Bitcoin Price: US$ 21,773.97 (-0.04%)

Ethereum Price: US$ 1,505.24 (-0.63%)

Another Year, Another Rally – Monthly Chartbook January 2023

- After a miserable 2022 for risk assets, 2023 opened on the opposite foot. Risk assets rose considerably across the board, in large part due to recent increases in global liquidity driven by China’s PBoC and the Fed.

- “Headline QT” remains in focus, but recent increases in liquidity have largely mitigated these forces. We believe that we may see this trend continue through the better part of Q1.

- 2022 was the year of dollar strength, a consistent thorn in the side of risk asset performance. It has come as no surprise that the recent rally has been accompanied by a period of dollar weakness. The DXY finds itself at a pivotal level, with risk assets not out of the woods just yet.

- Looking into the rally a bit closer, we can see that much of it has been attributed to multiple expansion rather than earnings expansion. We have written that much of the 2022 drawdown was attributed to multiple compression rather than earnings compression (something we increasingly expect to see as the year continues). If earnings are decreasing, the price rally may not have the legs many bulls are hoping for.

- For the better part of the last 3-6 months, we have been signaling the alarm of potential recession in 2023, citing several leading indicators. Since then, it appears as though some form of recession has become the base case for many market participants. At first glance, this could seem to be a good thing. However, we know that markets tend to be forward looking and eventually begin to look past the negative data and towards potential policy responses (which are usually good for risk assets). This can pose a risk as market participants attempt to “front-run the pivot” even more aggressively.

- Volatility will likely be a 2023 headline with the way things have been shaping up so far. Though the short to medium-term outlook is less clear, our long-term thesis remains squarely intact.

- Leading indicators are pointing to a noticeable economic slowdown by mid-year, which tends to favor bonds over risk assets as volatility rises. The push-pull between tighter monetary policy and improving liquidity conditions could cause volatility to remain elevated, especially as the US debt ceiling debacle comes to a head and concerns mount over the impact of larger fiscal deficits.

- Access to funding will remain one of the greatest risks for high-growth sectors like crypto.

- The need for liquidity expansion will become more pressing as the year progresses. Cracks in the labor market will also become more apparent, which will give the Fed cover for a shift towards more accommodative policy.

- The reversal in global liquidity we cited at the end of last year will start to accelerate in response to a weaker growth outlook and concerns over growing fragilities in sovereign debt markets, acting as support for risk assets in H2 2023.

- The impacts of changes in global liquidity on financial markets tend to lag anywhere from 6-18 months, setting up a more optimistic outlook for 2024 and beyond.

- In the first several weeks of 2023, BTC rose considerably. In fact, it has risen so much that it finds itself back within the $18k-$24k price range it was in prior to the FTX collapse. Bitcoin appears to like this price range, as the rally has been firmly rejected at the $24k range high yet again. If bulls can manage to flip this $24k weekly resistance area, BTC may be able to make some headway into the $28k-$30k region.

- Zooming in a bit further to the 3-day view, we have our BTC vs. Guppy Multiple Moving Average overlay chart. As a reminder, the GMMA is used to indicate shorter and longer-term momentum using different cohorts of moving averages. For the first time in over 12 months, the shorter-term moving averages (blue) have flipped the longer-term moving averages (red). In essence, the shorter-term momentum has had enough strength to finally flip through the longer-term momentum group. We are also seeing the longer-term moving averages in the early stages of slope reversal, which can be an early sign of momentum shift. However, price is approaching a pivotal level on this pullback. Should the longer-term moving average fail to act as support upon a retest, this current bout of short-term momentum may be just that — short. This analysis is one of cautious optimism at the moment.

- Continue on Delphi Pro…

Tether dominates Brazil as bitcoin, ether fall out of favor

- In a country where economic instability is as common as coconuts, Brazilians appear to favor the stablecoin tether as their cryptocurrency of choice.

- The federal tax authority, which compiles data from foreign and local exchanges on cryptocurrency usage, said that the value of all transactions for tether jumped 58% last year compared to a year earlier. Bitcoin and ether, also widely used, saw decreases of more than 60% from 2021.

- Last year, Brazil approved a law regulating cryptocurrencies, a major step forward as the country embraces digital assets.

- The main use case for Brazilians is as a speculative investment, Chainalysis reported Thomaz Fortes, the crypto lead at Brazil’s Nubank, as saying.

