Bitcoin Price: US$ 17,178.26 (+0.29%)

Ethereum Price: US$ 1,320.39 (+2.34%)

The Future of ETH Liquid Staking

- Proof-of-stake (PoS) is a consensus mechanism used in blockchains to process transactions, create new blocks, and maintain the chain’s security. In PoS, tokens are staked in order to provide security for the network. In return for staking their tokens, users are compensated with block rewards from the network and fees paid by users. To stake tokens, users have to run validator nodes. Given the technicalities involved with this, validation is typically undertaken by professional node runners.

- To increase accessibility to staking and liquidity, liquid staking protocols like Lido and Rocket Pool were developed. These protocols allow users to stake their tokens with validators in exchange for a portion of the interest yield earned. Additionally, these liquid staked tokens can be easily traded on decentralized exchanges, allowing users to convert them back to unstaked tokens (e.g., from stETH to ETH).

- Node operators are responsible for staking ETH and running validators on behalf of depositors.

- Rocket Pool has the most widely distributed operator pool, with 1,906 individual operators. They allow anyone to set up a mini-pool validator, with a minimum requirement of 16 ETH staked from the operator and another 16 ETH staked from Rocket Pool depositors.

- Lido has the second largest operator pool, with 27 node operators. However, they control a significant portion of the staked ETH, raising concerns about centralization risks on the Ethereum network.

- StakeWise is working towards decentralization through the launch of StakeWise v3, which will allow for permissionless node operators. StakeWise v3 was originally slated to launch in late 2022, but has since been pushed to early 2023.

- Frax Finance is planning for frxETH v2, which will help decentralize frxETH. It is expected to launch closer to the ETH Shanghai upgrade in March 2023.

- The ETH liquid staking market has grown tremendously, now capturing approximately 40% of all ETH staked. Lido is the clear leader, holding approximately 30% of staked ETH. Since the Merge, staked ETH has continued to increase along with yields. As yields have risen, so has the competition, as a significant portion of the market is still yet to be captured.

- While Lido remains the leader, its market share is slowly being eroded by competitors. Rocket Pool, StakeWise, and Frax are three protocols steadily gaining market share at Lido’s expense. Coinbase has also entered the competition, and now accounts for 16% of the liquid staking market. As one of the leading centralized exchanges, Coinbase has strong branding, and the ability to onboard users to staked ETH puts them in a prime position to grow.

- Coinbase and Frax are strong players to look out for given their astounding growth rates. ETH staked in cbETH increased Coinbase’s staked ETH from ~600k in July to ~1M as of Dec. 16th, 2022. Frax just launched their liquid staking product in October, and has seen rapid growth to ~45k staked ETH as of Dec. 16th.

- Continue on Delphi…

GALA and LDO Pump Amid “Short-Squeeze Szn”

- Over the past seven days, the two best-performing assets have been GALA and LDO, which are up 169% and 77% respectively. Much of these returns are the result of a weekend pump where GALA and LDO rallied 77% and 67% respectively.

- The rally is likely the result of a short squeeze instead of an organic increase in demand. The funding rates for both tokens were negative with traders with short positions paying 0.65% for LDO and 0.85% for GALA every eight hours.

- Generally, such aggressive positioning is “hunted” – a practice where market participants attempt to push the price of an asset to levels where traders are liquidated and forced to close positions.

- The open interest (OI) for both tokens also dropped significantly with OI for LDO decreasing from a high of $100M to $60M and OI for GALA decreasing from a high of $176M to $133M.

- LDO has also benefitted from a narrative-backed trend in tokens associated with liquid staking derivatives. Over the past 7 days, Rocket Pool and Ankr have also outperformed with RPL and ANKR rallying 24% and 34% respectively.

Hong Kong Firm With Ties to Bitmain Reorganizes to Focus on Crypto Asset Management and Hedging

- A Hong Kong firm with ties to crypto mining manufacturer Bitmain reorganized its business to bring crypto asset management and hedging services to the forefront, as the city pushes for a comeback in the digital asset space.

