Bitcoin Price: US$ 18,846.62 (+5.03%)

Ethereum Price: US$ 1,415.92 (+1.91%)

NFTPerp Gains Volume Traction As NFT Markets Stage A Comeback

- NFTPerp is a decentralized exchange for perpetual futures on NFT collections. The platform launched a beta version on Nov. 25, 2022 that allows traders to take long or short positions on NFTs with up to 5x leverage.

- The platform allows small investors to gain exposure to highly sought-after collections like CryptoPunks despite their high floor prices. Additionally, traders can now short NFTs to express a bearish view or hedge other positions.

- Trading volume on the platform exceeded 16K ETH in December 2022 and remains on track to go even higher this month with over 11K ETH so far. The most traded NFT collection is the Bored Ape Yacht Club with a 40% volume share, followed by Azuki with a 29% volume share.

- The successful beta launch of the platform indicates a growing interest from NFT traders in such derivatives that merge DeFi and NFTs. However, the low liquidity of many NFT collections leaves their derivatives vulnerable to price manipulation.

- It is unclear if NFT perpetual futures will gain significant adoption. But these primitives remain worth monitoring since the interactions they enable can potentially make the NFT markets more efficient over time.

From Dutch Auctions to Open Editions: A Deep Dive Into NFT Distribution Models

-

- Standard Mints. In a standard mint, there is a fixed price and fixed supply of NFTs to be sold. This is known to the public prior to the mint. In the early days, teams would launch with a first-come-first-serve public mint. This led to gas wars and a high prevalence of botting during mints of popular projects.

- Free Mints. The distribution mechanism is similar to standard mints (allowlist or public mint) except that the price is 0. This means that they are not used as a fundraising tool by teams. Despite costing nothing, free mints can reach substantially high prices — particularly those in (1) and (2). DigiDaigaku, BAKC, and MNLTH have reached floor prices of thousands of dollars.

-

- Dutch Auctions. In Dutch auctions, the price of an NFT starts at a high price and lowers incrementally over a fixed period of time until the lowest possible price is reached or all the tokens are sold out. In some Dutch auctions, everyone pays the same final price (fair Dutch auction or last price Dutch auction). In others, buyers pay different prices depending on when they made the purchase.

- Daily Auctions. In the daily auction model, one NFT is auctioned off at a fixed time interval forever. Unlike fixed-distribution models, the supply of the collection increases linearly over time. Daily auctions were pioneered by Nouns, where one Noun is auctioned off every day. While we use the terminology “daily auctions” for ease of reference, in reality, these can be tweaked to any schedule (e.g., one auction per hour).

- Gradual Dutch Auctions & Variable-Rate Gradual Dutch Auctions. Enter the gradual Dutch auction, where an NFT sale is broken up into a series of discrete Dutch auctions. In such models, teams can choose to sell tokens that are emitted at a constant rate (e.g., 15 tokens per hour) via Dutch auctions. Each successive Dutch auction starts out at a higher price than the previous auction. This effectively extends the sale period for the NFT, allowing more time for the market to find buyers. While theoretically interesting, there has yet to be an NFT project that has successfully implemented this in practice as far as we know.

-

-

- Variable-rate gradual Dutch auctions (VRGDAs) are a modification of the GDA, providing a way to issue NFTs using nearly any supply model/graph while still allowing users to buy them seamlessly at any time.

-

- Liquidity Bootstrapping Pools (LBPs): These are fair-price discovery platforms, similar to Balancer LBPs for fungible tokens. In this model, NFTs are sold over a fixed period of time using a liquidity pool. The mint price starts high and goes down over time. Unlike Dutch auctions, the mint price increases after each new mint. Buyers can choose to purchase NFTs when the price is appropriate for them. One major advantage with LBPs is that they are more resistant to minting bots and snipers — bots that buy at the top when the auction starts will lose, because every buy increases the price, making it harder to buy large quantities at once.

- Ranked Auctions: In ranked auctions, everyone submits their bids with the highest price they are willing to pay. At the end of the bidding period, the top X bids win (where X = supply sold). All winning bidders pay the same price at the end.

- Open Editions: In open editions, there is no supply cap. Anyone can mint an open edition during the time period it is open — it could be a few minutes, a day, or forever. Artists and photographers commonly drop open edition collections.

Bitcoin Inches Toward 19K as Recession Scare Subsides

- As Bitcoin enthusiasts continue to celebrate the 14th anniversary of the genesis block, the number one cryptocurrency’s price spiked to nearly $19,000 per coin on Thursday, according to CoinGecko, a level not seen since September 7, 2022, when BTC traded at $19,280 per coin.

- While a better—or at least less dire—economic forecast is likely driving the upward trend for Bitcoin, some also point to El Salvador’s recent moves to establish digital asset laws and make way for its so-called Volcano Bond. The Latin American country would use these Bitcoin-backed bonds to pay its debts and fund its future Bitcoin City.

