Bitcoin Price: US$ 20,173.57 (-9.92%)

Ethereum Price: US$ 1,574.40 (-8.27%)

BTC Hash Rate Surges As Miners Move Away From ETH Before The Merge

- Nikhil Wahi, brother of former Coinbase employee, pleads guilty in the first insider trading case ever involving crypto assets.

- Charles Schwab, Citadel Securities and Fidelity Investments announce a new crypto exchange called EDX Markets, backed by Sequoia and Paradigm.

- Fidelity Investments considers allowing individual investors to trade bitcoin on its brokerage platform.

- US inflation data for August indicates consumer prices increased 8.3% over the past year, marking the sixth consecutive month with inflation above 8%.

- Chamber of Digital Commerce, blockchain advisory group, urges the SEC to approve spot Bitcoin ETF.

- Yesterday, Bitcoin network’s hash rate reached a new all-time high of 232m TH/s, just as Ethereum’s hash rate declined to 859 TH/s. Bitcoin’s hash rate previously recorded an all-time high on June 12th.

- Hash rates represent a network’s processing power. The greater the hash rate, the greater the computational power securing the network. A rise in this metric indicates that more miners are coming online or that existing miners are deploying more machines to process transactions.

- Typically, an increasing hash rate indicates that it is profitable to mine the network. However, we see a different story playing out with Bitcoin when we consider the declining hash rates for Ethereum.

- The Ethereum Foundation officially announced the Merge on August 24th, signifying that the highly anticipated transition to proof-of-stake is finally underway. After the Merge, Ethereum miners will no longer receive any block rewards, effectively reducing revenue to zero.

- As indicated in the chart above, we have see an inverse correlation in hash rates between Bitcoin and Ethereum since August. This implies that miners are migrating from Ethereum to Bitcoin, as the new proof-of-stake mechanism no longer requires their services.

- Currently, the switch to proof-of-stake is scheduled to occur when we reach Terminal Total Difficulty (TTD) of 58750000000000000000000. This is expected to happen 2 days from now on September 15th. You can track the TTD and remaining time until the Merge here.

US CPI Report Shows Inflation Hotter Than Expected, Bitcoin Plunges 9.6%

- U.S. inflation decelerated in August, but remained higher than what economists had expected, a sign that the U.S. Federal Reserve will stay aggressive in raising interest rates.

- The consumer price index rose 8.3% in August from a year earlier, a mild slowdown from the 8.5% reported for July. Economists at FactSet had forecasted a 8.1% increase, and so the number was slightly higher than expectations.

- On a month-over-month basis, inflation rose 0.1% from July, when inflation remained unchanged, which many economists and politicians saw as a huge success.

- Bitcoin (BTC) rose 15% over the weekend in anticipation of a positive report for August but dropped 4% after the new numbers were released. Ethereum (ETH), which has largely been trading in an upward trend because the Merge, a software update on the Ethereum blockchain that is set to take place this week, dipped over 7%.

- Core CPI, which strips out more volatile food and energy prices, rose 0.6%, a much larger increase than in July.

El Salvador Launches 2 Debt Repurchase Offers Amid Uncertainty Over Its Bitcoin Bond

- The government of El Salvador issued an offer on Monday to buy back a portion of its sovereign debt bonds maturing in 2023 and 2025, the Central American country said in a statement.

- El Salvador established a purchase price of $910 for the bonds maturing in 2023, and a $540 price for those bonds maturing in 2025. Each bond is worth a total of $800 million.

- In July, when El Salvador’s President Nayib Bukele presented the repurchase plan, it was seen as an attempt to counter speculation about a potential default by El Salvador amid strained relations between the Central American country and the traditional credit market, particularly after El Salvador established bitcoin (BTC) as legal tender in September 2021.

- As of now, El Salvador is down roughly 50% on its sizable investments in bitcoin, representing a potential loss of $52.4 million, according to CoinDesk data based on Bukele’s announcements.

Craig Wright Won’t Give Cryptographic Proof He’s Satoshi, His Lawyers Say at Hodlonaut Trial

- Lawyers for Craig Wright, the Australian computer scientist best known for claiming to be the inventor of Bitcoin, said he will not provide any new cryptographic proof that he is Satoshi Nakamoto during his trial against Bitcoiner Hodlonaut, which kicked off in Oslo on Monday.