- In the past year or so Hong Kong has lagged behind its peer cities, like Singapore and Dubai, due to concerns over its regulatory landscape and the influence of mainland China, which has banned crypto trading and mining.

- However, since November authorities in the city have made their desire clear to bring Hong Kong back on the crypto map.

- Against this backdrop, Nasdaq-listed Dragon Victory International Limited (LYL) is rebranding to Metalpha Technology Holding Limited, the name of its asset management and hedging subsidiary, according to a statement sent to CoinDesk.

- After the rebranding, the “brand name will be much easier to be to be viewed by the client,” Metalpha founder and CEO Adrian Wang told CoinDesk. Essentially, investors and clients will be able to easily recognize the Metalpha financial services on the Nasdaq ticker, as the company pushes more into the crypto space.

- Dragon Victory was initially offering crowdfunding services out of Hangzhou, China, and later pivoted to supply chain management before finding its way to blockchain in 2021.

- Metalpha, which offers asset management and hedging services, is a limited liability company, 49% of which was owned by Bitmain-tied financial services firm Antalpha, and 51% of which was owned by Meta Rich Limited, which in turn was 100% owned by Dragon Victory International.

Ripple’s XRP leads CoinShares inflows in otherwise down week

- Ripple’s XRP saw inflows at CoinShares in the first week of the year as investors fled bitcoin and ether.

- About $3 million was added in XRP, representing 9% of CoinShares’s assets under management, the company said, citing improving clarity on its legal case with the U.S. Securities and Exchange Commission.

- Bitcoin saw outflows of $6.5 million and ether of $3 million. It was the eighth week in a row of ether outflows.

- Trading volumes remained low at about $5 billion a day, compared with $9 billion in 2022, CoinShares said.

Galaxy Digital’s Head of Research Sees More Venture Funding for Web3 Firms This Year

- Web3 blockchain startups and trading-based services led venture-capital deals and funding in 2022, and the trend could continue this year, according to Alex Thorn, head of research at crypto investment firm Galaxy Digital.

- Thorn told CoinDesk TV’s “First Mover” on Monday that the Web 3 sector, which is made up of non-fungible tokens (NFTs), decentralized autonomous organizations, the metaverse and online gaming, were 31% of deals in 2022, while 13% were made up of trading platforms.

- VCs invested more than $30 billion into crypto and blockchain startups in 2022, according to Galaxy’s “Crypto VC Year End” report.

- Thorn noted, however, that the number of deals and amount of money invested steadily declined every quarter during 2022, pointing out that macroeconomic factors coupled with the fall of significant crypto companies may have played a role in the decrease.

- The firm found that more money is being invested in later-stage companies, especially those that provide trading and exchange services, he said.

- “That makes some sense,” Thorn said, because “there are more later-stage companies than there were years ago.”

Crypto and banking apps targeted by ‘Godfather’ malware, warns BaFin

- Germany’s financial regulator BaFin has warned that crypto and banking mobile apps are being targeted by cybercriminals using the “GodFather” Android malware.

- BaFin stated that the malware has so far attacked 400 crypto and banking apps, including platforms operating out of Germany and 15 other countries, Monday’s announcement revealed. This includes 200 banking apps, 100 crypto exchanges, and 94 crypto wallets, according to a report by PCrisk.

- Today’s announcement is the latest warning of the growing threat posed by the GodFather malware. GodFather is among a class of Android-based trojans like Gustuff that targets crypto and banking mobile apps. It tricks its victims by displaying fake versions of online crypto exchange and banking websites. Cybercriminals are able to use the malware to steal the login data of victims.

- The GodFather malware can also steal text messages from the victim’s smartphone. This makes it possible for cybercriminals to use the malware to bypass two-factor authentication checks.