- Calming recession fears have also been good for other cryptocurrencies. Ethereum, the number one proof-of-stake blockchain, trading at $1,425.27, was up 6.2% on Thursday, but ultimately closed the day down 0.2%, trading at $1408.40, according to CoinGecko.

Polygon Proposes Hard Fork to Reduce Reorgs, Gas Spikes

- After a heated community debate last month, Polygon Labs appears to be moving forward with plans to hard fork the network early next week, according to a blog post published on Polygon’s website Thursday.

- In the post, Polygon Labs claims the hard fork—proposed to occur January 17—will help prevent network gas fee spikes and address chain reorganizations, also known as reorgs. Unlike soft forks, hard forks are not backwards-compatible and require all node operators on the network to update to the latest software at a specified time.

- The reduction in gas fee spikes will be achieved by doubling the value of the “BaseFeeChangeDenominator,” which Polygon says will “help smooth out the increase/decrease rate in baseFee for when the gas exceeds or falls below the target gas limits in a block.”

- Polygon believes the modification will work because it backtested such changes “against historical Polygon PoS mainnet data.”

Wyre lifts 90% customer withdrawal limit after securing new funding

- Wyre secured a new source of funding, allowing it to drop its recently introduced 90% customer withdrawal cap, the company said on Twitter today.

- “We’re excited to share that today we received financing from a strategic partner that allows us to continue our normal course of operations,” Wyre tweeted, adding that it would “resume accepting deposits and lift the 90% withdrawal limit effective immediately.”

- Wyre earlier this week said it would limit customer withdrawals in an attempt to continue operating despite financial headwinds and to better position the firm against any potential industry instability.

- The company laid off 75 employees earlier this month as news circulated that the firm may shutter. Wyre denied those rumors, and said it was still operating.

Cathie Wood sees ‘wall of worry’ ignoring blockchain tech, digital wallets and ChatGPT

- Ark Invest founder and CEO Cathie Wood said equity markets plagued by a “wall of worry” have “largely ignored” game-changing innovation last year that included blockchain technology and digital wallets, in addition to the ChatGPT bot developed by OpenAI that has taken the world by storm.

- “I have never seen markets this dislocated,” she wrote in a letter published Thursday, highlighting declining money supply and commodity prices that could point to lower inflation and even deflation. “Fear of the future is palpable, but crisis can create opportunities.”

- Wood, whose funds have now bought Coinbase shares for two days in a row, said that Bitcoin and Ethereum have not “skipped a beat” in processing transactions, despite the recent collapse of the FTX crypto exchange.

- She also noted growth in the use of digital wallets and said they’ve overtaken cash as the top transaction method for offline commerce.

- “Disruption can surface in surprising forms and at unexpected times,” she wrote. “Innovation solves problems and has historically gained share during turbulent times.”

Nexo Hit by ‘Flood of Withdrawals’ Following Office Raid Over Money Laundering Investigation

- Funds are flowing out of crypto lender Nexo following news that prosecutors in Bulgaria are investigating the company for fraud, according to blockchain analytics firms.

- Nexo is a British digital asset platform that loans out client funds and uses the proceeds to pay interest. (Disclosure: Nexo is one of Decrypt’s 22 investors.)

- Earlier today, the company said it was cooperating with the relevant authorities and regulators after news broke that Bulgarian prosecutors raided its Sofia offices as part of a financial crimes investigation.

Bank of International Settlements outlines policy approaches to ban, contain or regulate crypto

- The Bank of International Settlements (BIS) suggests that authorities can take three different approaches when it comes to crypto following a particularly turbulent year: Regulate, contain or call for a complete ban of the sector.

- The global group of central bankers also posed an alternative to “encourage sound innovation” with Central Bank Digital Currencies, according to the report about addressing risks in crypto published on Thursday.

- The BIS outlined the advantages and drawbacks of each of the three approaches and noted they could be mixed and matched to apply to different risks they perceive. The ongoing saga surrounding the collapse of FTX and the crash of the stablecoin TerraUSD were the main events cited.

- Without “gateways” like centralized exchanges, “crypto would have to rely on users taking self-custody of their funds in digital wallets using private keys,” the report said. “Given the risks involved, mainstream adoption would be inconceivable.”

- Banning crypto would be an “extreme option” and limit innovation. The BIS acknowledges that banning borderless decentralized activities is difficult. Putting a ban on centralized intermediaries would be more effective, but could push such activities to another jurisdiction.

- The other options would be to isolate crypto from traditional financial economies and to regulate the sector in a way similar to the financial services sector.

Bitcoin Dips With Stocks After US Report of 6.5% CPI Inflation

- The consumer price index (CPI) slipped 0.1% in December, roughly in line with expectations for a flat reading. On an annualized basis, the CPI was higher by 6.5%, in line with expectations and down from 7.1% a month earlier.

- The core CPI – which strips out volatile items such as food and energy – was up 0.3% in December, in line with forecasts. Annualized core CPI was up 5.7%, also in line with forecasts and down from 6% in November.

