Bitcoin Price: US$ 24,324.05 (+9.57%)

Ethereum Price: US$ 1,674.92 (+7.66%)

Bitcoin’s New Narrative: Ordinals

- Ordinals are data that users inscribe to specific sats on Bitcoin. To inscribe data on Bitcoin, these users use a combination of Taproot and ordinal theory. Users have already used these tools to inscribe mostly JPEGs on Bitcoin. Since going live, these inscriptions have caused a minor frenzy around inscriptions and Bitcoin-native “NFTs.”

- However, change comes slowly to Bitcoin. Many in the Bitcoin community have expressed strong reservations about Ordinals. The recent inscription craze has caused fees to climb and blocks to get much bigger. But the fee increase is a godsend to struggling miners and could help with Bitcoin’s overall security budget — something we noted as a concern earlier this year.

- For the first time in a long time, users are showing up to use Bitcoin rather than just HODL it.

- As Ordinals are new, there are issues to overcome. Content moderation is hugely challenging, the UX/UI needs to be upgraded, and the infra around Ordinals needs to improve. But Ordinal inscriptions are an entirely new use case for Bitcoin. They could bring in a substantial swathe of users who are more into NFTs and digital artifacts than hard money and digital gold.

- The most crucial concept to understand with Bitcoin Ordinals is ordinal theory. Ordinal theory ascribes a unique number to every sat on Bitcoin. As a refresher, a sat (or satoshi) is the lowest denomination of a Bitcoin. Each BTC has 100M sats. In ordinal theory, each of Bitcoin’s 2.1 quadrillion sats has a unique identifier. These identifiers have five different notations — an integer, decimal, degree, percentile or name. Ordinals make each sat unique, with enormous ramifications for Bitcoin.

- Ordinal sats would be interesting enough, but Rodarmor unlocked further potential with Taproot and inscriptions. Inscriptions inscribe sats with arbitrary data. Data can include pictures, gifs, videos (they would have to be short), and even HTML code. People have mostly been inscribing sats with pictures, including copies or derivatives of more popular Ethereum collections.

- Right now, Bitcoin blocks can store 4MB of arbitrary data, so the max size of an inscription is 4MB at status quo. Inscribing data is not free. Users have to pay fees to miners to store that data in a block. In general, the larger the file, the more expensive the fee. Luxor Mining, however, inscribed a wizard inscription that almost took up an entire 4MB block.

- For Ordinals to work on Bitcoin, specialized wallets are required — specifically those with sat control. Bitcoin users pay fees in sats to miners to send transactions. If a wallet can’t “freeze” a sat with an inscription on it, every time a user sends a transaction, there is a risk they could spend the inscribed sat. Only the Ord wallet can fully manage inscribed sats with sat control. However, other wallets like Sparrow can be set up to receive them.

- The current crop of inscriptions look similar to NFTs on Ethereum, leading people to perceive Ordinals as Bitcoin NFTs. But Ordinals have a few different properties that make the NFT model fall short in understanding their potential and how they differ from more familiar NFTs.

- The vast majority of inscriptions are images. If you have followed NFTs during the last two years, the current frenzy of Ordinal inscriptions will look familiar: lots of PFPs, derivative projects, low-effort scams, and a few gems. Some enterprising individuals have been inscribing text, gifs, videos, audio, and even applications on-chain. Someone even managed to inscribe a cloned version of Doom as an Ordinal. Ordinals are arbitrary data, and while people are taking advantage of the technology, they still seem to be focusing on images.

- Continue on Delphi…

Ordinals Support Comes to Bitcoin-Based Web Wallet Xverse

- Xverse, billed as a “Bitcoin wallet for Web3,” just rolled out support for Ordinals, the newly popularized protocol allowing users to inscribe NFTs onto the Bitcoin blockchain.

- “Today, we’ve launched first class support for Ordinals,” tweeted the wallet team on Wednesday. The company explained that inscribing NFTs through its software involves “no need to run a node, complex software, or anything else,” merely some Bitcoin to pay a transaction fee, which can be bought directly through the app.

- Inscriptions are made via Gamma.io, a Bitcoin NFT marketplace that rolled out “no-code ordinal inscriptions” last week. According to Xverse, roughly 5% of Bitcoin inscriptions so far have been made using Gamma’s tool.

