Bitcoin Price: US$ 20,226.71 (+0.26%)

Ethereum Price: US$ 1,638.39 (+4.06%)

ETHW Plummets After Bellatrix Upgrade Is Activated On Ethereum

- US Treasury says that users may apply for a license to withdraw funds deposited into Tornado Cash before sanctions were announced.

- Alex Mashinsky, the CEO of bankrupt crypto lender Celsius, plans to revive the firm with a focus on custody.

- KKR partners with Securitize to tokenize interest in a healthcare-focused PE fund. Tokens will be issued on Avalanche with trading limited to qualified buyers.

- South Korean court issues an arrest warrant against Do Kwon, co-founder of Terraform Labs.

- Since the Bellatrix upgrade was activated on Ethereum on September 6th, ETHW tokens declined 44% to hit an all-time low of $27 on September 12th. During the same period, ETH tokens rose by 9%.

- ETHW tokens represent an IOU from a particular centralized exchange to deliver an equivalent number of tokens from a potential proof-of-work hard fork of Ethereum.

- Currently, each Ethereum node is represented on two layers, the consensus layer (running proof-of-stake) and execution layer (running proof-of-work). The Bellatrix upgrade ensured that validators are producing updated blocks on the consensus layer that contain the code for merging the two layers.

- As this last major hurdle before the Merge was cleared, increasing confidence in Ethereum’s successful transition to proof-of-stake likely caused a divergence among market prices.

- Since such a hard fork has not happened yet, ETHW is a highly speculative token which may not be withdrawn to an on-chain wallet or transferred across exchanges. In the event that such a hard fork does not materialize, these tokens are likely to suffer extreme drawdowns or get delisted.

As Ethereum Merge Looms, Michael Saylor Pushes Back Against Bitcoin’s Energy Critics

- The Bitcoin maximalist, executive chairman of MicroStrategy and alleged tax evader said Wednesday in a letter that mining is “the most efficient, cleanest industrial use of electricity.” He said that Bitcoin’s mechanism is 100 times greater in its output cost than its input.

- Estimates place the annual energy consumption of Bitcoin on par with that of a small country. But proponents of the original cryptocurrency and its energy-intensive proof-of-work consensus mechanism argue that much of the burn comes from green sources, like wind and solar.

- In the PoW model, miners race against each other to add new blocks to the chain. But other popular blockchains are eschewing PoW. Ethereum’s pending Merge upgrade to a proof-of-stake consensus system is intended to significantly reduce those environmental concerns.

- In Saylor’s telling, it’s not so simple. He argued that “dedicated energy” powering these devices will move to “generic computers,” redistributing efficiency that would not limit carbon emissions. Saylor has previously pledged to defend Bitcoin against energy critics as a founding member of the Bitcoin Mining Council.

Crypto Network Tron Set to Capitalize on DeFi Boom With Wintermute as Market Maker

- The decision by blockchain network Tron to name Wintermute as the decentralized finance (DeFi) ecosystem’s official market maker is likely to help boost trading volumes in a network that’s already growing faster than rivals.

- Wintermute, which trades billions of dollars across crypto markets daily, will provide stability for Tron’s native TRX tokens and liquidity for major TRX trading pairs across various exchanges, Tron said Monday. That could help the token, which has daily trading volume of over $390 million across multiple crypto exchanges, data show, placing it among one of the most traded tokens but a fraction of ether’s $22 billion daily volume.

- Still, the network’s popularity has been growing. Tron has added over $1.2 billion in value since June even as the value locked on DeFi markets on other blockchains, such as Ethereum and Solana, has tapered off. In total, the ecosystem locks up over $5.5 billion worth of cryptocurrencies, with the decentralized lending market JustLend holding over $3.3 billion alone.

Terra’s Luna, Luna Classic Tokens Plunge as South Korea Issues Arrest Warrant for Do Kwon

- Terra tokens luna (LUNA) and luna classic (LUNC) plunged as a South Korean court issued an arrest warrant against Do Kwon, the network’s founder, and five others on Wednesday morning.

- LUNA fell 36% in the past 24 hours while LUNC dropped 25%, with much of the price movement coming after news of the warrant was made public on Wednesday morning. The warrant was issued four months after the collapse of the $40 billion Terra ecosystem and its algorithmic stablecoin (UST), which was the first domino to fall in this year’s crypto winter.

- Valued locked on Terra-based products fell 30%, dropping from more than $55 million to under $29 million at the time of this writing as the tokens fell and with investors likely withdrawing capital, data shows.

Google’s $4B Fine May Threaten Web3 Protocols, Legal Expert Says

- A European Union (EU) court judgment issued Wednesday didn’t just uphold one of the world’s biggest-ever antitrust fines, but it also carries a warning for developers of future Web3 open-source protocols, a legal expert has told CoinDesk.

- Ostensibly targeting one of the giants of Web 2.0 – Google – EU judges may have effectively constrained open-source developers by restricting controls on how their creations evolve, Amsterdam University’s Thibault Schrepel told CoinDesk.

- The complaint originated in 2018, when antitrust enforcers from the European Commission said the search giant and its parent company Alphabet had restricted competition by effectively forcing Android phones to pre-install Google’s own search app, and imposed a record-breaking sanction of 4.343 billion euros (US$4.336 billion).