- “Customers want a way to expand their earnings,” he said in October. “The retail growth in the number of users in crypto has been much faster than in the equities market.”

- Nubank reached 1.8 million crypto customers about four months after launching the service.

- Cryptocurrency-related revenue in the country is expected to show an annual growth rate of 15.25% between 2023 and 2027, Statista reported.

Binance Withdrawals Surge as Paxos-BUSD Drama Weighs on the Exchange

- Binance, the world’s largest crypto exchange by trading volume, has endured some $831 million of net outflows in the past 24 hours, according to blockchain intelligence firm Nansen’s data. Investors appear to be spooked by a regulatory crackdown on the Paxos-issued Binance USD (BUSD) stablecoin and so are reducing their holdings on the platform.

- Blockchain data on Nansen shows users withdrew some $2.8 billion of digital assets in the last 24 hours, outweighing the $2 billion of deposits during the same period.

- The withdrawals have followed the New York Department of Financial Services ordering Paxos on Monday to halt issuing the $16 billion BUSD stablecoin and a looming enforcement action by the U.S. Securities and Exchange Commission (SEC). Issued under the Binance brand, BUSD is the third-largest stablecoin and accounts for 35% of all Binance trading volume.

- Monday’s activity also marked the largest, daily net outflows from Binance since November, surpassing December outflows when the exchange’s lackluster report about its reserves alarmed investors, according to a data dashboard by crypto investment product firm 21Shares.

Crypto markets wrought ahead of US inflation data as regulatory issues steal focus

- Crypto markets were roiled by the SEC last week, and now there’s even more uncertainty after the New York Department of Financial Services ordered Paxos to stop issuing BUSD. Next up is U.S. inflation data for January.

- Prices are expected to have climbed 0.4% month-on-month in January, and all eyes will be on the release for any sign of acceleration that could trigger fresh action from the Federal Reserve.

- “I am committed to taking further actions to bring inflation back down to our goal,” said Federal Reserve Governor Michelle Bowman, noting that while there has been a recent decline in some measures of inflation, “we have a lot more work to do.” She said the Fed will continue to raise interest rates.

Paxos Says It’s ‘Prepared to Vigorously’ Fight SEC Lawsuit

- Paxos confirmed Monday it received a Wells Notice from the Securities and Exchange Commission, stating it’s prepared to take on the agency and any enforcement actions related to stablecoin Binance USD.

- A Wells Notice is an official letter from the SEC that informs recipients the agency is preparing to bring a potential enforcement action against them. Paxos received notice from the SEC that the agency is considering enforcement action against the company for not registering BUSD as a security, the company stated.

- Paxos disagreed with the SEC’s belief that its Binance USD token is a security, stating that it is prepared to “vigorously litigate” the disagreement if it’s forced to.

- “Paxos categorically disagrees with the SEC staff because BUSD is not a security under the federal securities laws,” the company said in a statement. “To be clear, there are unequivocally no other allegations against Paxos.”

Blockchain gaming’s struggles continue as active users drop 30% in three months: Messari

- Web3 gaming has been a bright spot in an otherwise down year for an industry that has seen funding dry up. That might not be the case for much longer if interest in blockchain gaming continues to wane.

- The number of active users for such games dropped 30% since October, crypto market researcher Messari said. The number of new users dropped by 34%.

- After an initial wave of simple “play-to-earn” games like Axie Infinity gained popularity during crypto’s bull run, a new class of more sophisticated games developed by seasoned developers has entered the market. Crypto enthusiasts continue to see blockchain gaming as a surefire way to eventually convince consumers to embrace web3, possessing digital wallets and owning digital assets.

- But Axie Inifity’s popularity collapsed as the bear market set in. So far there have not been any new blockchain game – Yuga Labs’s recent headline-grabber Dookey Dash may or may not qualify, depending on how one defines a web3 game – which have managed to attract a large number of gamers.

- During the last several months, a sharp reduction in cryptocurrency prices and non-fungible token trading volumes has caused sentiment to sour. But investment in blockchain gaming and NFT projects has remained robust, pulling in hundreds of millions of dollars in fresh venture capital each month. The trend continued last month with the NFT-gaming vertical securing the most funding among all categories, outpacing both infrastructure and financial services, according to The Block Research.

