Bitcoin Price: US$ 16,329.85 (-2.87%)

Ethereum Price: US$ 1,221.49 (-2.84%)

FTX under investigation in the Bahamas for possible criminal misconduct

- FTX, which filed for Chapter 11 bankruptcy protection in the U.S. on Friday, is now under investigation in its headquarters of the Bahamas.

- “In light of the collapse of FTX globally and the provisional liquidations of FTX Digital Markets Ltd., a team of financial investigators from the Financial Crimes Investigation Branch are working closely with the Bahamas Securities Commission to investigate if any criminal misconduct occurred,” the Royal Bahamas Police Force said in a release posted to Twitter Sunday.

- FTX Digital Markets is a subsidiary of FTX Trading and is licensed and regulated in the Bahamas.

Star Atlas cash runway sliced in half by FTX catastrophe

- Solana-based gaming metaverse Star Atlas saw its cash runway cut in half after the collapse of crypto exchange FTX, its CEO said on Twitter.

- Star Atlas is the latest crypto company to be affected by the shocking collapse of the Bahamas-based crypto behemoth.

- ATMTA, the Star Atlas development studio, had “material cash exposure” on deposit at FTX, according to CEO Michael Wagner. Despite the turmoil, the company still has a “strong balance sheet,” he said.

- “While previously we had multiple years of runway given current operations ahead of us, that has presently been reduced by approximately one-half,” Wagner said. He hosted a Discord town hall on Friday evening to discuss the news.

- Wagner apologized to Star Atlas employees and users, saying his “trust has been betrayed” by FTX. The company did not say how much cash it lost in the FTX collapse.

- “I believed this liquid cash position to be custodied with a reliable and trustworthy institution. I put my confidence and trust into an individual I believed to be a stalwart of the industry,” Wagner said. “Clearly that trust has been betrayed. Poor timing, and a failure to have sufficient backup measures in place to respond expeditiously to situations such as this resulted in a compromised position. That is on me, and for that, I am sorry.”

Crypto.com Accidentally Sent $400M in Ethereum to Wrong Address, CEO Calls Concerns ‘FUD’

- After the shocking collapse of FTX, other centralized crypto exchanges are under the microscope, and Crypto.com customers are concerned after CEO Kris Marszalek acknowledged that his exchange accidentally sent 320,000 ETH, around $400 million at the time, to a public address registered at a competitor exchange.

- Blockchain records on Etherscan show that on October 21, Crypto.com sent the sum, around 80% of its total ETH reserves, to rival exchange Gate.io—just before Gate.io provided “proof of reserves” to its users on October 28 as part of a new push for transparency after the FTX crisis.

- Gate.io subsequently returned the slightly diminished sum of 285,000 ETH, around $456 million as a result of a minor ETH surge, on October 29. Crypto.com released its own proof of reserves on November 12.

- “It was supposed to be a move to a new cold storage address, but was sent to a whitelisted external exchange address,” Marszalek tweeted on Saturday. “We worked with [the] Gate team and the funds were subsequently returned to our cold storage. New process and features were implemented to prevent this from reoccurring.”

Solana liquidity hub Serum to be forked after possible compromise in FTX hack

- Solana developers are forking FTX-developed token liquidity hub Serum after it may have been compromised in a hack on FTX.

- On Friday, a hacker made unauthorized withdrawals of more than $400 million from FTX. The situation further exacerbated the exchange’s insolvency crisis, which led it to file for Chapter 11 bankruptcy protection.

- Many Solana developers suspect the hack may have also compromised Serum, a well-known protocol that was developed by FTX and used by many apps on the Solana blockchain.

- Solana founder Anatoly Yakovenko noted that developers are rushing to fork Serum’s code today and resume the protocol without the involvement of FTX. Developers need another version of Serum because the original can only be updated via a private key that was controlled by someone at FTX and not the Serum DAO. As a result of the FTX hack, that key may have been compromised.

- “Afaik, the devs that depend on serum are forking the program because the upgrade key to the current one is compromised,” Yakovenko said.

- “The serum program update key was not controlled by its own organization, but by a private key connected to FTX. At this moment no one can confirm who controls this key and hence has the power to update the serum program, possibly deploying malicious code,” a pseudonymous developer called Mango Max said, adding that he is leading the Serum fork efforts.