- That decision was largely upheld by judges at the EU General Court Wednesday, even if they reduced the fine slightly to 4.125 billion euros. However, buried in their 1,100 paragraphs of legal reasoning is a potential bombshell for open-source developers.

Compound Treasury to let institutions use digital assets as collateral when borrowing USD or USDC

- Compound Treasury, a cash management solution for institutions powered by the Compound Protocol, announced on Sept. 14 that accredited institutions can now borrow USD or USDC with fixed rates starting from 6% APR, using Bitcoin (BTC), Ether (ETH), and supported ERC-20 assets as collateral.

- The DeFi-backed company whose notable clients include crypto companies, fintech institutions and banks, shared that the decision was made in response to recent market volatility, which has created a more robust demand for liquidity.

SEC Chair Gensler holds tight to his crypto position in preview of Senate testimony

- United States Securities and Exchange Commission Chairman Gary Gensler is scheduled to testify before the U.S. Senate Committee on Banking, Housing, and Urban Affairs in a hearing titled “Oversight of the U.S. Securities and Exchange Commission” on Sept. 15. The transcript of his speech was released in advance.

- Gensler called securities laws a “gold standard” of capital markets. In his 13-page comprehensive discussion of those markets, crypto markets took up about a page and a half, including footnotes.

- Gensler restated his belief that most cryptocurrencies are securities. Given that philosophy, he has asked SEC staff to “work directly with entrepreneurs to get their tokens registered and regulated, where appropriate, as securities.” He further stated that many intermediaries, such as exchanges, broker-dealers, and those with custodial functions, deal in securities and should be registered with the SEC “in some capacity.” In addition, he said:

- “Given the nature of crypto investments, I recognize that it may be appropriate to be flexible in applying existing disclosure requirements.”

BNB Chain to collab with Google Cloud to bolster Web3, blockchain startups

- Binance’s smart contract blockchain platform BNB Chain has partnered with Google Cloud to bolster Web3 and blockchain startups.

- Startups that are currently building products and services on the BNB Chain blockchain will also be able to build on Google Cloud’s scalable, secure and open source infrastructure.

- This will see over 1,300 active, BNB Chain-based decentralized applications (DApps) from the world of decentralized finance (DeFi), Metaverse, blockchain games and nonfungible tokens given access to the tools and infrastructure provided by both platforms.

- These projects will also be able to make use of Google Cloud for data encryption and on-demand analysis of on-chain data in real time. A key takeaway is providing the platform for developers and projects access to carbon-neutral cloud infrastructure to scale offerings.

- The partnership will also facilitate access to the Google for Startups Cloud Program to specific Web3 builders from the BNB Chain ecosystem. This includes projects that have been identified for the BNB Chain’s Most Valuable Builder (MVB) Accelerator initiative.

- The Google for Startups Cloud Program awards Google Cloud credits annually for up to 2 years to help early-stage businesses establish and grow their projects.

Emerging markets lead global adoption index: Chainalysis report

- While global adoption slowed down because of the chilling winds brought about by the crypto winter, emerging markets seem to be on fire in terms of crypto adoption as they surpass higher-income countries in an index that measures adoption.

- In a report titled, “The 2022 Global Crypto Adoption Index,” blockchain data platform Chainalysis analyzed the millions of crypto transactions worldwide, web traffic and other on-chain metrics to determine which countries are on top in terms of cryptocurrency adoption.

- The results show that in terms of crypto adoption, emerging markets are at the forefront. According to the data, lower-middle-income countries like Vietnam, Philippines, Ukraine, India, Pakistan, Nigeria, Morocco, Nepal, Kenya and Indonesia hold positions in the top 20 countries in terms of overall index score, with Vietnam holding the number one spot.

- Upper-middle-income countries like Brazil, Thailand, Russia, China, Turkey, Argentina, Colombia and Ecuador have also made it into the list while the United States and the United Kingdom are the only representatives of high-income countries within the index.

- Apart from the adoption rankings, the report also showed that even though adoption became slower amid the bear market, adoption levels are still higher than what the industry witnessed before the bull run of 2020.

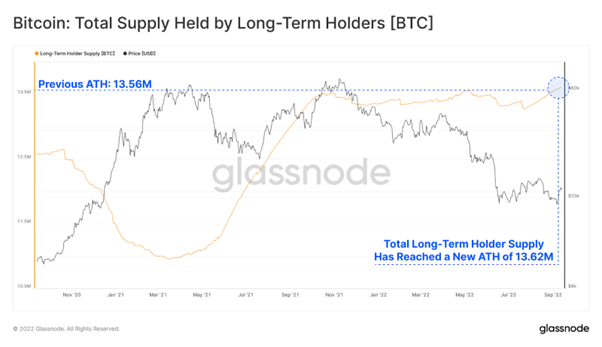

- #Bitcoin: Total Supply Held by Long-Term Holders has reached a new ATH of 13.62M $BTC.

- LTH Supply is the volume of #Bitcoin which has been dormant for 155-days, and is statistically the least likely to be spent during market volatility.