Polkadot mulls research into ‘token morphism’ amid regulatory crackdown

- The Polkadot community is looking into conducting a research study centered around “token morphism,” a term used to describe the process that was used to transform the protocol’s native dot token from a security into software.

- Polkadot announced that it achieved token morphism in November 2022, a process it said was the direct result of three years of dialogue with the U.S. Securities and Exchange Commission. Now, the project is considering funding a study that will explore how it managed the feat, according to a post on its governance forum.

- The proposed purple paper will offer guidelines on token morphism for Polkadot and the wider crypto ecosystem, the proposal stated. It comes amid increasing regulatory scrutiny from the SEC and other regulators, including enforcement actions against stablecoin issuer Paxos and crypto exchange Kraken this month that have spurred fears of sweeping enforcement actions targeted at the broader crypto space in the U.S.

- The proposal requested 14,776.74 dot tokens ($90,000) to sponsor the research. This funding will cover the work done by team members and ad hoc subject matter experts that include several of the people who were part of Polkadot’s dialogue with the SEC. The proposal asked for the funds to be delivered in two installments of 7,388.37 dot each.

Paxos Halts BUSD Minting as SEC Prepares Lawsuit

- The SEC is reportedly taking aim at the owner and issuer of the world’s third-largest stablecoin, Binance USD.

- The U.S. Securities and Exchange Commission plans to sue Paxos Trust for violating investor protection laws, the company has confirmed to Decrypt.

- Paxos said that it was halting the minting of BUSD and would “end its relationship with Binance” for the stablecoin in a press release. It also made assurances that existing BUSD tokens are fully backed and will be redeemable for at least a year.

- Binance founder and CEO CZ tweeted that he was also informed by Paxos that the New York Department of Financial Services (NYDFS)—an agency Paxos is registered with and regulated by—has directed the company to cease issuing BUSD.

- Paxos Trust has owned and operated the BUSD stablecoin business since 2019, when it entered into a licensing agreement with Binance, the world’s largest crypto exchange, to use its name and brand.

Correlation Between Crypto Market and Nasdaq Turns Positive Ahead of US CPI Release

- The correlation between the crypto market and the tech-heavy Nasdaq equity index has turned positive, indicating the digital asset investors’ renewed focus on risk appetite on Wall Street.

- The 90-day correlation coefficient between the crypto market’s total capitalization with Nasdaq has risen from -0.12 to 0.74 in four weeks, reaching the highest since early November, according to data sourced from charting platform TradingView.

- In other words, the crypto market is again moving in tandem with technology stocks. On days when technology stocks trade higher, cryptocurrencies, including bitcoin (BTC) and ether (ETH), are likely to do the same. Conversely, a decline in technology stocks could drag the crypto market lower.

- Speculation that Federal Reserve would resort to rate cuts later this year is perhaps behind the renewed correlation between the liquidity-addicted risk assets. The long-held positive relationship had crumbled in November, thanks to the spectacular collapse of Sam Bankman-Fried’s FTX exchange that saw crypto investors dump their tokens despite the risk reset on Wall Street.

Arbitrum-Based GMX Surpassed Ethereum Blockchain in Daily Fees Over Weekend

- Decentralized finance (DeFi) exchange GMX logged fees of over $5 million in a 24-hour period over the weekend – temporarily making it the largest revenue generator in decentralized finance (DeFi), ahead of even the Ethereum blockchain.

- This added to the $120 million in total fees accrued since September 2021, GMX’s dashboard data shows – which may signal fundamental strength for GMX’s native tokens.

- The fees are shared across GMX’s two tokens, gmx and glp. Gmx is the utility and governance token and accrues 30% of the platform’s generated fees, while glp is the liquidity provider token that accrues 70% of the platform’s generated fees.

- Ethereum fees clocked in at $4.7 million over that period. These fees were generated from user actions on Ethereum, such as transactions or issuance of ERC-20 tokens.

- However, these fees do not include the fees generated by applications on Ethereum itself. Uniswap, for instance, had upward of $1 million in fees collected from users.

Glassnode: The Emergence of Ordinals

- The digital asset market has experienced the first significant pullback since the rally throughout January, retracing from a weekly high of $23.3k to a low of $21.5k. This comes alongside significant regulatory news coming out of the US, such as the SEC issuing a fine to Kraken for their staking services, legal action by the SEC against Paxos for issuing the BUSD stablecoin, as well as several actions against crypto banking partners and payment providers.

