Bitcoin Price: US$ 21,185.65 (+1.51%)

Ethereum Price: US$ 1,576.94 (+1.57%)

NFT Debrief – January 2023 – Delphi Pro

- NFT sales volume rebounded significantly in December, finally breaking the downward trend. NFT sales volume on Blur reached $484M, nearly double the volume on OpenSea ($263M) during the same period. This is primarily due to Blur’s announcement of their final airdrop, which incentivizes NFT traders to place bids on the platform. Other notable developments:

- Kraken announced the launch of Kraken NFT on December 22, a gasless NFT exchange that spans multiple blockchains such as Ethereum and Solana. The public beta of the platform is now live for users to sign up.

- On Dec 14, 2022, Magic Eden introduced Rewards, a system to reward users based on their activity on the platform. They also have plans to expand beyond Solana and Polygon.

- Ethereum and Solana ended the year as the two most popular chains for NFTs, with $542M (81.6%) and $77M (11.6%) in NFT sales volume settled over the last 30 days, respectively.

- Polygon climbed to third place in December, riding on the momentum of a slew of mainstream brand partnerships such as Nike, Reddit, and Starbucks. The number of users per week in Polygon’s NFT ecosystem has increased by more than 4X since early August. The blockchain had over 350,000 users in the week between December 19 and December 26, an all-time high.

DeFi Protocol Sushi Lays Out 2023 Plans With Focus on DEX and User Experience

- Popular decentralized-finance (DeFi) application Sushi’s CEO laid out the protocol’s 2023 roadmap with focus on user experience and said Sushi will release its decentralized exchange (DEX) aggregator in the first quarter.

- The protocol will focusing heavily on DEX products this year, as part of its previous broader plans toward making the protocol sustainable and profitable. “Ultimately, we will provide deep liquidity, optimal pricing, sustainable tokenomics, & an easy-to-use platform, placing you first in everything we build,” CEO Jared Grey said in a blog post on Monday.

- The move comes after Sushi’s chief technology officer, Matthew Lilley, said in a tweet thread on Jan. 3 that two of its products – the Kashi lending platform and MISO, a launchpad for external tokens – would be shuttered because of low public interest and the significant effort that went into maintaining the two. Lilley said Sushi developers would focus more on the protocol’s DEX product.

- “Our goal is to become a market-leading DEX by improving our product stack & delivering feature parity to provide a firm foundation enabling innovation, like biased LP routes via our aggregation router & concentrated liquidity coming in Q1,” Grey said in the new blog post.

Bitcoin Miners and Average HODLers Are Back in the Black

- After a long crypto winter, Bitcoin miners and average BTC investors are now back in the black, according to a report today from blockchain intelligence firm Glassnode.

- Bitcoin rallied over the weekend and is now trading above $20,000 for the first time since the spectacular collapse of Sam Bankman-Fried’s FTX. This means it’s now profitable again for mining companies to run the expensive hardware necessary to mine the Bitcoin network. It also means that your average Bitcoin hodler, if they sold their stash now, would no longer be selling for a loss.

- Glassnode estimates that Bitcoin’s “realized price,” the average price that current investors paid for BTC, is at around $19,700. The average price that Bitcoin traded for in the last 155 days is $18,000, says Glassnode. In either case, Bitcoin is now trading well above that mark, today changing hands at more than $21,000.

Brazil’s Second-Largest Private Bank Launches First Tokenized Credit Note

- Bradesco, Brazil’s second-largest private bank, launched its first tokenized bank credit note on Friday.

- The bank completed the transaction for a total of 10 million Brazilian reals — equivalent to $1.95 million — under a regulatory sandbox run by the Central Bank of Brazil, the company said in a statement, adding that it was the first financial market tokenization operation regulated by that monetary authority.

- Other banks have also recently embarked on the Brazilian tokenization market. In December, also as part of the Brazilian Central Bank’s sandbox, Santander issued 40 million Brazilian reals ($7.8 million) in tokenized bonds to Indigo, a parking management company.

- In July 2022, Itaú Unibanco, Brazil’s largest private bank, announced the launch of its own tokenization platform, Itaú Digital Assets. In addition to tokenization, the firm also provides crypto custody and token as a service (TaaS) products.

Lazarus Group Moves 41,000 Ethereum Nabbed From Harmony Bridge Hack

- North Korea-linked cybercrime syndicate Lazarus Group has reportedly transferred $63.4 million in Ethereum from 2022’s mammoth Harmony bridge hack, depositing it on Binance, Huobi, and OKX.

- According to on-chain sleuth ZachXBT, the group used the privacy and anonymity system Railgun before consolidating the funds and depositing them on the exchanges.

- Railgun is an Ethereum-based smart contract system that lets users obscure the nature of their crypto transactions, removing identifying information.

- The sleuth claimed that the transfers, made on January 13, involved 350,000 separate wallet addresses.

- Binance CEO Changpeng “CZ” Zhao said that his team, in collaboration with Huobi, had detected the funds’ movements, which they then froze and recovered.

