Bitcoin Price: US$ 24,305.24 (-0.56%)

Ethereum Price: US$ 1,935.31 (-2.43%)

Mailchimp bans crypto content creators without prior notice

- The email marketing platform Mailchimp appears to have suspended its services to crypto content creators. Platforms associated with crypto news, content or related services started to have issues logging into accounts, followed by notices of service interruptions that began surfacing this week.

- Crypto-associated accounts such as the Edge wallet, a provider of self-custody crypto holding services, and Messari, a crypto research company, were among some of the affected.

- Early this morning, Sam Richards, at the Ethereum Foundation Tweeted that the Ethereum Foundation Ecosystem Support Program is likewise facing suspension.

Russia plans to roll out digital ruble across all banks in 2024

- The Bank of Russia continues working towards the upcoming adoption of the central bank digital currency (CBDC), planning an official digital ruble rollout in a few years.

- According to the Bank of Russia’s latest monetary policy update, the authority will begin to connect all banks and credit institutions to the digital ruble platform in 2024. That would be an important year for Russia as the country is expected to hold presidential elections in March 2024 and incumbent President Vladimir Putin has the constitutional right to get re-elected.

- By that time, the central bank expects to complete “real money” customer-to-customer transaction trials as well as the testing of customer-to-business and business-to-customer settlements.

- In 2023, the Bank of Russia also intend to conduct beta testing of digital ruble-based smart contracts for trades by a limited circle of participants.

- The bank pointed out that it expects to proceed with the CBDC rollout in a gradual manner, unlocking new different trials and features year by year. As soon as the Federal Treasury is ready, the digital ruble will also feature consumer-to-government, business-to-government, government-to-consumer and government-to-business payments, the Bank of Russia said.

Crypto markets bounced and sentiment improved, but retail has yet to FOMO

- An ascending triangle formation has driven the total crypto market capitalization toward the $1.2 trillion level. The issue with this seven-week-long setup is the diminishing volatility, which could last until late August. From there, the pattern can break either way, but Tether and futures markets data show bulls lacking enough conviction to catalyze an upside break.

- Investors cautiously await further macroeconomic data on the state of the economy as the United States Federal Reserve (FED) raises interest rates and places its asset purchase program on hold. On Aug. 12, the United Kingdom posted a gross domestic product (GDP) contraction of 0.1% year-over-year. Meanwhile, inflation in the U.K. reached 9.4% in July, the highest figure seen in 40 years.

- The Chinese property market has caused the Fitch Ratings credit agency to issue a “special report” on Aug. 7 to quantify the impact of prolonged distress on a potentially weaker economy in China. Analysts expect asset management and smaller construction and steel-producing companies to suffer the most.

- In short, risk asset investors are anxiously waiting for the Federal Reserve and Central Banks across the world to signal that the policy of tightening is coming to an end. On the other hand, expansionary policies are more favorable for scarce assets, including cryptocurrencies.

Uzbekistan blocks access to foreign crypto exchanges over unregistered trading

- The government of Uzbekistan, which has previously made significant steps toward a moderate approach to crypto, announced Wednesday that it has restricted access to a number of large international crypto exchanges due to accusations of unlicensed activity.

- In a statement from Aug. 10, the National Agency of Perspective Projects (NAPP) projects informed that “various electronic platforms” provide services for trade and exchange of crypto-assets without obtaining the required license in violation of the existing legislation and thus access to them was restricted.

- However, the tone of the statement suggested that after obtaining a license and fulfilling the requirement to deploy servers on the territory of the Republic of Uzbekistan, as prescribed by law, there should be no further obstacles to foreign exchanges providing their services. As for now:

- “They have no legal responsibility for transactions with crypto-assets, and cannot guarantee the legitimacy of transactions, as well as the proper storage and protection of confidentiality of personal data of citizens of the Republic of Uzbekistan.”

Tornado Cash DAO goes down without explanation following vote on treasury funds

- The Tornado Cash DAO went offline after many social media users reported the community discussing ways to challenge sanctions recently imposed by the United States Treasury Department’s Office of Foreign Asset Control.

- At the time of publication, the Tornado Cash DAO was offline reportedly following a discussion in which community members voted unanimously to add its governance layer as a signatory to its treasury’s multisig wallet, which manages a reported $21.6 million. It’s unclear what was responsible for the decentralized autonomous organization (DAO) going dark, but it followed a series of actions taken by different authorities and private entities in the wake of U.S. sanctions announced against the controversial mixer on Monday.

