Bitcoin Price: US$ 23,517.72 (-3.31%)

Ethereum Price: US$ 1,637.84 (-2.21%)

- Similar to the scalability trilemma, protocols engaging in interoperability can follow a maximum of 2/3 fundamental properties: trustlessness, extensibility, and generalizability.

- Traditionally, interoperable protocol layers can be broken down into three types of bridges:

- Natively verified

- Externally verified

- Locally verified

- Today, our focus will be on natively verified bridges. Unlike in externally and locally verified bridges, in natively verified bridges (also known as light client-based bridges), the operators of the bridge are the validators of the underlying chains. Chains that interoperate run on-chain light clients for each other in their execution layers which verify the consensus of the counterparty chains.

- The design only requires trust in the economic security of the consensus of each participating chain and eliminates the need for additional trust. For this reason, natively verified bridges like Rainbow and IBC are considered to be the closest to “trustless” across L1s. Natively verified bridges can be used to transfer any arbitrary data such as balances, storage, transactions, and events from the source chain to the target chain.

- However, they have two main limitations: cost and extensibility. To verify each other’s consensus, the chains must continuously keep track of the active validator sets and verify their signatures (consensus votes). This can be computationally expensive, especially if the receiving chain does not natively support the necessary precompiles and curves related to the consensus mechanism of the sending chain. This hinders the extensibility of light client bridges across heterogenous chains.

- So far, only IBC on Cosmos app-chains has successfully deployed on-chain light clients at significant scale. This has been achieved by substantial standardization, which requires all chains to conform to predetermined compatibility requirements.

- Recently, there has been significant effort to use ZKP technology to build cheap light client-based bridges. At their core, these bridges leverage ZKPs (commonly ZK-SNARKs) to reduce the gas costs of on-chain verification.

- ZK-SNARKs allow for two main functionalities:

- ZK aspect: hide inputs into the function being proved

- SNARK aspect: succinctness gives way to scalability

- The key to this scaling is the succinctness property; instead of verification being done directly on-chain, consensus can be proven off-chain and cheaply verified on-chain via succinct ZK-proofs. As a side effect, ZK-bridges also stretch the extensibility of light client bridges, as chains no longer need to natively support each other’s signature schemes in order to cheaply interoperate.

- For the sake of clarity, it’s important to distinguish between ZK-bridges and ZK-rollups. In ZK-rollups, ZKPs are used to validate every state transition, ensuring the rollup never makes an invalid transition. ZK-bridges, on the other hand, only prove consensus (with 2/3 validator signatures) and not individual state transitions (think transactions). This means that if the source chain’s validators collude, they could trick the destination chain into accepting an invalid state transition such as creating fake tokens. The on-chain light client on the destination chain wouldn’t be able to detect this, as it only verifies consensus (via 2/3 validator signatures) and not the state transition rules.

- To summarize — in ZK-bridges, ZKP technology is used to reduce the costs of verification without introducing new trust assumptions. As a side effect, ZKPs also help natively verified bridges improve their extensibility.

- Continue on Delphi Pro…

How to Navigate Token Unlocks – Delphi Video

- (00:00:00) – Introduction

- (00:00:24) – Why are tokens locked? / Factors affecting token unlocks

- (00:01:02) – Size of the unlock

- (00:01:31) – Liquidity / OTC market

- (00:02:32) – Perpetual Futures

- (00:03:26) – Tokenomics

- (00:04:36) – Conclusion

Check the Chain – Stables – Delphi Video Livestream

- Check the Chain is our new DeFi and Infrastructure premium livestream with analysis from Research Associate, Ceteris and Research Analyst, Jordan Yeakley. They deep dive into the data and walk through the hottest on-chain trends. This week they’ll focus on CeFi and DeFi stablecoins.

Flash loan exploit appears to be behind Platypus USD stablecoin attack

- Platypus USD (USP) lost its dollar parity on Thursday following an apparent exploit that allowed a wallet to siphon off about $8.5 million from the token’s liquidity pools, just weeks after Platypus DeFi issued the stablecoin.

- The presumed hack was accomplished by means of a flash loan exploit, during which an attacker takes out an enormous loan and settles it in the same block, sandwiching transactions that use the capital to exploit other protocols in between. The Platypus swap function on the network has been disabled since the attack.

- “There has been a flash-loan attack on USP,” a pinned message in the official Platypus Telegram channel warns users. “We are currently trying to assess the situation and will communicate promptly on it. For now all operations are paused until we get more clarity.”

- The alleged attacker appears to have taken out a $44 million flash loan from Aave V3, and in turn minted some 41 million US Platypus tokens. Next, the attacker cashed out some $8.5 million into other stablecoins, and paid back the flash loan. These actions all took place in the same block of transactions, on-chain data show.

