Bitcoin Price: US$ 16,619.46 (+1.77%)

Ethereum Price: US$ 1,243.28 (+1.78%)

DEX Tokens Outperform CEX Counterparts

- Binance creates a recovery fund to help strong projects facing a liquidity crisis.

- Bloomberg says FTX customers have a slim chance of recovering much of their deposits.

- Crypto.com accidentally sends 320K ETH to Gate.io. Crypto.com CEO says all funds were returned by Gate.io.

- Chiliz announces that 38M CHZ will be used to compensate FTX users that owned CHZ on the platform.

- Curve (fintech company, not the DEX) is in discussions to acquire BlockFi’s credit card customers.

- On Nov. 11, the FTX Group of companies filed for Chapter 11 bankruptcy. This included FTX.com, FTX US, Alameda Research, and other affiliated companies.

- Alameda Research, the group’s trading firm, allegedly collateralized illiquid assets in exchange for customer funds deposited on FTX. Ultimately, this led to the group’s downfall.

- These revelations prompted growing concerns about the solvency of other centralized exchanges (CEX), which soon began to see mass withdrawals. The highest net outflows were seen from FTX, OKX, and Bitfinex.

- Tokens issued by CEXs clearly depict these solvency concerns with a stark underperformance over tokens issued by decentralized exchanges (DEX).

- The chart above shows the price performance of a basket of CEX tokens vs. BTC and a basket of DEX tokens vs. BTC. Since the bankruptcy filing, the DEX basket is up 24% whereas the CEX basket is down 2%.

- As trust in centralized intermediaries has eroded, it stands to reason why the DEX basket has greatly outperformed its CEX counterpart.

- The CEX basket consists of FTT, BNB, GT, ASD, CRO, HT, KCS, OKB, and MX while the DEX basket consists of SUSHI, UNI, BAL, DYDX, PERP, CAKE, and GMX.

Citi: Correlation Between Equity Markets, Bitcoin Weakens Following FTX Collapse

- The correlation between the S&P 500 and bitcoin (BTC) has weakened as crypto markets suffer after the FTX and Alameda Research collapse, Citigroup (C) said in a research report last week.

- The S&P 500 gained almost 6% last week, whereas bitcoin fell by about 20%.

- Traditional financial markets have been largely unaffected by the collapse in an indication that “contagion effects are relatively siloed within crypto,” the report said.

- Given the magnitude of the fallout, it’s not yet certain if contagion into other asset classes has been avoided, but the digital asset sector remains relatively small compared with traditional markets, the report added.

- The bank notes that decentralized exchanges’ volumes have surged as much as 30% so far this month, increasing market share over centralized exchanges such as FTX, “amidst centralized custody fears.”

Multicoin Capital’s third VC fund has exposure of more than $25 million to FTX

- Multicoin Capital, a top-tier crypto venture capital firm, has revealed its more than $25 million stake in FTX via its $430 million venture fund, according to a letter obtained by The Block.

- The crypto venture capital firm’s third venture fund invested $25 million into FTX US, according to the correspondence, which said it represented 5.8% of the fund.

- Multicoin announced the $430 million fund in July. At the time, it told The Block that its founders, Kyle Samani and Tushar Jain, were the biggest LPs in the fund, along with other unnamed institutional backers.

- “This position will be assessed at the end of Q4 in accordance with VF3’s valuation policy, at which time we will determine if a markdown is appropriate,” referring to the venture fund, said the letter.

- Along with the $25 million investment into FTX US, the venture fund also held approximately $2 million on FTX International. It said it held these funds as some of its investments were funded by sending USDC over crypto rails on the exchange rather than via USD wire.

Binance Users Withdrew $1.35B of Bitcoin in Days Following FTX Collapse

- The world’s largest cryptocurrency exchange, Binance experienced record levels of bitcoin, ethereum and stablecoin withdrawals alongside the implosion of rival exchange FTX.

- Binance saw a net 81,712 bitcoin ($1.35 billion), or more than 15% of the roughly 500,000 bitcoin on its exchange, pulled from the platform over the past six days, according to data from CryptoQuant. In addition, a net 125,026 ether ($155 million) and $1.14 billion in stablecoins were withdrawn from Binance over the same period.

- Appearing on a Twitter space on Monday morning, Binance CEO Changpeng Zhao appealed for calm, and said a “slight” uptick in the pace of withdrawals is normal when the prices of cryptocurrencies drop.

- The withdrawals are an industry-wide issue, with Coinglass showing nearly 200,000 bitcoin pulled from exchanges over the past seven days bringing the level of bitcoin held on exchanges down to 1.88 million. Coinbase (COIN), Gemini and Kraken are among the crypto brokers seeing percentage declines similar to Binance.

Crypto Fund Inflows Surged Last Week as Investors Bought on FTX-Induced Dip

- Crypto funds saw their largest inflows in 14 weeks, with net inflows of $42 million in the seven days ended Nov. 11, according to a CoinShares report on Monday.

- The inflows coincided with the crypto market’s sharp downturn, triggered by the collapse of Sam Bankman-Fried’s business empire last week, including the FTX exchange and his Alameda Research trading firm.

- Bitcoin (BTC), the largest cryptocurrency by market capitalization, has fallen over 20% in the past seven days and was trading at about $16,400 Monday. The CoinDesk Market Index was up 0.8% in the past 24 hours.

- Despite the market downturn, the inflows could indicate that investors see “this price weakness as an opportunity” and are “differentiating between ‘trusted’ third parties and an inherently trustless system,” according to CoinShares.

Digital Asset Manager Valkyrie Lays Off 30% of Staff: Bloomberg

- Valkyrie Investments, Inc. has let go about 30% of its 23-person staff in recent weeks, according to a Bloomberg report.

