Bitcoin Price: US$19,549.86 (+1.49%)

Ethereum Price: US$ 1,331.40 (+1.95%)

Does History Suggest Price Volatility for BTC Ahead?

- FTX US and its founder Sam Bankman-Fried are under investigation by Texas’ securities regulator.

- Mastercard is launching a program to help banks offer crypto trading to their clients.

- Crypto broker NYDIG lays off one-third of its workforce.

- Magic Eden moves its NFT marketplace to an optional royalty model.

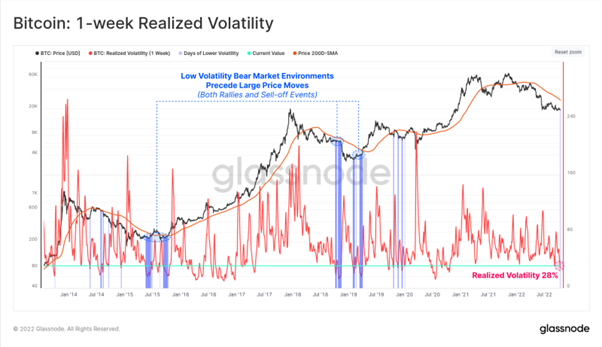

- The BitMEX 30-day Historical Volatility Index, also known as the BVOL Index, measures the rolling 30-day annualized volatility of Bitcoin. More specifically, this index utilizes the time-weighted average price (TWAP) of BTC/USD on a daily basis.

- High BVOL values indicate increased price volatility for BTC. Historically, when the BVOL falls below 25, a major spike in BTC price volatility tends to follow. As of Oct. 17, the BVOL sits at 19.72, the lowest reading since Jul. 2020.

- The previous three times the BVOL fell below 25, BTC experienced substantial price movements: (i) a 50% crash in late 2018, (ii) a 240% move upward in the spring of 2019, and (iii) the initial move which kickstarted the bull run of 2021.

- Furthermore, BTC’s open-interest leverage ratio currently sits at historic highs while its volatility has recently diverged from that of the VIX. Both of these developments further suggest that a large move is brewing in crypto land.

- Monthly Chartbook – Falling Out of the Merge

- The Fed remains hawkish, once again reiterating its desire to curb inflation at all cost. To quote Fed Chairman Powell, “To accomplish that [bring inflation back down to 2%], we think we’ll need… a period of growth below trend and also some softening in labor market conditions to foster a better balance between demand and supply and the labor market.”

- The DXY remains strong, consolidating beneath its recent highs as other central banks struggle to maintain financial stability within their own jurisdictions.

- The labor market is showing signs of stubbornness, with the most recent nonfarm payrolls coming in hotter than expected, adding fuel to the narrative of “sticky high inflation for longer.”

- The picture for BTC remains relatively unchanged from prior reports such as Searching for Market Bottoms and Bear Market Woes; When Is Enough, Enough?

- We have continued to stress that BTC and crypto markets have not yet decorrelated from macro events, and until there is evidence of this, the framework for analyzing BTC remains consistent.

SEC, CFTC Probing Bankrupt Crypto Hedge Fund Three Arrows Capital: Report

- The Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) are examining whether bankrupt crypto hedge fund Three Arrows Capital violated rules by misleading investors about its balance sheet and not registering with the two agencies, Bloomberg reported, citing two people familiar with the matter.

- The Singapore-based Three Arrows filed for bankruptcy in July, saying its business had “collapsed in the wake of extreme fluctuations in cryptocurrency markets.” In particular, the hedge fund suffered huge losses stemming from the collapse of the terraUSD algorithmic stablecoin in May. At the end of June, the Monetary Authority of Singapore (MAS) reprimanded Three Arrows Capital for misleading it with allegedly false information.

- The CFTC didn’t immediately respond to a request for a comment on the report.

Bitcoin Volatility Falls to Two-Year Low as TradFi Markets Wobble

- Despite its reputation as an unpredictable and risky asset class, crypto hasn’t been especially volatile in recent weeks.

- According to crypto market data provider Kaiko, Bitcoin’s 20-day volatility has come to equal that of the NASDAQ for the first time in two years. But while Bitcoin’s price has remained roughly the same since the start of September, both the NASDAQ and S&P have fallen 13% and 10% respectively since that time.