SEC Sues Terraform Labs and Founder Do Kwon For Securities Fraud

- The U.S. Securities and Exchange Commission on Thursday charged Singapore-based Terraform Labs and founder and CEO Do Hyeong Kwon—better known as Do Kwon—with securities fraud involving its algorithmic stablecoin Terra USD and the LUNA token.

- The complaint, filed in the U.S. District Court for the Southern District of New York, charges the defendants with violating the registration and anti-fraud provisions of the Securities Act and the Exchange Act.

- “We allege that Terraform and Do Kwon failed to provide the public with full, fair, and truthful disclosure as required for a host of crypto asset securities, most notably for LUNA and Terra USD,” said SEC Chair Gary Gensler. “We also allege that they committed fraud by repeating false and misleading statements to build trust before causing devastating losses for investors.”

Binance transferred $400 million from U.S. partner to Zhao-run firm, Reuters says

- Binance secretly had access to a bank account of its U.S.-based partner and transferred more than $400 million from that account to a trading firm managed by Chief Executive Officer Changpeng Zhao, Reuters reported.

- The transfers happened over the first three months of 2021, with money moving from the Binance.US account at Silvergate Bank to trading firm Merit Peak Ltd., Reuters said, citing banking records and company messages. The transfers started in late 2020, the report said.

- Reuters said it couldn’t determine whether the transferred funds belonged to U.S. customers, or the reasons or the reasons the funds were moved. Executive at the U.S. firm were reportedly concerned about the moves because they didn’t know they were taking place, Reuters said.

Canada Close to Tightening Rules for Crypto Exchanges: Sources

- Later this month, Canada’s umbrella markets regulator, the Canadian Securities Administrators (CSA), will tighten requirements for cryptocurrency exchanges operating in the country, according to two people who have been briefed on the plans.

- The collapse of FTX, among other failings in the crypto industry, has speeded the resolve of the CSA, which announced midway through last year that it required certain compliance “commitments” from unregistered crypto trading platforms operating in Canada while they pursue registration.

- The CSA declined to discuss updates to the pre-registration undertaking (PRU) regime, but said it would “publish additional details in the near future.”

- The U.S. Securities and Exchange Commission has already begun accelerating its crackdown on crypto companies, settling charges with exchange Kraken and alleging that a stablecoin issued by Paxos is a security. Other G-7 countries like the U.K. and Canada are likewise increasing their efforts to police the industry in the wake of last year’s disasters.

- Some Canadian industry players are worried about the possibility of onerous demands to acquire individual approvals from principal regulators in various territories, for instance. As it stands, some of Canada’s marketplace rules governing alternative trading systems are not passport-able to other jurisdictions.

- “This [update to PRU] was primarily driven by the Ontario Securities Commission and will crush the Canadian crypto industry overnight as it completely changes the CSA’s own stated rules and structures and will ensure it’s simply too expensive to do business in Canada,” said one person who asked to remain unnamed due to their ongoing business with regulators.

Flashbots Proposes New Class of ‘Matchmakers’ to Share MEV Gains With Ethereum Users

- Flashbots, a research firm formed to crack down on the unsavory practice of “maximal extractable value” or MEV on the Ethereum blockchain, proposed “MEV-Share” to distribute the gains more broadly.

- The new protocol would distribute MEV to Ethereum users, rather than just to validators and data-block builders, according to a blog post on the Flashbots website.

- MEV represents the profits made by validators and blockbuilders as a result of reordering or including certain transactions in certain data blocks. Initially seen as an abusive extra tax on users imposed by opportunistic traders wedging themselves into the blockchain process, the practice has become ubiquitous.

- Currently, one of the ways that validators on Ethereum earn MEV is through MEV-Boost, a software that Flashbots developed in order to democratize MEV earned by validators and solve some issues of centralization.

TrueFi’s TRU Token Rallies Over 200% After Binance’s TUSD Mint Sparks Speculation

- TRU, the governance token of decentralized lending protocol TrueFi, surged 220% on Thursday in an hour, data by CoinMarketCap shows, in a speculative flurry over a Binance stablecoin transaction.

- Before the rally took off, Binance, the world’s largest crypto exchange by volume, minted $50 million of TrueUSD (TUSD) stablecoin, according to blockchain data. The event sparked speculation among crypto traders about TUSD potentially gaining a larger role in trading on Binance after the regulatory crackdown on the Paxos-issued Binance USD (BUSD).

- However, the speculation about the TRU token appears to be misplaced because the issuers of the TrueUSD and TRU tokens were separated a while ago.

