Bitcoin Price: US$ 20,677.47 (-2.16%)

Ethereum Price: US$ 1,511.43 (-3.46%)

From 1 to 100: What the Future Holds for DEXs

- Even for industry veterans, the space has become akin to playing Minesweeper — constantly having to dodge hacks, thefts, misappropriation of funds, etc. These so-called “mines” are not limited to dodgy exchanges, they also test the mettle of even the best ones.

- To understand what the future could hold, we built a forecasting model using a multi-stage growth model. The methodology is explained below. It’s far from perfect, but it does allow us to “guesstimate” what future volume and corresponding gross revenue would look like using reasonable assumptions.

- Using our methodology, we estimate volume of $14.83T (spot-based DEXs) and $56.46T (derivative-based DEXs) at the end of 2030. The corresponding estimated gross revenue would translate to $14.83B and $56.46B, respectively, assuming a 0.1% take rate. The revenue here does not reflect costs (i.e., token emissions) in the form of staking/usage rewards, and includes LP fees.

- If a DEX has a fee-sharing model embedded within its token economy, accounting for the dollar value of token emissions becomes imperative to arrive at the adjusted revenue. Incorporating this metric within our model would introduce too many “unknowns,” as the token economics and price keep changing.

- The bear case begins with a 35% discount on the base growth rate. With these parameters, volume is estimated in the region of $6.55T (spot-based DEXs) and $16.09T (derivative-based DEXs) at the end of 2030. Corresponding gross revenue would be $6.55B and $16.09B, respectively.

- The bear case assumes we will grow at a muted rate, which could be due to several reasons. The most obvious ones that come to mind are: (a) an extended contraction cycle fueled by a change in the macroeconomic regime; (b) muted capital flows further across the risk curve; (c) a lack of technological innovation and overall growth; and (d) the gaps between liquidity, UI/UX, and product suites among CEXs and DEXs keep growing.

- The bull case begins with a 35% premium on the base growth rate. The modified parameters yield volume estimates of $30.51T (spot-based DEXs) and $77.85T (derivative-based DEXs) at the end of 2030. The corresponding gross revenue would be $30.51B and $77.85B, respectively.

- The bull case numbers probably seem unreasonable. For this to actually materialize, we need to see on-chain products make a sizable impact on the real-world economy and cater to individuals across the globe. Global equities did $160T+ in annual volume during 2021, so seeing crypto as a large fraction of that eight years down the line isn’t unrealistic if it truly gets embedded into people’s everyday lives.

- Given the erosion of trust and loss of user funds on CEXs, we assume that a percentage of CEX volume will migrate to DEXs as their performance and UX improves.

- The average daily volume over the last 365D was $21.58B (spot) and $74.39B (derivative) for our chosen basket of CEXs. Ceteris paribus, a mere 15% migration of volume (from last year) to DEXs would mean a ~133% and 760% increase in volume for spot and derivative-based DEXs, respectively.

- As mentioned previously, we expect a sizable inflow of capital and participants into the market over the next few years. In that case, the delta of volume for CEXs and DEXs will likely grow. During that growth phase, if a percentage of volume starts migrating to DEXs such that their overall share of market volume increases, the bull case can materialize.

National Australia Bank creates stablecoin called AUDN: AFR

- National Australia Bank (NAB) is launching a fully backed stablecoin called AUDN.

- The stablecoin will launch on the Ethereum network and Algorand blockchain, a smart contract platform similar to Ethereum. NAB plans to launch the stablecoin sometime mid-year.

- The stablecoin will be backed one-to-one with Australian fiat, and the money will be held by the NAB.

- The stablecoin will primarily be used as a settlement token between multiple transacting parties. For example, AUDN could be used for carbon credit trading, overseas money transfers and repurchase agreements, NAB’s Chief Innovation officer Howard Silby said. This is known as atomic settlement, something the NAB is attempting to transition to in some markets, according to the Australian Financial Review, which first reported the news.