- “Our management team did a thorough review of asset growth year to date and reviewed every employee’s role and contribution. Like many other companies in our industry, cuts needed to be made and ours were limited to sales and marketing,” Valkyrie CEO Leah Wald told Bloomberg.

Solana Foundation Invested in FTX, Held Millions in Sam Bankman-Fried-Linked Cryptos on Exchange

- The Solana Foundation said Monday it has tens of millions of dollars in cryptocurrencies stranded on FTX – as well as 3.24 million common stock shares in Sam Bankman-Fried’s bankrupt crypto exchange.

- In a blog post, the Foundation said it held 134.54 million SRM tokens and 3.43 million FTT tokens on FTX when withdrawals went dark on Nov. 6. Those assets are worth $29.3 million and $4.4 million, respectively, at current market prices per CoinGecko; they were worth around $107 million and $83 million one day before the freeze.

- Those holdings point to deep financial ties between Solana and FTX, which created the FTT token and held court over Serum, an on-chain crypto exchange that Bankman-Fried created and which was at the center of much of Solana-based decentralized finance (DeFi).

Sam Bankman-Fried’s Unceremonious Exit Leaves ‘Alameda Gap’ in Crypto Markets

- Last week’s collapse of Sam Bankman-Fried’s trading firm, Alameda Research, has left such a big hole in cryptocurrency markets that trading liquidity has thinned noticeably, according to a new report from Kaiko.

- The drop in liquidity over the past week is far larger than in any previous market drawdown, and it could be “here to stay” in the short term, according to Kaiko – especially since other trading firms including Amber Group and Genesis Trading have reported funds being trapped on FTX.

- Since Nov. 5, bitcoin liquidity within 2% of the mid-price has fallen from 11,800 BTC to 7,000 BTC, the lowest since early June, according to Kaiko, which analyzed data from 18 crypto exchanges.

- Kraken’s bitcoin (BTC) market depth has fallen by 57%, Bitstamp’s by 32%, Binance’s by 25%, and Coinbase’s by 18%, according to the report.

Binance will launch a new ‘industry recovery fund’

- Binance will launch a new fund to help prop up crypto projects facing liquidity crunches.

- Changpeng Zhao, Binance’s CEO, tweeted about the plan early on Nov. 14.

- “To reduce further cascading negative effects of FTX, Binance is forming an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis. More details to come soon,” said Zhao, adding that qualifying projects can contact Binance Labs, the exchange’s venture capital arm.

- In another tweet, Zhao also opened the door to any crypto investors wishing to contribute to the fund.

Glassnode The Fall of FTX

- Amidst this chaos, it is important to remember that the digital asset space is a free market, and this event represents a failure of a trusted centralized entity, not of the underlying cryptographic technology. There are no bail outs for Bitcoin, and the forest fire of an industry wide deleveraging will purge all excess and malfeasance, albeit with significant pain along the way. With a renewed focus on exchange Proof-of-Reserves underway, and a push towards self-custody, the market will heal, recover, and return stronger in the months and years ahead.

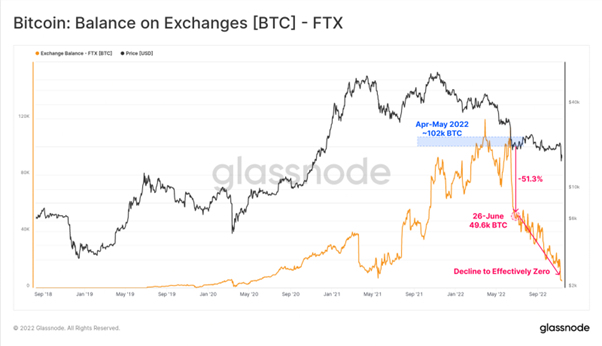

- The supply of ETH held on FTX has also experienced two periods of significant decline:

- In June, where reserves dropped by -576k ETH (-55.2%)

- This week, falling from 611k ETH to just 2.8k (-99.5%)

- Similar to the Bitcoin balance, this leaves close to no ETH in FTX owned wallets, with the bank run effectively clearing what was left from the balance sheet.

- Whilst there remains significant uncertainty regarding what really happened between FTX and Alameda, there remains a growing pool of on-chain data to suggest cracks had formed as far back as May-June. This would leave recent months as being simply a precursor to what was more than likely an inevitable collapse of the exchange.

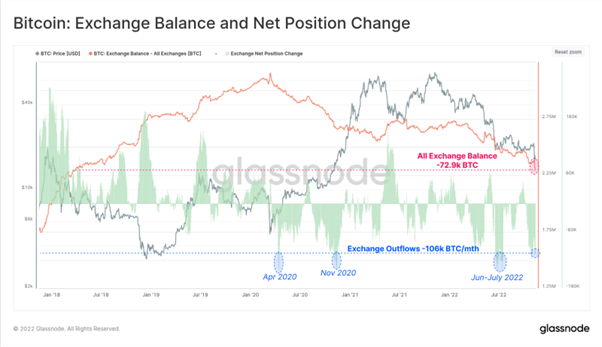

- On an industry wide scale, we have seen a withdrawal of coins from exchanges at a truly historic rate, as holders seek the safety of self-custody. The following charts map out the aggregate balance change of exchanges, investor wallet cohorts, and miners since the 6-Nov, when rumblings of troubles at FTX were still in their infancy.

- Exchanges have seen one of the largest net declines in aggregate BTC balance in history, falling by 72.9k BTC in 7-days. This compares with only three periods in the past; Apr-2020, Nov-2020, and June to July 2022.

- Continue on Glassnode Insights…