- Bitcoin (BTC) slipped about $150 on the news, with traders having bid the crypto higher in the days leading up to this morning’s report in hopes inflation might decline ever more. While December marks the sixth consecutive month of inflation slowing in the U.S. – the rate having peaked in June at 9.06% – it remains well above the U.S. Federal Reserve’s 2% target.

Crypto Brokerage Blockchain.com Lays Off 28% of Workforce as Industry’s Cruel Winter Continues

- Cryptocurrency brokerage Blockchain.com said it’s letting go of 28% of its workforce, or about 110 employees, adding to a dreadful week of bloodletting across the battered cryptocurrency industry.

- Thursday’s job losses come after Blockchain.com was forced to cut about 150 staff in July, as the firm grappled with a $270 million hit on loans it made to failed hedge fund Three Arrows Capital.

- “The crypto ecosystem is facing significant headwinds as its course corrects from the challenges of the last year,” said a Blockchain.com representative via email. “To better balance product offerings with demand, we’ve made the difficult decision to reduce operating costs and headcount to rightsize the company.”

- Blockchain’s losses compound a grim week in crypto that saw U.S. exchange Coinbase announce cuts of 20% of its staff, or around 950 jobs, followed by news that Ethereum development firm ConsenSys plans to lay off 100 or more staffers. CoinDesk estimates nearly 27,000 jobs have been lost across the industry since April of last year.

- Blockchain.com is now left with a staff of 280, having grown from 160 employees at the start of 2021. All impacted employees are receiving severance packages, the details of which vary by country, the company said.

FTX Loan Wiped Out $800M in BlockFi Executives’ Equity, Court Filing Reveals

- Executives from bankrupt crypto lender BlockFi granted themselves pay rises of as much as $275,000 each, after they saw $800 million in their equity holdings wiped out because of a loan from collapsed crypto exchange FTX, a court filing shows.

- A statement of financial affairs for BlockFi, which was filed Thursday in the U.S. Bankruptcy Court for the District of New Jersey, contains thousands of pages of transactions that took place in the run-up to BlockFi’s collapse. The firm had gross revenue of over $4 million for 2022 until its bankruptcy filing in November.

- Last June, FTX offered BlockFi a $400 million loan, and Thursday’s filing details the impact of the loan on 13 of BlockFi’s top executives.

- “The massive impact of the FTX transaction on management equity led BlockFi’s board of directors to, among other things, increase base salaries and make retention payments for those that remained in the interest of retaining business critical knowledge and capabilities,” the filing stated.

- Founder and CEO Zac Prince, for example, saw $413 million in equity value eliminated, and was compensated by a salary increase from $250,000 to $400,000, while Chief Operating Officer Flori Marquez saw a raise from $225,000 to $500,000, the filing said.

- BlockFi lawyers have been at pains to stress that – unlike other crypto bankruptcy cases such as the one for lender Celsius Network – there were no last-minute panicky withdrawals by BlockFi senior executives before its collapse.

- No member of the BlockFi management team withdrew any cryptocurrency from the platform after Oct. 14, the filing said, and the management team represented just 0.15% of the $7.7 billion in retail withdrawals over the year.

- But the filings nonetheless reveal significant withdrawals made by senior management – including over $9 million taken out of the platform by Prince in April, which the filing said was to pay U.S. federal and state taxes, and his withdrawal of just over $870,000 in August.

- Almost four months after Ethereum’s successful shift to a proof-of-stake network, the second-biggest blockchain has passed another major milestone. More than 16 million ether (ETH) have been deposited into Ethereum’s Beacon Chain staking contract, data from Etherscan shows.

- The 16 million ETH figure constitutes more than 13.28% of the total ether supply and represents nearly $22.38 billion at current prices. It comes nearly two years after Ethereum’s staking contract went live in 2020, when the network’s proof-of-stake Beacon Chain was introduced.

- While the growing number of staked ETH can be interpreted as a promising sign for Ethereum security and adoption, it may ramp up pressure on the network’s core developers to expedite work to enable withdrawals.

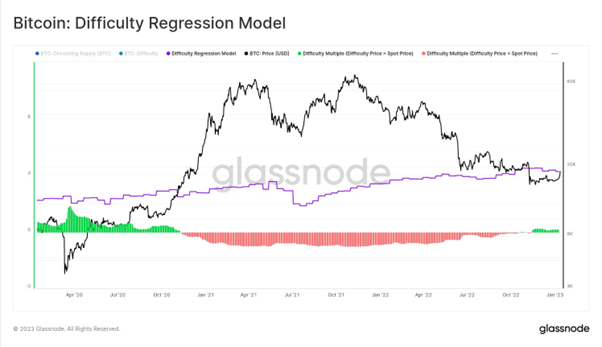

- #Bitcoin is in the process of retesting the estimated average cost of production price for Miners.

- This model uses a log-log regression analysis to relate Diffculty to Market Cap.

- Breaking above this level like offers much needed relief to miner incomes

- The $BTC price has also broken above the Short-Term Holder Realized Price at $17.8k.

- This means the average acquisition over the last 5-months is now in profit.

- The Realized Price is located at $19.7k, which happens to be coincident with the 200D-SMA.