- Security experts say the malware is able to mimic the Google Protect tool thus allowing it access to Accessibility settings on the victim’s phone. This access also allows the malware to expand its pool of infected apps. It does this by using the phone’s built-in screen capture capabilities to record keystrokes when logging in to apps outside of its list of infected apps.

- “It is unclear exactly how the software gets onto the infected end devices of customers,” the BaFin announcement stated. However, security experts say cybercriminals are distributing the malware via trojan-infected apps on the Google Play Store. These apps are fake versions of legitimate apps that come loaded with the trojan.

- Android users have been urged to review apps before installing them to avoid such fake apps. Android users have also been advised to turn on Google Play Protect. PCrisk also stated that the malware does not operate on devices that have their languages set to Uzbek, Russian, Azerbaijani, Kazakh, Kyrgyz, Armenian, Tajik, Belarusian, or Moldovan.

CoinDesk Research’s 2022 Annual Crypto Review

French Financial Regulator Supports Faster Mandatory Licensing for Crypto Firms

- France’s financial markets authority (AMF) wants to force crypto companies to seek a license if they aren’t already registered in the country, its chair Marie-Anne Barbat Layani said on Monday.

- Barbat-Layani appeared to be supporting a move proposed last year by the French Senate, which would mandate crypto firms to seek some of regulatory recognition in anticipation of the European Union’s new Markets in Crypto Assets (MiCA) regulation by Oct. 1, 2023.

- “The AMF, like the parliament, calls for an accelerated move to a regime of obligatory licensing for non-registered providers” of crypto services, Barbat-Layani said at an event, according to a tweet posted by the regulator.

- A number of prominent companies, including Binance, have registered with the AMF. The registration involves checks on companies’ governance and compliance with anti-money laundering rules. No provider has yet been issued a license, a voluntary procedure set out under French law.

- In an article published for Le Figaro newspaper, France Deputy Central Bank Governor Denis Beau said it would be “desirable” to have mandatory licensing in the country ahead of the European Union’s MiCA law coming into effect in 2024, citing the collapse of stablecoin ecosystem Terra-Luna and crypto exchange FTX. Beau’s statement appears to confirm reports that Governor Francois Villeroy de Galhau is pushing for the change.

Crypto VCs say half their token bets are sidelined with no launch date in sight

- Keeping tabs on performance should be easy for venture capitalists in crypto. The bulk of their bets, if not all of them, are denominated in liquid tokens that can be marked to market at any time.

- There’s just one problem: A growing number of VCs are reporting that at least half their portfolio projects are holding back the launch of their tokens, citing fears over price, exchange fees and increasingly aggressive regulation.

- Take Spartan Group, one of the more active investors in decentralized finance.

- Of the 108 projects that Spartan has backed through its $110 million DeFi fund, less than 40% have listed on exchanges, according to an investment report for the third quarter of 2022 obtained by The Block. Kelvin Koh, managing partner at Spartan Labs, said the fund in question invests in early-stage ventures, and that part of its returns — even for projects that have launched tokens — are unrealized.

- It turns out that many crypto VCs are in the same boat.

- “Around 60% are yet to launch, and due to FTX exposure around 3% are on life support,” Oliver Blakey, partner and co-founder of Ascensive Assets, said in an email. His firm has made 89 investments across two different funds.

Glassnode – A Volatility Slumber

- The digital asset market has opened the new year…by staying asleep. Since our final newsletter edition on 12-December (WoC 50, 2022), the markets are almost exactly where we left them.

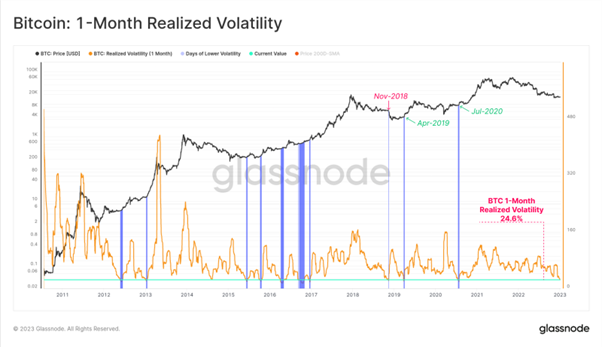

- Extremely low realized volatility, which historically precedes explosive market moves (in both directions), with latest examples of Nov 2018, and Apr-2019.