- TrustToken sold TUSD in 2020 to a firm called Techteryx, according to an announcement by TrustToken Chief Executive Rafael Cosman at the time. The post said Techteryx is an “Asia-based conglomerate with businesses … in the traditional real estate, entertainment, environmental and information technology industries.”

- TrustToken also separated from the TrueFi protocol and was renamed Archblock last year, as TrueFi embarked on a road to decentralize the platform.

- “Archblock is in the final stages of transferring all TrueFi IP and assets to the TrueFi Foundation, the TrueFi DAO’s legal entity,” a TrueFi spokesperson told CoinDesk, referring to the decentralized autonomous organization.

- TRU surged as high as 14.6 cents from 4.4 cents on Binance before later paring some of the gains. The token was trading at around 11 cents at press time.

Coinbase Says Client Assets Are ‘Segregated and Secure’ Following Proposed SEC Rule Change

- Coinbase is confident that its Coinbase Custody Trust Co. (CCTC) will remain a qualified custodian even if new rules proposed by the SEC come into play, according the company’s chief legal officer Paul Grewal.

- Coinbase Custody Trust is a New York-based business that provides cold storage for third-party investors’ digital assets. The SEC on Wednesday published a rule-change proposal that seeks to enforce much stricter provisions governing where registered investment advisers can custody cryptocurrency on behalf of their investors, limiting such investments to what are known as “qualified custodians.”

- These custodians must adhere to a stricter set of regulations, including keeping funds in a siloed account, unmixed with their own funds or those of other organizations.

Mt. Gox’s 2 Largest Creditors Pick Payout Option That Won’t Force Bitcoin Sell-Off: Sources

- The two biggest creditors of Mt. Gox, the crypto exchange that failed due to a hack nine years ago, have elected to get their bankruptcy recovery paid out mostly in bitcoin (BTC), according to people familiar with the matter.

- Defunct New Zealand-based crypto exchange Bitcoinica and MtGox Investment Funds (MGIF) – which together represent about a fifth of all Mt. Gox claims – will, as a result, get paid 90% of their collectable funds (which are calculated at approximately 21% of what they had locked on the platform at the time of the hack in 2014).

- Their decision to pick the former option could soothe longstanding fears among bitcoin holders that a wave of simultaneous liquidations tied to Mt. Gox bankruptcy recoveries could drive down the price of bitcoin. Had these two creditors opted to take the payout in fiat, the trustee overseeing the bankruptcy estate would likely have been compelled to sell off a significant portion of Mt. Gox’s recovered bitcoin holdings to fulfill all the fiat requests.

Tencent Teams Up With MultiversX to Expand Web3 Strategy

- MultiversX said Thursday it is partnering with Tencent Cloud to help the company expand its Web3 products. Tencent Cloud is the cloud component of the massive Chinese tech company’s portfolio, which also includes messaging app WeChat.

- MultiversX, previously known as Elrond, recently rebranded to focus on its metaverse initiatives. Tencent, which has previously worked in spaces such as gaming and audiovisual tech, will utilize the network to deploy a suite of blockchain-based products.

- “From blockchains to AI and beyond, cloud computing is a great necessity and an enabling force for innovation,” Beniamin Mincu, MultiversX CEO said. “We are thrilled to join forces with Tencent Cloud to explore exciting routes in a new strategic partnership between the two companies on payments, Web3 hubs, infrastructure, staking services and the metaverse.”

- Tencent, the company behind popular messaging app WeChat, invested $70 million into blockchain technologies in May 2020. In January 2022, the company added support for the Digital Yuan in WeChat’s wallet.

- “We aim to support the global Web3 community to adopt critical technologies to drive deeper connections between the virtual and real worlds,” Leo Li, vice president of Europe at Tencent Cloud International, said in a press release about the partnership.

- Tencent has faced regulatory challenges in its strategy. In August, Tencent halted trading on its Huanhe non-fungible token (NFT) marketplace due to scrutiny from regulators.

BUSD Drama Sets Stage for Stablecoin Market Reshuffling

- The uncertain future for embattled stablecoin Binance USD (BUSD) is stirring discord in the dollar-pegged crypto markets that one analyst says could accelerate into a dramatic reshuffling of the sector’s big winners and losers.

- With regulators this week forcing the issuer of BUSD to cease minting new tranches of the coin, Binance, the world’s largest crypto exchange by trading volume, risks running headlong into the ramifications of its decision in September to give preference to BUSD as a trading pair.

