Bitcoin Price: US$ 22,826.15 (-3.86%)

Ethereum Price: US$ 1,566.20 (-4.77%)

FTX-linked Alameda Research sues Voyager Digital for over $445M

- Troubled crypto trading firm Alameda Research is suing failed crypto lender Voyager Digital for more than $445 million, seeking to recover loan repayments that it made after Voyager filed for bankruptcy protection.

- The filing, made in a federal bankruptcy court in Delaware on Monday afternoon, noted that the total amount Alameda’s lawyers want back — $445.8 million — could go higher, if evidence of more payments from Alameda to Voyager is found. They’re also seeking the repayment of legal fees.

- Alameda Research is one of the more than 100 FTX-linked entities that filed for bankruptcy protection in November, when the crypto behemoth collapsed after a run on its utility token. Voyager Digital had filed for bankruptcy protection several months earlier.

- Alameda lawyers took aim at Voyager’s role in the collapse of FTX and Alameda in court documents, calling Voyager a “feeder fund” that did “little or no due diligence” before investing money from retail clients. Former Alameda Research CEO Caroline Ellison has pleaded guilty to criminal charges in a separate case.

Osprey Funds sues competitor Grayscale over bitcoin trust advertising

- Osprey Funds, which provides asset management services, accused Grayscale Investments of “unfair and deceptive acts and unfair competition.”

- Osprey said Grayscale’s advertisements were misleading when it said the Grayscale Bitcoin Trust (GBTC) would be converted to an exchange-traded fund, despite regulators having rejected that as a possibility, the firm said in a complaint filed in a Connecticut court on Monday. Bloomberg News first reported the legal filing.

- Grayscale has sued the Securities and Exchange Commission over the agency’s rejection of the company’s effort to convert its GBTC product into a spot exchange-traded fund. In a response brief, the SEC had said its rejection was “supported by substantial evidence.”

- “Grayscale launched campaign after campaign to convince participants in the markets, including their investment advisors, to engage Grayscale’s asset management services by telling them that a conversion to an ETF was inevitable, and thus Grayscale’s services would provide the only avenue offering benefits of such asset management services with access to an ETF structure,” Osprey said. “Grayscale knew that this message was false.”

- Osprey also alleged that Grayscale had been able to keep about 99.5% of the market share despite charging “more than four times the asset management fee” that Osprey itself charges because of Grayscale’s “false” advertisements.

Bitcoin slides after reaching highest level since August on Sunday

- Crypto prices slid alongside the S&P 500 and the Nasdaq, while the Dow traded in the green.

- Bitcoin fell 2.1% to $23,220 around 10:15 a.m. EST after reaching its highest level since August, according to TradingView data.

- Ether declined 1.4% to around $1,592. BNB fell 2.8%, while Cardano’s ADA was also down 1.2%. Polygon’s MATIC declined by over 6% in the past 24 hours after rising last week.

- Dog-themed memecoins also declined, with dogecoin and shiba inu down 3.2% and 2.5%, respectively.

- Bitcoin is “on track for its best January performance in a decade, indicative of a sharp reversal in bearish sentiment that negatively impacted prices for much of 2022,” according to crypto economist Ryan Shea of Trakx.

- Key to sustaining this bullish trend, he said, will be the Federal Open Market Committee (FOMC) meeting this Wednesday, with the Fed expected to raise rates by 25 basis points, “the smallest hike this tightening cycle.”

- If confirmed, Shea said “this would further support the ‘soft-landing’ narrative which has been gaining traction in both tradfi and crypto markets over recent weeks.”

- However, if Fed chair Jerome Powell’s comments indicate that there are more than two 25-basis point hikes upcoming, this could mean that a “more sustained reversal in crypto prices is on the cards,” he said.

Bitcoin Mining Difficulty Hits a New All-Time High

- It’s just gotten even harder to mine Bitcoin.

- Bitcoin’s mining difficulty has hit a new all-time high, rising roughly 4.68% from 37.59 trillion on Sunday to 39.35 trillion at the time of writing.

- Mining difficulty is the figure representing the computational power required to mine a single BTC. It’s updated roughly every two weeks, getting more difficult as more miners enter the network and easier when they leave.

- Mining difficulty has been climbing strongly and steadily over the past year, despite temporary decreases, such as in the month of December 2022.

- On January 30, 2022, the mining difficulty sat at 26.24 EH/s as per the data from CoinWarz, but it has since risen to 39.35 EH/s, a roughly 50% increase.

- Meanwhile, Bitcoin’s hash rate, which measures the amount of computational power dedicated to mining the cryptocurrency, currently sits at 305.81 ExaHashes per second (EH/s). This figure is still below the all-time high registered on January 6 of 348.7 EH/S.

- The current hash rate means Bitcoin miners are currently making over 305 quintillion codebreaking attempts every second in attempts to solve the computational equations needed to produce the proof-of-work (PoW) cryptocurrency.

Australian Regulators Flagged FTX Concerns Months Before Collapse: Report

- FTX had already set off alarm bells with Australia’s financial regulator several months before the crypto exchange’s catastrophic collapse, according to a report.

