Bitcoin Price: US$ 17,163.64 (+4.39%)

Ethereum Price: US$ 1,294.46 (+6.41%)

DEX Volume Spikes After FTX Collapse

- Weekly DEX volume across all chains increased 146% from $20B to $49.2B during the first week of November as the FTX saga unfolded. Monthly DEX volume also increased 110% from $107B in October to $50.8B in November.

- The bankruptcy of FTX and the following contagion has caused a loss of confidence in centralized institutions. This was reflected in market prices as a basket of DEX tokens vs. BTC has outperformed a basket of CEX tokens vs. BTC since the bankruptcy.

- This was also reflected in the sales of non-custodial, hardware wallets as Ledger reported its highest sales day following the bankruptcy announcement while Trezor also reported an “exponential increase.”

- However, major events in the crypto market also naturally spur on-chain trading activity due to higher volatility. During the Terra collapse, weekly DEX volume increased 115% from $29.1B to $62.7B during the first week of May.

- Almost 60% of November’s DEX volume occurred on Uniswap, followed by 9% each on Pancakeswap and Curve. Uniswap also surpassed Coinbase in daily volume for the ETH/USD pair on Nov. 14 with $1.1B on Uniswap vs. $600M on Coinbase.

Crypto Markets Today: Kraken Becomes the Latest Industry Giant to Cut Its Workforce

- Crypto exchange Kraken is laying off 30% of its global staff – around 1,100 people – in response to the crypto market downturn, the company said Wednesday.

- “Since the start of this year, macroeconomic and geopolitical factors have weighed on financial markets. This resulted in significantly lower trading volumes and fewer client sign-ups,” Kraken said in a blog post.

Bitcoin Correlation With the Dollar Index Turns Negative, Again

- The correlation of bitcoin (BTC) and ether (ETH) to the U.S. Dollar Index (DXY) has once again turned negative. BTC’s correlation coefficient to the DXY has fallen to -0.36, after moving as high as 0.84 on Nov. 19.

- Correlation coefficients measure the relationship between two assets, and range between 1 and -1. The former implies a direct pricing relationship between the assets, while the latter indicates an inverse relationship.

- BTC had held a persistently inverse relationship to the DXY since July, before crossing into positive territory on Nov 9. In August, the correlation between the two assets fell to -0.94.

- The timing of the reversal coincides with FTX-related market turmoil because the shift in pricing relationship occurred on the same day that Binance and FTX’s tentative deal fell through. The return to negative correlations signals that:

- Markets have likely reset and found a new level of comfort specific to prices

- Macro narratives will start to take hold again, as what impacts the dollar will likely be seen in crypto prices

Bitcoin, Ethereum Jump as Fed Chair Signals Slowing Rate Hikes

- Bitcoin and the wider crypto market jumped Wednesday after Federal Reserve Chair Jerome Powell said in a speech that December would likely bring smaller interest rate hikes.

- The biggest cryptocurrency by market cap was trading for $17,102 at the time of writing—up 2% in the hour after Powell’s speech and over 4% in the past 24 hours, according to CoinGecko.

- Ethereum, the second largest digital asset, jumped even more and was up over 6% in 24 hours, trading hands for $1,287.

- Every other major digital asset was up following the comments by Powell. “The time for moderating the pace of rate increases may come as soon as the December meeting,” he said.

The Ethereum Foundation Commences Shutdown of Ropsten Testnet

- The Ethereum Foundation said in a Wednesday blog post that the blockchain’s Ropsten test network (testnet) has begun to wind down, with a full shutdown anticipated for sometime between Dec. 15-31.

- The news comes as developers have gradually stopped participating on the testnet over the past few months, and participation rates have declined.

- Ethereum runs testnets so that developers can run software before launching it on Ethereum’s main network (mainnet). Test networks essentially act as copies of the Ethereum mainnet, and they allow client teams, infrastructure providers and developers to test any changes to their applications before launching them in a more high-stakes environment.

- Ethereum will also shut down its Rinkeby testnet sometime in mid-2023, giving developers ample time to move over any applications they have running to the Goerli or Sepolia testnets.

