Bitcoin Price: US$19,131.87 (-1.58%)

Ethereum Price: US$ 1,290.03 (-2.50%)

Is a Big Move Brewing for BTC?

- ETH supply turns deflationary as users spend more than $1.8m in gas fees to mint XEN tokens.

- Huobi founder, Leon Li sells his entire stake to About Capital, an investment firm reportedly spearheaded by Justin Sun.

- The LFG Foundation backtracks on a previously announced plan to repay small holders of UST tokens due to legal concerns.

- The OECD releases a new global tax reporting framework for crypto assets, covering intermediaries like exchanges, brokers, and ATM operators.

- Currently, the Bollinger Band Width Percentile (BBWP) indicator for BTC is at 15.87. Historically, BBWP readings above 90 or below 5 have marked major swing points. Although the indicator hasn’t dipped under 5 yet, similar readings have previously led to an upside of 70% or a downside of -59%.

- The BBWP is a second-order derivative of the Bollinger Bands, which are made up of three lines. The middle line is the 20-day simple moving average, and the upper and lower lines are two standard deviations from the middle line.

- The first-order derivative, Bollinger Bands Width measures the gap between the upper and lower bands. The second-order derivative, the BBWP compares the gap to its previous readings.

- Since Bollinger Bands are a volatility-based indicator, the BBWP helps us quantify the extent of current volatility compared with historical readings. When the indicator is above 95, it suggests the price move is quite extended and the asset may likely enter a period of sideways drift or full-fledged correction. On the other hand, when the indicator is below 5, it suggests that volatility has severely contracted and a big move is likely.

- On the chart above, the vertical lines mark the indicator’s high and low values. The percentage move from those extreme values gives us a sense of what to expect. Since Q2 2017, BBWP readings above 90 or below 5 have previously led to an upside of 204% or a downside of -51% on average.

- The BBWP is not perfect and other indicators must be used in tandem to conduct a meaningful analysis. However, it helps us understand how extended the current price move may be, and gives us an early indication of potential future moves.

- Crypto markets have been attached at the hip to traditional risk assets for the better part of the last 12 months. For better or for worse, everything has been distilled down into one big macro trade.

- Equities appear to be on the verge of another major test, and so far, there has not been enough evidence of any real decoupling between crypto assets and traditional assets, which we wrote about recently.

- In order for us to have any strong conviction in the idea of a break in the crypto <> macro relationship, we would need to see more sustained evidence of divergences in markets, and that simply hasn’t materialized yet.

- For example, the FOMC’s decision to hike rates another 75bps at the last FOMC meeting was largely expected. What was not expected was the Fed’s projected terminal rate.

- The updated Dot Plot implied a 4.6% Fed funds rate by December 2023, with Powell reiterating the Fed’s hawkish stance. This initially had a material impact on Fed funds rate expectations further out the curve (i.e. Q2-Q4 2023). Fed funds futures reacted, and so did BTC.

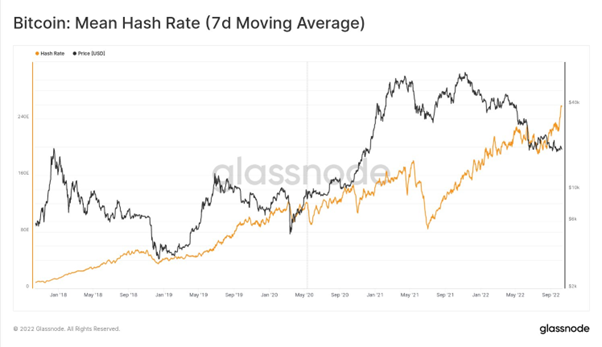

Bitcoin Mining Difficulty Surges to All-Time High, Putting Additional Squeeze on Miners

- The latest difficultly adjustment is in, and it now requires 35.6 trillion hashes to mine one bitcoin (BTC), up a whopping 13.55% from the previous measure, according data from btc.com.