- In the last four days, Circle froze more than 75,000 USD Coin (USDC) worth of funds on addresses listed by Treasury officials, dYdX said it had blocked some users’ accounts with funds linked to Tornado Cash, and Alchemy and Infura.io blocked remote procedure call requests to the crypto mixer. On Friday, authorities responsible for policing financial crimes in the Netherlands also announced the arrest of a developer allegedly involved in money laundering through Tornado Cash.

- Actions by centralized firms extended beyond those against transactions with the crypto mixer, and into communications platforms. On Monday, Tornado Cash co-founder Roman Semenov reported developer platform GitHub had suspended his account, and Discord users said the channel for the mixer also went dark on Friday. At the time of publication, Tornado Cash’s Telegram group was still active.

Curve Finance resolves site exploits, directs users to revoke recent contracts: Finance Redefined

- On Aug. 9, automated market maker Curve Finance took to Twitter to warn users of an exploit on its site. The team behind the protocol noted that the issue, which appeared to be an attack from a malicious actor, was affecting the service’s nameserver and frontend.

- Curve stated via Twitter that its exchange — which is a separate product — appeared to be unaffected by the attack, as it uses a different domain name system (DNS) provider.

Indian authorities freeze more crypto funds over money laundering allegations

- India’s Directorate of Enforcement (ED) announced Friday that it has frozen the financial accounts of Bengaluru-based financial services company Yellow Tune Technologies, some of which were held by Flipvolt crypto exchange, the Indian branch of Singaporean Vauld. The move is linked to an ongoing investigation into money laundering by China-linked instant loan companies. This is the second time this week the agency has taken action in the crypto sphere in connection with that case.

- The financial watchdog announced it was freezing Yellow Tune’s bank balances, payment gateway balances and balances in the Flipvolt cryptocurrency exchange for a total of 3.7 billion rupees, or $46.4 million after determining that the company was a shell entity incorporated by two Chinese nationals using pseudonyms. According to newspaper accounts, the ED spent three days searching premises associated with Yellow Tunes.

- The ED uncovered 23 entities that had deposited funds into Yellow Tune’s Flipvolt wallets that were further transferred out of the country. The ED was sharply critical of Flipvolt’s handling of the funds. The agency said:

- “Lax KYC [Know Your Customer] norms, loose regulatory control of allowing transfers to foreign wallets without asking any reason/declaration/KYC, non-recording of transactions on Blockchains to save costs etc, has ensured that Flipvolt is not able to give any account for the missing crypto assets. It has made no sincere efforts to trace these crypto assets.”

Bitcoin mining revenue jumps 68.6% from the lowest-earning day of 2022

- The Bitcoin (BTC) mining industry endured immense financial stress throughout the year 2022 as a prolonged bear market directly impacted their earnings when translated to the United States dollar. However, miners resilient to the year’s lowest mining revenue day, June 13, witnessed a 68.63% increase in mining revenue within a month.

- Over the year, revenue from Bitcoin mining dropped due to a multitude of factors centered around investor sentiment — driven by tensions arising from market crashes, ecosystem collapses and loss-making investments. Cutting through the noise, the Bitcoin ecosystem recovered across numerous determinants, including miners’ revenue in USD, network difficulty and hash rate.

- Data from blockchain.com confirms that BTC mining revenue jumped nearly 69% in one month — from $13.928 million on July 13 to $23.488 million on Aug. 12. The significant increase in mining revenue reassures Bitcoin mining as a viable business despite high operational costs. In addition, lower mining equipment (GPU) prices have allowed BTC miners to expand their existing infrastructure as they pursue mining the last 2 million BTC.

- Alongside mining revenue, Bitcoin’s hash rate grew over 10% over the last month, adding to the network’s resilience against double-spending attacks. However, as a result, network difficulty — a measure of how difficult it is to mine a new BTC block — increased for the first time since June.

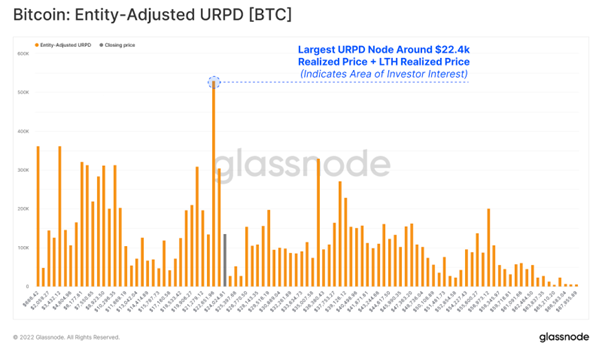

Glassnode:

The #Bitcoin URPD shows +530K BTC (3.18% of supply) changed hands around the $22,400 price region.

This area is now the largest volume node, showing investor interest around key on-chain cost basis:

- Realized Price: $21,773

- LTH Realized Price: $22,722