- Softness in on-chain activity for BTC and ETH, coincident with low overall market volatility, and setting up weak a baseline for the new year.

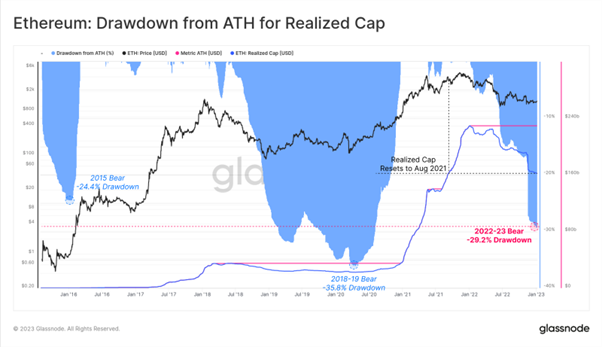

- Drawdowns in the Realized Cap indicating 2022 is comfortably one of the deepest bear markets to date with respect to capital losses.

- Bitcoin markets are infamous for their volatility, however in spite of this, the holiday break was exceptionally quiet. Realized volatility over the last month for BTC declined to multi-year lows of 24.6%, of which there are very few instances with similar levels (marked in 🟦). However, all prior examples preceded much higher volatility environments on the road ahead, with most trading higher, and just one (Nov 2018) trading dramatically lower.

- There are even fewer historically quiet periods for ETH, which has seen monthly realized volatility collapse to 39.8%. All primary instances of similarly low market volatility also preceded extreme volatility, with Nov-2018 (-58% sell-off) and Jul-2020 (2020-21 bull) being the primary examples.

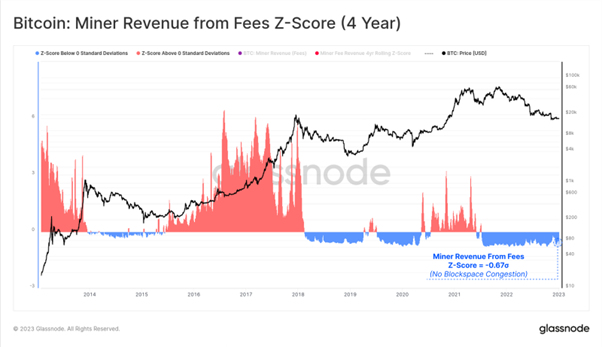

- Demand for Bitcoin blockspace continues to remain weak, with negligible upwards pressure on the Bitcoin fee market. The 4-yr Z-Score of miner revenues is yet to make any noteworthy progress back towards positive territory, and remains -0.67 standard deviations below the mean.

- Whilst not perfect, the Realized Cap is arguably one of the better tools available to measure true capital inflows, to compare valuations between assets. It acts to both filter out lost coins, partially account for volume churn (where the same coins constantly transact), and better reflects the true invested value by the market.

- With this as context, the Bitcoin Realized Cap has declined by -18.8% since the ATH, representing a net capital outflow of -$88.4B from the network. This makes for the second largest relative decline in history, and the largest in terms of USD realized losses. This resets the Realized cap to May 2021 levels, expelling all invested value throughout the second peak of H2-2021.

- The Ethereum Realized Cap has drawndown by an even larger relative scale, declining by -29.2% since the ATH set in Jan-2022. Ether investors have locked in a total of -$67.1B in net realized losses over the course of 2022.

- This also puts the prevailing bear market as the worst in history on a USD denominated realized loss basis, but not yet on a relative scale, eclipsed by the 2018-19 bear market at a 35.8% drawdown.