Bitcoin Price: US$ 16,692.56 (+0.18%)

Ethereum Price: US$ 1,200.43 (-1.29%)

Recurring Users Continue to Surpass New Users on Sudoswap

- Sudoswap is an automated market maker (AMM) that uses customizable bonding curves to facilitate buying and selling NFTs.

- Liquidity providers deposit NFTs and/or ETH (or an ERC-20 token) into pools. They choose if they want to buy or sell NFTs (or both) and specify bonding curve parameters. Traders can then buy NFTs from or sell NFTs into these pools.

- Sudoswap’s user base peaked at 1,922 daily active users (DAU) on Aug. 27 before beginning a slow decline. DAUs briefly spiked after the protocol announced details of its upcoming SUDO token launch on Sept. 1.

- At launch, 41.9% of the supply will be airdropped to XMON holders, 1.5% will be airdropped to 0xmons holders, and another 1.5% will be airdropped to LP providers.

- XMON holders can collect their SUDO tokens by participating in a lockdrop event, during which their XMON tokens will be locked for three months. Unclaimed SUDO tokens will be returned to the treasury.

- While Sudoswap’s total DAUs continue to decline alongside overall NFT trading volume, recurring users increasingly constitute a higher portion of DAUs than new users.

- Currently, 68% of DAUs are recurring users, with this figure reaching an all-time high of 76% on Nov. 13.

Reputational Identity — 2022 Progress Update

- Identity in Web3 can be approached in various ways, all of which can be combined to form the true picture of an individual. I like to think of the analogy of a group of blind men and an elephant — everyone tries to imagine what the elephant is like when they touch it, but their version is different from the others. The elephant only emerges when all the information is put together. Some of these pieces of information include:

- On-chain transaction history

- Asset ownership

- Biometric verification (bringing off-chain identity on-chain)

- Web3 social graphs

- We focus on reputational identity, which relies on track records and accomplishments to represent identity. Imagine a Web3 LinkedIn-type resume. This typically involves NFTs and soulbound tokens (SBTs, essentially non-transferrable NFTs). We believe these are worth looking at because several reputation-based protocols have taken off this year, some with over 1,000,000 users.

- Reputational identity relies on verifiable credentials (VCs), a W3C standard that enables credentials to be digital and interoperable. In the physical world, using credentials for identification has existed for a long time — think driver’s licenses, vaccine certificates, and diplomas.

- Verifiable credentials are tamper-proof credentials that can be verified cryptographically on the blockchain while representing all the same information as a physical credential. VCs are doing for physical credentials what crypto has done for cash.

- Continue on Delphi…

Starkware launches token on Ethereum, but it’s not yet tradable

- Starkware deployed its native token STRK on the Ethereum network.

- The STRK token is currently in a “no-trade status” and it “will remain in place until further notice by the StarkNet Foundation,” Starkware wrote in a Nov. 16 blog post. A date for when trading will start has not been released.

- Starkware, an Ethereum scaling protocol that obtained an $8 billion valuation earlier this year, confirmed in July it would release its own token.

- The countdown for vesting, or locked tokens to Starkware investors and core contributors has not started even though the token has been deployed, Starkware spokesperson Nathan Jeffay told The Block.

- The locked tokens from team members and investors can be used for staking while they are locked, which would yield locked token holders tradable, unlocked STRK tokens.

- The other 50.1% are held by the Starknet Foundation and are not locked. The Starknet Foundation announced its launch with a select group of board members last week, but has not published a specific plan on how it will use these tokens. Board members have equally weighted votes on proposals put forth by the Foundation.

Sui Network, a New Blockchain From Ex-Meta Employees, Launches Its Testnet

- Sui Network, a layer-1 blockchain created by ex-Meta (nee Facebook) engineers got a step closer to going live by announcing it has opened its testnet – a place where the viability of the technology can get a more thorough examination.

- The testnet “Wave 1” will be used for validators and full nodes to “improve decentralized coordination + incident response, and identify a core group of operators who have experience in deploying, monitoring, and debugging,” the company shared over Twitter.

- Sui has gained a lot of momentum over the past few months and is seen as a competitor to the Aptos blockchain – another layer 1 that was founded by ex-Meta employees. Aptos and Sui both use the same programming language called Move.

Meta and EU officials disagree on metaverse centralization

- Meta and the EU officials have different views about what the future of the metaverse would look like, according to a panel discussion featuring representatives from the social media giant, the European Parliament and the European Commission.

- Meta is proposing a single metaverse where the company holds centralized power, while EU representatives support the development of many different metaverses.

- “It is of utmost importance to be cautious not to recreate centralization and new kind of gate-keepers in this new digital world,” Eva Kaili, a member of the European Parliament who is leading the Parliament’s report on non-fungible tokens, told The Block in an email. “It is critical to ensure that people will have full power over their digital lives, the data they share and the content they produce.”

- Aura Salla, head of EU affairs at Meta, disagreed.

- “Our economy, our consumers, our customers will benefit if we focus on creating one governance,” Salla said, adding that “the metaverse is not only for Meta,” and that cooperation with businesses, stakeholders, creators and policymakers is necessary.