- The Australian Securities and Investments Commission (ASIC) first began looking into the company’s local operations in March 2022, according to documents revealed through a freedom of information request by The Guardian Australia.

- The concerns were first prompted by an article in the Australian Financial Review, which covered FTX’s plans to launch in the country within a matter of weeks.

Glassnode: Short Squeezes and Spot Demand

- The rally in digital assets has continued this week, with Bitcoin prices reaching a high of $23.9k on Sunday evening. The month of January has seen Bitcoin markets posting the best monthly price performance since Oct-2021, reaching over +43% YTD. This puts Bitcoin prices at the highest level since Aug-2022, and a +6.6% gain off the weekly lows at $22.4k.

- After a long, painful, and gruelling 2022, the new year has opened with a notable reversal of the downtrend throughout January. As is often the case, such rallies are usually fuelled by some degree of short squeezes within derivative markets, and this rally is no different.

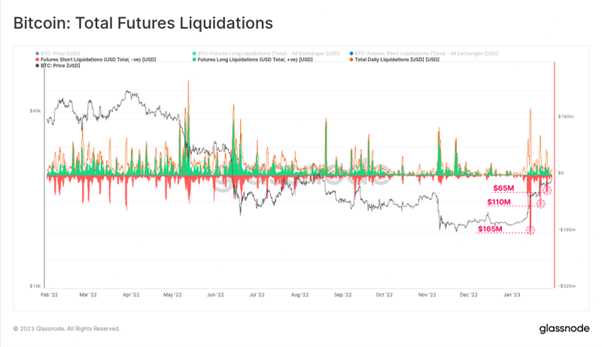

- To date, there have been over $495M in short futures contracts liquidated across three waves, notably with declining scale as the rally played out.

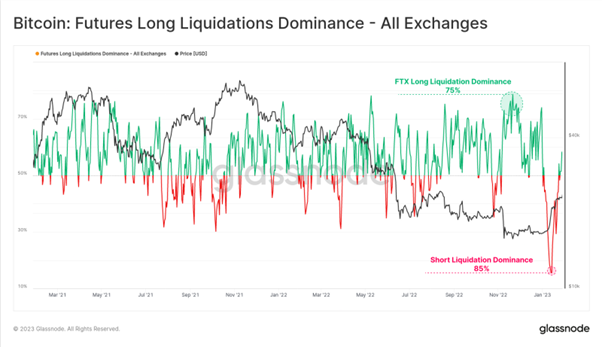

- We can see the initial short squeeze in mid-Jan took many traders by surprise, setting an all-time-low of 15% for long liquidation dominance (meaning 85% of liquidations were shorts). This is an even larger magnitude relative to the longs liquidated during the FTX implosion (75% long dominance), showing just how offside many traders were.

- Across both perpetual swap, and calendar futures, the cash and carry basis is now back into positive territory, yielding 7.3% and 3.3% annualized, respectively. This comes after much of November and December saw backwardation across all futures markets, and suggests a return of positive sentiment, and perhaps with a side of speculation.

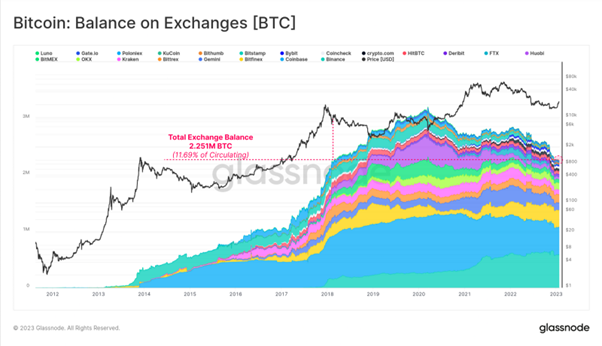

- The trend of coins flowing out from spot exchanges has been a major theme since March 2020, which to this day marks the all-time-high exchange coin balance. Today, the total BTC balance held on the exchanges we track is around 2.251M BTC, representing 11.7% of the circulating supply, and a multi-year low that was last seen in Feb 2018.

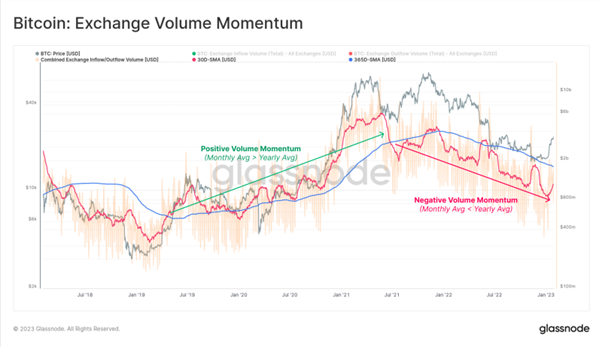

- Usually, market strength is accompanied by an increase in total on-chain exchange volumes, as investors and traders become more active. With the above as context, we can see that there remains a negative aggregate momentum within exchange transfer volumes. The monthly average is starting to increase, however it remains well below the yearly baseline at this stage.

Read full at Glassnode Insights..