- This is not the first-time banks in Australia have tried to launch a stablecoin.

- Four banks attempted to create a similar stablecoin product last year. The initiative failed due to competition concerns and the four separate banks being at different stages in their crypto strategies, according to AFR.

Circle, Uniswap Research Says DeFi Can Solve $2 Trillion FX Risk Problem

- Every day, about $2.2 trillion in foreign-exchange (FX) transactions carry a risk that the yet-to-be settled side of an agreement won’t meet obligations. But a new paper from Circle Internet Financial and decentralized exchange Uniswap Labs finds that a distributed ledger could solve that problem with simultaneous settlement.

- Several researchers from the two digital-finance companies – including Uniswap Chief Operating Officer Mary-Catherine Lader and Circle’s chief economist, Gordon Liao – contend that crypto’s innovations could be an answer to this major ongoing financial-stability concern for regulators. That’s one conclusion of their 20-page paper to be released in Davos for a panel at the World Economic Forum on Thursday.

- “On-chain FX can offer faster and more affordable transaction processes, as well as greater liquidity and stability,” the paper concludes.

- The researchers also say remittances – money that people send across international borders – could see their costs cut by 80% through decentralized finance (DeFi). Sending money to people in other countries has always been one of the strongest arguments for crypto, and the paper said the lower costs could translate to $30 billion a year remaining in people’s pockets.

‘Wtf is Bitzlato?’ Crypto Twitter rolls eyes at DOJ’s big arrest

- The U.S. Department of Justice got schooled in how not to manage expectations on Crypto Twitter Wednesday morning after it teased the announcement of an “international crypto enforcement action” in a move that immediately caused declines in the price of bitcoin and other cryptocurrencies.

- Speculation was rife about who might be targeted, with the industry on seemingly endless tenterhooks amid multiple investigations and bankruptcy filings in the wake of the collapse of the FTX crypto exchange. Hours later, the DOJ announced that it had arrested the Russian founder of “notorious” Hong Kong-based crypto exchange Bitzlato, lauding its move as “a significant blow to the cryptocrime ecosystem.”

- The crypto industry yawned. Bitcoin immediately reversed its price slide. And then came the memes.

- “Never heard of it,” tweeted Hailey Lennon, a partner at the law firm Brown Rudnick, who advises on crypto issues.

- Crypto watchers were underwhelmed by the DOJ’s takedown of Bitzlato, an exchange that allegedly partnered with the now-defunct dark net market Hydra to move more than $700 million in illicit funds. Founder Anatoly Legkodymov was arrested in Miami on Tuesday night for his alleged role in the “high-tech axis of cryptocrime.”

- Hours before the Justice Department announced Legkodymov’s arrest, speculation had been mounting that law enforcement could be targeting a much bigger fish.

- “It seemed like almost everyone on Crypto Twitter was certain that DOJ was going to announce an action against Binance,” said Carol Van Cleef, a Washington lawyer and CEO of Luminous Group, referring to the exchange that aborted a surprise plan to take over FTX last year.

Binance, ether, bitcoin all lower as US economy slows

- BNB, ether and bitcoin slid with traditional markets after U.S. economic data showed signs of an economy starting to take a breather.

- Retail sales fell more than expected, tripping up what had been an improving market.

- Bitcoin was trading at around $20,800 at 4:15 p.m. EST, according to TradingView data.

- Ether was down 1.4%. Binance’s BNB fell 1.3%. Binance traded lower earlier in the day after the market reacted — erroneously — to an announcement of a pending enforcement action from the U.S. Department of Justice. That action was actually against a little known outfit named Bitzlato.

Davos Day 3 Shows Conflicting Visions for the Metaverse, CBDCs

- DAVOS, Switzerland – Conversations about blockchain on day three of Davos show architects of the metaverse are still trying to figure out what exactly it is – and regulators hinting central bank digital currencies (CBDC) could potentially do more harm than good to the global economy.