Binance Temporarily Suspends Deposits of USDC, USDT on Solana

- Binance has announced that it temporarily suspended deposits of the stablecoins USDC and USDT on the Solana blockchain “until further notice.”

- It has since reopened deposits for USDT on Solana.

- USDT and USDC, created and managed by the companies Tether and Circle, are stablecoins pegged to the U.S. dollar, which exist on a wide variety of blockchains, including Solana and Ethereum.

- Binance didn’t provide any explanation for why the decision was made. It isn’t the only crypto exchange to shutter withdrawals of the two leading stablecoins on the Solana blockchain.

Bitcoin Exit From Crypto Exchanges Rises to 220K Over Past 10 Days

- Roughly another 26,000 bitcoin (BTC) has been pulled from crypto exchanges over the past 24 hours, bringing the total amount withdrawn since Nov. 7 to more than 220,000 bitcoin, according to data from Coinglass.

- At last read, there were 1.87 million bitcoin on exchanges tracked by Coinglass, the lowest level in at least one year, and down from 2.11 million on Nov. 7.

- The fast pace of declines comes as investors move their bitcoin into self-custody after FTX last week first suspended client withdrawals and ultimately declared bankruptcy, putting into question exactly when or if customers might be able to gain access to their holdings.

Chainalysis Confirmed as FTX Creditor in Bankruptcy Case

- Analytics firm Chainalysis has announced that it is owed money in the bankruptcy proceedings for collapsed exchange FTX.

- In documents filed to bankruptcy court in Delaware on Wednesday, Chainalysis was identified as a creditor and asked for any relevant materials to be sent to its lawyers.

- The blockchain analysis firm had a longstanding relationship with FTX, going back to at least 2019, when the two joined forces to revamp the exchange’s anti-money laundering (AML) and know-your-customer (KYC) systems.

Ethereum Software Firm ConsenSys Co-Launches Ethereum Climate Platform

- ConsenSys, an Ethereum-software firm that helped engineer the Merge, is co-launching with 18 other firms the Ethereum Climate Platform (ECP) at COP27’s UN Climate Change Global Innovation Hub. (COP27 is short for 27th Conference of the Parties of the UNFCCC. UNFCCC is short for United Nations Framework Convention on Climate Change. COP27 runs Nov. 6-18 in Sharm el-Shiek, Egypt.)

- The platform is built for the Ethereum ecosystem, and will aim to mitigate the excess energy consumption that the blockchain used before it went through the Merge in September.

- “The idea is to gather a bunch of capital and invest the capital into technologies that can have a significant positive impact” Joseph Lubin, the founder of ConsenSys and a co-founder of the Ethereum blockchain told CoinDesk. “I anticipate that this group will want to fund projects that are not old style, legacy technology projects but do think about how they build systems.”

Uniswap website goes dark for some users after Cloudflare routing problem

- Uniswap, the biggest decentralized exchange (DEX) for crypto, is suffering an outage affecting some users caused by a routing problem at internet infrastructure firm Cloudflare.

- The Uniswap website currently loads as a blank page when opened by some users — while others appear unaffected. Users have reported that the issue has been ongoing for more than four hours as of the time of publishing. The project’s official Discord addressed the issue, blaming Cloudflare, a tool that enables secure connections on the internet.

- In a Reddit post, the Uniswap team advised users to connect to the protocol via its IPFS link. IPFS stands for interplanetary file system and is a decentralized file storage protocol that powers connections on peer-to-peer networks.

- The problem does not yet seem to have a negative impact on the protocol’s trading volume. Data from Uniswap shows 24-hour trading volume is up 14%, with $269 million in trades completed today.

JPMorgan: The Shrinking Stablecoin Market Is Another Sign of Investors’ Exodus From Crypto

- One way of measuring investors’ exodus from the crypto ecosystem is the shrinkage of the stablecoin market, JPMorgan said in a research report Wednesday.

- Stablecoins, a type of cryptocurrency whose value is pegged to another asset such as the U.S. dollar, are the equivalent of cash in the crypto world and provide a bridge between fiat currencies and cryptocurrencies, the report said. The growth of the stablecoin market can be viewed as a proxy for the amount of money that has entered the digital assets sector, the report added.

- The combined market cap of the largest stablecoins reached a peak of $186 billion in May, before the Terra/LUNA collapse, the note said. That compares with less than $30 billion at the start of 2021 and about $5 billion a year before that. Since May, the stablecoin universe has dropped by $41 billion, with just under half of the decline attributed to the demise of Terra.

- JPMorgan says that excluding Terra, it could be argued that the stablecoin market peaked at around $170 billion at the start of the year, was little changed till May 2022, and has been falling ever since.

- The bank says that since May 2022 about $25 billion has actively exited the crypto market via stablecoin redemptions.

El Salvador’s President Nayib Bukele and Tron’s Justin Sun to Buy One Bitcoin Every Day

- Bitcoin-holder El Salvador President Nayib Bukele and Justin Sun, the founder of the Tron cryptocurrency network and Grenada’s ambassador, have decided to accumulate bitcoin at a pace of 1 BTC per day.