- That’s creating an opening for the two other big names in stablecoin markets: Circle’s USDC and Tether’s USDT. According to Kaiko researcher Conor Ryder, USDT will likely be the short-term winner as market makers ,and perhaps even Binance itself, tap that as the trader favorite over BUSD.

- The potential shakeup comes as traders continue to move stablecoins off centralized exchanges. Outbound transfers of coins such as USDC and USDT on the Ethereum blockchain have outpaced deposits for nine consecutive days, according to data from Nansen. It is a ramping-up of the withdrawal trend that began in earnest with FTX’s collapse in early November.

- “It’s very possible that after all the exchange fear from last year that holders of stablecoins have moved away from CEXs,” said Ryder, referring to centralized exchanges. He said another downward force has been market makers reducing stablecoin liquidity since the start of 2023.

Only 31% of Staked Ether May Be Profitable: Binance Research

- Analysis by Binance Research has found that a notable minority of ether holders who staked their ETH in Ethereum’s Beacon Chain over the past three years are making money, while the rest are underwater.

- Ethereum staking involves users locking their ETH tokens to validate transactions in return for a reward paid out in ether. Staking, therefore, is referred to as passive investing – coins lying dormant in self-custody or in an exchange wallet to use. Currently, onchain annualized staking yields are around 4%.

- More than 16.5 million ether, worth $27.7 billion, has been staked since Beacon Chain went live in December 2020, of which 31% or 5.115 million ETH are in profit while the rest, 11.385 million ETH, are in loss, according to Binance Research.

- The loss here means ether’s current going market rate is less than the rate prevalent when they were locked in the Beacon chain.

- The analysis comes at a time the market is trying to gauge potential selling pressure following Ethereum’s Shanghai upgrade, scheduled for mid-March. The highly anticipated upgrade is set to open withdrawals of staked ETH.

- Per Binance Research, those underwater have little incentive to liquidate their holdings after the Shanghai upgrade. Meanwhile, those in profit are likely to keep holding.

Bitcoin Primed to Rally to $56K as Nasdaq Breaks Out of Bull Flag, Chart Analyst Says

- “Based on the first law of physics, an object in motion will continue in motion until an outside force affects it,” Wall Street’s champion trader Martin S. (Buzzy) Schwartz wrote in his book “Pit Bull.”

- Bitcoin (BTC) has rallied nearly 50% in the first seven weeks of the year, reaching a six-month high of $24,900, with outside forces like the sentiment in traditional markets largely supportive. Recently, the crypto market and Wall Street’s tech-heavy Nasdaq index have grown resilient to the Federal Reserve’s angst and the resulting uptick in Treasury yields.

- So one chart analyst expects a continued move higher that could see bitcoin more than double in value in the coming months.

- “Bitcoin is breaking out from a long basing formation. There is a saying, the bigger the base, the higher into space,” William Noble, director of research at Emerging Assets Group and former analyst at Goldman Sachs and Morgan Stanley, told CoinDesk.

- “Bitcoin may move from consolidation to another parabolic move back to $56,000,” Noble said, having correctly predicted the cryptocurrency’s late 2020 surge from $20,000 to $40,000.

- “Going parabolic” is an expression often used in the crypto market to describe an expected impulsive move higher with limited downticks.

- Bitcoin’s recent bull revival follows a prolonged period of sideways trading at the depths of the bear market around $18,000, or the basing pattern, as Noble said.

- The widely tracked momentum indicator relative strength index (RSI) has diverged bullishly on the weekly chart, confirming an end of the downtrend.

- A bullish divergence of RSI occurs when the indicator does not reciprocate the new low on price, as observed in November 2022. That’s a sign of bears losing power and bulls gaining strength.

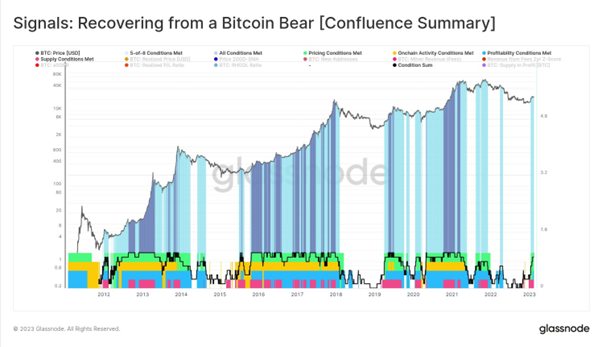

Glassnode: 8 out of 8 #Bitcoin on-chain Signals are now firing from our Recovering from a #Bitcoin Bear dashboard.

- It covers:

- Price models

- Onchain Activity

- Profit/Loss

- Supply Dynamics

- The last one to fire off is Fee Revenue Z-Score due to Inscriptions.