- Historically, Bitcoin has been tightly correlated with tech stocks, but with higher beta (volatility relative to the rest of the market)—thus defying its label in some circles as a safe-haven asset, or “digital gold.” However, despite a violent crash in June, crypto has proven to be one of the best-performing asset classes in Q3, next to the U.S. dollar.

Ripple’s XRP Ledger Is Getting a Sidechain That’s Compatible With Ethereum

- Blockchain software company Peersyst has launched an Ethereum-compatible sidechain on the XRP Ledger’s devnet, Peersyst and RippleX announced Monday. Devnets, or developer networks, are separate from a blockchain’s main network, or mainnet, and are used to test and troubleshoot new technologies.

- This means the Ethereum-compatible sidechain for XRPL is now live, but still in an early phase. The sidechain uses the coding language Solidity, the same code that is used to program applications and smart contracts on the Ethereum network and other Ethereum Virtual Machine (EVM) blockchains, such as Avalanche. But unlike Ethereum, the XRPL sidechain uses XRP as its native currency.

- Ripple CTO David Schwartz said over a year ago in September 2021 that an EVM-compatible chain on the XRPL was in the works.

Aptos Debuts Its Blockchain, Putting Millions in VC Dollars to the Test

- Aptos Labs blockchain launched its mainnet on Monday, becoming the first of the Facebook spin-off networks to premiere and putting to the test its multibillion-dollar valuation.

- Aptos is the brainchild of several ex-Meta employees who pioneered the company’s failed diem stablecoin. The Aptos blockchain’s code is written with Move, the Rust-based programming language favored by Mysten Labs’ Sui blockchain, another upcoming network.

- While Aptos Labs has declared its network “live,” its ecosystem is far from completed, with dozens of teams yet to launch the wallets, trading venues and non-fungible token tech essential to decentralized finance (DeFi). Until those – and a token – debut, there won’t be much to do on Aptos.

- The blockchain itself is up and running, having completed its “genesis transaction” on Oct. 12. Even so, the infrastructure has proven rocky; People building within Aptos told CoinDesk the mainnet rollout was “rushed.”

The Next Major Ethereum Upgrade, Shanghai, Now Has a Testnet

- Ethereum developers can start testing out their next upgrades to the protocol on the new “Shandong” test network (testnet).

- The Shanghai upgrade, for which Shandong is the testnet, is projected to happen at some point in 2023. It will be Ethereum’s first upgrade since the Merge in September, when Ethereum transitioned from a proof-of-work consensus mechanism to a proof-of-stake model.

- Right now, some Ethereum Improvement Proposals (EIP) being considered for inclusion in Shanghai could address some efficiency and scalability issues. Perhaps the most anticipated proposal is EIP 4895, which will allow for those who have staked ether (ETH) on the Beacon Chain to withdraw their stake, along with any rewards they have earned over time.

Binance to Launch Cloud Mining Business in November

- The world’s largest crypto exchange by volume, Binance continues its push into the embattled crypto mining industry with a plan to begin offering a crypto cloud mining product next month.

- Crypto miners have had a tough year, with the price of bitcoin having hung around $20,000 for months, a far cry from its peak above $68,000 in November 2021. Other cryptos have faced similar or even worse declines. One of the largest mining-related firms in the U.S. filed for Chapter 11 bankruptcy in late September.

- Other companies, however, are seeing opportunity from this crisis, with CleanSpark going on a buying spree of mining rigs and data centers, and decentralized finance (DeFi) platform Maple Finance starting a $300 million lending pool.

- Binance Pool announced its own $500 million lending fund for bitcoin miners last week and said it would enter cloud mining, a service that allows investors – who otherwise might not be able to buy and operate their own equipment – to rent crypto mining machines. The official launch of the cloud mining service will come in November, a Binance spokesperson told CoinDesk via email on Monday.

FTX, Sam Bankman-Fried Under Investigation by Texas Regulators

- Cryptocurrency exchange FTX, its FTX US division, and founder and CEO Sam Bankman-Fried are being investigated by Texas regulators over potential securities violations, according to a state filing.

- Regulators are probing whether yield-bearing accounts offered by FTX US should be considered unregistered securities, as described in a filing related to the bankruptcy proceedings of Voyager Digital. FTX recently won the bid to acquire the assets of the firm. Barron’s first reported the news.