- The World Economic Forum (WEF) released two reports on the metaverse on Wednesday. In an effort to encompass the broad – and at times vague – concept of the metaverse, the reports set it up as “an immersive, interoperable and synchronous digital world that will change how we interact, work and play.”

- Despite the hype around the metaverse, propelled by Facebook’s transformation into Meta Platforms back in 2021, the world has yet to witness or experience anything concrete.

- “It’s an evolving concept. One that doesn’t have a standard definition yet,” said Cathy Li, head of media, entertainment and sport at WEF, during a Wednesday press conference.

- Open-ended questions about how the metaverse should be regulated also require extensive testing, said Huda Al Hashimi, deputy minister of cabinet affairs for strategic affairs in the United Arab Emirates, at the same event.

- “We also see that regulators will be acting more like referees rather than gatekeepers. And that code of conduct will actually take precedence over formulating policies,” Al Hashimi said.

MakerDAO Favors Holding GUSD Stablecoin as Part of Reserve in Early Voting

- Decentralized finance giant MakerDAO’s community was heavily favoring keeping Gemini’s GUSD stablecoin as part of Maker’s reserve. The ongoing vote is testing confidence in Gemini, the Winklevoss-founded exchange that has been swept up in recent crypto contagion.

- Voters are casting votes whether to keep the GUSD ceiling at the current $500 million, to decrease it to $100 million or to zero, which would boot GUSD from the reserve, according to Maker’s governance site.

- At press time, 69% of the votes favored keeping the GUSD ceiling intact at $500 million, while 31% voted for dropping GUSD to zero. The final result may change; the voting ends Thursday (Jan. 19) at 16:15 UTC.

- The Maker protocol is led by a decentralized autonomous organization (DAO), in which holders of the protocol’s governance token, maker (MKR), can vote on proposals. Currently, MakerDAO holds $489 million in GUSD in its Peg Stability Module (PSM) facility, which acts as a reserve system with $7 billion of assets to back its DAI stableoin’s value and price peg to the dollar.

- Starting in October, Gemini has been paying a 1.25% annual yield to Maker on GUSD holdings based on an earlier agreement.

- The forerunner of the liquid staking derivatives market, Lido became the largest decentralized finance (DeFi) app by total value locked (TVL) earlier this month, surpassing MakerDAO.

- Lido’s claim to the throne comes after a period of steady growth for the staking-as-a-service provider. In just the last month its TVL has spiked 33% at press time, according to data from DeFiLlama.

- Users have locked $7.8 billion on Lido. The vast majority of that sum comes from Ethereum, with smaller amounts from other blockchains, including Solana.

- Interest in liquid staking protocols has swelled in 2023 as governance tokens for these protocols have surged in price. For example, since Dec. 31 to now, the price of LDO has jumped 108% to $2.01, while its average 24-hour volume rose 802%, per CoinGecko. Holders of LDO have a say in how the protocol is managed, from setting fees to assigning node operators.

Skybridge Capital Founder: The Time to Invest in Crypto Is Now

- Bitcoin’s price could be nearing its bottom point so the time to invest in it may be now, Anthony Scaramucci, founder of asset manager SkyBridge Capital, said Tuesday.

- Speaking to CoinDesk TV’s “First Mover” from the World Economic Forum’s annual conference in Davos, Switzerland, Scaramucci said long-term crypto investors need to keep a three- to five-year outlook and not dwell on day-to-day performance.

- “I’m encouraging people to invest now,” Scaramucci said. “We’re closer to a bottom than we are to another top.”

- Scaramucci’s firm, which has $2.2 billion in assets under management, had a $45 million tie to failed crypto exchange FTX when founder Sam Bankman-Fried bought an estimated 30% stake. According to Scaramucci, SkyBridge then bought $10 million worth of FTX’s native token, FTT, which it later sold at an estimated $9.6 million loss. He did not say when the FTT was sold.

