Bitcoin Price: US$ 20,490.74 (-0.66%)

Ethereum Price: US$ 1,572.69 (-1.12%)

Does the DOGE Rally Mean “Alt Szn?”

- After weeks of moving within a narrow range, crypto assets are showing signs of life. Over the past seven days, ETH is up 14% while DOGE is up 102%. Other meme tokens have also outperformed with ELON rallying 59% and FLOKI gaining 42%.

- Seemingly, the rationale behind this price action in meme tokens has been attributed to Elon Musk’s acquisition of Twitter.

- Historically, a strong rally in DOGE has marked the beginning of an “alt szn” – a time period characterized by aggressive risk-taking behavior where capital flows to crypto assets other than BTC.

- Most recently, we’ve seen this scenario play out during the first half of 2021 when DOGE price increased by 172x while BTC dominance decreased by 42%. Previously, this has also occurred in May 2017 and January 2018.

- Different sectors take turns rallying. Generally, a bull market starts with an increase in BTC price. This is typically followed by a rally in ETH, after which other altcoins begin to rally.

- Given that we’ve already seen price increases in ETH and DOGE, several market participants are also expecting a rally in other altcoins. It remains to be seen if this rally has any legs or if this is merely generating exit liquidity before we hit new lows.

Coinbase Files to Support Ripple Against SEC Case

- Crypto exchange Coinbase has petitioned a federal court for permission to file a friend-of-the-court (amicus) brief in the ongoing lawsuit between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs.

- Coinbase joins the Blockchain Association, an industry lobbyist group, SpendTheBits, a crypto payments app that uses XRP and John Deaton, a lawyer, in hoping to shore up Ripple’s case against the SEC, which sued Ripple at the end of 2020 on allegations it sold XRP as an unregistered security.

- The exchange highlighted whether the SEC provided “fair notice” prior to bringing its enforcement action, taking a dig at the common industry complaint that the regulator has not provided clear guidance to businesses in the process.

- “Given the absence of SEC rulemaking for the cryptocurrency industry, the question of whether the SEC has given fair notice before bringing an enforcement action against sales of one of the thousands of unique digital assets will often be highly fact-intensive, which makes it particularly ill-suited for adjudication on summary judgment,” Coinbase’s filing said.

ATOM 2.0 On-chain Voting Goes Live

- Cosmos revamped its latest roadmap to position its native token, ATOM, as the preferred collateral within its ecosystem.

- After a month of deliberation and in the latest instance of the growing business of digital assets activism — the proposal, ATOM 2.0, has gone live for on-chain voting.

- Community members have two weeks to vote on the Cosmos proposal. Quorum is set at 40%, lower than the typical pass rate of 50%. Voter turnout was around 7% at the time of publication, with over 90% ratifying the proposal.

- ATOM 2.0 is a new vision piece and “counterpart” to the original 2017 Cosmos white paper that focuses on inter-blockchain communication (IBC), interchain security and liquid staking. It “marks the transition to the next phase of the Cosmos Hub as an infrastructure platform,” according to the proposal’s authors.

14 Years Since the White Paper: Can Bitcoin Keep Growing?

- Fourteen years to the day after Satoshi Nakamoto published the famous Bitcoin white paper, the first cryptocurrency’s once-meteoric growth is showing signs of slowing.

- In June 2011, Bitcoin reached 25,000 unique wallet addresses active each day. By February 2015, it had 250,000. Bitcoin hovered a little under 600,000 unique daily addresses for most of 2017 — and had 668,000 unique addresses by the end of February 2022.

- The number of bitcoins unspent for the past year reached an all-time high in September of 12.5 million bitcoins, or 65% of total circulating supply, per crypto analytics firm Glassnode. So, it may be that investors viewing bitcoin as digital gold that holds value despite a hawkish Fed, or retail traders giving up trading during a bear market, are contributing to a slowdown in active addresses per day.

- Yet, the total number of Bitcoin addresses continues to grow, exceeding one billion in July 2022, according to Glassnode.

Dogecoin’s 102% Spike Steals the Spotlight as October Ends

- Crypto markets fell on the final day of October, with bitcoin (BTC) declining 1.2% and ether (ETH) falling 1.8%. The two largest cryptocurrencies by market capitalization ended the month up 5% and 17%, respectively.

- Dogecoin (DOGE), the Shibu-Inu themed meme coin, led all gainers for October, rising 102%, about 90% of which occurred during the last week. DOGE remains a top 10 cryptocurrency by market capitalization at approximately $15.6 billion.

- Unlike BTC and ETH, whose fortunes appear tied to macroeconomic factors, burn rates and centralized exchange balances, dogecoin’s appeal appears to stem from community, personality (Elon Musk) and the opportunity for outsized gains within a rapid period of time.

- This week, crypto investors will be weighing a range of economic indicators. In the U.S. the Federal Open Market Committee (FOMC) announces its latest interest rate decision, a widely expected 75 basis point increase. The Bureau of Labor Statistics will release its latest jobs data while the Institute for Supply Management issues its October manufacturing report.