- After uploading an image and sending a transaction to their provided Ordinals address, users can find their inscriptions inside their Xverse NFT collection within 20 to 30 minutes—and embedded in the blockchain forever.

- Xverse, too, lets Bitcoin users interact with Stacks, with plans to introduce instant payments via the lightning network.

Gensler opens new regulatory front for crypto firms: custody

- SEC Chair Gary Gensler signaled an escalation to his post-FTX crackdown on the crypto industry on Wednesday, saying that digital asset firms are in broad violation of current custodial rules meant to safeguard customers.

- “The current model in the crypto field is a model that takes control, one would say ownership, of those funds, and commingles that with thousands, and often hundreds of thousands or even millions of other customer funds,” Gensler told reporters following a 4-1 commission vote to further tighten custodial rules.

- “Crypto exchanges today, generally how they’re modelled, do not meet the qualified custodian standards of the current rule” set by the SEC around custody of assets in 2009, he added.

- It’s the latest area where the SEC chair plans to expand scrutiny of digital asset firms, raising the regulatory and legal risks for them even more following a high-profile settlement with Kraken that ended its U.S. staking-as-a-service business and a notice to Paxos that the SEC may sue the company over its involvement in the Binance USD (BUSD) stablecoin.

El Salvador to Launch ‘Bitcoin Embassy’ in Texas

- El Salvador is planning to open a “Bitcoin embassy” in Texas, according to the country’s ambassador to the U.S.

- El Salvadoran ambassador Milena Mayorga said on Twitter yesterday that she had met with Texas Deputy Secretary of State Joe Esparza to discuss the idea.

- The Texas Secretary of State confirmed to Decrypt that they met with El Salvador’s ambassador to the U.S. “to discuss opportunities for cultural and commercial exchange,” but would not elaborate.

Lido DAO’s Governance Token LDO Jumps on Treasury Proposal

- LDO, the governance token of the decentralized autonomous organization (DAO) behind liquid staking system Lido, has gained 10% on the day after it submitted a proposal on Tuesday over whether it should sell or stake the $30 million in ether from its treasury.

- The proposal was submitted by Lido DAO’s financial unit, Steakhouse Financial, and considers four treasury-related proposals, including whether the DAO should sell or stake the 20,304 ether (worth about $30 million) it holds in its treasury, diversify its stablecoin holdings and sell its protocol surplus of staked ether to finance operating expenses.

- The token, LDO, was up 18% early Wednesday and has since retreated to around 10% higher on the day. LDO has gained 30% in a month and witnessed a rally late last week after the news that U.S.-based crypto exchange Kraken had settled with the Securities and Exchange Commission to sunset its crypto staking service in the U.S.

Cosmos Hub to undergo Rho network upgrade today

- The Hub, the central chain of the Cosmos ecosystem, is preparing for the anticipated Rho network upgrade that’s set to launch today around 8 p.m. EST at a block height of 14,099,412.

- The upgrade will bring with it a range of improvements to Cosmos’ testing infrastructure, as well as the addition of what’s called the “global fee” software module — an added piece of code that will allow transaction fees to be collected from users and distributed globally.

- The aim is to improve the security of the Cosmos network by reducing the likelihood of validators colluding or misbehaving, the core development team at Cosmos said.

FTX Transferred $7.7B From Bahamian Estate to US Units Ahead of Bankruptcy Filing, Court Told

- FTX sent $7.7 billion in assets from the crypto company’s Bahamian estate to its U.S. counterparts in the period leading up to its bankruptcy filing last year, a Delaware bankruptcy court was told during a Wednesday hearing.

- Court-appointed joint provisional liquidators in the Bahamas said that $5.6 billion was transferred from Bahamas unit FTX Digital’s custodial accounts to U.S. entity FTX trading, while another $2.1 billion was transferred to FTX’s U.S. trading arm, Alameda Research.

- “And then we have other tangible assets of about $3 million, mostly relating to office furniture, equipment and the fleet of cars that the employees had in the Bahamas,” Christopher Shore, a lawyer for the liquidator, said during the hearing.

- FTX’s new management reached a cooperation agreement in early January with court-appointed liquidators in the Bahamas to iron out disagreements and address the assets in dispute.