Fed Likely to Raise Rates by 50 Basis Points in December; Bitcoin Jumps

- In its eighth and final meeting of 2022, the Federal Reserve will likely raise interest rates by another 50 basis points, or 0.5 percentage point, Fed Chair Jerome Powell implied Wednesday. The previous four Fed rate hikes were for 75 basis points, or 0.75 percentage point.

- “It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down,” Powell said at an event at the Brookings Institute in Washington, D.C. “Time for moderating the pace of rate increases may come as soon as the December meeting.” A 50-basis point hike would lift short-term rates to a target range to 4.25 to 4.50%.

- Bitcoin (BTC) jumped about 1% on the news to $16,982.

- Speculation over a smaller rate hike mounted in recent weeks after two consecutive lower-than-expected inflation reports by the U.S. Labor Department gave central bankers some relief that price pressure is starting to cool.

- The Fed chair also said that the terminal rate would be higher than previously forecast in the latest economic projections by the FOMC in September, which projected rates going as high as 5%.

South Africa Adds Crypto Businesses to List of Accountable Institutions

- South African lawmakers have added crypto businesses to the country’s list of accountable institutions, according to an amendment document published on Tuesday.

- Businesses that offer exchange services, or are responsible for taking care of the safekeeping of crypto will have to identify and define new and existing clients and keep records of their identity. The rule was added as an amendment to the country’s Financial Intelligence Act of 2001 and will take affect on Dec. 19.

LedgerX to Make $175M Available for FTX Bankruptcy Proceedings: Bloomberg

- LedgerX, a subsidiary of bankrupt crypto exchange FTX, is preparing to put up $175 million toward its parent company’s bankruptcy proceedings, according to a Bloomberg report, which cited people familiar with the matter.

- The money could be transferred as early as Wednesday.

- The funds will come from a $250 million pot LedgerX was planning to use in a regulatory bid to get approval to settle crypto derivatives without the use of intermediaries.

- The contribution from LedgerX would provide a crumb of comfort for FTX’s more than one million creditors. FTX’s top 50 creditors are collectively owed about $3.1 billion, according to court documents from the bankruptcy filing.

Uniswap’s own NFT marketplace aggregator live months after Genie acquisition

- Uniswap Labs, the main developer behind decentralized exchange protocol Uniswap, is starting a new NFT marketplace, which it hopes will break the barrier between cryptocurrency exchanges and such NFT markets.

- “Historically, everyone views tokens and NFTs as two very separate experiences. But at the end of the day, they’re both digital assets and the goal is to unlock universal ownership in exchange for creators and for communities. NFTs and tokens are just two different ways to unlock value in our digital worlds,” said Scott Gray, head of NFT product at Uniswap Labs.

- The marketplace aggregates NFTs up for sale from OpenSea, X2Y2, LooksRare, Sudoswap — including its pools, which sell NFTs along price curves — Larva Labs, X2Y2, Foundation and NFT20.

- The developer has been working on the product since June when it purchased NFT aggregator Genie as part of expansion efforts to include NFTs and ERC-20 tokens among its products.

- At the time, it announced plans for an integration with the Uniswap web app and said Genie would remain accessible until the new Uniswap NFT experience was available. For now, the Genie website will redirect to the NFTs on the Uniswap website. The launch comes with some $5 million worth of perks for eligible historical Genie users.

Binance, Coinbase, Kraken ordered to disclose user data in hack probe: FT

- Six exchanges — including Binance, Coinbase, Luno and Kraken — will have to share user data to help trace $10.7 million in funds stolen from an unnamed UK-based exchange in 2020.

- London’s High Court issued a court judgment demanding the handover of the data, according to a Financial Times report. Two of the six exchanges involved were not named.

- The anonymous exchange — which has not shared its name to avoid “tipping off” the hackers — has already managed to trace $1.7 million of the funds from the hack.

- The amount in question was deposited into 26 accounts on the exchanges in cryptocurrencies including bitcoin, XRP, ether and tether. It’s one of the first applications of a new law in the UK to help track assets in cyber-fraud cases, even if the companies holding the information are based overseas, according to FT.

Secret Network says it resolved risk from Intel hardware vulnerability

- The developers of Layer 1 blockchain Secret Network said they resolved a security issue flagged by researchers who highlighted a vulnerability posed by Intel hardware the network used to enable privacy-preserving smart contracts.