Elon Musk takes sole control of Twitter

- Elon Musk is in charge. He became the sole director of Twitter after all other directors were kicked to the curb following his purchase of the social media giant.

- Effective at the time of Musk’s takeover, former directors let go included Bret Taylor, Parag Agrawal, Omid Kordestani, David Rosenblatt, Martha Lane Fox, Patrick Pichette, Egon Durban, Fei-Fei Li and Mimi Alemayehou, according to a filing with the U.S. Securities and Exchange Commission detailing terms of the material agreement for the $44 billion deal.

Twitter to Reportedly Begin Charging $20 Per Month for Verification – video

- “The Hash” panel discusses how Twitter could change under billionaire Elon Musk’s ownership. The Washington Post reports the social media company will lay off a quarter of its workforce. And according to The Verge, Twitter is gearing up to charge $19.99 for its Twitter Blue subscription. “The Hash” team also breaks down insights into the rise of dogecoin recently.

Vitalik Buterin shares the kind of DeFi regulation he would like to see

- With debates raging about potential DeFi regulation, Ethereum co-founder Vitalik Buterin has broken down what he sees as productive solutions.

- Buterin noted that the two main regulatory goals are protecting consumers and making it harder for bad actors to move money around, according to a tweet thread. He suggested three ways of achieving this — such as limiting leverage on DeFi protocol front-end websites, requiring transparency about what audits have been done and restricting access to tools through the use of knowledge tests.

- Buterin added that he would like to see zero-knowledge technology being used to meet requirements like these. This technology allows for something to be mathematically proven without necessarily giving away the information behind it.

- He also criticized some other potential ways of regulating DeFi protocols. He said that putting know-your-customer requirements on DeFi front ends would only annoy users and not frustrate hackers. This is because bad actors interact directly with the protocols and don’t need to access them via the front ends. He added that centralized exchanges are a much better place for this type of regulation.

Aptos DeFi project under fire, asks community for confidence vote

- Aptos-based DeFi project Arco Protocol has handed over a decision to its community: back it or let the whole thing shut down.

- The project explained that it had come under heavy criticism after its token sale was struck by issues, leading to the loss of key partnerships with exchanges and other protocols. Among all these issues, the project faced accusations that it was a scam and that the team intended to run away with the funds, it said on Twitter.

- As a result, it has put out a Twitter poll asking for support in order to continue. It gave three options: back the project and keep it running; hand over control of the project to the community; or shut the whole thing down and issue a refund.

- While the poll still has hours left, nearly half of the 9,000 votes — 48% — are in favor of a refund. This is followed by a third of votes backing the community and a remaining 20% that want it to be decentralized. While this does mean 52% of voters are in favor of the project continuing in some form, it will likely have to go with the most popular vote and shut down.

HUSD stablecoin sharply loses peg even further, drops to just $0.30

- The HUSD stablecoin has dropped by 60% over the last few hours and is now worth just $0.30. This comes just days after the stablecoin was delisted from crypto exchange Huobi, which it was associated with.

- The stablecoin was trading below the peg since Oct. 28 and sat at around $0.76 over the weekend. At 4 a.m. this morning, it sharply plummeted to a low of $0.28 before bouncing slightly.

- Huobi said on Oct. 27 that it would be delisting HUSD. It added that it would convert users’ assets to the stablecoin tether (USDT).

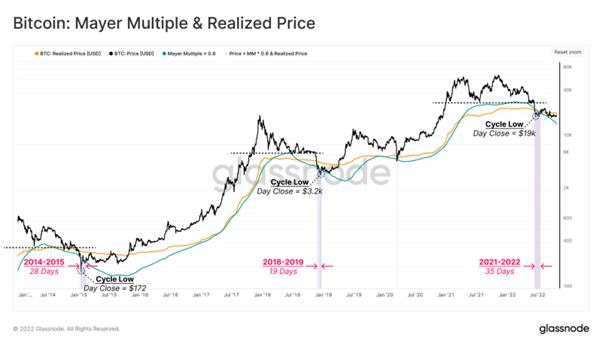

- Bitcoin has rallied back above the $20k level this week, pushing off a low of $19,215, and trading as high as $20,961. After consolidating in an increasingly tight range since early September, this is the first relief rally in many months.

- At this stage, the 2022 bear has inflicted severe financial loss, both on investors who have capitulated, and those who still weather the storm. The last remaining piece of the puzzle appears to be a component of duration, time, and ultimately, investor apathy.

- The market is currently approaching the underside of the Realized Price at $21,111, where a break above would be a notable sign of strength.

- Compared to the end of the 2018-19 cycle, both the magnitude of wealth redistribution, and the final supply concentration at the bottom are somewhat lower in the 2022 cycle. This adds further evidence to the case that additional consolidation and duration may still be required to fully form a bear market floor.

- That said, the redistribution which has occurred to date is significant, and certainly indicates that a resilient holder base is actively accumulating within this range.

- CONTINUE ON GLASSNODE…