- “The cooperation agreement is a starting point. But the issues as to whether assets belong in the Bahamian estate or in the U.S. estate are open issues. And so the statements that Mr. Shore has made in that regard are statements that the U.S. Senators reserved all their rights on, and frankly, disagree with with many,” a representative for FTX said.

Gaming titan Square Enix plots NFT game on Polygon

- Square Enix, the maker of Final Fantasy, is set to debut its blockchain game Symbiogenesis as it wades further into the web3 waters.

- The game, built on Ethereum Layer 2 Polygon, will be a “digital collectable art experience,” according to a company release, with an evolving storyline set on a mysterious floating continent. Holding or trading digital collectables will be key to advancing in the game.

- It will also offer players multiple endings, but only three players will get to play the final “World Mission.”

- “Symbiogenesis was designed from the ground up on the blockchain and is designed to provide an exceptional experience for both community building and trading,” said Symbiogenesis producer Naoyuki Tamate.

- Ahead of the launch of the game this spring, Square Enix is planning a series of campaigns to help its fans get comfortable with blockchain-based products.

Interactive Brokers Rolls Out BTC, ETH Trading to Professional Investors in Hong Kong

- Interactive Brokers (IBKR) has begun offering cryptocurrency trading to professional investors in Hong Kong in partnership with crypto exchange OSL Digital Securities.

- Eligible clients include individuals with over 8 million Hong Kong dollars (US$1 million) in investable assets and institutions with over 40 million Hong Kong dollars ($5 million).

- Interactive Brokers and OSL’s aim is to allow clients to invest in bitcoin (BTC) and ether (ETH) via a single platform alongside stock, options, futures, bonds and so on.

- The two firms teamed up to introduce crypto trading in Hong Kong in June, citing the city’s high concentration of institutional and professional investors.

- Mixed signals have come out of Hong Kong in recent months regarding its future regulatory environment for crypto. Its Financial Services and Treasury Bureau said in October that it was exploring allowing retail customers to trade crypto or approving a crypto exchange-traded fund (ETF).

- However, in November, Julia Leung (then the deputy CEO of the Securities and Futures Commission and now the CEO) called for tougher rules on crypto firms, highlighting how the FTX exchange’s collapse demonstrated the threat that digital assets could pose due to links with traditional financial services.

Ether Staking Service Lido Granted 1M Optimism Tokens to Incentivize Wrapped Staked Ether Adoption

- Ethereum liquid staking protocol Lido Finance has been awarded 1 million optimism (OP) tokens to help scale the adoption of wrapped staked ETH (wstETH) across the Optimism ecosystem.

- The move is part of a broader plan. Last year, Lido said it will reward staked ether (stETH) liquidity providers on Arbitrum and Optimism with a cumulative 150,000 LDO tokens, Lido’s governance token, to attract users to the service.

- Optimism is a speedy and low-cost blockchain that works atop Ethereum, helping to scale the network. Liquid staking refers to the exchange of staked ether for tokenized versions of ether that can be used in decentralized finance (DeFi) applications such as Lido. Uses range from using these tokens as collateral for loans or margin trading to earning yields of up to 6% as of Wednesday.

- Lido and Optimism aim to increase the availability of wrapped staked ether (wstETH) with OP tokens through the new liquidity mining and user incentives program. wstETH is a tokenized version of ether equal to the value of ether locked by a user on Lido.

- “Liquid staking tokens are an essential money lego for the DeFi ecosystem,” Jacob Blish, head of business development at Lido, told CoinDesk in a statement. “The value of wstETH on Optimism is that it further democratizes access to liquid staking for those who do not want to pay or cannot afford to pay mainnet fees.”

- Starting Wednesday, the program will see 1 million OP tokens distributed over a six-month period.

Conflux Network to Build Blockchain-Based SIM Cards in Partnership With China Telecom

- Blockchain protocol Conflux Network will build blockchain-based SIM cards in partnership with China Telecom, the second-largest wireless carrier in China with an estimated 390 million subscribers, as per a Wednesday tweet.

- China Telecom will launch the first BSIM pilot program in Hong Kong later this year, Conflux Network said. This will likely be followed by pilots in key mainland China locations such as Shanghai.

- The BSIM card will manage and store the user’s public and private keys in the card and carry out digital signatures in a way that the private key does not exit the card. The BSIM card can also allow encrypted storage and key retrieval.