- Secret’s promised privacy apps may have been compromised due to a vulnerability in certain Intel SGX chips called xAPIC or ÆPIC Leak.

- Intel SGX chips are commonly used by software firms for privacy computing. Secret’s blockchain nodes also use them to encrypt data in a software setup called a “trusted execution environment(TEE).” However, the presence of xAPIC vulnerability also meant hackers could potentially snoop on systems depending on SGX. To prove the risk faced by Secret, the researchers extracted a “consensus seed” to decrypt all private transactions on the Secret blockchain.

- “We evaluated TEE-based blockchain Secret Network to see if it was susceptible to ÆPICLeak, and ended up finding the master decryption key for the whole network,” said Andrew Miller, a lead researcher of the report and Assistant Professor at the University of Illinois, Urbana-Champaign.

- The researchers showed that it was possible that a malicious hacker could have also obtained all the transactional history on the network, contrary to Secret’s promise of full privacy.

Crypto Exchange Binance Sees Biggest Inflow of SHIB Tokens Since February

- Binance, the world’s largest crypto exchange, received large amounts of shiba inu (SHIB) tokens on Tuesday, raising speculation of a price drop because large transfers of a cryptocurrency to an exchange is often a prelude to a sale.

- The exchange registered a net inflow of more than 1.8 trillion SHIB ($16 million) tokens, the highest single-day tally since Feb. 28, according to data tracked by Glassnode.

- The tokens came from an address supposedly owned by Crypto.com in two transactions, each carrying 900 billion SHIB, at 12:39 UTC, according to data sourced from Dune Analytics.

- “So now he is going to sell part of SHIB?” on-chain researcher Lookonchain tweeted, noting the transfers.

NFT Investor Animoca Brands to Start $2B Metaverse Fund: Report

- Non-fungible token (NFT) and gaming investor Animoca Brands plans to set up a fund worth as much as $2 billion to invest in metaverse businesses, the firm’s co-founder, Yat Siu, said in an interview, Nikkei Asia reported on Wednesday.

- Siu said that Animoca Brands will unveil the fund, called Animoca Capital with plans to make its first investment next year. The fund’s focus “will be everything on digital property rights,” he added.

Binance Enters Japan With Acquisition of Regulated Crypto Exchange Sakura

- Binance has bought Sakura Exchange BitCoin (SEBC), a Japanese crypto exchange regulated by the country’s Financial Services Agency (FSA), for an undisclosed sum, according to a blog post Wednesday.

- With the acquisition, the world’s largest crypto exchange by trading volume enters the Japanese market, adding it to the now substantial list of countries in which it has some degree of regulatory authorization.

Perpetuals-Focused Decentralized Exchange GMX Surpasses Uniswap in Daily Fees Earned

- Decentralized exchange GMX has evolved as a serious competitor to established industry players such as Uniswap in the wake of FTX’s collapse.

- On Monday, GMX earned $1.15 million in trading fees, surpassing Uniswap’s $1.06 million for the first time on record, according to data tracked by Delphi Digital.

- The decentralized exchange, which allows users to trade perpetuals or futures with no expiry without an intermediary using smart contracts, is perhaps benefitting from a broader shift toward perpetual-focused decentralized platforms triggered by the recent fall of centralized giant FTX.

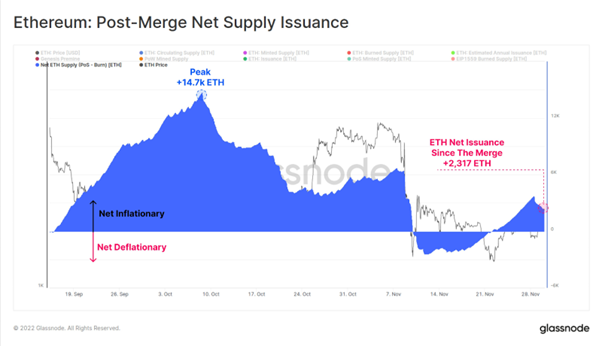

Glassnode

- Since the #Ethereum Merge, the total net coin issuance has been just +2,317 $ETH.

- A total of 131,454 $ETH has been issued to PoS validators, whilst 129,137 $ETH has been burned via EIP1559.