- “We are buying one #Bitcoin every day starting tomorrow,” Bukele tweeted late Wednesday. Soon after, Sun announced a similar plan, mimicking Bukele’s accumulation strategy.

- The strategy of purchasing bitcoin on a set schedule instead in reaction to market movements is known as dollar cost averaging (DCA). The advantage of DCA is that it removes the emotional component of decision-making and you end up paying less in dollar terms for the investment over the long run than you would spend while timing the market.

- Bukele and Sun’s decision to employ the DCA strategy comes as the recent collapse of Sam Bankman Fried’s cryptocurrency exchange FTX threatens to prolong the crypto bear market. Analysts are worried that bitcoin could slide to $13,000, having already lost 76% since hitting a record high of $69,000 a year ago.

Ether Staking Yields Jump Up to 25%; All-Time High Since Merge

- Just staking ether on Lido is paying out 10% annualized, while a more elaborate move bumps yield to as much as 25%.

- “Recently, the liquid staking protocol also had to increase rebasing oracle limits from 10% to 17.5% to let the increased rewards flow to stETH token holders,” analysts at Delphi Digital said in a Friday note. Rebasing, or elastic, tokens are cryptocurrencies that automatically adjust supply levels to maintain a constant value.

- The increased rewards have led to related borrowing strategies offering yields of as much as 25.5% on the Interest Compounding ether product (icETH) offered by Index Coop.

- As a result of the increased rewards, the yield earned by recursive borrowing strategies such as icETH has also reached an all-time high of 25.5% since the Merge. It stands at 24.05% at writing time.

Genesis sought emergency loan of $1 billion: WSJ

- Genesis sought an emergency loan of $1 billion from investors before telling clients it was suspending redemptions in the wake of the collapse of FTX, The Wall Street Journal reported.

- Genesis sought access to the credit facility by 10 a.m. Monday, citing a liquidity crunch, according to the Journal. The firm failed to get that funding, according to a confidential fundraising document viewed by the newspaper.

JPMorgan Chase, Wells Fargo among potentially exposed FTX parties

- FTX has named Kroll Restructuring Administration as its agent as it navigates the federal bankruptcy process and cited dozens of companies and people affected by its collapse, a petition filed by the exchange shows.

- Kroll is to act as a claims and noticing agent, often assigned to cases where creditors are in excess of 1,000 parties. As claims agent, Kroll will liaise between entities in the legal proceedings, managing documentation and preparing and serving related notices. FTX filed for Chapter 11 bankruptcy protection on Nov. 11 in the U.S. Bankruptcy Court for the District of Delaware.

- Following the filing, FTX Group announced over Twitter that it established Kroll as its claims agent, and provided a link to where related documents filed to the U.S. Bankruptcy Court may be accessed.

FTX Ventures Was a Disorganized Mess With Missing Financials, Bankruptcy Documents Say

- Crypto exchange FTX established a $2 billion venture capital fund early this year, instantly becoming one of the crypto industry’s largest funds. The capital was said to fully come from the now-collapsed FTX and then-CEO Sam Bankman-Fried. New bankruptcy documents claim to show, however, that the inner workings of FTX Ventures, like much of the company, were an organizational nightmare.

- FTX Ventures participated in funding rounds for some of the largest names in crypto, including Bored Ape Yacht Club creator Yuga Labs, USDC stablecoin issuer Circle and two different fundraises for the Aptos blockchain. The collapse of FTX following liquidity concerns, which led the firm to seek Chapter 11 bankruptcy protection, raised questions about those investments.

- The FTX umbrella covered over 100 smaller legal entities, which complicates any story about the internal organization. According to paperwork filed on Thursday with the U.S. Bankruptcy Court for the District of Delaware, FTX Ventures, the operations that both invested in companies and accepted investments, spread its funds across Clifton Bay Investments LLC, FTX Ventures Ltd, Island Bay Ventures Inc and, “potentially, affiliated companies.”

- Of those groups, Clifton Bay Investments and FTX Ventures were the only entities that prepared quarterly financial statements. And financial statements for Island Bay Ventures haven’t even been located, according to new FTX CEO John Ray.

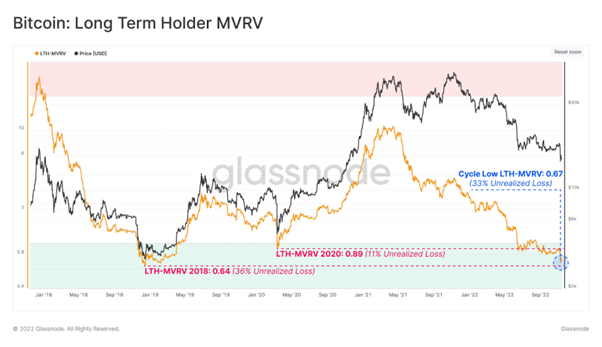

Glassnode

- #Bitcoin Long-Term Holders are currently experiencing acute financial stress, holding an average of -33% in unrealized losses.

- This is comparable to the lows of the 2018 bear market, which saw a peak unrealized loss of -36% on average.