Bitcoin Price: US$ 17,356.34 (-2.51%)

Ethereum Price: US$ 1,266.54 (-3.13%)

A Nuanced Approach to Estimating Mark-to-Market Crypto-Asset Values

- In other words, Alameda transferred their illiquid book to FTX in exchange for liquid customer funds.

- Imagine this:

- Alameda has $100M of an illiquid token, XYZ, that trades at $1. They can’t liquidate XYZ for $100M due to liquidity constraints. But, they do need $100M to conduct their business.

- Alameda reckons they can borrow $100M against their XYZ token, cover the losses, and repay the loan. Borrowing against risk assets is not uncommon, but it potentially puts the lender in trouble if liquidity conditions for the collateral asset depreciate. A maximum loan-to-value ratio needs to be set in stone based on this. More importantly, the ratio needs to be adhered to.

- If the value of the collateral drops such that the loaned XYZ token is now valued at $75M, then FTX can ask for more collateral or liquidate Alameda. This plays out smoothly as long as the mark-to-market (MTM) value of the collateral equals the USD value of the loan.

- The scenario works unless the value of the collateral drops significantly or there is a bank run on FTX. In an unfortunate turn of events for Alameda and FTX, both of the mentioned scenarios played out.

- A statement issued by Caroline Ellison supports the claim that Alameda used illiquid assets as collateral to obtain a loan from FTX. Per The New York Times: “She said Alameda had taken out loans and used the money to make venture capital investments, among other expenditures…lenders moved to recall those loans…but the funds that Alameda had spent were no longer easily available, so the company used FTX customer funds to make the payments.”

- To further cement this claim, the testimony of John J. Ray III (current CEO of FTX) reads: “First, customer assets from FTX.com were commingled with assets from the Alameda trading platform. Second, Alameda used client funds to engage in margin trading which exposed customer funds to massive losses. Third, the FTX Group went on a spending binge in late 2021 through 2022, during which approximately $5 billion was spent buying a myriad of businesses and investments, many of which may be worth only a fraction of what was paid for them. Fourth, loans and other payments were made to insiders in excess of $1 billion.”

- If Alameda cannot repay the loan, then FTX, in theory, should’ve been able to liquidate the XYZ token for $100M to make the customers whole.

- However, this assumes that there is either sufficient liquidity to sell the collateral assets or that there are willing buyers on OTC markets.

- None of the above materialized. FTX wasn’t able to liquidate its assets. Alameda didn’t repay its loans. In the end, the customers ended up with the short end of the stick.

- Continue on Delphi…

Valhalla Floor Price Surges After Armory Token Airdrop

- Valhalla is a gaming and web3 culture-focused NFT collection, created by a Los Angeles-based startup called Stacked. On Dec. 7, the collection announced a token airdrop for the NFT holders.

- Holders will receive 5 tokens per NFT over the course of two weeks. The first token was airdropped on the day of the announcement itself. Since then, floor price has increased by 267% from an average of 0.7 ETH on Dec. 7 to an average of 1.87 ETH yesterday.

- Called Armory Tokens, holders can use them to re-roll specific Avatar traits. Re-rolling refers to updating the on-chain metadata of the user’s Avatar NFT. This action requires the user to burn the corresponding Armory Token as well.

- While these tokens do not expire, they can only be used during certain periods, with the first re-roll period occurring from Dec. 14 to Dec. 28. Once a trait is re-rolled, the change cannot be reversed.

- Valhalla has also introduced an event-only trait called “Chainsaw”, which will only be available for the next two weeks before being retired. The perceived scarcity has made this a highly sought-after trait.

Watch The Year Ahead for DeFi (Video) – Youtube

- We sit down with Ashwath Balakrishnan, Division Lead for DeFi at Delphi Digital, to look at the year that was and the year that may be in the world of Decentralized Finance.

Telegram’s No-SIM Signup Feature Helps Toncoin Rally, Bitcoin Also Higher

- Messaging app Telegram recently unveiled a new privacy-boosting feature, lighting a fire under toncoin (TON), the native token of the decentralized layer one blockchain The Open Network, formerly known as Telegram Open Network.

