Bitcoin Price: US$ 24,305.24 (-0.56%)

Ethereum Price: US$ 1,935.31 (-2.43%)

Is This The Most Reliable BTC Bottom Signal?

- Acala Network suffered an exploit where hackers minted over 1.2 billion aUSD tokens, leading to a 99% collapse in price.

- Venture capital firm Dragonfly acquired MetaStable Capital, hedge fund with $400 million under management.

- Aave began blocking addresses that have previously received ETH withdrawals from Tornado Cash.

- Galaxy Digital terminated its acquisition of crypto custodian BitGo, citing a failure to deliver audited financial statements.

- In July 2022, the Puell multiple, one of the most reliable bottom signals for BTC, fell to 0.34. This is the lowest the indicator has gone since 2019.

- Even as the indicator currently sits at 0.54, values under 0.50 have historically marked price bottoms and are considered as good accumulation zones.

- So, what exactly is the Puell multiple? Well, it’s the daily issuance of BTC (in USD) divided by the 365-day moving average of the daily issuance of BTC (in USD).

- In other words, it compares the short-term revenue of BTC miners to its longer term trend. A lower score equates to lower revenue for miners.

- Since 2014, the Puell multiple has gone below 0.50 only 4 times: during the previous market bottoms of 2015 and 2019, the Covid-induced crash of Spring 2020, and most recently in July 2022.

- Although the indicator is not great for smaller time frames, it does specify a good accumulation range for long-term investors.

- Even as the Puell multiple seems to indicate a market bottom, other indicators must be used in tandem to conduct a meaningful analysis.

BitGo to sue Galaxy Digital for $100M over dropped acquisition

- Digital asset custodian BitGo said it planned to seek more than $100 million in damages from Galaxy Digital, alleging the investment firm owed the funds as part of a “reverse break fee” in its decision to terminate an acquisition agreement.

- In a Monday blog post, BitGo referred to Galaxy’s actions as “improper” in claiming a breach of contract to drop an agreement to acquire the digital asset custodian. BitGo has enlisted the services of law firm Quinn Emanuel to pursue legal action against Galaxy for not paying a “$100 million reverse break fee it had promised back in March 2022.”

- According to Galaxy, BitGo failed to provide audited financial statements for 2021 by July 31, 2022 as part of the acquisition agreement, a claim Quinn Emanuel partner R. Brian Timmons denied:

- “The attempt by Mike Novogratz and Galaxy Digital to blame the termination on BitGo is absurd […] Either Galaxy owes BitGo a $100 million termination fee as promised or it has been acting in bad faith and faces damages of that much or more.”

Celsius Network coin report shows a balance gap of $2.85 billion

- A new bankruptcy coin report filed on Sunday shows that troubled crypto lender Celsius’ actual debt stands at $2.85 billion against their bankruptcy filing claims of a $1.2 billion deficit.

- The latest report shows that the company has net liabilities worth $6.6 billion and total assets under management at $3.8 billion. While in their bankruptcy filing, the firm has shown around $4.3 billion in assets against $5.5 billion in liabilities, representing a $1.2 billion deficit.

- The coin report also noted that of the total 100,669 Bitcoin (BTC) deposited by investors, the company has lost 62,853 BTC and currently holds only 37,926 BTC. Wrapped Bitcoin (WBTC) currently represents 64% of the company’s BTC debt.

- The company filed for Chapter 11 bankruptcy on July 14 after it became one of the many crypto lenders to perish in the wake of crypto contagion caused by the now-defunct Terra-USD collapse, which was aggravated further after the crypto market collapse.

Ethereum ICO-era whale address transfers 145,000 ETH weeks before the Merge

- An Ethereum whale wallet that participated in the genesis initial coin offering (ICO) and obtained about 150,000 Ether (ETH) in 2014 was activated again on Aug. 14 after three years of dormancy.

- The whale address transferred 145,000 ETH to multiple wallets as the price of Ether surged to a new three-month high of over $2,000. The transfers were made in batches of 5,000 ETH, with a few transfers of over 10,000 ETH. The total value of the transferred Ether is over $280 million, and the wallet address currently has a balance of 0.107 ETH.

- The 145,000 ETH transfer was only the second time the whale wallet has been activated since the ICO, the first being in July 2019 when it sent 5,000 ETH to the exchange Bitfinex while Ether was trading at $219, with the transaction valued at just over a million dollars.

- The movement of such a high amount of ETH attracted community attention, with many claiming it could be dumped before the Merge — the official transition of the current proof-of-work-based blockchain to a proof-of-stake one. However, it is important to note that most transactions are to unknown wallets rather than an exchange.

