onramp

- Several web3 companies are now making it easier to use their services through a new partnership with fintech titan Stripe.

- Solana-based NFT platform Magic Eden, blockchain music streaming platform Audius and wallet provider Argent are among the first partners, according to a blog post from Stripe.

- Web3 DEX Orca, blockchain gaming startup Fractal and wallet provider Backpack are also involved in the program.

- The API integration created by Stripe means that customers will now be able to make fiat purchases of crypto directly on the platforms and will no longer have to navigate offsite to transfer assets into crypto before making purchases.

- The onramp is a customizable widget that developers can embed directly into their decentralized exchange, NFT platform, wallet or dApp, according the blog. Stripe handles all the KYC, payments, fraud and compliance, removing the need to integrate multiple third-party services.

CME Group Teaming With CF Benchmarks for 3 New DeFi Rates and Indices

- Derivatives marketplace Chicago Mercantile Exchange (CME) and cryptocurrency index provider CF Benchmarks this month will introduce reference rates and real-time indices for aave (AAVE), curve (CRV) and aynthetix (SNX), the two said in Thursday.

- The new rates will be calculated and published starting Dec. 19 and are currently not tradable futures products.

- “These three new benchmarks, together with Uniswap launched earlier this year, will capture more than 40% of the total value locked in [decentralize finance] protocols on the Ethereum blockchain,” said CME Group’s head of cryptocurrency products, Giovanni Vicioso.

- The launch comes as interest in decentralized finance (DeFi) and associated blockchain-based projects continues to grow and cryptocurrency traders are increasingly exploring DeFi protocols, Vicioso told CoinDesk, even as the industry recently took another hit with the collapse of crypto exchange FTX.

- “We continue to take a cautious, careful approach to this market,” Vicious said. “Exactly how it will develop is yet to be seen.”

SBF was ‘delusional’ in interview, says Galaxy’s Mike Novogratz

- Galaxy’s CEO Mike Novogratz thinks Sam Bankman-Fried is “delusional” and will spend time in jail.

- After watching the former FTX CEO’s live interview with the New York Times on Wednesday, Novogratz alleged that Bankman-Fried is “just spewing more lies.”

- “It was delusional, let’s be really clear,” Novogratz told Andrew Ross Sorkin on CNBC. “Sam is delusional about what happened and his culpability in it.”

- Novogratz said that the ramifications of the FTX collapse would spread beyond crypto to all markets in general. He also said he didn’t think that Bankman-Fried had acted alone.

- “You don’t pull this off with one person,” he said. “I’m not saying he even planned this all like a criminal mastermind. What they did was criminal and they need to be prosecuted for it.”

Decentralized crypto exchange volumes nearly double in November amid FTX debacle

- Cryptocurrency exchange volumes jumped in November from the previous month as the collapse of FTX roiled markets, with decentralized platforms seeing an increase of 93%.

- Centralized (CEX) exchange volumes, which include platforms like Binance and Coinbase, rose by 24% to $673 billion, up from $543 billion in October, according to The Block’s data. Decentralized (DEX) exchanges, excluding layer 2’s, saw a substantially bigger increase, with volume doubling to $65 billion from $34 billion.

BlackRock CEO Says ‘Next Generation for Markets’ Is Tokenization

- BlackRock CEO Larry Fink said that “the next generation for markets, the next generation for securities, will be tokenization of securities.”

- In the world of blockchain, tokenization refers to a process where a digital representation of an asset is created on a blockchain, authenticating its transaction and ownership history.

- This approach enables a different way to trade assets like stocks, bonds, real estate, or even alternative assets like land, wine, or art, allowing the transfers to be visible on a public ledger.

- Speaking at a New York Times DealBook event, Fink argued that tokenization will provide “instantaneous settlement” and “reduced fees.” Despite these advantages, he added that the development of this type of technology wouldn’t disrupt BlackRock’s business model.

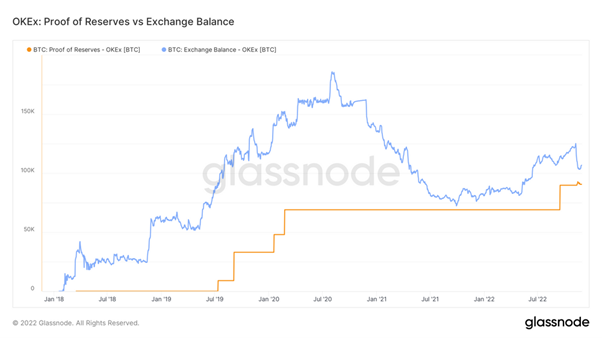

Glassnode Introducing Proof-of-Reserve Exchange Metrics (NEW METRICS OFFERED)

- In a bid for enhanced transparency, and in an attempt to counter practices of fractional reserves, many exchanges have started a process of self-reporting their crypto reserves. The industry commonly refers to this practice as “Proof-of-Reserves”, which involves the verifiable disclosure of both reserves held (on-chain), and matched liabilities (both on- and off-chain).

- To provide an easy-to-access view of these proof-of-reserves disclosures, we are monitoring the balances of coins and tokens held within these exchange self-reported addresses, and providing tools to aide in visualization, and verification for Glassnode members, and the community – these newly metrics are freely available to all.

- Exchange balance metrics do not reflect the officially reported numbers by the exchanges themselves, nor do they always provide a bullet-proof, 100% guaranteed quantification of on-chain exchange funds. What Exchange Balance metrics do present is our best estimate of the true balance held on each exchange, quantified as closely, and as verifiably accurate as possible (see below).

- In contrast, Proof-of-Reserves metrics track only the balance of a (small) set of addresses which are publicly disclosed by the respective exchange. This set of addresses is static and does not change unless an exchange publicly updates their set of proof-of-reserve addresses. There is nothing else that gets included into the proof-of-reserve balances – it is plainly the sum of coins held in addresses officially communicated by exchanges.