- Users who switch to a BSIM card will be able to store digital assets safely, transfer their digital assets conveniently, and display their assets in a variety of applications, Conflux said.

EU Now Accepting Applications for Its Blockchain Regulatory Sandbox

- The European Union’s executive arm on Tuesday launched a regulatory sandbox for innovative applications of distributed ledger technologies (DLT) that underline crypto.

- The European Commission’s blockchain regulatory sandbox, or testing environment, aims to “facilitate the cross-border dialogue with and between regulators and supervisors on the one hand, and companies or public authorities on the other hand,” an official announcement said.

- The initiative is part of a EU funding program to bring businesses, citizens and public administrations to the digital age. The bloc is also exploring how DLT-based solutions could help cut out intermediaries in securities trading, with a pilot due to begin in March.

- The DLT sandbox will run until 2026 and will annually support 20 projects involving blockchain applications for public and private sector use “to verify information and make services trustworthy.”

- The first call for applications is open until April 14, with a panel of independent academic experts selecting projects for the first cohort. The sandbox is open to “companies from all industry sectors” as well as public entities.

- “Priority will be given to more mature use cases where legal and regulatory questions of broader relevance arise,” the announcement said.

Crypto Wallet Messaging Application Push Protocol Expands to BNB Chain

- Communications network Push Protocol will expand to BNB Chain, the world’s largest smart contract blockchain in terms of daily active users, as part of a broader plan to gain more users.

- According to DeFiLlama, BNB Chain is the third-largest blockchain network with more than $5 billion total value locked, and an estimated 230 million unique wallet addresses.

- “Until now, Push Protocol’s web3 notification services have been limited to Ethereum and Polygon,” said Harsh Rajat, project lead and founder of Push Protocol, in a statement to CoinDesk. “We know that BNB Chain is hugely popular with retail investors and are excited to expand our offering to this entirely new segment,”

- Push Protocol enables cross-chain notifications, transactional data, or software-based messaging on on-chain wallets and decentralized finance (DeFi) applications to a user’s wallet address.

- Any smart contract, dapp or back-end service can integrate Push to provide a communication layer through notifications or chats that are tied to the wallet addresses of users.

- This is similar to notifications by websites or applications on smartphones, where relevant or important information is shown to users.

- Push Protocol’s native PUSH tokens were trading at 38 cents at the time of writing time.

- Australian cryptocurrency exchange Digital Surge is set to come back online after stakeholders signed the recovery plan on Wednesday, according to documents seen by CoinDesk.

- The stakeholders signed the recovery plan a day before the exchange was set to go into liquidation, according to documents submitted to Australian Securities and Investments Commission (ASIC). Creditors were notified earlier today through a circular.

- The exchange is expected to resume trading next week, a person familiar with the situation said.

- The Brisbane-based exchange was hit hard by the collapse of FTX as it held 33 million Australian dollars on the defunct platform founded by Sam Bankman-Fried.

- This is the first successful restructuring of a Australian cryptocurrency exchange, according to Michael Bacina, digital asset specialist and partner at Piper Alderman. “Digital assets face challenging legal issues, and it took the hard work of knowledgeable specialists to get here. The deal is a testament to the goodwill seen throughout the blockchain community in Australia,” Bacina added.

Cardano Gets ‘Valentine’ Upgrade: Here’s How it Benefits ADA Token

- An upgrade to improve security and interoperability features on the Cardano blockchain was pushed live in early Asian morning hours on Wednesday.

- Dubbed “Valentine,” the upgrade will make enhancements to cross-chain functionality for decentralized finance (DeFi) applications building on the network. It was proposed earlier in February and voted favorably by network validators, as CoinDesk reported.

- The upgrade is said to bring enhanced cryptographic features to Cardano while improving cross-chain decentralized application (dapp) development on Plutus – the smart contract platform of the Cardano blockchain.

- “Interoperability is key for blockchain growth. As more dapps are built on Cardano, it is essential that they are not siloed to just one ecosystem, enabling users to interact with different blockchains and access a wider range of services,” a Cardano developer and code maintainer said in a tweet.

- Cross-chain bridges are software applications that enable transactions to occur between various blockchains.

- Such a feature on Cardano would allow developers to build applications that connect Cardano with other blockchains, which would in turn give users access to other blockchains to interact easily with financial services offered by Cardano dapps.

