Bitcoin Price: US$ 24,842.20 (+2.35%)

Ethereum Price: US$ 1,703.27 (+1.40%)

- NFT market volume on Ethereum continues its uptrend from last month, recording monthly transaction volume of over $1B in January. This is a level not seen since June 2022. Blur accounted for 46% of January’s total NFT volume, surpassing OpenSea’s 40% share. Blur’s airdrop finally took place on Valentine’s Day, with over $300M worth of BLUR tokens distributed to traders and creators.

- OpenSea is feeling the heat from Blur, announcing 0% marketplace fees for a limited amount of time. They also moved to a minimum of 0.5% optional creator earnings for all collections without on-chain enforcement and updated their operator filter to allow sales using NFT marketplaces with the same policies.

- Other notable developments:

- Coinbase NFT paused creator drops to focus on features and tools that creators have requested. Coinbase signaled that they are not shutting down the NFT marketplace, and more developments will be announced in the future.

- The English Premier League announced a 4-year licensing partnership with Sorare, allowing fans to buy and sell licensed digital collectibles from one of the most popular sports leagues in the world.

- On January 21st, software engineer Casey Rodarmor launched Ordinals, which made individual sats (a unit of Bitcoin) trackable and effectively turning them into NFTs. Inscription is the process of linking content data with individual sats. This has sparked a heated debate in the Bitcoin community, with some embracing the new upgrade and others vehemently rejecting Ordinals.

- The growth in Bitcoin Ordinals has led to a corresponding surge in fees on the Bitcoin network. On January 30th, the daily fees spent inscribing Ordinals was $682. By February 11th, this had skyrocketed to over $73,000, a 100-fold increase.

- At the time of writing, the Bitcoin network had seen more than 100,000 Ordinal inscriptions. Users are inscribing images, videos, audio, text, etc., on-chain, with certain inscriptions like Ordinal Punks already fetching sky-high prices via OTC trades.

- Continue on Delphi Digital…

Coder Brings Ordinals to Litecoin as Bitcoin Inscriptions Surpass 154K

- Ordinal Inscriptions and the ability to mint content other than transactions on the Bitcoin network have taken the blockchain by storm, with over 154,000 inscriptions created to date, according to Dune analytics. Now, a developer has adapted the Ordinals project for rival proof-of-work blockchain Litecoin.

- Launched in 2011, Litecoin is a peer-to-peer cryptocurrency designed to be quicker at processing transactions than Bitcoin. Litecoin was created by Charlie Lee, a former Google employee, who sold all of his Litecoin in 2017 to avoid potential conflicts of interest.

- The quest to bring Ordinals to the Litecoin blockchain began on February 10, when a pseudonymous Twitter user, Indigo Nakamoto, offered 5 LTC (around $500) to anyone who could port Ordinals to Litecoin.

- On Sunday, software engineer Anthony Guerrera launched the Litecoin Ordinals project on GitHub after forking the GitHub repository for Bitcoin Ordinals posted by Casey Rodarmor in January.

- Litecoin was chosen because it is the only other blockchain on which Ordinals could work, Guerrera said, due to its soft forks of the SegWit and Taproot technology found in Bitcoin—both of which are essential to making Ordinals work.

- “Basically, I was motivated by the bounty that Indigo and a few others put out for someone to port Ordinals to Litecoin,” Guerrera told Decrypt via Twitter DM. “I approached Indigo about a week ago to step up to the challenge.”

- Guerrera says the bounty to port Ordinals to Litecoin grew from 5 LTC to 22 LTC, or around $2100.

Blur Overtakes OpenSea as Ethereum NFT Trading Skyrockets

- Following two straight months of sales growth, NFT trading rapidly accelerated over the past week as Ethereum NFT volume more than doubled during that span. It’s due to an evolving market in which upstart marketplace Blur has overtaken leader OpenSea, with traders rapidly flipping valuable NFTs like they’re DeFi tokens.

- According to data from DappRadar, Blur has generated $460 million worth of Ethereum NFT trades over the past seven days—a 361% increase over the previous span. OpenSea, meanwhile, saw a 12% increase in trading volume to $107 million during that period. The third-place marketplace, X2Y2, tallied barely $11 million in trades in that time.

- Overall, CryptoSlam points to a 155% week-over-week increase in Ethereum NFT trading volume. The surge in volume comes during a week in which Blur airdropped its BLUR governance token to NFT traders who earned rewards through the marketplace, and also by trading elsewhere ahead of Blur’s own launch last fall.