- Recent weeks have also seen the somewhat surprising introduction of NFTs hosted on the Bitcoin blockchain in the form of Ordinals and Inscriptions, with over 69k Inscriptions already created. As a result, there has been a significant uplift in Bitcoin network activity, and rising fee pressure.

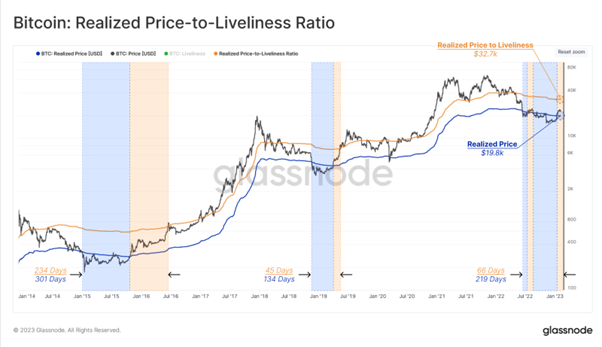

- With the spot price of Bitcoin breaking above the Realized Price, the market has entered what has historically been a macro transitional phase, generally bounded by two pricing models:

- The lower band of this zone is the Realized Price 🔵 ($19.8k), corresponding to the average on-chain acquisition price for the market.

- The upper band is determined by the Realized Price to Liveliness ratio 🟠 ($32.7k), a variant of the Realized Price reflecting an ‘implied fair value’ weighted by the degree of HODLing activity.

- Comparing previous periods within the aforementioned range, we note a similarity between the present market, and 2015-16 and 2019 re-accumulation periods.

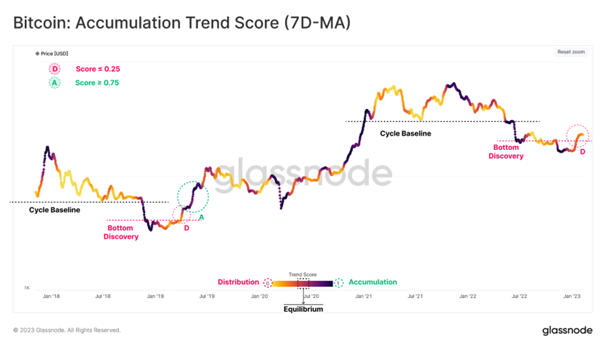

- The price rally has paused at a local high of $23.6k. We can inspect investor behaviour at this time by leveraging the Accumulation Trend Score, reflecting the aggregated balance change of active investors over the past 30 days. A higher weight is assigned to larger entities (such as whales and institutional sized wallets), and a value of 1 (purple colors) indicates that a wide cross-section of investors are adding meaningful volumes of Bitcoin to their on-chain balance.

- Comparing to previous bear markets, similar rallies out of the bottom discovery phase have historically triggered a degree of distribution, primarily by the entities that accumulated near the lows. The recent rally is no exception (🔴 D), where this metric has dropped below 0.25.

- Accordingly, the sustainability of the prevailing rally will have some dependence on whether these larger entities continue to accumulate (🟢 A), resulting in the Accumulation Trend Score advancing back towards a value of 1.0.

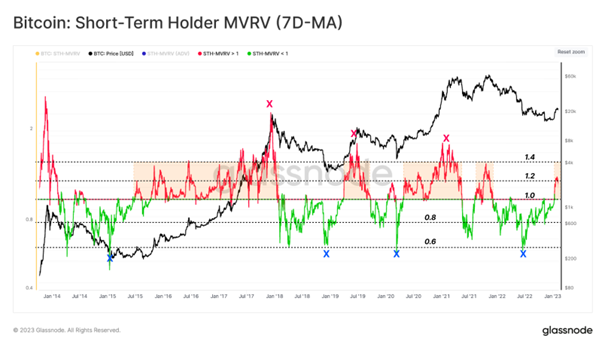

- The recent rejection at the $23.6k level resonates with this structure, as the STH-MVRV hit a value of 1.2. Considering the third observation, and in case of further correction, the market returning to $19.8K would indicate a STH-MVRV value of 1.0, and align with a return to the cost basis of the cohort of new buyers, and the Realized Price.

- Continue on Glassnode Insights…