US Fed Opens Pathway for Crypto Banks to Tap Central Banking System

- The U.S. Federal Reserve said Monday it is publishing its final guidance for novel financial institutions to access its “master accounts,” something these firms need to participate in the global payment system.

- Monday’s announcement would seemingly move the U.S. central bank one step closer to possibly allowing Wyoming special purpose depository institutions (SPDI), like Custodia (formerly Avanti) and Kraken Bank, access to these accounts so they would not need intermediary banks. The Fed first proposed guidance last year, opening up a request-for-comment process. Nearly 300 respondents filed comments, leading to a second public feedback process earlier this year.

- In a statement, Fed Vice Chair Lael Brainard said, “The new guidelines provide a consistent and transparent process to evaluate requests for Federal Reserve accounts and access to payment services in order to support a safe, inclusive, and innovative payment system.”

- The guidance is largely similar to what was first proposed in 2021, and will create a multi-tiered system allowing the Fed to adapt its evaluation process for granting access depending on what kind of financial institution is applying. Each tier corresponds to a respectively more stringent review process.

Crypto Funds See Minor Outflows, Ending Six-Week Inflows Streak: CoinShares

- Crypto funds had $17 million in outflows in the seven days up to Aug. 12, ending six consecutive weeks of inflows, according to a CoinShares report.

- Bitcoin (BTC) investment products saw $21 million in outflows, and short bitcoin positions, which bet on a price decline of the largest cryptocurrency by market capitalization, had $2.6 million in inflows.

- Altcoin funds had outflows of just $100,000 for ethereum and tron and $200,000 for cardano and XRP.

- For crypto investment providers, outflows were split across ProShares, Purpose, 3iQ Digital Asset Management and CI Investments.

- “It is difficult to discern if this is a meaningful change in sentiment given its small size, although minor outflows were seen across a broad set of providers,” James Butterfill, CoinShares’ investment strategist, wrote in the report. “It also comes at a time of low trading volume and a recovery in prices, suggesting there could be an element of minor profit-taking.”

- Outflows were spread across regions. Canadian outflows totaled $26 million and U.S. outflows totaled $10 million. Australia, Brazil and Switzerland all saw outflows of around $1 million.

- During the recent capitulation event, Bitcoin migrated from weaker hands, to those stepping in at the lows.

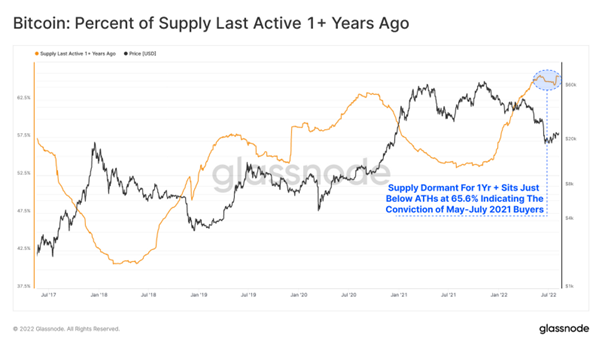

- In this weeks edition, we shall explore the Maturity Gauntlet. This is the maturation process of of BTC holdings in investor wallets. Generally, longer hold times signify improving odds of a higher conviction, and cost insensitive owner. After such a deep capitulation, we are seeking to characterize out who sold, and who stepped in at the lows.

- Currently, Supply Active 1+ Years sits just below the previous ATH set in May 2022 at 65%. This highlights the significant conviction of May-July 2021 buyers after the great miner migration. The equilibrium over the last three months indicates that coin maturation is in balance with spending. This is can be considered a constructive mechanic within a bear market.

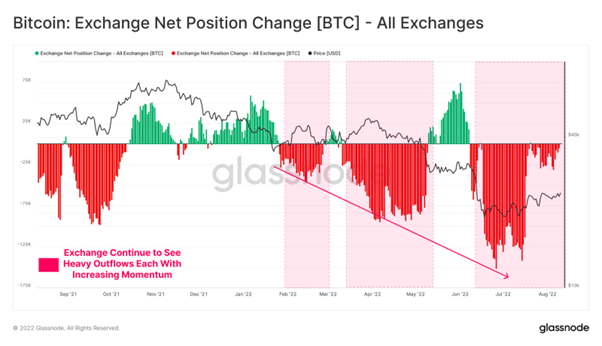

- Beginning with Exchange Balances, Exchanges continue to experiences a macro decline in supply held, with this trend developing since the March 2020 capitulation event. Year to date, exchange outflows have continued with generally increasing intensity as prices declined. This underscores a persistent structural demand, from both small and large investors, for sovereign self custodial assets.

- On balance, Exchanges have seen a net outflow of -100K BTC following the May 2022 LUNA capitulation, which accounts for 3.2% of the total outflows since the March 2020 ATH.