- Skybridge is now considering whether to buy back its shares from the failed FTX. Scaramucci said he hopes his company will hope to do that “by the middle of this year,” even though he said Bankman-Fried “never affected the way the [SkyBridge] business was run.”

Genesis Bankruptcy Filing Imminent as Creditor Negotiations Stall: Reports

- Crypto lender Genesis, a wholly owned subsidiary of Digital Currency Group (DCG), is on the verge of filing bankruptcy after negotiations between the troubled firm and creditors have failed to move forward, according to multiple reports.

- Bloomberg, which cites sources close to the situation, reported today that Genesis is preparing to file for bankruptcy protection as soon as this week. Genesis first warned of such a move in November after it suspended client withdrawals following the collapse of cryptocurrency exchange FTX.

- Genesis and parent company DCG have been unsuccessful in reaching an agreement with creditors despite offering several proposals, according to Bloomberg.

Cathie Wood-backed 21shares offers first staking index ETP

- Cathie Wood-backed 21Shares unveiled the 21Shares Staking Basket Index ETP, the first crypto staking index ETP offering diversified staking income.

- The 21Shares Staking Basket Index ETP tracks proof-of-stake cryptocurrencies including Binance Coin, Cardano, Cosmos, Polkadot, Solana and Tezos, the company said. The 21Shares staking index methodology was built in collaboration with Swedish index provider Vinter.

- “Staking is a long-standing feature of the blockchain ecosystem that allows crypto holders to earn rewards in exchange for locking up their assets,” said Arthur Krause, director of ETP Product at 21.co, the parent company of 21Shares.

Bitcoin Erases Entire FTX-Related Decline in Latest Surge

- Bitcoin (BTC) has risen to $21,550 early Wednesday, surpassing the level at which it stood on Nov. 5 just prior to the collapse of crypto exchange FTX. According to CoinDesk data, the price of bitcoin is now at its highest since mid-September.

- Behind today’s advance were this morning’s larger than expected decline in the producer price index (PPI) for December combined with a bigger than forecast drop in December retail sales.

- The PPI fell 0.5% in December, bringing the year-over-year rate down to 6.2% versus 7.3% previously. Market expectations had been for just 0.1% dip in December and a year-over-pace of 6.8%. The core PPI for December fell 0.1%, in line with forecasts, but the year-over-year rate fell to 5.5% versus expectations for 5.7%.

- December retail sales fell 1.1% versus forecasts for just a 0.8% decline. Combined with a drop of 1% in November, this marks the first back-to-back 1%+ declines in monthly retail sales since the pandemic panic.

- A check of traditional markets finds the 10-year U.S. Treasury yield down a whopping 16 basis points to 3.39%, its lowest since mid-September, and well below the current Fed Funds rate target of 4.25%-4.5%. This sort of “inversion” has typically been an excellent forecaster of a recession, or at least a sizable economic slowdown. Should that come to pass, it would surely mean easier monetary policy than currently forecast, a possible boon to risk assets, including bitcoin.

Ethereum Layer 2 Network Optimism Sees Bump in Transactional Activity. Here’s Why it Matters

- Crypto traders and investors are increasingly seeing the Optimism ecosystem as a likely spot for capturing returns along the lines of the 100-times-plus multiples sometimes witnessed in prior bull-market cycles.

- Transactional activity has steadily bumped on the scaling upstart in the past weeks, crossing over rival Arbitrum’s activity, which has fallen nearly 50% since its November peak.

- Such activity can serve as a predictive indicator of forthcoming investor interest in any blockchain ecosystem, as it suggests buyers of underlying tokens and users of decentralized applications (dapps) built on that network, in this case, Optimism.

SEC racks up 50% increase in crypto enforcement actions in 2022: Report

- The Securities and Exchange Commission brought a record number of crypto-related enforcement actions last year, up 50% from 2021, according to a new report from consulting firm Cornerstone Research.