- Part of the Bitcoin code includes a so-called difficulty adjustment every 2,016 blocks (about every two weeks). The size and direction of the adjustment depends on the total computing power mining bitcoin, and its purpose is to keep block confirmations coming about every 10 minutes.

- The current network hash rate is 257 million terra hashes per second (TH/s), according to blockchain.com, a significant rise from this time last year when it was at around 140 million TH/s.

- Rising difficulty paints an even drearier picture for bitcoin miners who are already feeling the squeeze of weak bitcoin prices and higher energy costs.

Polygon launches testnet for Layer 2 network Hermez

- Polygon is launching a public testnet for Ethereum scaling solution Hermez, as the race for a dominant Ethereum Layer 2 solution gets underway.

- Polygon acquired the Ethereum Layer 2 scaling solution Hermez late last year for $250 million. Hermez runs on top of Ethereum and boosts its scalability by allowing it to process more transactions for a cheaper price. This is the first time anyone will be able to test out the new network.

- Hermez is a type of Layer 2 scaling solution known as a zkEVM, which offers benefits that other Layer 2s do not, mainly around security and application customization.

- “It was widely believed that zkEVM will take several more years to ship, which makes this an even more groundbreaking milestone, not only for Polygon but for the whole Web3 industry,” said Polygon Co-founder Mihailo Bjelic.

- ZkEVMs enhance all the benefits of Layer 2s, while allowing developers to create Zero Knowledge (ZK) applications using the industry standard coding language Solidity. What this means is that applications and developers receive all the security and scaling benefits of ZK provides, without having to learn a new coding language.

Bitcoin and Ether Fall Slightly as Macro Clouds Loom Over Market

- Crypto markets were lower on Monday, trading in sync with traditional markets as investors awaited a key U.S. inflation report due later this week.

- The CoinDesk Market Index, a broad-based market index that measures performance of cryptocurrencies, was down 1% over the past 24 hours. Bitcoin (BTC) slid 1.0% and ether (ETH) lost 0.9%.

- BTC was trading in a range between $19,200 and $19,600. The price slipped below $20,000 after Friday’s U.S. job growth report showed that hiring was slowing but still robust, suggesting the Federal Reserve will need to keep tightening monetary policy to bring down inflation.

- A report Thursday from the Labor Department is expected to show Consumer Price Index (CPI) inflation data slowing to 8.1% in September from 8.3% in August – but still four times the Federal Reserve’s 2% inflation target.

- “Today’s movement reflects the general bearish trend across all markets and is likely influenced by some de-risking ahead of inflation figures,” said Riyad Carey, a research analyst at crypto data firm Kaiko.

Circle’s USDC Stablecoin Has Lost All Its Post-Terra Gains

- After a 7-week rally in May and June that sent USD Coin’s market capitalization above $56 billion, an all-time high, Circle’s stablecoin has now lost all the ground it gained earlier this year.

- On Monday, USDC had a market cap of $46 billion—the lowest it’s been since January of this year.

- USDC was recently dealt a blow from an effort to “enhance liquidity and capital-efficiency” at Binance. At the start of September, the world’s largest crypto exchange by volume said that it would begin automatically converting competing stablecoin balances—including USDC, Pax Dollar and TrueUSD—to its own Binance USD stablecoin.

Ethereum Supply Turns Deflationary—But Price Still Struggles

- As global financial institutions wrestle with record levels of inflation, Ethereum is facing an inverse dilemma.

- Since Saturday, ETH supply has dropped by over 4,000 tokens, according to data from ultrasound.money, but saw no corresponding price boost. ETH’s price, despite a lowered supply, has fallen some 3.6% in the same period, to $1,307 at writing.

- The turn marks the first deflationary run—where more ETH is destroyed than created—since the Ethereum network’s landmark move to prove of stake in September.

Glassnode

- #Bitcoin Difficulty has adjusted to a new all-time-high due to a rapid increase in network hashpower.

- This increases the $BTC cost of production, and puts additional stress on miners.

- We have launched a new dashboard tracking miner capitulation risk🧵 https://glassno.de/3CNddGc