- “The Enforcement Division is now investigating FTX Trading, FTX US, and their principals, including Sam Bankman-Fried,” wrote Joseph Jason Rotunda, director of enforcement for the Texas State Securities Board.

New Mastercard Program Looks To Offer Crypto Capabilities to Banks

- Mastercard is delving deeper into the cryptoasset business by offering banks the ability to provide trading capabilities to customers, as it seeks to utilize recent acquisitions and partnerships.

- Institutional partners involved in Mastercard’s Crypto Source program are set to gain access to buy, hold and sell certain cryptoassets, the company revealed Monday.

- A Mastercard spokesperson told Blockworks the initiative is being prepared for pilot programs, noting that the company is working out which assets will be supported.

- The upcoming program comes after banking giant BNY Mellon said last week that it would allow certain institutional clients the ability to hold and transfer bitcoin and ether on its new crypto custody platform in the US. Industry watchers and executives have said that TradFi institutions are opting to get more involved in the segment despite the ongoing crypto winter.

- Mastercard is also set to offer banks and fintechs security management, the ability to spend and cash out crypto, as well as product development and consulting services.

Australian Regulator Suspends Holon’s Crypto Funds Managed by Gemini

- Australia’s financial services and markets regulator suspended Sydney-based asset manager Holon Investments from offering or distributing three crypto funds to retail investors for 21 days, according to a press release.

- The decision was taken by the Australian Securities and Investment Commission (ASIC) due to non-compliant target market determinations (TMD) by Holon Investments.

North Korean Hacker Group Lazarus Targets Japanese Crypto Firms

- The infamous North Korean hacker group Lazarus has attacked several Japanese crypto funds through phishing and social engineering, according to a joint statement by local police and the Financial Services Agency of Japan.

- A report by Japan News adds that some companies have had their internal systems hacked and some cryptocurrency has been stolen.

- Phishing is a form of hack that involves a malware-infected link being sent to a victim, a virus will be installed on the targeted computer when the link is clicked. Lazarus is said to have been sharing these links via email and social media.

- Lazarus Group is accused of behind the $625 million Ronin Bridge exploit, blockchain analytics firm Elliptic also traced the $100 million Horizon Bridge hack back to Lazarus in June.

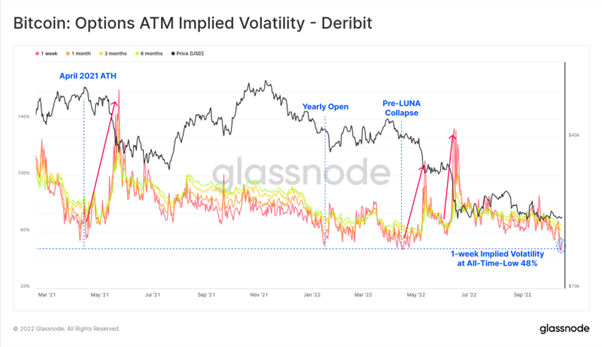

- The Bitcoin market is primed for volatility, with both realized and options implied volatility falling to historical lows. Futures open interest has hit new all-time-highs, despite liquidations being at all-time-lows. Volatility is likely on the horizon, and Bitcoin prices rarely sit still for long.

- In the off-chain domain, volatility is also brewing in the derivatives markets. Options pricing of short-term implied volatility (IV) has reached an all-time-low of 48% this week. Several prior instances of such low IV has preceded violent moves, often compounded by the de-leveraging of derivatives and DeFi markets.

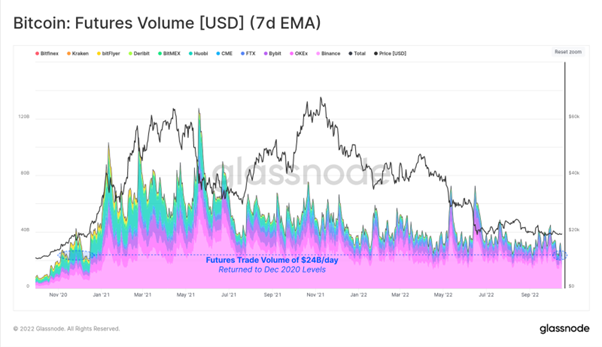

- Trading volumes in futures markets have also declined to multi-year lows of $24B per day. This returns to levels last seen in December 2020, before the bull cycle had broken through the 2017 cycle $20k ATH. This may signal a lower liquidity trading environment should the market find momentum in either direction.