- Last year’s record of 30 crypto-related enforcement actions was second only to 2020, when the SEC brought 29 such actions. The most frequent allegations were fraud and unregistered securities, the firm found. Of those 30 enforcement actions, 70% alleged fraud, 73% alleged an unregistered securities offering and 50% alleged both.

- Some of the biggest cases brought last year include the charges against a former Coinbase employee, his brother and his friend for allegedly running an insider trading scheme and another case in December against former FTX CEO Sam Bankman-Fried for allegedly defrauding investors.

- SEC Chair Gary Gensler has said that the vast majority of cryptocurrencies are securities. Lawmakers last year introduced legislation to regulate crypto, with some bills giving the Commodity Futures Trading Commission jurisdiction over the largest digital assets.

- “It seems crypto assets will likely continue to be a priority under the Gensler administration,” said Simona Mola, principal at Cornerstone Research and author of the report. Mola cited the 50% uptick in enforcement actions and the agency’s expansion of its Crypto Assets and Cyber Unit.

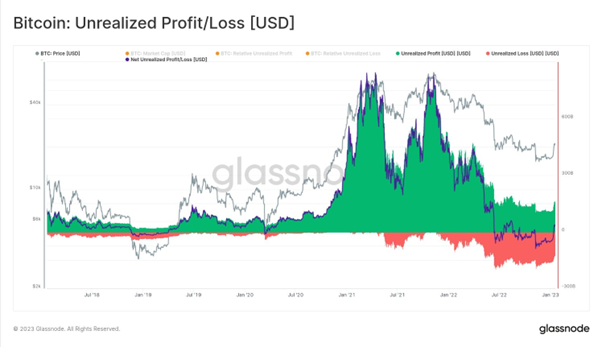

- The concept of Realized, and Unrealized Profit and Loss is one of the most powerful in #Bitcoin on-chain analysis.

- By pricestamping coins, we can measure the total USD value held by investors in Profit or Loss.

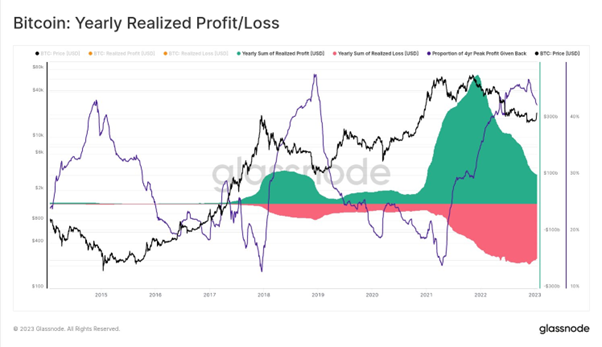

- We can also assess Realized component of Profit/Loss.

- This reflects the USD value investors locked in, comparing their acquisition price, to disposal.

- Here we can see that #Bitcoin bears tend to see the market give back 45%+ of the gains from the bull🔵

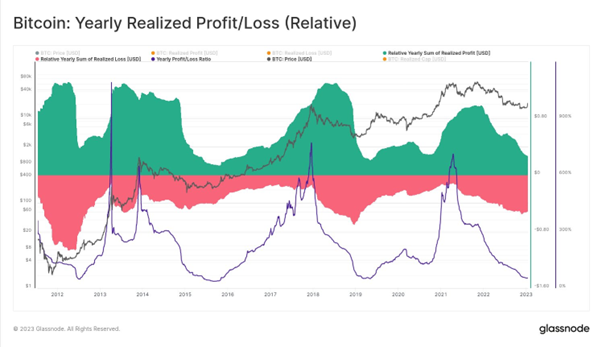

- Bringing the last chart into a Relative scale, we can develop cyclical #Bitcoin oscillators, showing ebbs-and-flows between market regimes.

- 🐂Bulls tend to peak with 7x more Profit than Loss.

- 🐻Bears often bottom with 2x to 3x more Loss than Profit