- On Dec. 6, Telegram announced that users can purchase an anonymous number on the Telegram founder’s Fragment blockchain by paying Toncoin. Users can then utilize the unknown number to sign up for Telegram, bypassing the need to use a SIM card to apply for the service as previously required. Other end-to-end messaging applications like Signal and WhatsApp still require users to use their own mobile numbers.

- TON has rallied 30% from $1.84 to $2.4 since the official announcement, with prices reaching as high as $2.8 at one point. Bitcoin, the leading cryptocurrency by market value, has gained a meager 4.5% during the same period, CoinDesk data show.

Coinbase Introduces Recovery Tool for Lost ERC-20 Tokens: Report

- U.S.-based crypto exchange Coinbase (COIN) has introduced a feature that will help customers recover more than 4,000 as-yet unsupported ERC-20 tokens sent to its ledger, according to a TechCrunch report. An ERC-20 token refers to any cryptocurrency created on the Ethereum blockchain.

- “It’s been a pain point for customers who sent ERC-20 tokens to a Coinbase receive address,” Will Robinson, vice president of engineering at Coinbase, told TechCrunch. “When people accidentally sent these assets, they were effectively stuck up until this point.”

- The feature will become available in the next few weeks for customers, except those in Japan or users of Coinbase Prime. There will be a 5% recovery fee for amounts over $100 in addition to a separate network fee that applies to all recoveries.

- While transfers of ERC-20 tokens aren’t significant, they are popular among developers who want to create their own tokens on the Ethereum blockchain and other users who believe in the networks behind those tokens.

- Some of the most popular ERC-20 tokens are uniswap (UNI), aave (AAVE), 0x (ZRX) and chainlink (LINK).

Flow Hits New Low After NFT Trading Craters, Dapper Downsizes

- Flow surged to prominence in early 2021 as NBA Top Shot led the charge for NFTs into the mainstream. But amid a significant decline in trading action on the platform and following recent layoffs from creator Dapper Labs, the blockchain’s native coin just set a new all-time low.

- Flow, the network’s eponymous native cryptocurrency, fell to $0.89 early this morning, marking a new low according to data tracked by CoinGecko. It has rebounded slightly to above $0.90, but Flow is still down 6% on the day, nearly 14% over the past week, and about 26% in 30 days.

Crypto.com Receives License as a Payment Institution in Brazil

- Crypto.com has obtained a Payment Institution License from the Central Bank of Brazil, the crypto exchange said on Thursday.

- The license allows the company to continue offering regulated fiat wallet services in the country, where the Crypto.com Visa card has been available since 2021.

- “Brazil and the entire Latin America market is a significant region in the pursuit of our vision of cryptocurrency in every wallet,” Crypto.com CEO Kris Marszalek said in a statement. Marcos Jarne, general manager and head of legal for Latin America at Crypto.com, added that “Latin America is a major driver in crypto adoption and regulators have also been playing a key role to foster this.”

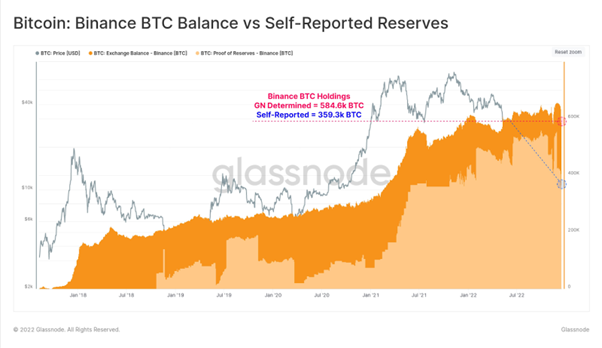

Glassnode

- A property of public blockchains is our ability to monitor the balances held by large entities (like Exchanges).

- For Binance, we estimate total #Bitcoin holdings at around 584.6k $BTC (dark-🟠).

- This compares to 359.3k $BTC in self-reported Proof-of-Reserves wallets (light-🟠).