- The Binance chief claimed that the total recovery came to 124 Bitcoin, suggesting that the attackers had converted funds from ETH to BTC.

- Though Lazarus reportedly originally made the illegitimate transfers in the form ETH, these tokens could have been later swapped for BTC at many points during the mixing and consolidating process.

Binance Will Allow Institutional Investors to Keep Collateral Off the Crypto Exchange

- Binance will allow institutional investors to keep their collateralized crypto used for leveraged positions, off the platform.

- The exchange will enable investors to post collateral with Binance Custody, which will hold the assets off the internet, in cold storage wallets, Binance said in a statement on Monday. Once trades are settled, the assets would then become accessible to the user again.

- The feature, called Binance Mirror, could be a major blessing for crypto investors trading in the leveraged markets as most crypto traders have to keep their collateral on the exchange for trading. However, using cold storage wallets means users can continue to trade crypto during volatile sessions without massive outflows on an exchange.

- Users’ assets would also be protected against on-chain hacks, to which hot wallets are vulnerable.

- The collapse of Binance’s rival FTX in November last year prompted fears about crypto exchanges’ ability to keep users’ assets safe, with regulators probing FTX over the misuse of customer funds.

Shiba Inu about to launch Ethereum Layer 2 network Shibarium in beta

- Shiba Inu developers are preparing to release the meme token’s Layer 2 network called Shibarium in beta form — with the full launch to follow not long after.

- Shibarium is a planned Ethereum-based Layer 2 network for the Shiba Inu ecosystem. Transactions on the chain will be paid for using bone, the governance token of the Shiba DAO. Bone tokens will also be used to reward validators and delegators in the Shibarium network, according to the announcement. As such, 20 million bone tokens, currently worth $27 million, have been reserved to pay out these rewards. Shiba Inu developers say this move will improve the utility of the bone token.

- Shiba Inu’s planned Layer 2 network will also utilize other Shiba Inu-based tokens like leash and the ecosystem’s native meme coin shib. Shibarium transactions will trigger shib token burns, the announcement stated. Token burning results in the permanent destruction of tokens by sending them to a project’s “burn address,” thus removing them from the total circulation forever.

Bitcoin Surge Causes Over $500M in Liquidations, Highest in 3 Months

- Crypto markets surged to regain the $1 trillion market capitalization mark over the weekend amid signs of bottoming and a record number of short liquidations contributing to the uptick.

- Nearly $500 million in shorts, or bets against higher prices, were liquidated since Friday to mark the highest such levels since October 2022, data from Coinalyze shows.

- The liquidation figure mean over 70% of traders booked losses as exchanges closed leveraged positions due to a partial or total evaporation of the trader’s initial margin. Crypto exchange OKX saw $256 million worth of short losses on Friday alone, the most among all crypto exchanges, followed by $125 million on Binance and $42 million on Huobi, CoinGlass data show.

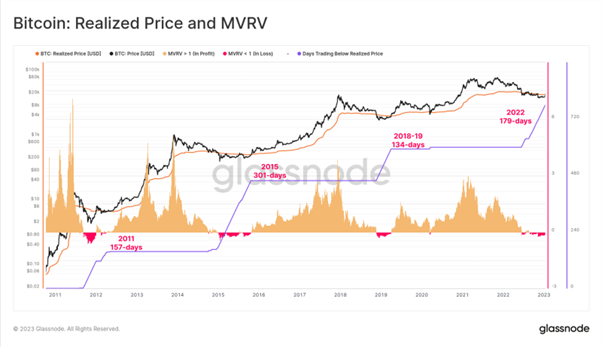

Glassnode: Is Bitcoin Back?

- After one of the least volatile periods in Bitcoin history (WoC 2), the market pulled off a remarkable and explosive 23.3% rally this week. BTC prices rallied from a weekly low of $17k to over $21k, breaking through several widely observed technical and on-chain pricing models. Many of these models tend to act as significant psychological resistance levels during bear markets, which makes this particular event noteworthy.

- The 200D-SMA remains one of the most widely used technical analysis tools across all asset classes, often finding application as a litmus test for macro market trends. This has proven true over the years for Bitcoin, where a simple check of whether price is above or below the 200D-SMA tending to correlate with a macro bullish, or bearish trend, respectively.

- With this weeks powerful rally, the market overcame this psychological level at $19.5k. Bitcoin markets often express a strangely consistent cyclical behavior, with this cycle trading below the 200D-SMA for 381-days, which is just 5-days shy the 2018-19 bear market at 386-days.

- Sitting just above the 200D-SMA was the Realized Price at $19.7k. Within the world of Bitcoin, this psychological cost basis model is also widely observed. With prices now convincingly above this price model, it indicates that the average BTC holder is back in a net unrealized profit.

- To date, the 2022-23 bear market has spent 179-days below the Realized Price, making it the second longest duration across the last four bear cycles.

- Continue on Glassnode Insights…