Glassnode: Ordinal Theory and the Rise of Bitcoin Inscriptions

- Emergence of Ordinal Theory. The satoshi is the smallest unit of account within the Bitcoin blockchain, equal to 0.00000001 BTC, or one-one-hundred-millionth of a bitcoin. Ordinal theory is a proposed methodology for individually identifying (via a serial number), and tracking each individual satoshi throughout the Bitcoin coin supply. The methodology tracks satoshis as they travel from first minting, through the full lifespan of transactions.

- It is important to note that Ordinal Theory is a theoretical concept and methodology overlaid into Bitcoin UTXO set at the social layer. It has no on-chain footprint, and satoshis are not actually serialized at a protocol level.

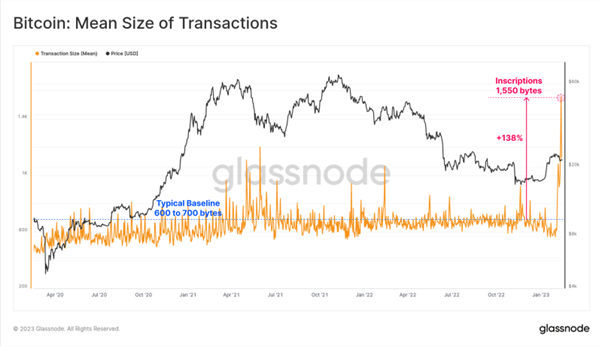

- Inscriptions are a new technology which leverages both the discounted Witness data footprint, and the newly unconstrained per-transaction Witness data size. In effect, it is a method to insert arbitrary data such as images, audio files, and even software into the Witness data portion of a transaction. The chart below shows how the average Bitcoin transaction size has increased by 138% in recent weeks, as Inscription transactions with a larger data footprint increase in number.

- These Inscriptions are best described as digital artefacts, which differ from NFTs found on other chains. Typically, NFTs found on Ethereum or Solana are a unique token which contains a reference pointer to the target file (such as an image file) hosted elsewhere. Hosting services range from cloud servers, to IPFS, to file-storage blockhains, each with unique counterparty risk trade-offs, and unique to each NFT token. Inscriptions on the other hand actually contain the raw file data, written directly into the Bitcoin blockchain, making them somewhat unique in character.

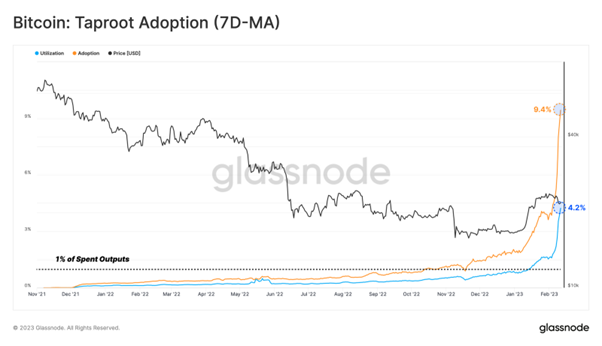

- The effect of this new innovation has seen Taproot adoption and utilization spike to all-time-highs of 9.4% and 4.2% respectively (please refer to our research piece for more information on adoption vs utilization).

- Since Ordinals have no on-chain footprint, the protocol level fungibility remains unchanged. However, fungibility at the social layer is altered, with individual sats now having a form of rarity, and a history of inscribed information. Should Ordinal Theory and Inscriptions catch, this effectively alters the perceived value of each satoshi, such that a collector may be willing to pay more than the notional value due to the carried Inscription.

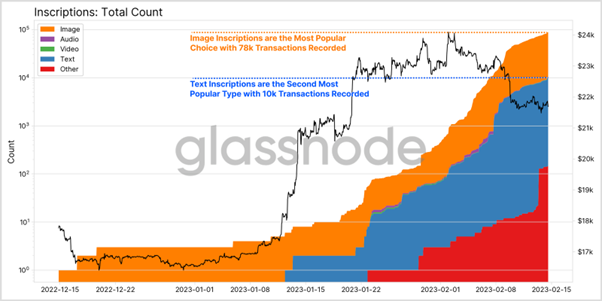

- The total number of Inscriptions is above 90k at the time of writing, with the most popular format being image files, with over 78k to date, and text representing over 10k inscriptions (note chart below left hand scale is log).

- Continue on Glassnode Insights…