Kraken freezes FTX and Alameda accounts, ‘maintains full reserves’

- Kraken has frozen accounts owned by FTX Group, Alameda Research and their executives following their filing for Chapter 11 bankruptcy protection.

- “Kraken has spoken with law enforcement regarding a handful of accounts owned by the bankrupt FTX Group, Alameda Research and their executives,” the U.S.-based crypto exchange tweeted today, adding: “Those accounts have been frozen to protect their creditors.”

- Kraken added that its other clients’ funds are not affected and that it “maintains full reserves.”

Binance, Huobi Block FTT Deposits After $400M Worth of Tokens Unexpectedly Released

- Crypto exchanges Binance and Huobi blocked deposits of FTT, FTX’s native tokens, Sunday after about $400 million worth of the tokens were released out of schedule, with no official explanation.

- FTT tokens follow an unlocking schedule wherein large batches of the tokens are periodically released. On Sunday, however, the tokens were released out of schedule without warning or communication from FTX or related parties.

- Over 192 million FTT tokens were released, blockchain data shows. These were released from the main deployer address.

- Binance founder Changpeng Zhao noted on Twitter: “Binance has stopped FTT deposit, to prevent potential of questionable additional supplies affecting the market. Also encourage other exchanges to do the same.”

FTX had only $900 million in liquid assets backing $9 billion in debt: FT

- FTX had only $900 million in liquid assets against $8.9 billion in liabilities on the eve of bankruptcy, the Financial Times reports.

- Citing investment materials, the report noted that the largest easily sellable assets available to FTX were $470 million of Robinhood shares owned via an outside corporate entity belonging to CEO Sam Bankman-Fried.

- Despite being formally based outside of the U.S., $5.1 billion of the liabilities FT reported were in U.S. dollar balances.

Crypto.com Holds 20% of Its Reserves in Meme Token SHIB

- Notable cryptocurrency exchange Crypto.com revealed today that it holds 20% of its reserves in the Shiba Inu (SHIB) token—a highly speculative “meme coin.”

- Data from blockchain analysis firm Nansen shows that the platform holds the largest share (31%) of its digital assets in Bitcoin, followed by SHIB at 20%. Nansen’s data reveals that Crypto.com has about $570 million worth of the Ethereum-based meme coin.

- Crypto.com’s reserves also feature a significant quantity of Ethereum itself, making up about 17% of the firm’s holdings, while the Tether (USDT) and USDC stablecoins each make up about 5% of the exchange’s reserves. Various other cryptocurrencies and tokens collectively account for another 20% of the total.

GameStop to End FTX.US Ties, Refund Customers

- Video game retailer GameStop (GME) plans to end its relationship and its pilot gift card marketing partnership with FTX.US, after the crypto exchange filed for bankruptcy protection.

FTX US Temporarily Froze Crypto Withdrawals, Adding to Chaos of Bankruptcy Proceedings

- FTX US temporarily ceased processing withdrawals around midday Friday before inexplicably restarting hours later, adding to the confusion of a chaotic week that saw the ouster of exchange CEO Sam Bankman-Fried.

- The manual shutdown occurred shortly after midday New York time, according to a person familiar with the matter as well as on-chain data. But later Friday the exchange appeared to resume processing withdrawals.

- FTX Group filed for bankruptcy protection in the U.S. earlier Friday, including FTX US – a day after FTX CEO Sam Bankman-Fried tweeted that FTX US had no financial exposure to FTX’s “liquidity” issues.

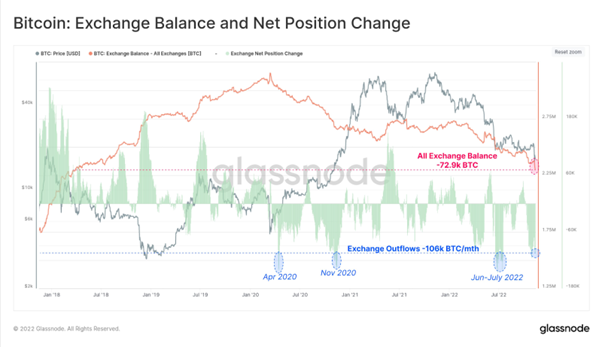

- Following the collapse of FTX, #Bitcoin investors have been withdrawing coins to self-custody at a historic rate of 106k $BTC/month.

- This compares with only three other times:

- Apr 2020

- Nov 2020

- June-July 2022