FTX Japan Users Can Resume Withdrawing Funds Tomorrow

- Customers of FTX Japan will be able to withdraw deposits of crypto and fiat currency tomorrow, the Japanese subsidiary of bankrupt crypto exchange FTX said Monday.

- The withdrawal process will be facilitated through Liquid Japan, a crypto trading platform purchased by FTX last spring. The company’s announcement comes after FTX Japan paused withdrawals last November as founder and former CEO Sam Bankman-Fred’s crypto empire came crumbling down.

- The Tokyo-based company stated that customers who are eligible to withdraw their funds have already been notified about the process via email, which requires them to create an account with Liquid Japan and confirm the existing balance of their FTX Japan account.

Number of Bitcoin Whales Drops to Lowest Level Since 2019

- The number of Bitcoin (BTC) whales, or wallet addresses holding 1,000 or more BTC, hit its lowest level since August 2019 on Sunday.

- There were 2,027 whales on Sunday, February 19, according to crypto analytics service Glassnode; the last time their number dropped this low was August 5, 2019, when they numbered 2,023.

- Owning that much Bitcoin at its current price of around $25,000 represents a sizeable show of faith in the digital currency, with each whale holding almost $25 million in Bitcoin.

- The number of Bitcoin whales peaked in February 2021 at just under 2,500 but has declined steadily since then.

Hong Kong Mulls Reopening Crypto Trading for Retail Investors

- Hong Kong looks ready to invite retail traders back to the crypto casino.

- In a new consultation paper, the Securities and Futures Commission of Hong Kong (SFC) proposed “to allow all types of investors, including retail investors, to access trading services provided by licensed VA [virtual asset] trading platform operators.”

- The proposal recommends that several conditions be met before crypto trading for retail investors is reopened, however—including knowledge and risk assessments, as well as potentially setting limits to how much exposure traders are allowed.

- The SFC identified criteria for which cryptocurrencies would be available for trading, too. Trading platforms would be responsible for vetting the team behind a token, as well as marketing materials, legal risks, and to establish “how resistant it [the token’s network] to common attacks” such as a 51% attack.

- After that, though, the token pool appears relatively shallow, with the Commission proposing that only “large-cap virtual assets” be eligible for listing.

Fireblocks testing ‘off-exchange’ crypto custody solution: Financial News

- Fireblocks is trialing a hybrid custody solution that its clients can use to safeguard their crypto even while trading on exchanges, according to a Financial News report on Friday.

- The proposed platform has been conceived as an “off-exchange” service. This platform will enable clients to keep their crypto assets in custody while trading on exchanges. The funds will only move out of the custody platform when the trades need to be settled. Huobi and Deribit have been added as partners in the project.

- Fireblocks Senior Vice-President of financial markets Stephen Richardson said the arrangement could help customers minimize their exposure to crypto exchanges. Richardson added that institutional traders were wary of keeping crypto tokens on exchanges following FTX’s November collapse, the report added.

Solana Soars Double-Digits as Helium Network Announces Merge Date

- Solana bulls are back in action.

- The upcoming Helium migration and substantial NFT sales volume appear to be fueling a double-digit recovery for Solana.

- SOL, the native token powering the layer-1 blockchain Solana, has gained over 11% overnight and is the largest gainer among the top 50 cryptocurrencies by market capitalization, according to data from Coingecko.

- At press time, SOL trades at around $26.09, retreating from its new 90-day high of $26.96 earlier today.

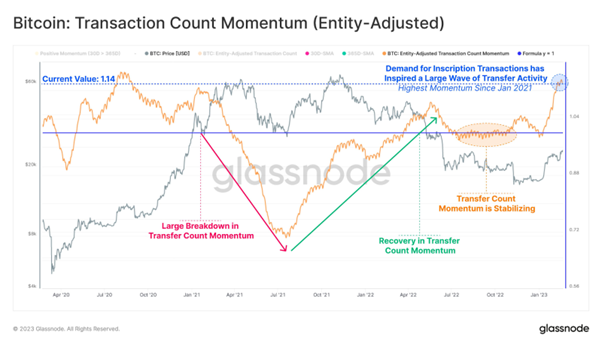

- The current demand for Inscription transactions has sent the #Bitcoin Transaction Count Momentum to its highest level since Jan 2021.

- The rapid ascent in Transaction Count reflects a significant increase in network activity, as demand for on-chain transactions begins to return.