- The Norwegian trial is one of two simultaneous lawsuits centered around a series of tweets from March 2019 in which Hodlonaut expressed doubt about Wright’s claims to be Satoshi, and called him a “fraud” and a “scammer.” Hodlonaut, known in real life as Magnus Granath, initiated the suit in Norway to get a judge to rule that his tweets were protected by the Constitutional right to freedom of speech, and prevent Wright’s defamation suit filed in the U.K. from moving forward.

- During his opening statements on Tuesday, Wright’s lead attorney, Halvor Manshaus, told the court that establishing Wright’s ownership of Satoshi’s private keys – a move many of Wright’s doubters say would settle the years-long argument over his claims – isn’t enough.

- “Craig Wright is of the perception that to sign … with the private key, one block or the other … is not conclusive evidence of whether he is Satoshi or not,” Manshaus told the court. “It’s never one thing or the other is sufficient, you need several elements, you need the whole package.”

Binance Sued in Italy Over Exchange Outages, Hearing This Week

- Global cryptocurrency exchange Binance is due to appear in an Italian court on Thursday over a class-action lawsuit filed by a group of investors seeking damages for losses suffered during platform outages at critical trading times last year.

- A group of Italian and international Binance users filed suit against the company and CEO Changpeng Zhao in November 2021, citing multiple incidents when the platform went offline and locked users out of the exchange. The investors allege the outages made it impossible for them to change their trading positions and led to “tens of millions” in losses.

- Binance is not the only crypto exchange to go offline when trading volumes go up. When big news drives crypto prices up, traders flock to exchanges, and exchanges have historically tended to buckle under the pressure. One incident cited by the disgruntled investors occurred in February 2021, when multiple high-profile crypto trading platforms like Binance, Kraken and Gemini experienced technical issues due to increased trading loads over news that Elon Musk’s Tesla had invested $1.5 billion in bitcoin.

- The suit also alleges Binance violated Italy’s financial regulations when it let Italian users trade leveraged futures on the platform. Futures are trading agreements to sell an asset at a set price and time in the future.

Fidelity will ‘shift’ retail customers into crypto soon — Galaxy CEO

- $4.2 trillion asset management firm Fidelity Investments is reportedly working toward offering Bitcoin (BTC) trading services to its 34.4 million retail investor base, according to Galaxy Digital CEO Mike Novogratz and people familiar with the matter.

- While Fidelity hasn’t officially confirmed plans to incorporate crypto onto its retail platform, Novogratz told a conference audience in New York on Tuesday, that the move may be just around the corner:

- “A bird told me that Fidelity, a little bird in my ear, is going to shift their retail customers into crypto soon enough.”

- “I hope that bird is right. So we are still this institutional march and that gives crypto its floor,” he added.

- Novogratz isn’t the only person to have signaled the potential move from Fidelity. The Wall Street Journal (WSJ) on Tuesday noted that Fidelity is currently “weighing a plan” to allow individual investors to trade Bitcoin on its brokerage platform.

- A similar note was shared by Eight Global Founder and CEO Michaël van de Poppe last week, suggesting that the platform will launch Bitcoin trading for retail customers in November.

- Fidelity in a Tuesda statement addressed the rumors, noting:

- “While we have nothing new to announce, expanding our offerings to enable broader access to digital assets remains an area of focus.”

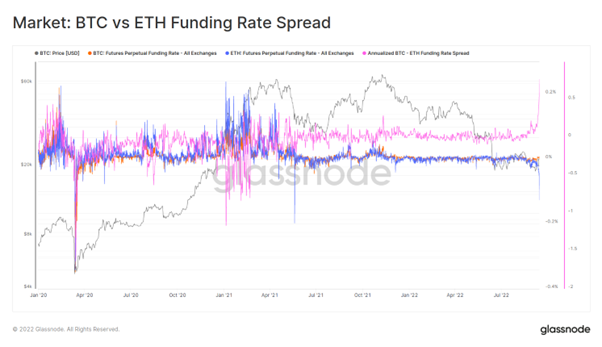

Glassnode

- The spread between $BTC and $ETH perpetual futures funding rates is pushing to a new ATH of 77% annualized.

- This indicates traders are heavily short $ETH relative to $BTC, likely speculating/hedging for the upcoming Merge.